Abra is a Silicon Valley headquartered financial services and technology company that operates a cryptocurrency wallet and exchange app making cryptocurrency investing damm easy for everyone.

Through its mobile app, it allows users to trade in both cryptocurrencies and traditional assets like stocks, ETFs, indices, and commodities.

It has so much to offer that I thought of penning down a feature review of Abra today.

Here you go:

What is Abra?

Abra is a complete crypto wallet app and much more.

Abra was founded in 2014 by Bill Barhydt, a former Goldman Sachs software engineer and former director of Netscape. Since its inception, Abra has reached many milestones, and to date, it has raised a funding of more than $35 million from various venture capital funds.

Since its inception, Abra has come a long way to secure its position as top tech companies in the crypto wallet space. In June 2018, the Wall Street Journal listed it on the “Top 25 Tech Companies to Watch in 2018”.

Now, let’s discuss the services offered by Abra and what makes it unique from other crypto wallets.

Abra Wallet Services

Abra is not just any other crypto wallet but is packed with unique features aimed to simplify crypto transactions. The wallet can be termed as a one-in-all tool, that helps to manage all your crypto holdings and fiat currencies.

Let’s check out some of the services offered in Abra wallet:

- Through its mobile app, Abra allows you to transact in over 90 cryptocurrencies in the US and more than 200 for users internationally directly through its wallet

- It also acts as a money transfer app, which will enable you to send funds to other and switch your crypto balance to any of the supported fiat currencies on demand

- All your fiat balance on the app wallet are held as Bitcoin balance and is secured against any form of volatility. For example, your wallet is having a fiat balance of $7,000, which is represented as 1 BTC. Suppose the BTC price cracks by 20%; then your wallet balance will be updated as 1.25 BTC. In the same way, if BTC prices go up by 20%, your new balance will be 0.833 BTC.

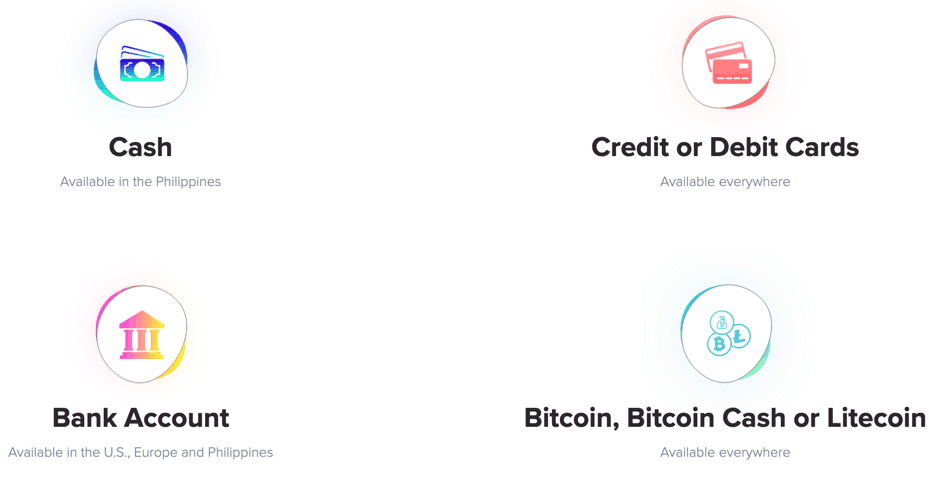

- It offers a convenient way to fund your wallet through bank wire transfer, credit & debit cards, teller service (only available in the Philippines), and cryptocurrencies.

- Allows investment in US stocks, ETFs, indices without even living in the United States

- Also, it allows you earn interest on your cryptocurrencies and stablecoins as well as get a loan against your crypto holdings.

How To Get Start With Abra?

