When you want to trade Futures contracts or Margin trading, you run the risk of being liquidated if the market price moves against your preferred direction.

The calculation of your liquidation price is dependent on whether you choose to trade in Cross-Margin or Isolated Margin mode.

Cross Margin takes into account all of the available funds in your Futures or Margin wallet, but the Isolated Margin mode only uses the funds allocated to the particular trade.

Liquidation is an automatic procedure which takes place if the allocated margin is not enough to cover any more losses for your position.

When the price reaches the liquidation price, your trade will be closed immediately if you do not add further margin to your wallet or the trade itself.

This article explains how the liquidation price is calculated on Binance, ByBit and Stormgain so that you can make the calculations yourself before taking the trade.

How To Calculate Liquidation Price On Binance?

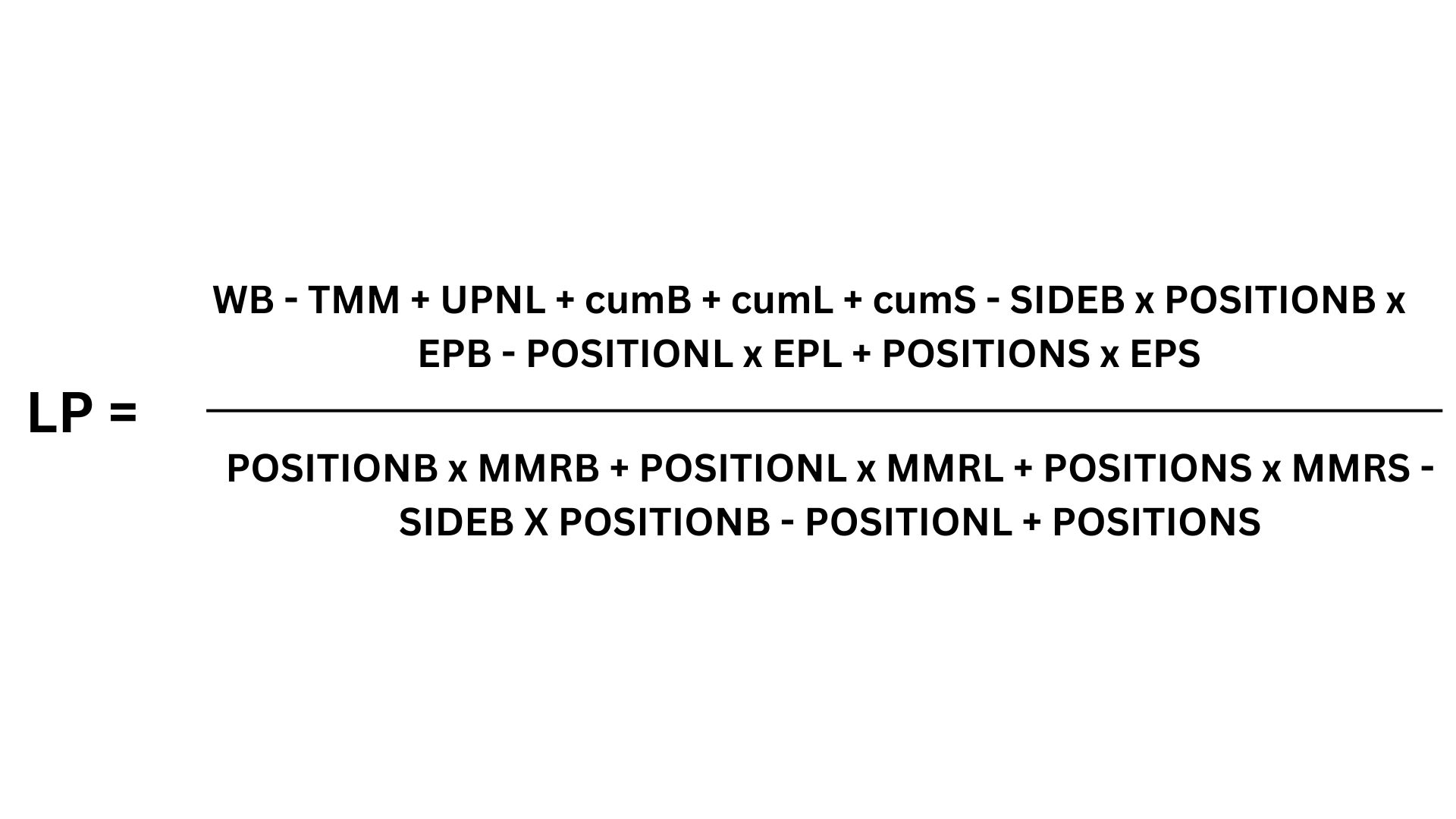

This might seem like a convoluted formula but your derivatives exchange does this calculation for you and displays the liquidation price when you are about to confirm a trade.

