One term you’ll frequently encounter in crypto is “Centralized Crypto Exchange”.

If you’ve ever used platforms like Coinbase, Kraken or Binance to buy, sell, or trade cryptocurrencies, you’ve already interacted with a centralized exchange.

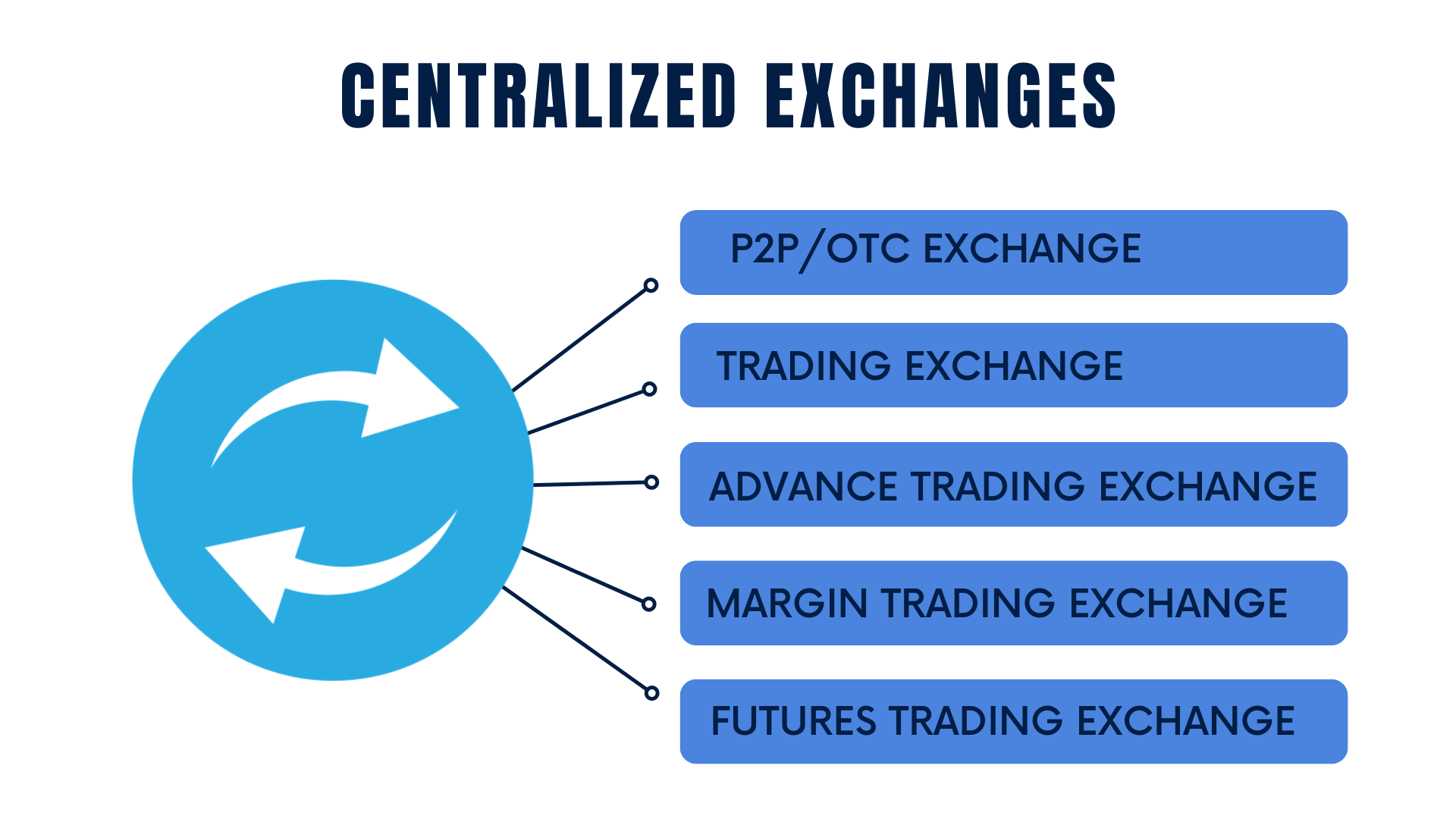

These platforms serve as intermediaries, facilitating transactions between buyers and sellers while offering various services, from spot trading to Futures contracts and even staking.