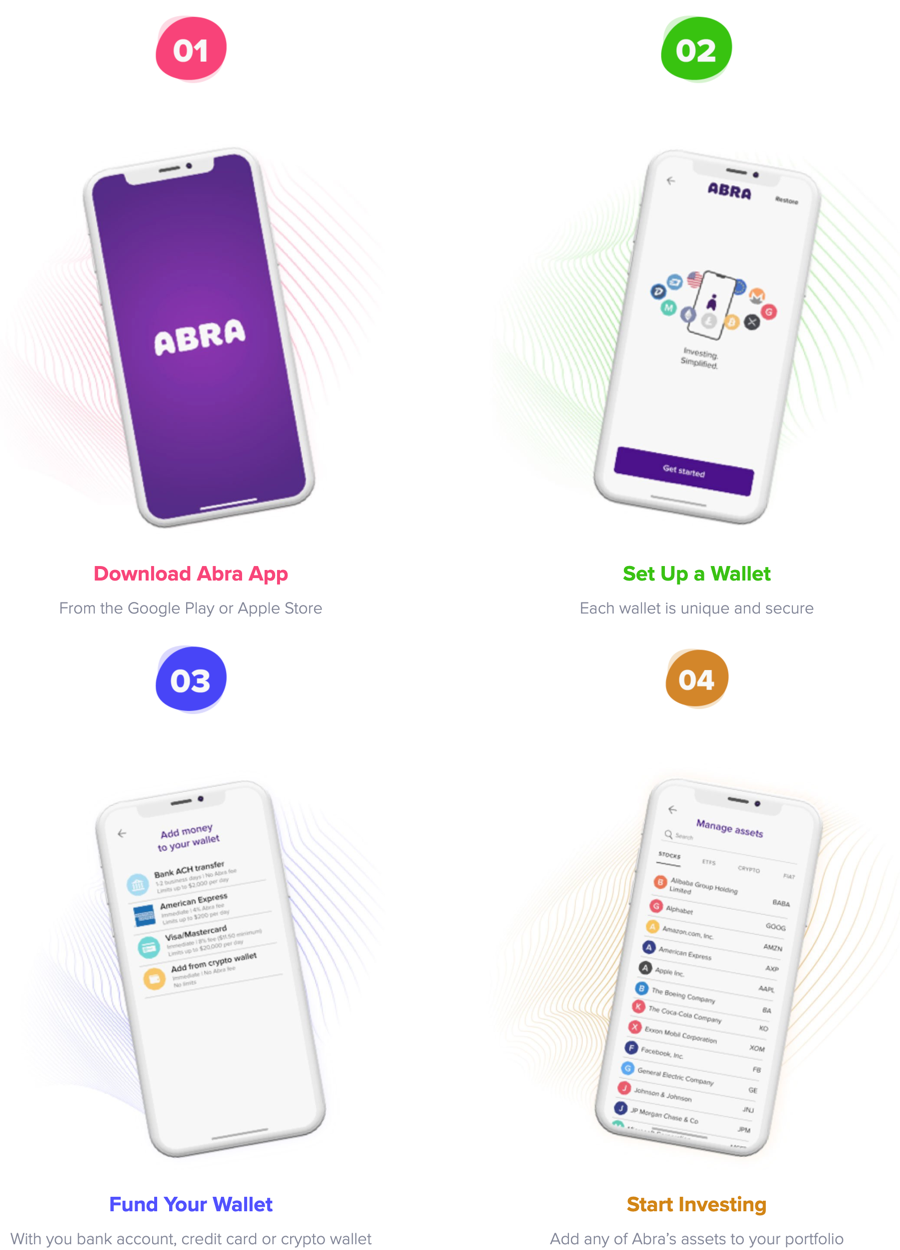

Setting up your Abra wallet is very easy and is like setting up an online shopping application.

The following are the steps involved in a successful set-up of Abra wallet.

- Download the Abra mobile app from Google Play Store or Apple store

- After successful installation, the app requires you to provide your basic details like your name, email address, and mobile number

- You will receive a one-time verification on your mobile number to validate your app installation. Following which you will be prompted to create a four-digit PIN to protect your Abra wallet.

