Cryptocurrency trading is a highly volatile and unpredictable market.

The prices of cryptocurrencies can fluctuate wildly in a matter of seconds, making it difficult for traders to make consistent profits.

To mitigate this risk or to take advantage of it, traders often use leverage.

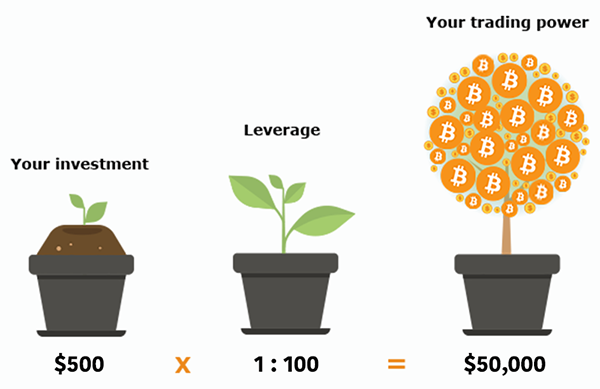

Leverage is a tool that allows traders to borrow funds to invest in an asset. It essentially magnifies the trader’s investment, allowing them to control a larger position with less capital.

In this article, we will explain how 100x leverage works in crypto, using Bitcoin (BTC) as an example.

How Does Leverage Work In Crypto: Explained with BTC as an example.

When a trader uses leverage for crypto trading, they borrow funds from crypto leverage exchanges to increase their buying power.

The borrowed funds are known as the margin. In traditional financial markets, leverage is commonly used in trading stocks, forex, and commodities.

For example, if a trader wants to buy $10,000 worth of Bitcoin with 2x leverage, they would need to deposit $5,000 in their trading account. The broker would then lend the trader the remaining $5,000 as a margin.

If you take a long trade and the Bitcoin price increases by 10%, your profit would be $1,000 ($10,000 x 10%).

However, since you used 2x leverage, you would also owe the broker the $5,000 you borrowed as a margin. Even there are a few exchanges like Binance Futures, Huobi, and Phemex that offers up to 125x leverage.

This $5,000 is returned to the broker when you close your position, and your profit will be $1,000, not taking into account the platform fees.

On the other hand, if the Bitcoin price decreases by 10%, your loss would be $1,000 ($10,000 x -10%).

However, since the trader used 2x leverage, you would also owe the broker the $5,000 you borrowed as a margin. So, your net loss will still be $1,000, and the $5,000 will be returned to the broker once the position has been closed.

As you can see from these examples, leverage magnifies both profits and losses. Traders must be careful when using leverage, as it can quickly lead to large losses if the market moves against them.

New to leverage trading? Know if crypto leverage trading is safe

What is 100x leverage?

Leverage is expressed as a multiplier, such as 2x, 5x, or 100x.

For example, if a trader has $1,000 and uses 2x leverage, they can control $2,000 worth of assets. If the trader uses 5x leverage, they can control $5,000 worth of assets.

100x leverage means that the trader can control 100 times the amount of capital they have. So, if a trader has $1,000 and uses 100x leverage, they can control $100,000 worth of assets.

The idea of using high leverage can be tempting as it can lead to potentially large returns.

However, it is important to understand the risks involved in using high leverage. The higher the leverage, the more substantial the potential losses can be. Even, you can lose more than than what you have invested.

Is 100x leverage safe?

Using 100x leverage in crypto is not safe for most traders.

The high leverage magnifies profits and losses, making it a high-risk strategy. Traders who use 100x leverage must have strict risk management strategies in place to mitigate the risk of large losses.

One common risk management strategy is to use stop-loss orders.

A stop-loss order is an order to sell an asset when it reaches a certain price. Traders can set a stop-loss order at a price that would limit their loss to a certain percentage of their trading account.

For example, if a trader has a $1,000 trading account and wants to limit their losses to 10%, they could set a stop-loss order at a price that would result in a $100 loss.

If the trader is using 100x leverage, they would only need to set the stop-loss order at a price that is 1% away from their entry price.

Another risk management strategy is to use lower leverage.

Traders who are not comfortable with the high risk of 100x leverage can use lower leverage, such as 2x or 5x. While this will reduce their potential profits, it will also reduce their potential losses.

Tips for using high leverage in crypto trading

If you decide to use high leverage in your crypto trading, there are some tips you should keep in mind to help manage the risks:

- Use a stop-loss order: A stop-loss order is an order to sell your position if the market moves against you. By using a stop-loss order, you can limit your potential losses and help manage your risk.

- Trade with a plan: Before entering a trade, have a clear plan in place. Determine your entry and exit points, and stick to your plan. Avoid making impulsive trading decisions based on emotions.

- Use proper risk management: When using leverage, it is important to use proper risk management. Avoid risking too much of your capital on a single trade, and diversify your portfolio to help manage your risk.

- Understand the market conditions: Before entering a trade, it is important to understand the market conditions. Crypto markets can be volatile, and it is important to be aware of any potential risks or news events that may affect the market.

Conclusion

High-leverage trading in cryptocurrency can be a double-edged sword.

While leverage trading has a lot of benefits, it also comes with significant risks. It is essential to understand the risks involved in using high leverage and to manage these risks appropriately.

Traders should use proper position sizing, set stop-loss orders, monitor their margin levels, and use technical analysis to manage risk and build a proper trading strategy.

High-leverage trading is not suitable for everyone and requires experience, knowledge, and a high-risk tolerance. Traders should carefully consider their risk tolerance before using high leverage in cryptocurrency trading.