The enigmatic 21 million Bitcoin limit is a question that lingers in the minds of many, weaving a narrative of scarcity, value, and the future of this digital gold.

But this limit isn’t just a random number; it’s a fundamental aspect that shapes Bitcoin’s essence.

Intrigued?

There’s more.

Imagine a world where the allure of Bitcoin isn’t just its revolutionary technology but also its finite supply.

It’s a dance of innovation and scarcity, each step echoing the rhythms of value and demand.

We’re about to embark on a journey to explore why only 21 million Bitcoin can ever exist and the seismic shifts expected when this limit is reached.

Each revelation promises to be as enlightening as it is pivotal in understanding the future of this coveted cryptocurrency.

The intrigue is just beginning; shall we dive in?

The Design of Bitcoin

Now that we’ve set the stage, you’re probably curious about the intricate design that enforces Bitcoin’s 21 million limit.

Well, fasten your seatbelt because we’re about to delve into the genius of Satoshi Nakamoto’s creation.

Bitcoin’s design is a masterpiece of cryptographic innovation and economic foresight.

Imagine a digital currency free from the clutches of central banks, its value, and scarcity governed by mathematical precision.

Sounds revolutionary.

Here’s the deal – at the heart of Bitcoin lies the blockchain, a decentralized ledger where each mined block rewards miners with a certain number of Bitcoins.

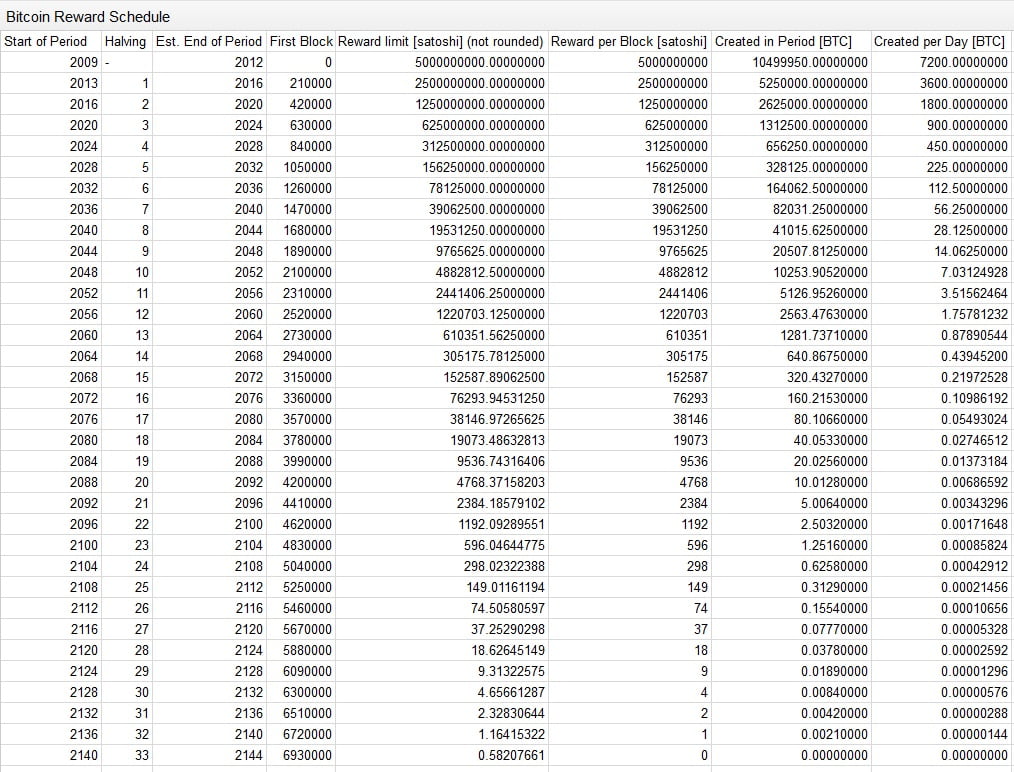

But this reward halves after a certain number of blocks, a phenomenon aptly named ‘the halving.’

