There’s a term that’s been making waves, and if you’re keen on maximizing your profits, you’ve probably come across it: Leveraged trading.

As you dive deeper into the crypto trading realm, understanding tools like auto-deleveraging can be your safety net.

So, whether you’re a seasoned trader or just dipping your toes, stick with me as we unravel the intricacies of auto-deleveraging and how it’s reshaping the crypto exchange landscape.

Need for Auto-Deleveraging in Crypto Exchanges

Alright, so leverage can be both a boon and a bane.

But how do exchanges ensure they don’t end up holding the bag and cover the loss of high-risk traders?

In traditional markets, the broker steps in if a trader can’t cover their losses.

But things move at lightning speed in the high-speed, high-stakes crypto world, especially with high leverage and speculating on the market’s direction.

Most exchanges use a “margin calls” system where they are forced to liquidate positions close to being unprofitable.

But sometimes, these systems can’t keep up due to rapid market movements.

That’s where auto-deleveraging comes into play like a safety net, and the system automatically deleverages opposing traders’ positions and divides the loss proportionately to all profitable and higher leveraged traders.

It’s a way to ensure everyone gets their fair share and the exchange doesn’t end up out of pocket.

New to crypto trading? Learn the Role of collateral in crypto leverage trading.

Understanding Leverage: A Quick Refresher

Think of leverage as a double-edged sword.

On one side, it can amplify your profits.

Still, on the flip side, it can also magnify your losses, and this means that the chances of getting auto-deleveraged increase if a trader has a more profitable position with high effective leverage.

Instead of trading with your initial margin, you’re trading with a multiplied amount, hoping to maximize potential profits.

Sounds enticing, but remember, with great power comes… well, you know the rest.

What is Auto-Deleveraging?

Auto-deleveraging is essentially a risk management tool used by the crypto future trading platform.

When leveraged traders have their position liquidated, and the liquidation doesn’t cover that loss, the exchange will reduce or auto-deleverage the positions of profitable traders with the highest ADL ranking to make up the difference.

Think of it as a trade-off.

These traders benefit from the exchange’s leverage, allowing them to amplify their profits.

So, it is only fair that the traders with the highest profits and effective leverage used are the first to be deleveraged.

The Auto-deleveraging mechanism is a way to spread that risk proportionately to all profitable traders across the platform’s user base.

This ensures that no single risky trader can create a situation where the contract loss would drag down the exchange, which bears the brunt of a sudden market downturn.

How Auto-Deleveraging Works: A Step-by-Step Process

Auto-deleveraging might sound complex, but it becomes more apparent when broken down step by step.

