Leverage is a powerful concept that can supercharge your crypto trading potential.

But here’s the kicker—it also opens up a whole new world of risks.

You might wonder: Can your balance go negative in crypto leverage trading?

This is an essential question, and I’m glad you’re here to find out.

So, grab your coffee, and let’s dive in!

Understanding Leverage in Crypto Trading

In crypto trading, leverage is essentially a loan given to you by the exchange.

That’s right—a loan!

It allows you to trade with more capital than you have in your account.

By multiplying your trading power, you can potentially achieve higher profits.

But there’s a catch.

Remember, while leverage can amplify your profits, it can also magnify your losses.

If the market moves against your trade, you could lose more than your original investment.

It requires careful planning, disciplined risk management, and a deep understanding of the crypto market dynamics.

So, if you’re considering diving into crypto leverage trading, arm yourself with knowledge and caution.

The Reality of Negative Balances

Let’s tackle the crux: can your balance go negative in crypto leverage trading?

Well, brace yourself because, in theory, it can.

However, it’s critical to understand how and why this might happen.

Negative balances in leverage trading occur when losses exceed the account’s balance.

Let’s paint a picture.

Suppose you’re trading Bitcoin with leverage, and the market suddenly turns.

If the losses mount and surpass the collateral in your account before the exchange can liquidate your position, you may owe the exchange money.

In a disastrous scenario, your balance could slip into the negatives.

This is a stark contrast to regular spot trading, where in the worst case, your account balance might fall to zero if the asset’s value drops dramatically, but you can’t lose more money than you’ve invested.

However, with leverage trading, the stakes are significantly higher, and the risk of a negative balance becomes a possible reality.

But there’s a ray of hope in this rather gloomy scenario.

Most reputable crypto exchanges have protective measures, like automatic liquidations, to prevent traders’ balances from going negative.

These measures aim to close your position before losses exceed your margin.

Even with such mechanisms, there are instances where a market’s extreme volatility and rapid price swings can outpace the exchange’s ability to close positions promptly, leading to potential negative balances.

New to leverage trading? Learn How to leverage trade crypto?

Case Studies

So, we’ve covered the theory, but how does this all play out in real life?

To better understand, let’s consider a case study.

Consider Trader A, who entered a 10x leveraged long position on Bitcoin when its price reached $30,000 and went to sleep. The trading balance in the wallet is $100, and all of it was used in this trade.

However, the market took a downturn overnight, and Bitcoin dropped to $20,000.

This caused Trader A’s position to be liquidated, and their account balance fell to zero, but it didn’t go into the negative, thanks to negative balance protection.

Conversely, Trader B was not as lucky with their crypto exchange choice and risk management strategy.

They entered a 30x leveraged long position on Bitcoin and went to bed. They also used their trading balance of $100 in this position.

For this example, let us take the overnight fees to be 0.1% and the funding fees to be 0.5%.

So on a position of $100*30x = $3,000, the overnight fee was $3, and the funding fee was $15.

Due to the lack of negative balance protection offered by the exchange, their position was liquidated, making their trading balance $0, and the fees were added.

So their losses exceeded her initial investment, and she had a negative balance of $18.