Now, picture this halving occurring approximately every four years, reducing the influx of new Bitcoins into the market until we hit the magic number – 21 million.

But this design isn’t just about scarcity; it’s a narrative of deflationary economics, where the finite supply amplifies value, turning every mined Bitcoin into a digital nugget of gold.

Curious about the implications?

As we peel back the layers, a world where technology and economics converge unveils a narrative as complex as it is fascinating.

Ready for the revelations?

The journey is about to get even more exciting!

New to crypto investment? Learn Why invest in Bitcoin?

Significance of the 21 Million Limit

In the documented correspondence between Nakamoto and software developer Mike Hearn, insights into the 21 million limit can be found.

Nakamoto aspired for Bitcoin’s unit prices to align with existing fiat currencies, envisaging a scenario where 0.001 BTC equaled 1 Euro.

This alignment was anchored in the uncertainty of Bitcoin’s future adoption – a niche presence would warrant lesser value per unit.

In contrast, extensive adoption in global commerce would significantly amplify its worth.

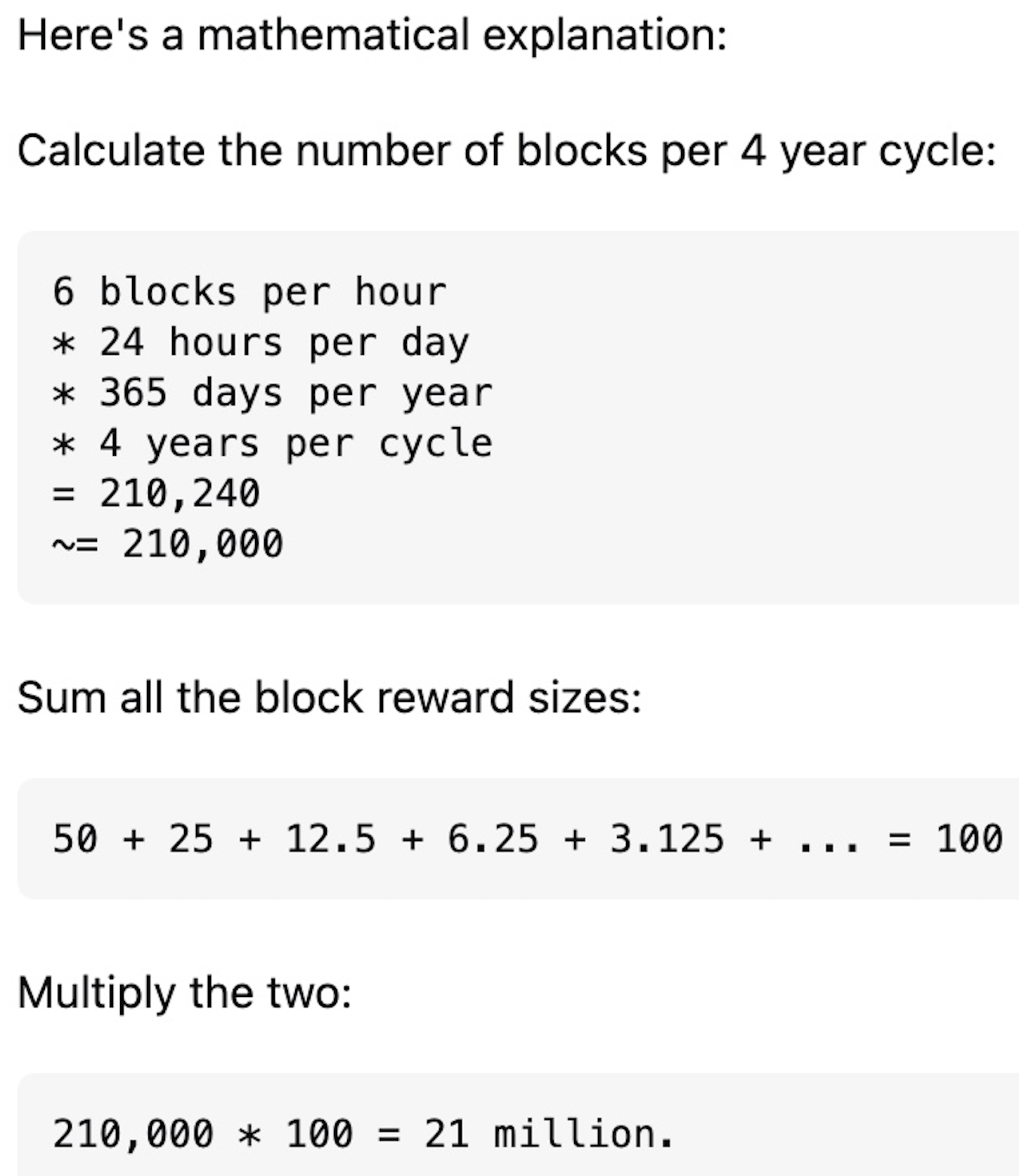

The methodological origin of the 21 million limit is nestled in Nakamoto’s two pivotal decisions: introducing new blocks to the Bitcoin blockchain every 10 minutes and halving miner rewards every four years.

A mathematical dissection yields a profound coincidence.

With six blocks per hour, 24 hours a day, 365 days a year over a four-year cycle, approximately 210,000 blocks are added.

When multiplied by the sum of block reward sizes, a total of 21 million Bitcoins emerges.

Yet, this mathematic revelation circles back to the foundational question – why these specific parameters?

While mathematical and algorithmic alignments provide structural and operational insights, they don’t necessarily penetrate the philosophical and economic rationale behind the 21 million limit.

Nakamoto’s silence on explicit reasoning invites speculation and theories, instilling an element of mystique in Bitcoin’s foundational ethos.

