One of the most promising ventures in the crypto world is to start your own crypto exchange.

These platforms allow users to buy, sell, and trade digital currencies, and they have become the backbone of the cryptocurrency ecosystem.

However, it is not easy to make a cryptocurrency exchange.

It requires careful planning, a deep understanding of the market, and a commitment to security and customer satisfaction.

In this comprehensive guide, I will walk you through the key steps to start a crypto exchange, from market research and regulatory compliance to technology infrastructure and marketing strategies.

Whether you’re a seasoned entrepreneur or new to the crypto world, this article will provide the insights and tools you need to launch a successful and secure cryptocurrency exchange.

What Is A Crypto Exchange?

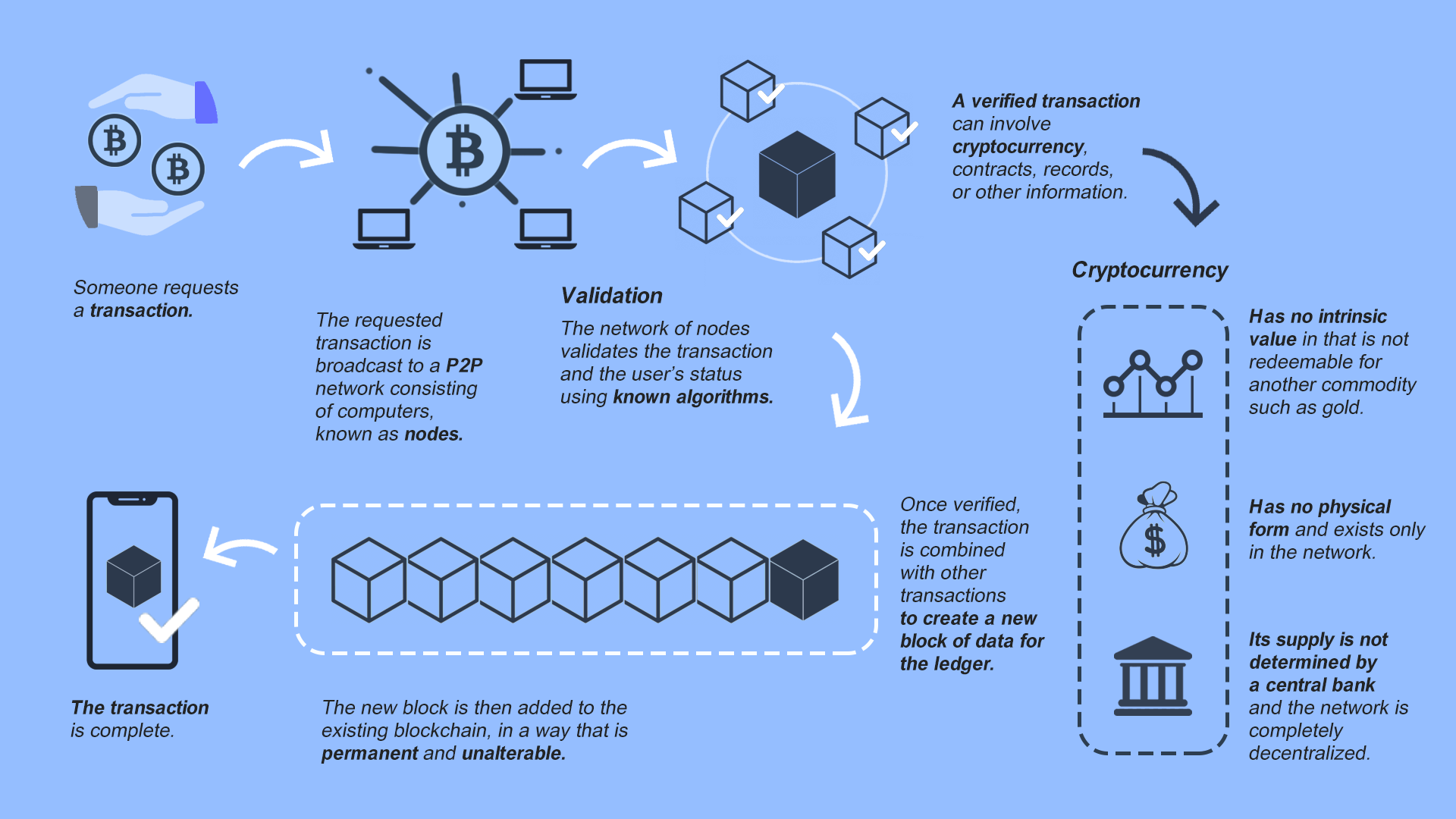

At its core, cryptocurrency exchange software is a platform that allows users to buy, sell, or trade digital currencies.

Think of it as a currency exchange marketplace where you can exchange one cryptocurrency for another or fiat currency (USD, EUR, etc.).

Market Research and Analysis

Before you dive headfirst to start your own Bitcoin exchange, it’s essential to conduct thorough market research and analysis.

Let’s break it down.

1. Identifying Your Target Audience

Who are the people most likely to use your exchange?

Are they beginners or experienced traders?

Are they looking for a simple platform or advanced trading features?