1. The Trigger: Liquidation Isn’t Enough

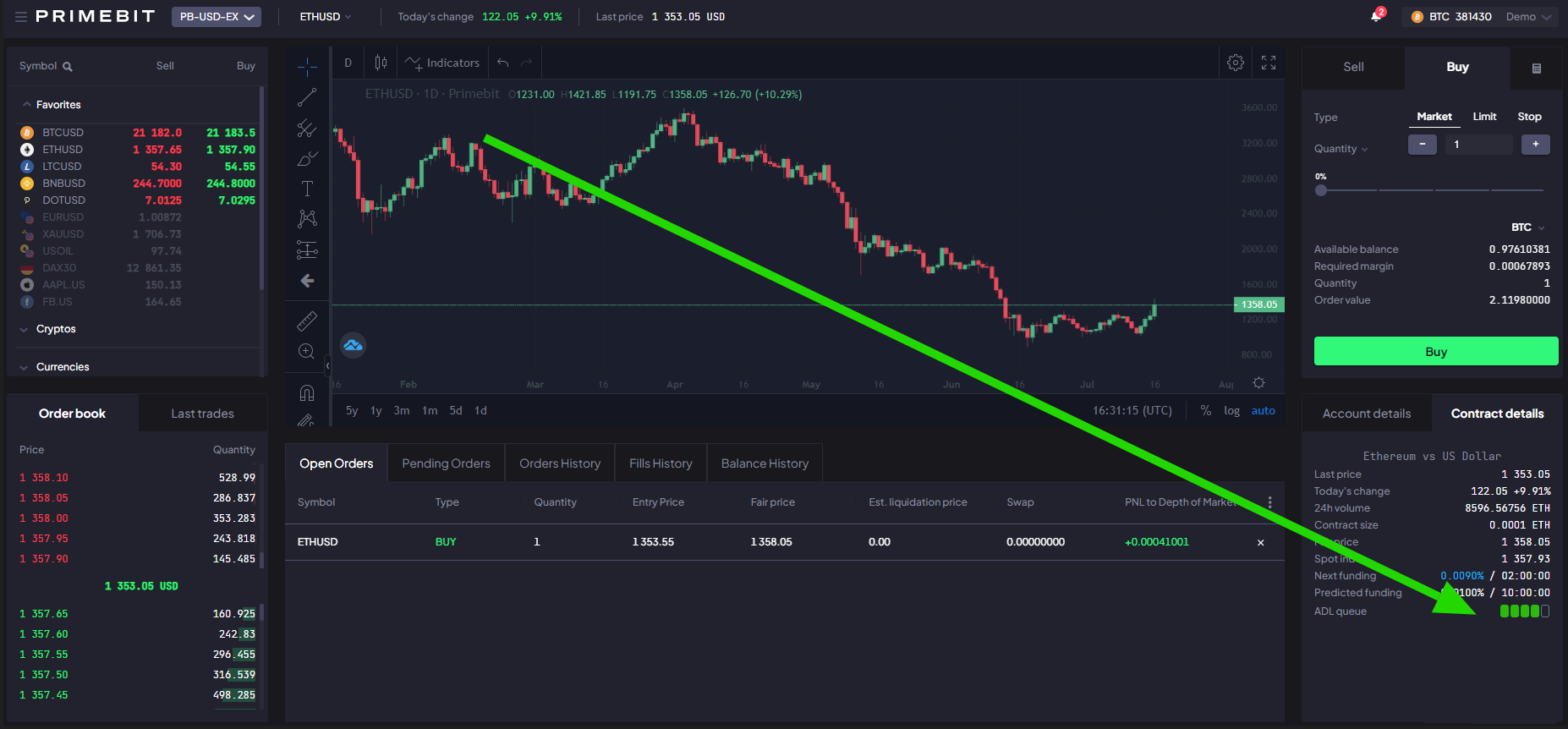

First, auto-deleveraging kicks in when a trader’s position reaches the liquidation price, but the liquidated order isn’t filled due to extreme market volatility.

This leaves a gap, and that’s where ADL comes into play.

2. The Ranking System

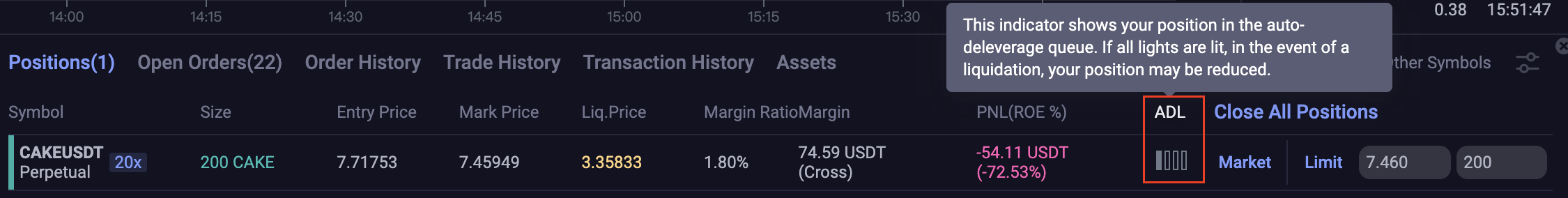

Exchanges typically have a ranking system according to their PNL.

This represents your priority in case the deleverage mechanism kicks in.

The more profits and effective leverage a trader has used, the higher their priority in the queue and rank.

