Navigating the crypto landscape can often feel like deciphering a new language, especially when it comes to choosing the right crypto exchange.

Centralized crypto exchange or Decentralized cryptocurrency exchange?

Which is safer?

More efficient?

As someone who’s delved deep into both worlds, I understand the confusion.

In this article, I’ll break down the key differences, advantages, and drawbacks of each, helping you make an informed decision tailored to your trading needs.

Ready to demystify the world of crypto exchanges?

Let’s dive in!

Centralized Exchanges (CEXs) vs. Decentralized Exchanges (DEXs)

Centralized Exchanges (CEX)

Before making an informed decision about which type of exchange to use, it’s crucial to understand what each one entails.

Let’s start by exploring centralized cryptocurrency exchanges.

Definition and Overview

Centralized exchanges (CEXs) are platforms operated by centralized entities that facilitate the trading of cryptocurrencies.

In a CEX, the exchanges may act as the middleman between buyers and sellers, overseeing all transactions, being the liquidity provider, and keeping custody of users’ digital assets in centralized wallets.

Popular examples include Coinbase, Binance and Kraken.

Advantages of CEX

So, why do people use centralized exchanges?

Here are some key advantages:

1. High Liquidity: CEXs often have higher liquidity and trading volumes, making it easier for large crypto investors and institutional investors to buy or sell large orders of assets without significantly affecting the market price.

2. User-Friendly Interface: These platforms are generally designed with ease of use in mind, making them accessible to crypto newcomers.

3. Speed and Efficiency: Transactions are usually faster, as they don’t have to be verified by a network of nodes.

4. Customer Support: Centralized exchanges often offer robust customer service, helping users resolve issues quickly.

Disadvantages of CEX

While CEXs offer several benefits, they’re not without their drawbacks:

1. Central Point of Failure: Being centralized means that if it is hacked, your funds are at risk. This has happened in the past with exchanges like Mt. Gox.

2. Control Over User Funds: In a CEX, you don’t have full control over your own funds; the exchange does. This goes against the ethos of decentralization in the crypto world. Remember, if you don’t hold your private keys, you don’t control the coin.

3. Regulatory Risks: Centralized exchanges are more susceptible to regulatory actions, which could impact your ability to transfer, withdraw, or deposit funds.

4. Lower transaction fees: As the CEXs provide liquidity and make money off of the volume traded on the exchange, they can keep the transaction fees lower compared to DEXs.

Keep reading to see how this compares to decentralized exchanges.

Decentralized Exchanges (DEX)

Now that we’ve covered centralized exchanges, let’s shift our focus to decentralized cryptocurrency exchanges.

Understanding the nuances of how DEXs work will help you make a more informed choice about where to trade your crypto assets.

Definition and Overview

Decentralized exchanges, or DEXs, are platforms that operate without a central authority or intermediary, so no KYC requirements.

They facilitate peer-to-peer trading as they match users’ buy and sell orders.

Smart contracts on a blockchain execute transactions, and users maintain control of their own funds at all times.

Uniswap, Sushiswap, and PancakeSwap are some popular examples.

Advantages of DEX

So, what makes DEXs appealing? Here are some compelling advantages that are a subset of the advantages of decentralized finance:

1. Security and Control: One of the most significant benefits of the protocol is that you have full control over your funds. There’s no central authority to get hacked, reducing the risk of losing your assets.

2. Privacy and Anonymity: Many DEXs don’t require you to undergo identity verification, offering a higher level of privacy.

3. Open and Permissionless: Anyone can use a DEX, and there are no restrictions on listing tokens, providing a wider range of assets to trade.

4. Censorship Resistance: Being decentralized means that it’s difficult for any single entity to shut down the exchange or manipulate the market.

Disadvantages of DEX

While DEXs offer several unique advantages, they also come with their own set of challenges:

1. Liquidity Issues: DEXs often have lower liquidity compared to centralized exchanges, which can result in higher price slippage.

2. User Experience: The user interface and experience are generally not as polished as those centralized exchanges offer, which can be a barrier for newcomers.

3. Slower Transaction Speeds: Transactions can be slower and more expensive, especially on congested networks.

4. Smart Contract Vulnerabilities: While rare, smart contracts that run DEXs can have bugs or vulnerabilities that could be exploited and lead to losses of hundreds of millions of dollars.

5. Impermanent Loss: Impermanent loss occurs when the price of tokens within a liquidity pool changes after you’ve deposited them. This can result in fewer returns than simply holding the tokens in your wallet.

6. Gas Fees: When you trade on a DEX, you have to pay network fees as you are interacting with a smart contract that lives on the blockchain. These fees can add up if you do this often and also if the network is congested.

Decentralized exchanges offer enhanced security and privacy but may lack user experience and liquidity.

Considering the pros and cons of CEXs and DEXs, consider what aspects are most important for your trading needs.

Recommended Read: What is liquidation in crypto trading?

