Crypto margin trading platforms allow crypto margin traders to use huge leverage while trading is slowly becoming the new normal in the cryptosphere.

You being here tells me that you have figured out, and wish to participate with these crypto traders using high leverage on some of the best crypto margin trading exchanges.

So based on our experience, here are some of the best exchanges for margin trading crypto:

(Editor's Choice For 2023) |

| Get Upto $30,000 Bonus |

| Welcome Bonus upto $5135 | |

- Deposit in: Bitcoin & altcoins - KYC & VC Backed | Joining Bonus uptp $5000 |

Best Crypto Leverage Trading Platforms Of 2023

Let’s get started with the list of the best Bitcoin & crypto exchanges that offer leverage to trade:

- ByBit [100X Leverage Crypto Exchange: Best Overall]

- BingX [100x Leverage & No KYC]

- Bitget [up to 100x on its Futures contracts]

- Phemex [20x Leverage]

- MEXC [100x leverage on Futures platform]

- Binance [20x Leverage On Bitcoin]

- Stormgain [Bonus Of $25 ]

- PrimeXBT [70% Joining Bonus]

- BitMEX

- BaseFEX

- Kraken

- CEX.io

- Poloniex

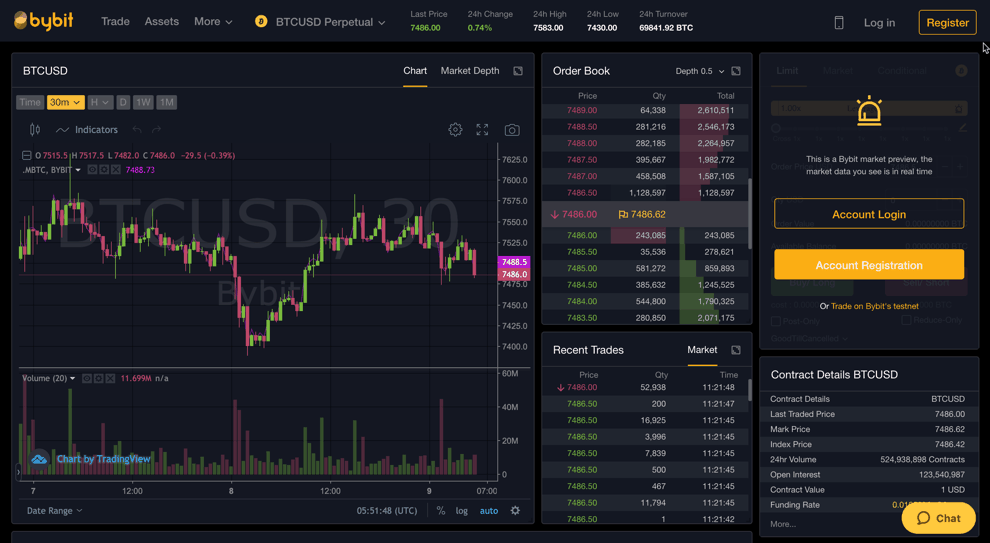

1. Bybit – A Premier Leverage Trading Platform

Bybit is one of the leading contenders in this list for 2023. Established in 2018, Bybit is a cryptocurrency derivatives exchange that caters to both individual retail clients and professional traders.

The platform has gained widespread recognition for its robust trading system, designed to deliver a seamless and reliable trading experience. It boasts an impressive 100,000 transactions per second matching engine, offering high liquidity and low latency.

Bybit offers up to 100x leverage on its Bitcoin contracts, allowing margin traders to maximize their potential profits. It also offers perpetual contracts for other popular cryptocurrencies, including Ethereum, EOS, and XRP.

One of Bybit’s standout features is its user-friendly interface, which is intuitive for beginners, yet sophisticated enough for seasoned traders. It also offers a mobile app, enabling trading on the go.

As for security, Bybit employs industry-standard protections, including two-factor authentication, cold storage for assets, and an insurance fund to protect against unforeseen market volatility.