3. The Deleveraging Process

The ADL system automatically will start auto deleveraging, according to the profit and leverage priority, starting with the top percentile trader.

It will begin to reduce its position if the contract loss can’t be covered until the debt from the liquidation is earned back.

The system then matches the selected profiting positions with liquidation orders at the bankruptcy price of the initial order.

After the auto-deleveraging is triggered, the forced liquidation by order matching will be abandoned.

Instead, the system will directly find a counterparty determined by the algorithm for the account being liquidated and trade directly at the marked price.

The system then matches the selected profiting positions with liquidation orders at ‘Bankruptcy Price’.

A Maker’s rebate will be paid to the trader covering the loss, and a Taker’s fee will be charged to the trader whose loss was covered.

4. Notification and Transparency

Most traders who experience an ADL will receive a notification from the exchange if their positions have been affected by auto-deleveraging.

Plus, they’ll often provide a real-time ADL ranking starting from the highest ranking so traders know where they stand.

Once all their open orders have been canceled and the position is liquidated, they are free to re-enter the market.

Benefits of Auto-Deleveraging for Traders

1. Market Stability: The Bigger Picture

The cryptocurrency market has always been volatile, and ADL prevents potential cascading liquidations by ensuring exchanges can cover losses during extreme market conditions.

A stable market benefits all traders, reducing the chances of sudden and unpredictable price crashes through the liquidation of leveraged positions by profit and leverage.

2. Protection from Extreme Volatility

With ADL in place, traders are somewhat shielded from the brunt of extreme volatility.

This is unfair to traders who trade with low effective leverage as it forces low-risk traders to get deleveraged

3. Ensuring Exchange Solvency

Imagine trading on an exchange that goes bankrupt due to a loss after a liquidation cascade.

Some exchanges have an insurance fund to cover such times.

But if a single whale trader is holding a large position speculating for an uptrend, the trader can create a large contract loss that can’t be covered by the balance in the insurance fund.

The exchange will cover the rest via ADL, ensuring that exchanges remain solvent.

The ADL system was designed to cover that loss after liquidation with a contract loss that cannot be covered by the Insurance Fund.

Potential Risks of Auto-Deleveraging

While auto-deleveraging (ADL) offers a safety net for the crypto trading ecosystem, it has potential pitfalls.

1. Unexpected Position Reductions: The Surprise Factor

Even if you’re on the winning side of a trade, ADL can reduce your position if your position is in the top percentile.

While exchanges provide notifications, the rapid pace of crypto markets might not always give you ample time to react.

2. Reduced Profits: The Unpleasant Reality

If your position is reduced during ADL, it can directly impact your potential profits.

Imagine seeing a profitable trade trimmed before the market moves even more in your favor.

Ouch!

Recommended Read: What is Over-Leveraging in Crypto?

Popular Crypto Exchanges Implementing Auto-Deleveraging

1. Bybit:

Bybit is a heavyweight in the derivatives trading arena.

Bybit’s ADL system is designed to ensure fairness.

ADL kicks in when the market moves rapidly, and the liquidation engine can’t close a position at the bankruptcy price.

2. Binance Futures:

You can’t talk about crypto without mentioning Binance, can you?

Binance Futures, the exchange’s derivatives trading arm, employs ADL to reduce auto-liquidation risk when there is insufficient balance in the insurance fund.

3. OKEx:

Another major player, OKEx, has a well-defined ADL mechanism in place.

The platform prioritizes the ADL process based on leverage and profit, ensuring the system is effective and equitable.

Conclusion: The Evolving Landscape of Crypto Trading Safety Measures

As we’ve delved into the intricacies of Auto-Deleveraging (ADL) and its role in the crypto ecosystem, it’s evident that exchanges are not just sitting on their laurels.

They’re actively innovating, striving to create a safer and more transparent trading environment.

But here’s the thing: As much as ADL is a game-changer, it’s just one piece of the puzzle.

So, what’s the takeaway?

Embrace the innovations, but always trade with caution.