Now to understand the formula mentioned above, the following is what each of the variables mean:

- WB – The balance in your Futures or Margin wallet

- TMM – The maintenance margin of all other open contracts except this one. If the trade is in isolated margin mode, TMM is 0.

- UPNL – Unrealized PNL of all contracts except this one. In isolated margin mode, UPNL is 0

- cumB – The maintenance amount of BOTH positions in one-way mode

- cumL – The maintenance amount of LONG positions in hedge mode

- cumS – The maintenance amount of SHORT positions in hedge mode

- SIDEB – The direction of BOTH positions where 1 denotes a Long position and -1 denotes a short position

- POSITIONB – Absolute value of BOTH position size in one-way mode

- EPB – Entry price of BOTH position in one-way mode

- POSITIONL – Absolute value of LONG position size in hedge mode

- EPL – Entry price of LONG position in hedge mode

- POSITIONS – Absolute value of SHORT position size in hedge mode

- EPS – Entry price of SHORT position in hedge mode

- MMRB – Maintenance margin rate of BOTH positions in one-way mode

- MMRL – Maintenance margin rate of LONG position in hedge mode

- MMRS – Maintenance margin rate of SHORT position in hedge mode

When the liquidation price is calculated to be less than 0, the screen only displays ‘–’

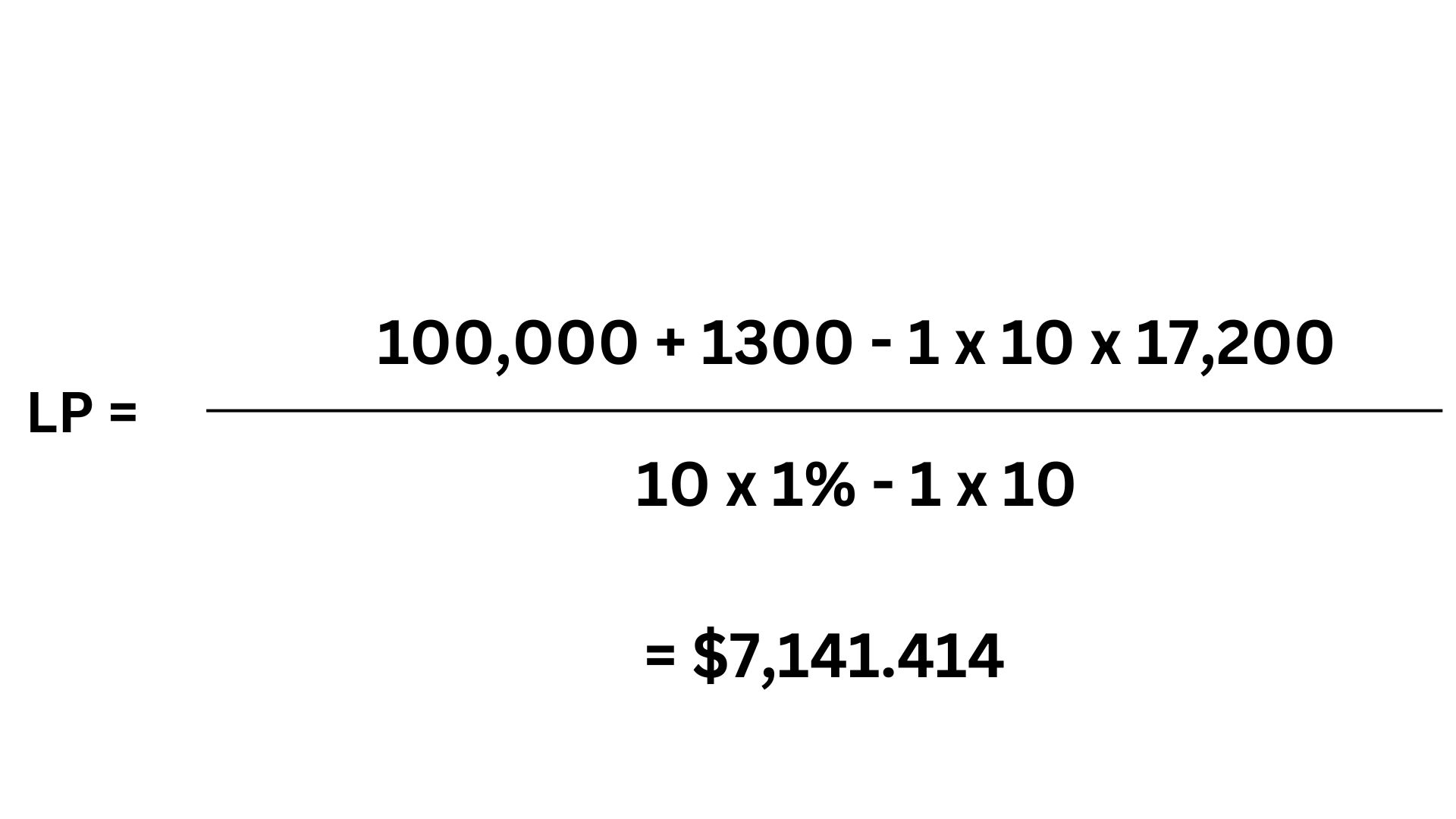

Let’s try to understand this with an example.

The position is LONG with a size of 10 BTC, an entry price of $17,200 and 125x leverage, and the Wallet Balance is $100,000

- Notional value = Price x Size = $17,200 x 10 = $172,000

- Maintenance Margin = Notional value x Maintenance Margin rate – cum

= $172,000 x 1% – 1300

= $420

- WB (Wallet Balance) = $100,000

- TMM = 0

- UPNL = 0

- cumB = $1300

- cumL = 0

- cumB = 0

- SIDEB = 1 (as it is a long position)

- POSITIONB = 10

- EPB = $17,200

- POSITIONL = 0

- EPL = 0

- POSITIONS = 0

- EPS = 0

- MMRB = 1%

- MMRL = 0

- MMRS = 0

As per the above formula,

So, on Binance, the liquidation price for a BTCUSDT contract with these particulars is $7,141.414

Interested in Futures Trading? Know How long can you hold crypto futures contracts?