Moreover, Bybit’s 24/7 customer support service, available via live chat, sets it apart from many competitors, ensuring that assistance is always just a click away.

In terms of fees, Bybit operates a maker-taker model and offers competitive rates in the industry. The exchange also offers a flexible withdrawal system, with three withdrawal periods each day.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

As of 8 May 2023, Bybit requires both current and new users to complete a minimum of Level 1 of KYC to be able to use any of their products and services.

Existing users who are non-KYC will only be allowed to close any of their existing open positions or orders, return loans, or withdraw.

You can always read our in-depth ByBit Exchange Review here.

2. BingX [No KYC]

BingX is a popular crypto social trading exchange launched back in 2018. The exchange focuses on providing a simple and easy-to-use trading service for digital assets.

With BingX, you can trade in a wide range of market types, be it spot or derivatives like perpetual or standard future contracts in cross-margin or isolated margin mode.

It also offers access to additional features like copy trading, grid trading, P2P trading, etc. Plus, it supports a wide range of order types like a limit order, market order, take profit and stop loss.

The exchange offers maximum leverage of 150x for futures trades and access to a wide range of cryptocurrencies and trading pairs.

Talking about the trading fees, it charges you a maker and taker fee of 0.0200% and 0.0500%, respectively, for perpetual futures. Also, for spot trading, it charges you a flat fee of 0.1% for both maker and taker fees.

Additionally, there is no need to verify identity to start trading on the platform. By verifying your email, you can deposit, withdraw and trade with certain limitations.

Furthermore, the exchange offers many security features to protect your account. Plus, BingX offers you 24/7 customer service through multiple support channels.

3. Bitget: A Fast-Growing Platform with High Leverage & Copy Trading Features

Bitget, founded in 2018, has rapidly grown into a leading global exchange to trade cryptocurrencies and finds its well-deserved place among the best margin trading platforms of 2023.

What sets Bitget apart is the impressive leverage it offers, up to 100x on its Futures contracts. This high leverage makes it a prime choice for traders seeking to maximize their potential returns, though it is important to bear in mind the associated risks of the crypto markets.

Bitget boasts a comprehensive selection of cryptocurrencies for trading, including the major coins and a variety of altcoins.

This diversity allows traders to margin trade crypto, diversify their portfolio and explore various market opportunities with minimal margin trading fees.

The platform’s standout feature is its copy trading system with its low trading fees, where novice traders can follow and replicate the trades of experienced traders.

This feature significantly simplifies the trading process for beginners and provides a learning opportunity for those who want to step away from spot trading.

When it comes to security, Bitget employs industry-standard measures such as two-factor authentication, cold storage for funds, and advanced SSL encryption to protect user data.

Bitget operates on a tiered maker-taker fee model, which varies based on the user’s 30-day trading volume. The fees are competitive, starting from 0.04% for takers and 0.02% for makers.

Bitget’s customer service is available 24/7, providing assistance through live chat and email. They also have an extensive FAQ section on their website to help users resolve common issues.

4. MEXC: Rising Star with High Leverage and Robust Features

Mexc, though a relatively new player in the crypto exchange arena, has made significant strides since its inception, making it a standout choice for crypto margin trading in 2023.

One of the most striking features of Mexc’s margin account is its high leverage ratio.

It provides up to 100x leverage on its Futures platform and its leveraged tokens, attracting traders who are willing to take on higher risks for potentially higher returns.

Mexc supports a diverse array of cryptocurrencies. The platform lists numerous altcoins and stablecoins, offering traders a wide selection of trading pairs to trade crypto.

The platform’s user interface is intuitive and well-designed, catering to both beginners and experienced traders.

Real-time charts, detailed market analytics, high daily trading volume, and a range of technical indicators are available, enabling traders to thoroughly analyze market trends and put them in the running amongst the best crypto margin trading exchanges out there.

On the security front, Mexc employs industry-standard practices such as cold storage, two-factor authentication, and encryption technology to safeguard users’ funds and personal information.

