As a seasoned trader, I understand the allure of leverage trading in the cryptocurrency world.

But I’ve also seen how easily it can turn sour when not cautiously approached.

So, you’re wondering, what’s the best leverage for Bitcoin?

You’re in the right place because I’m about to dive deep into this topic.

We’ll explore how to select the right leverage for your crypto trades, consider specific factors for Bitcoin, and analyze some real-life scenarios.

Leverage Explained

In the trading world, leverage is a powerful tool that can amplify both your gains and losses.

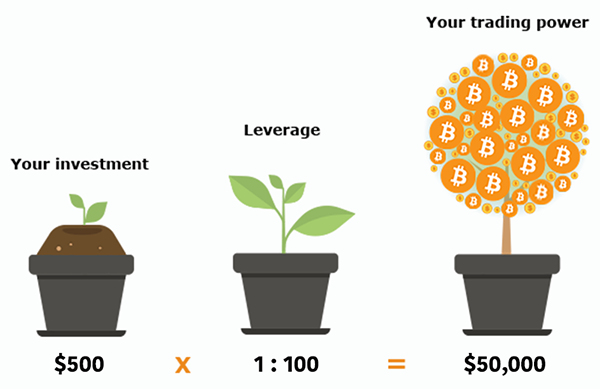

Leverage allows you to borrow funds from a broker to open a position larger than your initial investment.

This is done using a multiplier, such as 2x, 5x, or even 100x, or a ratio like 2:1, 5:1, and 100:1, representing the amount you can borrow for every dollar you invest.

But here’s the catch: Leverage is a double-edged sword. While leverage can amplify your profits, it can also magnify your losses.

Stay with me as we explore how to choose the best leverage for Bitcoin and how to navigate the risks associated with it.

Trust me. You won’t want to miss this!

Benefits and Risks of Leverage Trading

Regarding crypto leverage trading, the potential benefits can be tempting, but the risks are something you can’t ignore.

Let me show you both sides to help you make an informed decision.

First, the benefits:

Leverage trading can amplify your potential profits, allowing you to open larger positions with a smaller initial investment.

This can give you greater exposure to the market, increasing the potential for significant gains.

For example, with 10:1 leverage, a 5% increase in the asset’s value can translate into a 50% profit.

Leverage trading can also be a powerful tool for diversifying your portfolio.

Using borrowed funds to open multiple positions, you can spread your risk across different assets.

This can help reduce the impact of a poor-performing investment on your overall returns.

However, let’s not forget about the risks:

While leverage can amplify your profits, it can also magnify your losses.

You could lose more than your initial investment.

When using 10:1 leverage, if the asset’s value falls by 5%, your loss would be 50% of your investment.

That’s a tough pill to swallow!

The volatile crypto market can make leverage trading even riskier.

Rapid price swings can trigger margin calls, forcing you to add more funds to your account or close your position at a loss.

But here’s the kicker: High leverage can also increase the pressure to make quick decisions.

This can lead to impulsive trading and poor risk management, increasing potential losses.

In conclusion, while it offers the potential for significant profits, it also comes with increased risk.

The key is to understand the mechanics of leverage and the impact it can have on your trades.

By doing so, you’ll be better equipped to navigate the risks and make informed decisions.

So, stick with me as we explore how to choose the best leverage for Bitcoin and what factors to consider.

Trust me. You’ll want to know this!

How To Choose The Best Leverage For Crypto

Choosing the right leverage for your crypto trades can be a game-changer.

I understand; you want to maximize profits without exposing yourself to excessive risk.

So, how do you strike that balance?

To choose the best leverage for your crypto trades, let’s dive into the key factors.

1. Understanding your risk tolerance: Before you go all in with high leverage, take a step back and assess your risk tolerance. Are you comfortable with the potential for substantial losses? Do you have a backup plan in case things go south? Understanding your risk appetite will help you make informed decisions when choosing leverage levels.

2. Evaluating market conditions: The crypto market is known for its volatility, which can be both an opportunity and a risk. Before you decide on leverage, consider the current market conditions. Is the market trending up, down, or sideways? Are there any upcoming events that could impact the market? You can make more informed decisions about leverage by evaluating the market conditions.

3. Assessing your experience: You may be comfortable using higher leverage if you’re a seasoned trader with a good track record. However, if you’re new to the game, starting with lower leverage might be wise and gradually increasing it as you gain more experience.

4. Diversifying your trades: Instead of going all in on one trade, consider diversifying your trades across different assets. This can help spread your risk and reduce the impact of a poor-performing trade on your overall portfolio.

5. Setting stop-loss orders: To protect yourself from significant losses, set stop-loss orders at predetermined levels. If the market does not go in the intended direction of your trade, you can automatically close the position and minimize losses.