This article will delve deep into centralized crypto exchanges, exploring their features, advantages, drawbacks, and how they fit into the broader cryptocurrency ecosystem.

So, let’s dive in!

What are Centralized Crypto Exchanges (CEXs)?

So, what exactly is a Centralized Cryptocurrency Exchange?

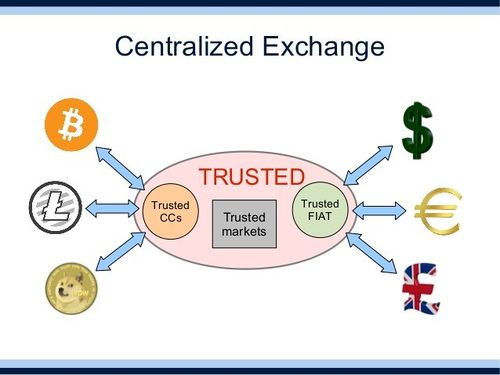

In simple terms, a CEX is a platform that is an intermediary between buyers and sellers of cryptocurrencies.

Think of it as a digital marketplace where you can buy and sell cryptocurrency assets.

But here’s the catch: Unlike decentralized exchanges, where trades occur directly between users, centralized exchanges have worked hard to control the trading process from start to finish.

What does this mean for you?

When you use this cryptocurrency exchange, you entrust the platform to buy and sell cryptocurrencies, secure your funds, and provide liquidity.

These centralized exchanges include benefits like speed, a user-friendly interface, and customer support.

However, it also comes with risks, such as susceptibility to hacking and regulatory scrutiny.

How Centralized Exchanges Work

Learning more about CEXs can provide valuable insights into how users’ funds are managed, how trades are executed, etc.

Let’s break it down into key components:

Account Creation and Verification

- Sign-Up: The first step in using a centralized exchange is creating an account.

- KYC Procedures: Know Your Customer (KYC) procedures are standard on most centralized exchanges. You’ll need to verify your identity by providing identification documents like a passport or driver’s license and sometimes even proof of residence for anti-money laundering reasons.

- Two-Factor Authentication (2FA): For added security, every exchange worldwide requires or strongly recommends enabling 2FA, usually through an app like Google Authenticator or via SMS.

Deposits and Withdrawals

- Funding Your Account: Most centralized exchanges allow deposits in fiat currencies like USD, EUR, etc., and crypto assets like Bitcoin (BTC) and Ethereum.

- Withdrawal Limits: Depending on the level of verification and the policies that centralized exchanges follow, there may be limits on how much crypto users can withdraw at once, subject to the regulations.

- Fees: Be aware that some exchanges charge fees for deposits and withdrawals of digital assets.

Trading Mechanisms

- Spot Trading: This is the most straightforward type of crypto trading, where you can enter buy and sell orders for a token, and the transaction is settled “on the spot.”

- Futures and Options: Many centralized exchanges allow crypto derivatives like Futures and Options contracts, allowing for more complex trading strategies to trade crypto.

- Order Types: The largest centralized exchanges usually offer a range of order types, giving you control over the price at which you conduct transactions to buy or sell.

- Liquidity: Because centralized exchanges aggregate buyers and sellers in one place, these exchanges also offer high liquidity, making transaction processing easier to execute large trades without impacting the market price.

- Trading Pairs: These types of exchanges offer a variety of trading pairs (e.g., BTC/USD, ETH/BTC), allowing users to exchange between different supported tokens or fiat currencies.

Recommended Read: What is a decentralized exchange?

Advantages of Centralized Exchanges

When trading cryptocurrencies, centralized exchanges often come out on top for various reasons.

Let’s dive into some key advantages that make these platforms suitable for intermediate and expert users.

High Liquidity

Centralized exchanges often have a large user base, which means higher trading volumes and, consequently, higher liquidity.

Why does this matter?

Higher liquidity makes it easier to buy or sell large quantities of assets without causing drastic price fluctuations, unlike their decentralized counterparts.

This is especially beneficial for traders who transact with significant volumes.