Mexc operates on a maker-taker fee model, with fees ranging from 0.02% to 0.075%, depending on the trader’s 30-day trading volume. This competitive fee structure makes it an appealing choice for high-volume traders.

Mexc’s customer support is available 24/7 via live chat, and there’s a comprehensive FAQ section on their website to help users with common issues.

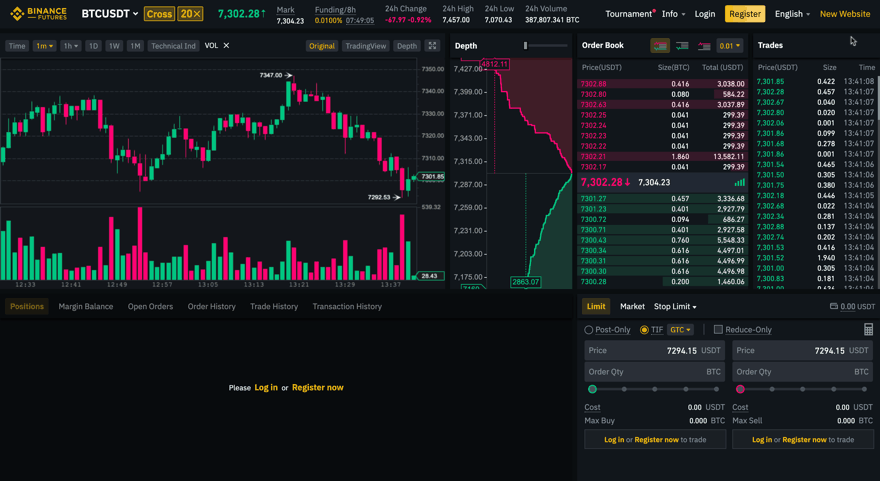

5. Binance: The Behemoth of Crypto Leverage Trading

Binance can not be left out of the conversation when discussing the best trading platforms of 2023.

Launched in 2017, Binance quickly ascended to become one of the largest and most influential crypto exchanges globally, boasting a broad range of services, including margin trading.

Binance’s offering, known as Binance Futures, offers traders the opportunity to trade crypto with up to 125x leverage on Bitcoin futures which is the highest in the industry.

Binance also offers fiat currencies on its platform for trading pairs as well as deposits. This high degree of leverage makes it possible for traders to amplify their potential profits significantly, though it also increases risk.

An impressive aspect of Binance Futures is its broad range of available trading pairs. Traders can speculate on the price movements of a vast array of cryptocurrencies, giving them the ability to diversify their trading strategies.

The platform is known for its robust trading engine, capable of handling a massive number of transactions with minimal latency, ensuring a smooth trading experience.

In terms of security, Binance implements a variety of measures, including two-factor authentication, withdrawal whitelisting, and a Secure Asset Fund for Users (SAFU) that acts as an emergency insurance fund.

User experience is another area where Binance shines.

Its interface is intuitive and user-friendly, while still providing all the technical analysis tools that a seasoned trader might require. Additionally, Binance offers a mobile app for trading on the go.

When it comes to fees, Binance operates on a tiered maker-taker model, with fees that decrease as a user’s trading volume increases. This makes it an attractive option for high-volume traders.

6. Stormgain: Simplified Trading with High Multipliers

Stormgain, established in 2019, has quickly made a name for itself as one of the top crypto leverage trading platforms of 2023.

One of Stormgain’s key selling points is its generous leverage offering – up to 200x on certain cryptocurrency pairs. This high amount of leverage opens the door for potentially substantial gains, even from relatively small price movements.

The exchange is offering crypto futures trading in a selection of popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, and others.

The platform’s user interface stands out for its simplicity and intuitiveness, making it an excellent choice for beginners. The platform offers a demo account feature, allowing newcomers to practice trading with virtual funds before risking real money.

In terms of security, Stormgain utilizes a range of measures, including encryption, two-factor authentication, and cold wallet storage for client funds.

As for customer support, Stormgain provides 24/7 assistance via live chat and email, ensuring users can get help whenever needed.