How To Calculate Liquidation Price On Bybit?

When using isolated margin, you are allowed to add more margin to prevent your position from getting liquidated.

Initial Margin Rate = 1/Leverage

The Maintenance Margin Rate is dependent on the Tiered Margin

Liquidation price = Entry Price * [1 ± 1(Initial Margin Rate – Maintenance Margin Rate)] ±1 (Extra Margin Added) / Contract Size

You need to substitute -1 for a Long position and +1 for a Short position

As an example, take a short entry of 1 BTC at $17,200 with 50x leverage. Assume that no extra margin is added

So, Initial Margin Rate = 1/50

In this case, Liquidation price = 17,200 * (1 + 2% – 0.5% ) = 17200 * 1.015 = $1,745.8

If you use the cross margin mode, then your liquidation price is dependent on your wallet balance and not only the margin allocated to the trade.

Here, Liquidation price = Market Price ±1 (Available Balance + Initial Margin – Maintenance Margin) / Exposed Position Size

Again, you will use -1 for a Long position and +1 for a Short

Example, you long 5 BTC at $17,200 and have an available balance of $1,000, and the current Market Price is $17,250

Initial Margin = 5 * 17,200 * 1% = $860

Maintenance Margin = 5 * 17,200 * 0.5% = $430

So Liquidation price = 17,250 – (1,000 + 860 – 430) / 5

= $3,164

New to trading crypto? Learn What is Long and Short order?

Conclusion

As you can see, cross-margin trading gives you more leeway when it comes to how many losses you can take before getting liquidated.

But this also means that when you do get liquidated, your wallet will be empty.

Also, different crypto futures exchanges have their own ways of calculating your liquidation price, so you should pay attention to this before you start trading.

Even if you do not do the above calculations by yourself, you should make a note of the price mentioned when you take the trade.

In the cryptocurrency market, working with high leverage is always risky if one, you are not able to babysit the trade by monitoring it closely. Or two, if you are inexperienced and do not know how to recognize trading setups and set stop losses.

Getting started with futures trading? Know What is spread trading in crypto?