User-Friendly Interface

If you’re a new crypto trader looking to choose between centralized and decentralized exchanges, these trading platforms’ simplicity, centralization, and intuitiveness can be a real boon.

Even if you’re an experienced trader, CEXs make your trading activities more efficient and less stressful.

Speed and Efficiency

Centralized exchanges are generally faster when it comes to executing trades.

This is because they control the order book, and all transactions occur directly through their systems and liquidity pools.

So, if you’re looking for quick trades and low fees, centralized platforms often have the edge.

Customer Support

One of the significant advantages of centralized exchanges is the availability of dedicated customer service teams.

Got a problem with a transaction?

Need help understanding a feature?

You can usually get quick and professional assistance, which helps in trusting the exchange, something that’s often lacking in decentralized platforms.

Disadvantages and Risks of Centralized Exchanges

While a centralized exchange operates with a host of benefits, it’s crucial also to consider the downsides and risks associated with using these platforms.

So, what are the potential pitfalls you should be aware of?

Let’s delve into some of the key disadvantages.

- Central Point of Failure

Because all transactions and funds are processed through a single entity, exchanges must be very secure as they are more susceptible to hacking and fraud.

Remember the infamous Mt. Gox hack?

It is a cautionary tale of what can happen when too much trust is placed in a single organization to store cryptocurrency.

Some exchanges keep most of their customers’ funds in cold storage.

- Control Over User Funds

When you deposit your assets into digital wallets of a centralized exchange, you’re essentially handing over control to that organization.

This means you rely on their security measures and choose to store your funds with them.

And let’s face it: not all exchanges are created equal regarding security.

- Regulatory and Compliance Issues

Centralized exchanges are often subject to government regulations, which can be both a pro and a con for many investors.

On the downside, this can lead to sudden changes in trading conditions like volatility, market manipulation, and even the delisting of certain assets, affecting your trading strategies and portfolio.

- Downtime and Maintenance

Centralized platforms sometimes need to go offline for maintenance, updates, or to resolve issues.

During these periods, you won’t be able to trade, which can be frustrating and potentially costly if the market is volatile.

Recommended Read: How to choose a crypto exchange?

Comparison with Decentralized Exchanges (DEX)

What does a centralized vs. decentralized exchange comparison look like?

Let’s dive into the key differences that set these platforms apart.

- Control and Custody

In a CEX, the exchange holds your funds and private keys, acting as custodians.

Conversely, a DEX allows you to retain control of your assets and private keys as you sign off on smart contracts straight from your wallet.

Why does this matter?

Maintaining control can offer enhanced security but also squarely places the onus of responsibility on your shoulders.

- Trading Volume and Liquidity

CEXs generally offer higher liquidity due to their large user base and centralized order book.

DEXs, while improving, often lag in this aspect due to the AMM (Automated Market Maker). If you’re a high-volume trader, this difference can be a game-changer.

- User Experience

CEXs usually offer a more user-friendly interface with customer support and a wide range of features.

DEXs, being more decentralized, can sometimes be less intuitive and lack customer service, making them more suited for experienced traders.

- Anonymity and Privacy

DEXs often allow for more anonymous transactions, which don’t require extensive KYC procedures.

CEXs, being regulated, usually require full identity verification, which might not sit well with those prioritizing privacy.

- Speed and Efficiency

CEXs, with their centralized infrastructure, often offer faster trade execution.

DEXs, while improving, can sometimes be slower due to the use of peer-to-peer blockchain technology for their transactions.

Popular Centralized Exchanges

With so many options out there, which ones should you consider?

Let’s look at some of the most popular centralized exchanges that have gained significant traction in the crypto community.

- Coinbase

- Binance Futures

- Gemini

- Kraken

- Huobi

- Bybit

Conclusion

Centralized exchanges offer many benefits, such as high liquidity, user-friendly interfaces, and robust customer support.

However, they also come with risks, such as being a central point of failure and regulatory hurdles.

The key is to know what you’re looking for in an exchange.

Are you a beginner seeking a simple, straightforward platform?

Or are you an experienced trader in need of advanced trading options?

Ultimately, the choice between using a centralized or decentralized exchange—or even which centralized exchange to use—comes down to your individual needs, trading style, and risk tolerance.

Remember, each platform has its own unique set of features, fees, and security measures.