Imagine this: You’ve spotted Bitcoin hovering around $10,000, and your gut screams, “Buy!”.

You excitedly place your order, picturing yourself sailing on a wave of digital gold.

That’s where stop-loss orders come in.

Think of them as your trusty crypto parachute, ready to deploy and cushion your fall if the market plunges.

In the volatile world of crypto trading, solidly understanding stop losses is like wearing a seatbelt on a rollercoaster: essential for a safe and thrilling ride.

Stop-loss orders are like automatic “buy and sell” instructions that are used to limit losses according to your risk tolerance.

You enter a price point; if the trigger price is reached, your order is executed, and you pull your money out of a fast-moving market.

Using a stop loss order might effectively differentiate between a profitable trade and a tearful goodbye to your cash.

It’s a powerful tool that can also be used to help you navigate crypto with peace of mind.

The Basics of Stop Loss Orders: Demystifying Your Crypto Safety Net

Let’s discuss the basics of stop-loss orders and break down the important concepts.

Here are a few stop loss examples that helped me understand the concept:

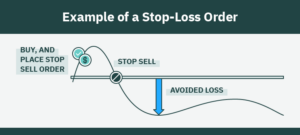

Assume that in case of a long position, you bought Bitcoin (BTC) when the “current market price” was $9,500, and you expect it to increase further in value.

First, you pick a specific price for your stop loss, like $9,000.

This is your trigger price, and you will act when the prevailing market price reaches a predetermined limit price and exit the trade.

You enter the stop loss order on the crypto exchange, ready to execute when market conditions require it.

The crypto market is volatile, but you can chill after placing a stop-loss order.

This is because the exchange can now constantly monitor the price and execute your order when it is reached.

As long as Bitcoin stays above your trigger price, nothing happens.

But once the price equals $9,000, your set stop loss orders are executed to protect against losses.

Before you know it, your Bitcoin is out of the market and back in your portfolio.

So, stop-loss orders are like having a safety net woven into your trading strategy and technical analysis.

They’re not foolproof, but they can help you limit potential losses.

How Stoploss Orders Work: Your Crypto Rescue Mission Control

If you want to make sure you limit your losses or lock in potential gains, you need to follow these steps:

Step 1: First, choose your target.

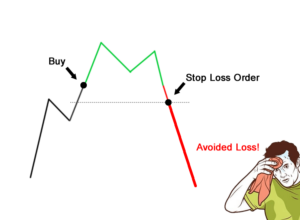

Let’s say you bought 1 Ethereum at $1,500.

You decide you’re happy with a 10% profit, so your take profit is $1,650.

The amount you are willing to lose on this trade is 5%, which means your stop loss value will hit when the price reaches $1,425.

Step 2: Now, enter your orders in the exchange accordingly. If Ethereum goes to $1,650, take a profit and close the position, and if it dips below $1,425, then create an order to sell all Ethereum and cut the losses.

This activates your stop loss order.

Step 3: The exchange silently monitors the price of Ethereum as you explore the market.

Ethereum spikes, then dips, then climbs again.

But your cool-headed exchange doesn’t panic.

It keeps a steady eye on both trigger prices.

Suddenly, the market takes a nosedive!

Ethereum plummets below $1,425.

But fear not! Your exchange springs into action.

It automatically sends a “sell” signal and triggers the stop loss order.

Woosh! Your Ethereum is safely sold, minimizing your downside risk.

Remember, stop-loss orders aren’t magic shields.

But they’re like having a trusty co-pilot, helping you navigate the volatile market.

New to crypto trading? Know What is a crypto trading pair?

Benefits of Using Stop Loss Orders: Your Crypto Safety Squad

Stop loss orders are like having a whole squad, each with its superpowers (advantages and disadvantages) to keep you going.

Let’s see how they benefit your trading game:

1. Fearless FOMO Fighter: Imagine being glued to the screen, watching your favorite altcoin drop like a failed rocket.

You feel the urge to hold onto the stock forever, hoping the price will return.

But guess what?

Placing a stop loss is a voice of reason, saying, “Hey, remember your strategy? Let’s cut our losses before things get too crazy.”

Setting a stop loss order helps you stick to your plan and avoid holding onto a sinking ship.

2. Stress-Busting Shield: A Stop loss order is an order that takes on the burden of watching the market so you can relax knowing your holdings are protected.

No more checking charts every five seconds, placing a market order to sell, or catching red candles!