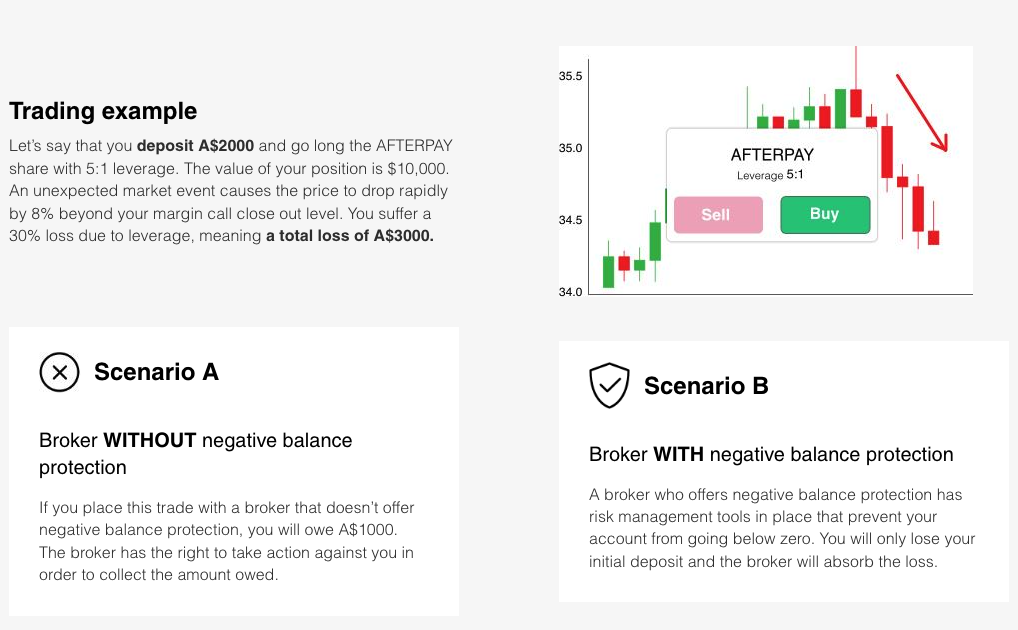

The picture below shows another case study of a similar situation.