6. Regularly reviewing your leverage levels: It’s crucial to review and adjust your leverage levels based on changing market conditions, trading strategy, and risk tolerance. Don’t just set it and forget it; stay on top of your trades and adjust as needed.

By following these tips, you’ll be well on your way to choosing the best leverage for your crypto trades.

Approach it cautiously, monitor your emotions, and stay informed about the market.

And here’s the most important part: When it comes to leverage, less is often more.

Going for high leverage is tempting, but the risk increases proportionately.

Don’t let the allure of quick profits cloud your judgment.

Take time, research, and choose leverage levels that agree with your risk tolerance and trading strategy.

Your future self will thank you!

Recommended Read: How to leverage trade crypto?

What is the Best Leverage For Bitcoin?

What is the best leverage for Bitcoin?

That’s the million-dollar question.

Well, let me tell you, there’s no one-size-fits-all answer to this.

Your ideal leverage depends on your risk tolerance, trading strategy, and market conditions.

However, I can offer some insights that may help you find the leverage that suits your needs.

So, what do you do?

1. Beginner Traders: If you’re a beginner, I recommend starting with low leverage, like 2:1 or 3:1. I know the temptation to go big is real, but trust me, starting small will allow you to learn the ropes without exposing yourself to excessive risk.

2. Experienced Traders: If you’re an experienced trader, you may feel comfortable with higher leverage. However, even then, I would caution against going too high. Consider using leverage between 5:1 and 10:1. This can balance potential returns and risk well.

3. Market Conditions: Pay attention to the market conditions. In a volatile market, even small price movements can significantly impact your leveraged position. It might be wise to reduce your leverage in such situations.

4. Risk Management: Always have a risk management plan regardless of your experience level or the market conditions. Set stop-loss orders, diversify your trades, and do not invest more than you are okay to lose.

5. Professional Advice: If you’re unsure about the right leverage level, consider seeking advice from a professional. They can help you assess your risk appetite and make a trading strategy that works towards your financial goals.

Now, let me be clear. Leverage can be a powerful tool, but it’s not a guaranteed path to riches.

Even experienced traders can suffer significant losses when trading with leverage.

In the end, the best leverage for Bitcoin is the one that aligns with your risk tolerance and trading strategy.

So, take your time, assess your options, and choose the leverage that suits your needs.

Remember, in the world of crypto trading, slow and steady often wins the race!

Recommended Read: What is the role of collateral in crypto leverage trading?

Case Studies of Leverage Trading in Bitcoin

Real-life case studies can offer invaluable insights when understanding the practical aspects of leverage trading in Bitcoin.

Let me walk you through a couple of examples highlighting the potential upsides and downsides of leverage trading.

Case Study 1: The Success Story

Meet Alice, an experienced trader who decided to leverage her $1,000 investment in Bitcoin at 10:1 leverage.

This means she’s trading with $10,000 worth of Bitcoin.

As luck would have it, the price of Bitcoin increased by 5%.

With leverage, Alice’s profit is not just $50 (5% of $1,000) but $500 (5% of $10,000).

That’s a whopping 50% return on her original investment!

However, don’t let this success story fool you into thinking that leverage trading is a surefire way to make profits.

Let’s look at another case study.

Recommended Read: Can your balance go negative in crypto leverage trading?

Case Study 2: The Cautionary Tale

Meet Bob, who, like Alice, leveraged his $1,000 investment in Bitcoin at 10:1.

Unfortunately for Bob, the price of Bitcoin dropped by 5%.

Without leverage, Bob’s loss would have been $50 (5% of $1,000). But with leverage, his loss is magnified to $500 (5% of $10,000).

That’s half of his initial investment!

Now, you might be wondering, what’s the takeaway from these case studies?

Well, it’s simple.

While it can be a lucrative strategy, it’s not without risks. And that’s precisely why it’s crucial to have a well-thought-out risk management plan in place.

It’s worth noting that both Alice and Bob leveraged their investments at 10:1, but their outcomes were drastically different.

The market’s unpredictable nature plays a significant role in determining the success or failure of leverage trading strategies.

If you’re considering leverage trading in Bitcoin, keep these case studies in mind.

Remember, it’s not just about the potential rewards; it’s also about managing the inherent risks.

Approach leverage trading with caution, educate yourself, and, most importantly, be prepared for possible losses.

After all, it’s not just about winning in the world of trading.

It’s also about minimizing losses when things don’t go your way.

Conclusion

Leverage trading in Bitcoin offers the potential for substantial profits by allowing you to trade with a larger position than your initial investment.

On the other hand, it also magnifies your potential losses.

The key to successful leverage trading lies in understanding how leverage works, assessing your risk tolerance, choosing the right leverage for your trading strategy and not to walk on the path of over-leveraging.

Be sure to do your due diligence, have a risk management plan, and approach leverage trading with caution and respect for the market’s volatility.

Happy trading!