3. Smarter Risk Management Coach: Stop losses are like a wise coach who teaches you to manage risk like a pro.

They help you define your acceptable loss limit and automatically exit trades when things go south.

4. Disciplined Trading Partner: Discipline can be tricky, especially in the heat of the crypto market.

Stoplosses act like your disciplined trading partner, sticking to your strategy.

They help you avoid emotional decisions and focus on your long-term investment goals.

5. Sleep-Sound Peace of Mind Potion: Imagine setting your stop losses and going to sleep without worrying.

A stop loss in crypto trading is like a potion for peace of mind and an insurance policy against the fluctuation of the market.

So, stop loss orders aren’t just a fancy type of order.

You can use a stop loss order to be your crypto safety squad, working to keep your trading journey smooth despite all the volatility.

Remember, even crypto traders need superheroes sometimes!

Stop Loss Myths: Debunking the Crypto Boogeymen

Let’s bust some of these myths I discovered while researching and show why stop losses deserve a place in your trading toolbox.

Myth #1: They guarantee profits. Nope! Stop losses minimize losses, not guarantee profits.

They’re like an escape hatch, not a rocket to riches.

They can be used that way, but commonly, using stop-loss orders is designed to limit the potential losses.

Myth #2: They make you miss out on gains. Not if you use it in a may be slightly different way!

Setting a stop loss slightly above your entry price can protect your initial investment while leaving room for potential profits.

Myth #3: They’re too complicated. False alarm! Stop losses are a surprisingly simple order type.

Just choose a trigger price, place the order, and let the exchange do the rest.

It’s like setting a timer on your oven in order to protect your dish from burning.

Myth #4: They trigger market crashes. While large stop-loss orders can influence prices slightly, they’re not powerful enough to crash the whole market.

Myth #5: They’re not for everyone. Stop losses can benefit any trader, whether you’re a seasoned trader or a crypto newbie.

They’re like training wheels for a market where prices can change rapidly.

So, the next time you hear whispers about stop-loss monsters, remember this: they’re not your enemy but your allies.

Recommended Read: What is over-leveraging in crypto and why is it risky?

Level Up Your Crypto Game: Advanced Stop Loss Strategies for Masters

Conquered the basics of stop-loss orders? Feeling ready to level up your crypto trading game?

Buckle up because we’re about to dive into advanced stop-loss strategies:

1. Trailing Stop Losses: Think of trailing stops as the first thing you pick up after finishing crypto trading for beginners.

Use a stop-loss order of this kind to set the stop loss price as the market climbs in your favor.

Imagine your long position soaring!

Instead of a fixed trigger, your trailing stop order follows, catching you before a short-term price fall.

When the trailing stop loss hits, the order becomes a market order and sells your full position.

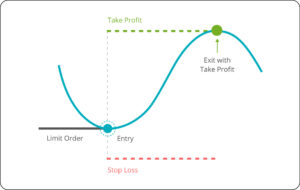

2. Take Profit Orders: Stop-losses minimize losses, but take profit orders lock in gains.

Think of them as, “If Bitcoin’s price rises to $20,000, sell some and celebrate!”

It’s like taking your winnings off the table with a buy or sell order while letting the rest ride the wave.

3. OCO Orders: Want to maximize your agility in a conditional trade?

You might use OCO (One Cancels the Other) orders.

Set one to sell if the price drops and another if it reaches a target price when you want to buy or sell a specific range.

You now have a safety net and a victory lap, all in one buy order!

4. Brackets & Chasing Stops:

Brackets involve setting multiple stop losses (limit order) at different price levels.

Chasing stops adjust your stop loss based on a technical indicator and trading pair.

These strategies are like the black belts of stop loss, but remember, these are good to know, and orders also require practice in case of a short or long position.

5. Diversification: Diversifying your portfolio across crypto assets costs nothing.

Please start with the basics, master them, and then slowly experiment with these techniques.

With practice and knowledge, you can navigate the current market with confidence and finesse.

Recommended Read: Why have multiple accounts on multiple crypto exchanges?

Stop Loss Orders: Your Crypto Safety Net

So, you’ve journeyed through stop-loss orders, from simple escape hatches to advanced trailing stop order maneuvers.

It’s time to integrate these tools into your cryptocurrency trading strategy to mitigate risk.

Stoplosses aren’t magic shields; they’re your trusty crew, ready to navigate volatile markets and minimize losses.

Embrace them, experiment with them, and watch your confidence increase alongside your crypto portfolio.

Stoplosses allow you to trade boldly, but always trade smart!