Welcome to the fast-paced world of crypto trading!

OTC stands for “Over-The-Counter,” a big deal in the crypto universe.

Unlike regular buying and selling on crypto exchanges, OTC trading is a private deal.

It’s like the difference between shopping at a busy mall and making a VIP purchase in a quiet, exclusive store.

Why does this matter?

Well, in the bustling crypto market, big crypto traders – we’re talking big – need a unique way to trade without causing a stir.

Imagine trying to sell a huge number of crypto coins on a regular exchange simultaneously.

It could make prices swing up or down too much!

In this article, we’ll dive into OTC trading, how it’s done, and why it’s crucial in crypto.

Whether you’re new to crypto or looking to learn more, you’re in the right place.

Understanding the Basics of OTC Trading

When you hear “OTC trading” in the crypto world, think of it as a behind-the-scenes action.

It’s like when you trade baseball cards directly with a friend instead of in a store where everyone can see.

In OTC trading, cryptocurrencies are traded directly between two parties.

Without anyone else knowing the details right away.

This differs from trading on an exchange where everyone can see the prices and trades happening in real time.

So, what makes OTC trading unique?

- Discretion

First, it’s discreet.

It’s like telling a secret that only two people know.

Big-time traders, or ‘whales’ as some call them, like OTC because they can buy or sell a lot of crypto without others watching.

This helps them keep the price they pay or get stable.

If they did this on a public cryptocurrency day trading platform, the price could go wild because other traders would see a big trade happening and react to it.

- Flexibility

Second, OTC trades are flexible.

You’re not stuck with the prices you see on the exchange.

Instead, the buyer and seller can discuss it and agree on a price that works for both.

This can be a better deal than what’s on the public market.

- No trading hours

Lastly, OTC trading can happen at any time, not just during the opening hours of an exchange.

It’s a 24/7 possibility, which is perfect for the around-the-clock nature of the crypto world.

But how exactly does OTC trading take place?

Imagine you want to sell a ton of your crypto coins.

You might call up an OTC broker, someone like a matchmaker for crypto trading.

They find someone who wants to buy what you’re selling.

Then, you and the buyer agree on a price, make the exchange, and the broker often takes a small cut for making the connection.

In summary, OTC trading is a private, flexible, and all-day way for people to trade many cryptocurrencies.

It keeps things smooth in the market and is a favorite for those who want to make big moves without making big waves.

Now that you know the basics, you’ll understand why OTC is a critical play in the crypto game.

New to crypto world? Learn Advantages and disadvantages of using crypto over traditional currencies?

The Importance of OTC Trading in the Crypto World

Think of the crypto market as a big ocean.

Like in the ocean, there are giant creatures like whales and smaller ones like fish.

OTC trading is super important because it’s where the crypto whales swim.

These people want to buy or sell a lot of cryptocurrency at once.

Without OTC trading, if a whale wanted to sell a giant amount of crypto on a centralized exchange, it could splash around the prices for everyone else.

OTC trading lets these big deals happen quietly without scaring the fish or tipping over any boats.

Also, OTC helps people all over the world get into crypto.

Some places don’t have big crypto exchanges, or maybe it’s tough to use them because of local laws.

OTC trading gives these folks a chance to join in, kind of like a secret back road that’s open all the time, even if the main road is closed.

Plus, OTC trading can lead the way for new projects and start-ups.

When a new crypto project starts, they might need to trade significant money without making a scene.

OTC helps them do this smoothly.

It’s a pretty big deal that helps the whole crypto world keep turning.

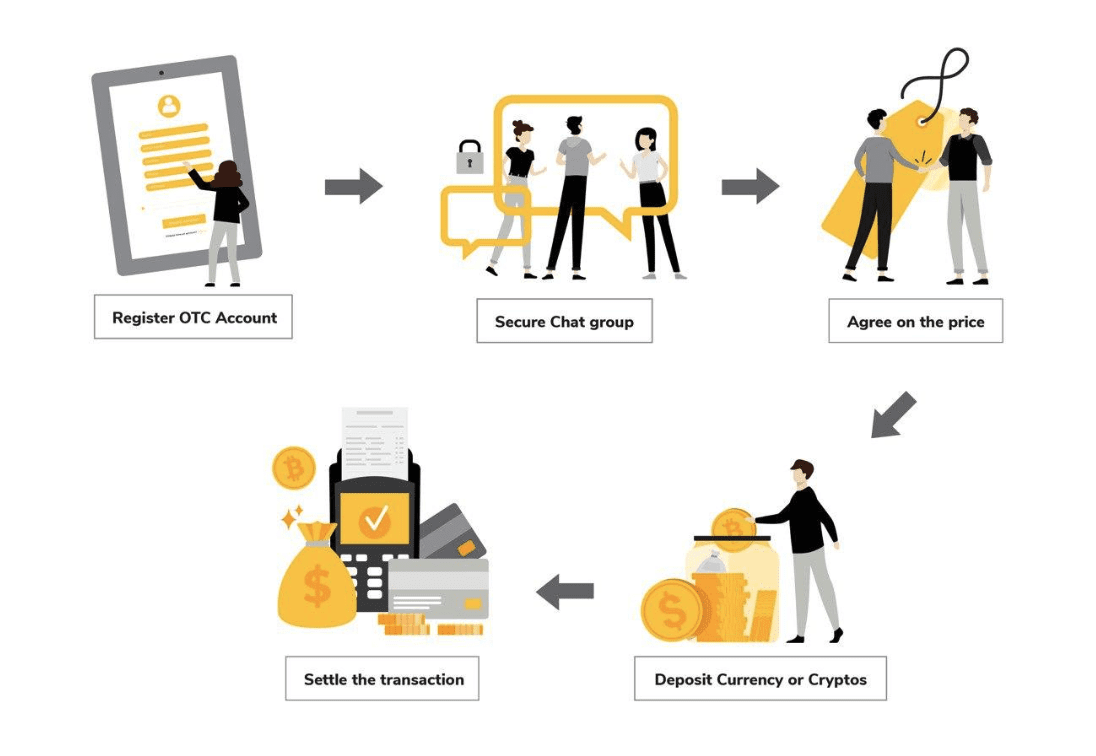

How OTC Trading Works in the Cryptocurrency Market

Alright, let’s break down how OTC trading happens in the crypto world.