Nevertheless, the 21 million limit is intrinsic to Bitcoin’s economic architecture.

It fosters a scarcity akin to precious metals, propelling its value proposition.

As the final Bitcoin nears its mining around 2140, anticipated market dynamics rooted in supply and demand principles suggest potential value augmentation.

Every mined Bitcoin epitomizes a step towards the finite supply, a narrative that has and continues to fuel its global intrigue and adoption.

The 21 million cap isn’t merely a numerical limit but a multifaceted economic, philosophical, and speculative instrument that continues to shape the discourse and dynamics of Bitcoin in the global financial ecosystem.

Current Status of Mined Bitcoins

With the 21 million limit and its significance now in clear view, you’re probably itching to know how many Bitcoins have been mined to date.

Ready for a snapshot of the present?

Here it comes.

Over 19.5 million Bitcoins have been mined, bringing us tantalizingly close to the cap.

Intriguing.

Each mined coin is a step towards the enigmatic limit, a milestone that’s as anticipated as it is mysterious.

But here’s the kicker – with each passing day, the mining process becomes more complex.

Picture a world where the gold rush intensifies, yet the remaining nuggets are buried deeper, demanding more effort to unearth.

Curious about the final stretch?

As we inch closer to the 21 million mark, every mined Bitcoin isn’t just a digital asset; it’s a piece of history, a chapter in the unfolding narrative of the world’s first decentralized currency.

Ready to explore the implications of reaching this cap?

The revelations ahead promise to be as profound as they are pivotal.

Onward we go!

Recommended Read: How much Bitcoin does the US government own?

What Happens When 21 Million Bitcoins Are Mined?

As we edge closer to that enigmatic 21 million mark, a question looms: What happens when every Bitcoin is mined?

It’s a mystery that has intrigued many, and you’re about to get a front-row seat to the unfolding drama.

First off, let’s tackle the miners.