Centralized Exchanges (CEX) vs Decentralized Exchanges (DEX): Comparative Analysis

Alright, you’ve got the basics down for both centralized vs decentralized exchanges.

But how do they stack up against each other regarding key factors like liquidity, security, user experience, and regulation?

Let’s dive into a comparative analysis to help you decide which type of exchange aligns with your trading goals.

Liquidity

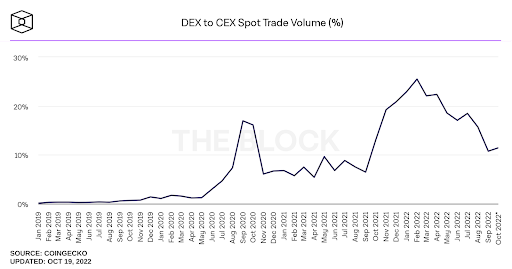

Centralized exchanges often contribute high liquidity due to large trading volumes.

This is crucial if you’re a market maker looking to execute large trades without causing significant price fluctuations.

Conversely, DEXs generally struggle with liquidity, especially for less popular tokens.

So, if liquidity is a top priority for you, a CEX might be the better choice.

Security

DEXs offer enhanced security since you maintain control of your own funds.

There’s no central authority to get hacked, which minimizes your risk.

However, CEXs act as a central point of failure.

If the exchange is compromised, your funds are at risk.

So, if you value security above all else, a DEX could be your go-to platform.

User Experience

Centralized exchanges often offer a more polished, user-friendly interface, complete with customer support.

This makes them ideal for crypto newcomers.

DEXs, however, can be less intuitive and might require a steeper learning curve.

If ease of use is a significant factor for you, you might lean towards using a CEX.

Regulation and Compliance

Centralized exchanges are also more susceptible to being regulated, and they will be required to comply, which could impact your ability to trade certain assets or even access your funds.

Governments use this to stop money laundering, terrorist funding mechanisms, etc.

DEXs offer more freedom but come with their own set of risks, including the lack of oversight and being unregulated.

If you’re concerned about regulatory issues, you must weigh the pros and cons carefully.

Your choice will ultimately depend on what you prioritize—be it liquidity, security, user experience, or regulatory compliance.

Keep these factors in mind as you decide, and you’ll be well on your way to a satisfying trading experience.

Recommended Read: How do bitcoin futures contracts affect bitcoin prices?

Future Trends and Predictions

So, you’ve got a solid grasp on the current landscape of centralized and decentralized exchanges.

But what about the future?

Where are we headed in the ever-evolving world of crypto trading platforms?

Let’s delve into some future trends and predictions that could shape your trading decisions down the line.

- Rise of Hybrid Exchanges

First off, keep an eye out for hybrid exchanges.

These platforms aim to combine the best of both worlds—CEX and DEX—offering the high liquidity and user-friendly interface of centralized exchanges while incorporating the security features of decentralized platforms.

If this trend catches on, it could revolutionize how we trade crypto.

- Regulatory Changes

As governments worldwide become more involved in the crypto space, we can expect more stringent regulations like anti-money laundering (AML) measures affecting both CEXs and DEXs.

This could either legitimize the platforms further or create hurdles for users, depending on the nature of the regulations.

- Technological Advancements

Don’t overlook technological advancements.

As blockchain technology evolves, we’re likely to see faster, more efficient decentralized exchanges and consequently DeFi.

This could potentially solve some of the current issues with DEXs, like low liquidity, and slower transaction speeds, making them more competitive with their centralized counterparts.

- Mainstream Adoption

Lastly, consider mainstream adoption.

As cryptocurrency continues to penetrate the mainstream financial markets, we can expect a surge in the number of users on both centralized and decentralized platforms.

This will likely result in improved services, less volatility, and more competitive fees as exchanges vie for users.

The future of crypto trading platforms is anything but static.

From hybrid exchanges to regulatory changes and technological advancements, numerous factors could influence your trading experience.

Stay informed and adaptable, and you’ll be well-positioned to take advantage of whatever the future holds.

Conclusion

So there you have it—a comprehensive look at centralized and decentralized exchanges, their pros and cons, and what the future might hold for each.

At the end of the day, the “best” platform for you will hinge on your specific needs, whether it’s liquidity, security, user experience, or regulatory compliance that tops your list of priorities.

Both CEXs and DEXs have unique offerings that cater to different types of traders.

Centralized exchanges are often the go-to for beginners and those prioritising liquidity and user experience.

On the other hand, decentralized exchanges offer more control and privacy, appealing to those who are more security-conscious.

As the crypto landscape evolves, staying updated on the latest trends and regulations will be key.

Whether you opt for a centralized, decentralized, or even a hybrid exchange like StormGain, make sure it aligns with your trading goals and risk tolerance.

Thank you for joining me on this deep dive into the world of crypto exchanges.

Here’s to making informed choices and successful trades in your crypto journey!