When it comes to fees, Stormgain operates on a fixed-rate model for its trading fees, which can be higher than some competitors. However, the platform does not charge for deposits, and withdrawal fees are relatively low.

To learn more, check this StormGain review.

7. PrimeXBT: 100x Leverage and Advanced Trading Tools for a Diverse Market

PrimeXBT exchange has scintillated the leveraged trading for millions of crypto enthusiasts and is one of the crypto exchanges that allow shorting cryptocurrencies on a large amount of leverage.

One of PrimeXBT’s key selling points is its leverage offerings, which go up to 100x for cryptocurrencies. This excessive leverage, while entailing a degree of risk, allows traders the possibility of maximizing their returns.

The platform supports trading in a variety of cryptocurrencies, alongside other traditional markets such as Forex, commodities, and indices. This broad range provides traders with a unique opportunity to diversify their portfolios within a single platform.

PrimeXBT’s interface is user-friendly yet sophisticated, offering advanced charting tools, multiple order types, and customized technical analysis indicators.

These features are designed to help traders make informed decisions based on real-time data and market trends.

On the security front, PrimeXBT employs a host of measures, including cold storage for funds, two-factor authentication, and encrypted SSL connections, among others, to ensure the safety of its users’ assets and data.

The platform operates on a flat-fee model, charging a 0.05% fee for all crypto trades, which is relatively competitive in the industry.

PrimeXBT Offer: Get a 35% additional bonus on the deposit of any amount of BTC on PrimeXBT. Meaning, if you put 1 BTC to trade on PrimeXBT, you will get an additional 0.35 BTC to trade. So in total, 1.35 BTC when you register using this exclusive deal for TheMoneyMongers readers. |

PrimeXBT’s customer support is available 24/7, providing timely and effective assistance through live chat and email.

Their comprehensive help centre and educational resources also support traders in navigating the platform and understanding the markets. You can also have a look at PrimeXBT review to learn more about it.

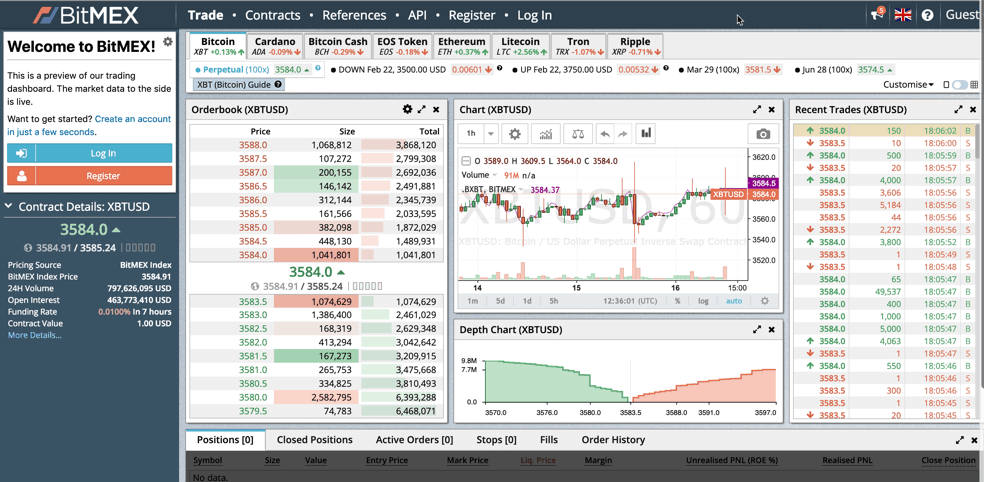

8. BitMEX: The Pioneer of Crypto Leverage Trading

BitMEX, short for Bitcoin Mercantile Exchange, has long been a cornerstone of the crypto leverage trading world.

Launched in 2014, it is known for pioneering the concept of leverage trading in the cryptocurrency space, and it continues to be a leading choice among traders in 2023.