Today, block rewards incentivize them, those shiny new Bitcoins that emerge with every mined block.

But here’s the twist – when all Bitcoins are mined, these rewards will vanish.

Sounds ominous.

But wait, there’s a silver lining.

Transaction fees.

Imagine a world where miners are compensated not by new Bitcoins but by fees users pay to make transactions.

It’s a shift from creation to maintenance, where miners are guardians of transaction integrity, ensuring the blockchain’s pulse keeps beating strong.

But here’s where it gets intriguing.

The 21 million limit could catapult Bitcoin’s value to dizzying heights.

Picture a world where scarcity and demand dance to the rhythms of market dynamics, each Bitcoin a digital artifact of immense value.

Now, let’s venture into the realm of speculation.

Some predict a world where finite and fully mined Bitcoin becomes a universal store of value.

Imagine a digital gold standard where Bitcoin is the anchor, steadying the volatile seas of global finance.

But hold on, there’s another layer.

The environmental impact.

With no more Bitcoins to mine, the energy-intensive process of mining could take a backseat, ushering in an era of sustainability where the blockchain’s integrity is maintained without the environmental toll.

Curious about the broader implications?

Each fully mined Bitcoin isn’t just a digital asset; it’s a catalyst for innovation, policy reform, and market dynamics.

It’s a world where the finite nature of Bitcoin influences every transaction, every investment, and every financial maneuver.

Ready to explore this uncharted territory?

As we stand on the brink of a fully mined Bitcoin world, the revelations promise to be as transformative as they are unprecedented.

It’s a journey into a future where the rules are rewritten, and every assumption is reevaluated.

Implications for Investors

So, with the 21 million cap in sight, you’re likely pondering the aftermath for investors and the market.

It’s a pivotal moment.

A finite supply could mean skyrocketing value for each Bitcoin held.

But wait, there’s more.

Imagine a market where scarcity drives demand, turning each Bitcoin into a prized possession.

For investors, it’s not just about holding a digital currency but a rare asset akin to owning a piece of art or a sliver of gold.

But here’s the clincher – market dynamics could shift, volatility might wane, and Bitcoin could transition from a speculative asset to a stable store of value.

Intrigued?

The journey to the last Bitcoin promises a seismic shift, a transformation where every assumption is challenged and new paradigms emerge.

The future awaits!

Recommended Read: Differences between Bitcoin vs Cryptocurrency

Impact on Altcoins and the Broader Crypto Market

As the final Bitcoin is mined, a ripple effect through the altcoin market is inevitable.

But what does this mean for the myriad of other cryptocurrencies?

Hold tight because we’re about to explore uncharted territories.

Imagine a world where Bitcoin, the pioneer of cryptocurrencies, has reached its supply limit.

In this landscape, altcoins might step into the limelight, offering alternative avenues for investment and utility.

But here’s the twist – with Bitcoin’s capped supply, its perceived value could skyrocket, casting a towering shadow over the altcoin market.

It’s a dynamic interplay where altcoins could either bask in Bitcoin’s reflected glory or wrestle with its overwhelming presence.

Curious about the market dynamics?

As Bitcoin’s mining era concludes, the broader crypto market could witness seismic shifts.

With their diverse utility and unlimited supply, Altcoins might become the new frontier for innovation, investment, and utility.

Ready to explore this evolving narrative?

A world where Bitcoin’s scarcity shapes not just its destiny but the trajectory of the entire crypto market is unfolding.

The dance of supply, demand, and value is about to enter a captivating new chapter!

Recommended Read: Is cryptocurrency legal in USA?

Conclusion

We’ve unraveled the enigma of the 21 million Bitcoin cap, stepping into a future teeming with possibilities.

Each revelation, each mined Bitcoin, is a step into uncharted terrains where value, scarcity, and innovation converge.

Ready for the unfolding narrative?

The journey to the last Bitcoin is a saga awaiting its dawn!