Imagine you’ve got a big pile of cryptocurrency, like Bitcoin, and you want to sell it without making a big splash in the market.

Here’s what you do:

- First, you find an OTC broker. This person is like a guide who knows everyone in the crypto world. They keep your business quiet and find someone who wants to buy a lot of Bitcoin, just like you’re selling.

- Next, the broker helps you and the buyer agree on a price. It’s not like the set price you see on a public crypto exchange. You both get to discuss it and come to the right deal, like haggling at a garage sale.

- Once the price is set, the broker arranges the trade. This part is super important because it’s when the crypto changes hands. You and the buyer swap your Bitcoin for their cash. The broker ensures this swap goes smoothly, like a referee in a sports game.

- But here’s the cool part: even though you’ve sold a bunch of Bitcoin, the market doesn’t freak out because it was all done privately. It’s as if you’ve moved a mountain without anyone noticing because you did it one stone at a time.

- And finally, the broker gets a small piece of the action, a fee for hooking up the trade. It’s their reward for making sure everything goes off without a hitch.

Advantages of OTC Trading in Crypto

Let’s chat about the plus sides of OTC trading in crypto.

It’s got some cool perks that make it a go-to for the big players in the game.

- Privacy

First off, OTC trading is super private.

It’s like passing notes in class without the teacher seeing.

When big buyers and sellers make moves, they don’t want everyone to know because it could stir things up.

OTC lets them buy or sell vast amounts of crypto silently without causing a price roller coaster for everyone else.

- Deal Size

Another big win is that OTC deals can be huge, like buying a whole pizza instead of just a slice.

On a regular exchange, buying a lot of crypto all at once can be challenging.

There might not be enough for sale at the price you want.

But with OTC, you can find someone ready to make a large trade, so you get exactly what you need.

- Price – Get the best one

Then there’s the whole thing about price.

In OTC, the buyer and seller can shake hands on a price they both like.

This can be better than the up-and-down prices on public exchanges.

It’s like agreeing on the best trade for your baseball cards instead of taking whatever someone offers you.

- Timing

OTC trading is also super flexible with timing.

Need to make a trade outside of regular hours?

No problem.

OTC trades can happen anytime, day or night.

It’s like having a 24-hour diner in the crypto world — always open when hungry for a trade.

- Possibility of Saving Money

Last, OTC trading can be easier on your wallet regarding big trades.

Since the price doesn’t bounce around as much, you might save some cash.

If you splash on a public exchange, the price could increase because everyone sees you’re buying a lot.

Recommended Read: What is fundamental analysis?

Challenges and Risks Associated with OTC Crypto Trading

Now, even though OTC trading sounds pretty awesome, it’s not all smooth sailing.

There are some challenges and risks to keep in mind.

- Trust

First up, there’s trust.

In OTC trading, you’ve got to trust the person on the other side of the deal.

It’s not like an exchange where there’s a system checking everything.

It’s more like a handshake deal.

If the person you’re trading with doesn’t come through, you could be in trouble.

That’s why having a good broker is vital — they’re like the trusty friend who knows both people in a trade.

- Did You Get the Best Price?

Then there’s the price.

Sure, you get to make a deal on the price, but how do you know it’s the best one?

Without all the prices from an exchange, you might miss out on a better deal elsewhere.

It’s like selling your bike to a neighbor without knowing that someone down the street would have paid more for it.

- Lack of a Safety Net

Also, there’s not much of a safety net in OTC trading.

Exchanges often have rules and protections, but with OTC, you’re on your own.

If something goes wrong, like if the crypto or the money doesn’t show up, there’s no exchange policy to help you.

You’re left to deal with the mess yourself.

- Regulatory Concerns

Regulations, or the rules about trading, can be tricky, too.

Since OTC trades are private, it’s harder for governments to keep an eye on them.

This means there could be more risk of breaking the rules without even knowing it, especially if you’re trading in different countries.

For instance, USA has complicated rules for trading crypto.

- Lack of Transparency

Lastly, because OTC trading is so private, it can be hard to figure out what’s happening in the market.

If many trades happen secretly, the public exchange prices might not tell the whole story.

It’s like trying to guess who’s winning a game without being able to see the scoreboard.

Recommended Read: How are crypto exchanges different from traditional stock exchanges?

Conclusion: Is OTC Crypto Trading Right for You?

OTC trading is a big deal in the crypto world.

It’s great for keeping things low-key when you’re moving a lot of coins.

You can make deals, trade anytime, and sometimes even save money.

But remember, it’s like walking through a forest without a path.

You need to trust who you’re dealing with, know you’re getting a fair deal, and be ready for any risks that come without the safety of an exchange.

Before jumping into OTC trading, think about what you’re after.

Are you trading a lot? Do you need privacy? Can you handle the risks?

If you’re nodding your head, OTC could be your game.

But if you’re unsure, it’s okay to stick to regular exchanges until you’re ready.

Ultimately, it’s all about what works best for you in the crypto adventure.