BitMEX offers up to 100x leverage on Bitcoin, and up to 50x on other selected cryptocurrencies like Ethereum, Litecoin, and Ripple.

While this is lower than some newer platforms, it’s worth noting that this level of leverage still carries substantial risk and should be approached with caution.

The platform supports a comprehensive range of trading products including perpetual contracts, and upside/downside contracts. These options give traders the flexibility to execute a variety of trading strategies according to market conditions.

The BitMEX trading platform is renowned for its robustness and high liquidity, ensuring smooth trading even during volatile market conditions.

The interface, while somewhat complex for beginners, provides a wealth of technical analysis tools and charting features that experienced practitioners will appreciate.

On the security front, BitMEX employs a variety of measures such as multi-signature deposits and withdrawals, full risk checks after every order placement, and all Bitcoin being stored in cold wallets.

BitMEX operates a maker-taker fee structure, which can work out to be relatively cost-effective for high-volume traders.

Customer support is available 24/7 via email, and the platform also has a comprehensive FAQ section and a trading guide for beginners.

To know more, have a look at this detailed BitMEX review.

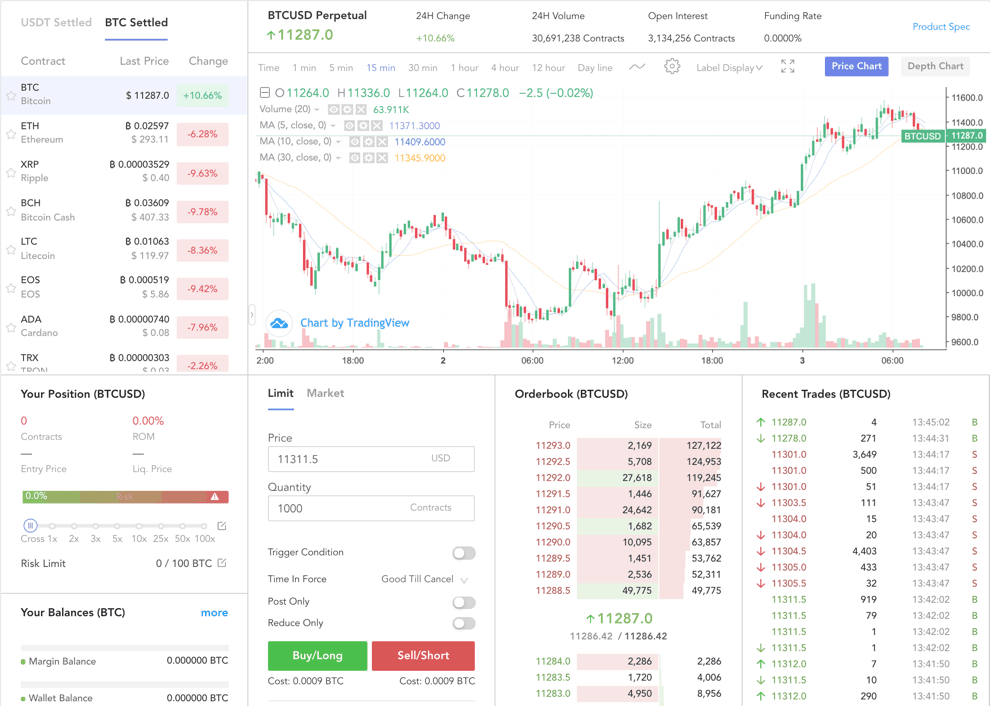

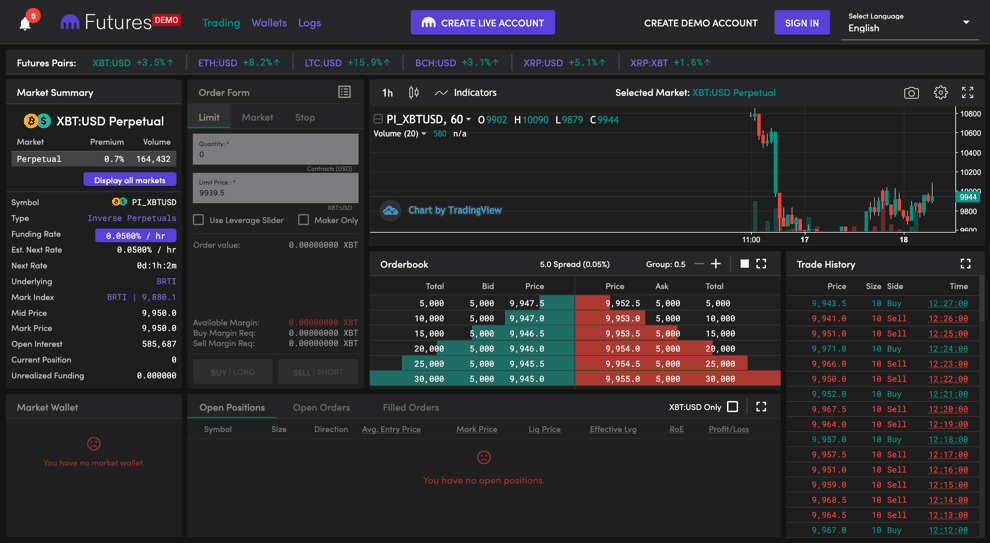

9. BaseFEX: User-Centric Leverage Trading Experience

BaseFEX is one of those crypto platforms that offers margin trading and is unlike any other, as professionals in the financial industry developed it.

Founded in 2018, BaseFEX is a relatively new player in the crypto trading arena, yet it has quickly risen to prominence due to its commitment to providing a user-centric trading experience.

BaseFEX offers a competitive leverage ratio of up to 100x on Bitcoin and up to 20x on other supported cryptocurrencies. While the leverage offered is not the highest in the market, it strikes a good balance between risk and potential return for traders.

The platform supports a good selection of popular cryptocurrencies and both perpetual and Futures contracts, providing flexibility for traders to adapt to different market conditions.