By making sure you understand your audience’s needs and preferences, you can tailor your exchange to meet their specific requirements.

Your target audience will also influence other extremely important aspects of your exchange, such as the UI, marketing strategies, and customer support.

2. Analyzing Competitors

Once you’ve identified your target audience, it’s time to analyze your competitors.

Who are the major players in the crypto exchange market?

What features do they offer?

What are their strengths and weaknesses?

By understanding the competition, you can identify gaps in the market and opportunities to differentiate your exchange for long-term success and a good trading experience.

But that’s not all.

Analyzing competitors also gives you insights into best practices and potential pitfalls to avoid.

3. Identifying Unique Selling Propositions (USPs)

With a clear understanding of your target audience and competitors, you can now identify your unique selling propositions (USPs).

What sets your exchange apart from the competition?

Is it a user-friendly web interface, advanced trading features, or top-notch customer support?

Your USPs are the key to attracting and retaining users, so it’s essential to highlight them in your marketing and branding efforts.

Recommended Read: Centralized vs Decentralized Exchanges

Regulatory Compliance

When starting a crypto exchange, regulatory compliance is not just a box to tick—it’s a critical factor that can make or break your business.

Navigating the complex web of regulations can be daunting, but it’s important to ensure that you do it to protect your exchange and your users.

Let’s break it down.

1. Understanding the Legal Landscape

First, you must understand the legal landscape of the country or region where you plan to operate.

What are the local regulations governing cryptocurrency exchanges?

Are there any licensing requirements or reporting obligations?

By understanding the legal landscape, you can ensure that your exchange operates within the bounds of the law, which tends to differ by geography.

Regulations can vary significantly from one jurisdiction to another, so it’s a great idea to consult with legal experts familiar with the specific regulations in your area so that you can guarantee compliance. For instance, if you are planning to operate in United States, knowing if crypto is legal in USA or not would help you out.

2. Implementing AML and KYC Procedures

Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures are crucial for preventing illegal activities on your exchange, such as money laundering and terrorist financing.

These procedures involve services like verifying the identity of your users and monitoring their transactions for suspicious activities.

But that’s not all.

Implementing robust AML and KYC procedures is also a requirement for regulatory compliance in many jurisdictions.

Technology and Infrastructure

When it comes to starting a centralized crypto exchange, technology, and infrastructure are the backbone of your platform.

From the technology stack, the admin panel, to the trading engine, every component plays a crucial role in the functionality, security, and user experience of your exchange platforms.

Let’s break it down.

1. Choosing the Right Technology Stack

This includes the programming languages, frameworks, and tools to power your platform.

However, the technology stack you choose will impact the scalability, performance, and security of your exchange.

Your developer will also need to figure out how the API connection will work with the server, as it forms a large part of some trading strategies.

Making a token out of the API key and storing it on the user’s device is a safeguard against hacking and helps incorporate transparency.

It’s essential to select blockchain technology that is robust, reliable, and suitable for the specific needs of your back-end and front-end.

2. Building or Buying a Trading Engine

The trading engine is the heart of your exchange.

It matches buy and sell orders, processes transactions, and updates the order book in real time.

You have two options: build a custom trading engine from scratch or buy a white label solution.

Building a custom trading engine gives you more control and flexibility, but it can be time-consuming, and you have to consider the cost to build.

On the other hand, buying a white-label solution is faster and more cost-effective, but it may have limitations in terms of customization and scalability.

It all depends on how fast you want your time to market to be and what you are willing to sacrifice for that.

3. Implementing Security Measures

Security is a top priority to start a Bitcoin exchange.

With the increasing number of hacks and security breaches, it’s essential to implement robust security measures to protect your startup and your users.

This includes using offline cold wallet storage for most cryptocurrency holdings, enabling two-factor authentication (2FA) for user accounts, and encrypting sensitive data.

But that’s not all.

Regular security audits and penetration testing are crucial for identifying and fixing potential vulnerabilities in order to develop a high-quality crypto exchange business.

Liquidity Management

When running a successful crypto exchange, liquidity is a key factor that can’t be overlooked.

Liquidity refers to the ease with which assets can be bought or sold on your platform without causing significant price fluctuations.

High liquidity attracts more users, fosters trust, and ensures smooth trading.

1. Importance of Liquidity in Crypto Exchanges

Why is liquidity so important?

High liquidity means users can easily buy or sell assets on your platform without waiting for a matching order.

This results in faster transactions, tighter spreads, and more stable prices.

But here’s the thing: Liquidity is a two-way street.

It not only attracts more users but also encourages existing users to trade more frequently.

In short, liquidity is a key factor in the success of your exchange.

2. Strategies to Boost Liquidity

Boosting liquidity on your exchange may seem challenging, but there are several strategies you can employ to achieve this goal.

Let’s take a closer look at each.

2.1 Partnering with Other Exchanges

Connect your exchange with other exchanges by sharing order books and liquidity pools with an exchange like Binance.

This way, you can increase the volume of trades on your platform and offer more competitive prices for active users.

This strategy can be particularly effective for new exchanges building their user base.