- In the next step, confirm whether you are a resident of the United States of America or not

- Following this, you will be provided with the recovery seed phrase of your wallet

And, once your wallet set-up process is complete, and you can add funds to your wallet and start investing in different cryptocurrencies.

Users need to undergo KYC verification and provide additional documents to be able to use the Abra wallet. The following are the details:

As Abra mentions itself as a financial institution, rather than a crypto company, it is required to collect additional documents from the users. The verification process is very similar to the process conducted by other companies, wallets, and exchanges. Documentation is necessary if you are going to add funds to your Abra wallet through your bank account or credit card.

Abra Supported Countries

Abra wallet is supported in over 150 countries.

However, there are some restrictions for users in the United States. Due to regulatory restrictions, people from New York, Connecticut, and Hawaii are prohibited from using Abra.

Abra Supported Payment Methods

- Bank: Abra support a variety of major and regional banks in the US

- American Express: US only. Eligible consumer cards include Amex cards, Bluebird, and Serve

- Visa or Mastercard: Debit and credit cards issued globally

- Crypto: Bitcoin, Ethereum, Litecoin, or Bitcoin Cash, which can be easily transferred globally from any exchange or wallet.

While adding funds to your Abra wallet, you need to give a little attention to your country of residence because not all countries accept all payment modes.

For the United States, users have the option to link their bank account, use Visa, Master or AMEX debit/credit card, set up wire transfer through US-based bank, or deposit cryptocurrencies from an external wallet.

For users in Europe, they have the option to link a Single European Payment Area (SEPA) bank account or use Coinify, use Visa or Master debit/credit card, or deposit cryptocurrencies from an external wallet.

Users in the Philippines have more or less the same option as users of the US and Europe. And, users in other parts of the world can only add funds either through VISA or Master credit/debit card or make external wallet transfer. In case of local bank transfers, check the deposit and withdrawal limit allowed in respective countries.

Abra Fees

Abra has the following fee structure on the deposits, withdrawals, and exchanges.

Deposits

- External wallet transfer- Nil

- Add funds via US bank or PH bank- Nil

- Via wire transfer (US)- Nil

- Add funds via EU bank (SEPA)- 0.25%

- Add funds via US-issued AMEX card- 4%

- Add funds via MasterCard- 4% or $10 flat

- Teller service- up to 2%

Withdrawals

- Withdrawing of cryptocurrencies including altcoins- Nil

- Withdrawing via US or PH bank- Nil

- Teller service- up to 2%

Abra does not impose any fee on exchanging two currencies within the app and for sending funds to another Abra wallet. Your Abra wallet is global and flexible. You can deposit and withdraw from your wallet in many different ways: via banks, tellers, or any cryptocurrency.

Is Abra Useful & Safe For Beginners?

A big question, whether Abra is useful and safe for beginners or not. In my view, compared to any other crypto wallets, Abra is packed with features that make storing and exchanging cryptocurrencies very interesting. And, for beginners, it is a safe and secure option.

Being a mobile operating app available on both Android and iOS, its very easy to use if one follows the step-by-step installation process. The whole interface is very intuitive, and good placement of all the features makes it a straightforward app, which everyone looks for.

A wide range of payment options, from bank transfers, credit/debit cards to external wallet transfers to add funds to wallet makes investing in cryptocurrency much easier. Further, the ability to invest in traditional assets like equity adds to the uniqueness.

Since Abra is a non-custodial wallet, meaning users always keep control of their funds, making it an extremely secure option for storing cryptocurrencies. However, offering cold wallet support would have been an added advantage.

Conclusion

Lots have been discussed and said about Abra, and by now, you should be pretty clear if you are going to use it or not.

Currently, it looks as easy as it can be at first sight. Other features like anonymous trading, support of more cryptocurrencies, adding more number of countries in deposit and withdrawal of funds through fiat currency would add punch to Abra.

With its straightforward and easy to use functionality, Abra looks suitable for those who want to invest and hold digital assets for a long period as well as for those who are beginners.

So what are you waiting for, join Abra now !! and let us know about your experience in the comments section below 🙂

You might also like:

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023