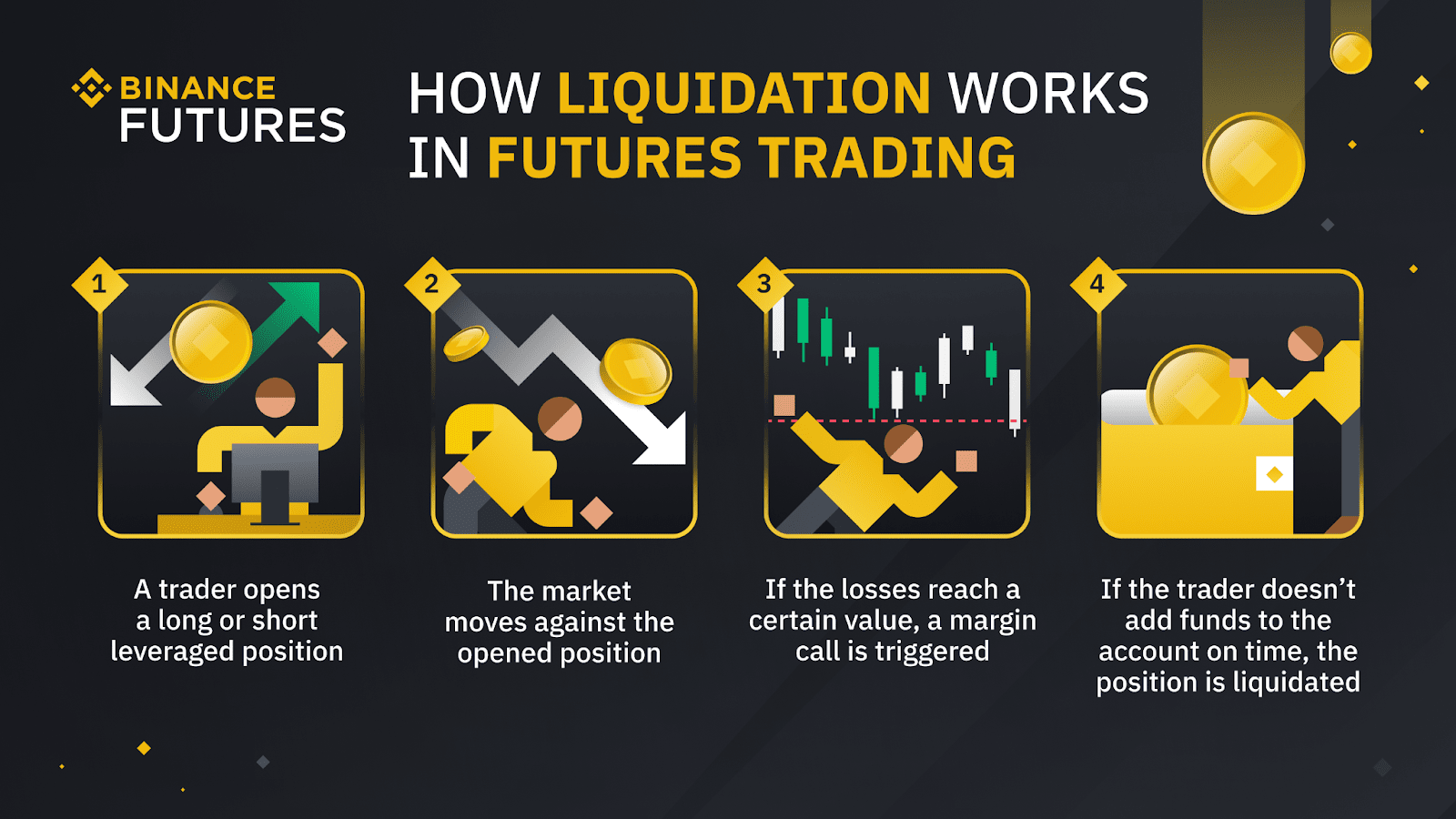

The Mechanism of Margin Calls

As you dive deeper into crypto leverage trading, you must understand the mechanism of margin calls.

A margin call is like a wake-up call from your broker, but it’s not one you’d look forward to.

When trading with leverage, you borrow funds to amplify your trading capacity.

But you’re expected to maintain a minimum account balance, known as the ‘maintenance margin’.

A margin call happens when your account balance dips below this maintenance margin due to losses on your positions.

Your broker will ask you to refill the funds to return your account to the required level.

If you don’t respond by topping up your account, your broker can liquidate your positions to cover the loss.

That’s why understanding margin calls is so important in crypto leverage trading.

They act as a safety net, protecting the broker and, by extension, the trader from going into a negative balance.

Recommended Read: What is the role of collateral in crypto leverage trading?

Impact of Market Volatility on Leverage Trading

Have you ever wondered about the relationship between market volatility and leverage trading?

Crypto prices can skyrocket or plummet within minutes. While this volatility can be a trader’s best friend, it can also turn into their worst enemy, especially when leverage is involved.

Imagine you’re trading with high leverage.

This means that even small price movements can impact your profits or losses.

Here’s where volatility comes in.

Those ‘small’ price movements aren’t so small in highly volatile markets. They can be wild swings that could significantly inflate your profits or losses.

Let’s say you placed a leverage trade predicting the price of Bitcoin will go up.

If volatility works in your favor and the price soars, you’re in for major profits.

But what if the markets take a sudden downturn?

With high volatility and leverage combined, losses can pile up rapidly, potentially leading to a margin call or, even worse, a negative account balance.

That’s why it’s important to always stay aware of market conditions when trading with leverage.

Negative Balance Protection

You might think, is there a safety net regarding negative balances in crypto leverage trading?

Luckily, there is, and it’s known as “Negative Balance Protection.”

Negative Balance Protection is a risk management feature some crypto derivatives exchanges offer.

It promises that your account balance will not fall below zero, regardless of the market conditions.

It’s designed to protect traders from potential losses that can be magnified due to leverage.

When losses start to mount and get close to exceeding your margin, your position will be automatically liquidated to prevent a negative balance.

But it’s important to note that not all platforms provide this protection. So, it’s crucial to read the fine print when choosing a platform for crypto leverage trading.

Strategies for Avoiding Negative Balances

Let’s explore some strategies to help safeguard you from this undesirable situation.

First and foremost, set a stop-loss order.

You’d be surprised at how many traders forget this essential step.

A stop-loss order allows you to contain your losses by closing your position once it hits a certain level.

Second, constantly monitor your margin balance.

Remember, as you trade, you’re not just dealing with your own money but borrowed funds as well.

Next, diversify your portfolio.

By spreading your investments across various assets, you reduce the risk of suffering massive losses if one investment turns sour.

Another strategy is to use lower leverage.

While high leverage can amplify profits, it can also amplify losses.

Lastly, never stop learning.

The crypto market is dynamic, and staying informed about market trends, news, and various trading strategies can help you make more educated decisions.

Buckle up, and let’s move toward the conclusion!

Recommended Read: What is the best leverage for bitcoin trading?

Conclusion

As we wrap up this journey through the labyrinth of crypto leverage trading, it’s evident that the possibility of a negative balance is accurate but not inevitable.

With the right understanding of leverage mechanics, awareness of market volatility, and clever risk management strategies, you can mitigate this risk significantly.

Negative balance protection can be your safety net, but not all platforms offer it.

So choose wisely!

Dive in with knowledge, tread cautiously, and always stay informed.

Because in this volatile world of crypto, knowledge isn’t just power. It’s profit.