2.2 Offering Incentives

Offering a potential reward, such as reduced trading fees or rewards for high-volume crypto currency traders, can also boost liquidity.

2.3 Listing Popular Cryptocurrencies

Listing popular cryptocurrencies with high trading volumes can also boost liquidity.

Recommended Read: What is liquidation in crypto trading?

User Experience and Interface Design

When attracting and retaining users on your crypto exchange, user experience and interface design are key.

A well-designed, user-friendly platform can make all the difference in a competitive market.

You can implement several features to enhance the user experience on your exchange.

Let’s take a closer look at each.

Easy Registration and Verification

The registration and verification process is the first interaction users have with your platform.

Make it as simple as possible.

Use clear instructions, minimize the number of steps, and provide instant feedback.

Remember, a smooth onboarding process sets the tone for the user’s experience.

Intuitive Trading Interface

The exchange’s trading interface is the heart of your operation.

It should be intuitive, easy to navigate, and visually appealing.

Use clear labels, consistent layouts, and simple navigation menus.

Provide real-time data, interactive charts, and easy-to-use trading tools.

Mobile App Availability

With the increasing use of mobile devices, offering a mobile app for your exchange is crucial.

Ensure that your app is user-friendly, responsive, and offers all the features on your desktop platform.

Make it so that the users receive a one-time reward to download and login to the app.

Customization Options

Allowing users to customize their trading interface can enhance the user experience.

Offer features such as customizable layouts, color schemes, and widgets.

By giving users the flexibility to tailor their interface to their preferences, you can create a more personalized and enjoyable experience and vice versa.

Marketing and Promotion

Once you build a cryptocurrency exchange, it’s time to attract users to connect with your exchange and generate hype.

But with the growing number of exchanges and trends in the market, standing out from the crowd can be challenging.

That’s where marketing and promotion come in.

Let’s break it down.

1. Building a Strong Online Presence

Your website is your digital storefront, so ensure it’s professional, user-friendly, and informative.

But here’s the thing: your online presence extends beyond your website.

Create active profiles on social media platforms like Twitter, Facebook, and LinkedIn.

Share valuable content, engage with your audience, and establish yourself as an authority in the crypto space.

2. Strategies for Attracting Users

There are several strategies you can employ to attract users to your exchange:

2.1 Content Marketing

Content marketing is a powerful tool for attracting users and establishing credibility.

Create valuable content that educates and informs your audience.

This could include blog posts, articles, videos, or infographics.

Share your content on your website, social media, and relevant online communities.

Remember, providing valuable content not only attracts users but also positions you as an expert in the crypto space.

2.2 Affiliate and Referral Programs

Affiliate and referral programs are a great way to incentivize users to promote your exchange.

Offer rewards for users who refer new customers or promote your platform on their channels.

This not only attracts new users but also encourages existing users to spread the word, ultimately proving profitable for your exchange

2.3 Offering Promotions or Incentives

Offering promotions or incentives can also attract users to your exchange.

This could include reduced trading fees, bonuses for high-volume traders, or rewards for new users.

Remember, promotions and incentives should be used strategically to attract users looking to start trading, and encourage trading activity.

Customer Support

In the fast-paced world of crypto trading, responsive and helpful customer support is crucial.

Users may encounter issues, have questions, or need assistance anytime regarding withdrawal, exchange rates, or a notification they received.

Providing top-notch customer support not only solves their problems but also builds trust and loyalty.

It’s essential to train your support team operator and monitor their performance.

Also, provide regular training on your platform, common issues, and communication skills.

Monitor interactions with users, gather feedback, and continuously improve your support.

Remember, your support team is the face of your exchange.

Their performance can significantly impact user satisfaction and loyalty globally.

Launch

After months of hard work, you’re finally ready to launch your crypto exchange.

But before you go live, it’s crucial to test your platform thoroughly to ensure a smooth and successful launch.

Let’s take a closer look at some strategies for a successful launch.

Soft Launch

A soft launch involves releasing your platform to a limited audience before the official launch.

This allows you to test your platform realistically, gather feedback, and improve.

A soft launch can help you identify and fix any issues before the official launch.

Beta Testing

Beta testing involves releasing your platform to a select group of users for testing and feedback.

Beta testers can provide valuable insights, identify issues, and help you improve your platform.

Beta testing not only enhances the quality of your platform but also builds trust with your users.

Gradual Rollout

A gradual rollout involves releasing your platform in stages, starting with a limited audience and gradually expanding.

This allows you to monitor your platform, gather feedback, and make improvements as you go.

A gradual rollout reduces the risk of issues and ensures a smooth and successful launch.

Conclusion

From market research and regulatory compliance to technology infrastructure and customer support, every aspect plays a crucial role in the success of your platform.

By understanding the basics, identifying your target audience, implementing robust security measures, and providing top-notch customer support, you can create a thriving and secure crypto exchange that meets the needs of your users.

But remember, launching your exchange is just the beginning.

The crypto industry is constantly evolving, and staying ahead of the competition requires continuous improvement, adaptation to market changes, and a relentless focus on user satisfaction.

By staying informed, listening to your users, and striving for excellence, you can build a successful and sustainable crypto exchange that stands the test of time.