The platform’s user interface is clean and intuitive, designed to cater to both experienced and beginner traders alike. It also offers a demo trading feature, which is especially useful for newcomers to practice trading without risking real money.

Security is a high priority at BaseFEX. The platform employs industry-standard security measures such as cold storage for client funds, SSL encryption, and two-factor authentication. It also provides an insurance fund to cover any losses from unforeseen trading risks.

BaseFEX operates a maker-taker fee model, with competitive rates compared to another margin trading platform. Additionally, there are no deposit or withdrawal fees, which is a definite plus for traders.

Customer support is available 24/7 via live chat and email, ensuring traders can get assistance whenever required.

10. Kraken: Trustworthy Leverage Trading with Wide Range of Options

Kraken- a US registered entity based out of San Francisco, USA, is one of the few US platforms that allow crypto leverage trading for USA investors and gives up to 5x leverage.

One of the most respected and oldest cryptocurrency exchanges, Kraken, founded in 2011, continues to hold its position as a top choice for margin trading crypto in 2023.

Kraken offers leverage up to 5x on a wide array of cryptocurrencies, including Bitcoin, Ethereum, and many others.

While the leverage offered by Kraken may not be as high as some other platforms, it is worth noting that lower leverage can often mean lower risk, making it a good choice for traders adopting a more conservative approach.

Kraken’s selection of trading pairs is one of the broadest in the market, offering over 50 cryptocurrencies for trading. This diversity can be particularly appealing to traders looking to explore opportunities beyond the major cryptocurrencies.

Kraken’s trading platform is highly versatile, catering to both new and experienced participants.

Its simple and intuitive interface makes it a good choice for beginners, while advanced traders can take advantage of Kraken Pro’s sophisticated charting and trading tools along with borrowing funds from the margin trading platform.

When it comes to security, Kraken has a strong reputation.

It employs a range of security measures, including cold storage for the majority of funds, encrypted data, and two-factor authentication.

The fee structure at Kraken is competitive, with fees ranging from 0.01% to 0.02% for futures trading and up to 0.26% for spot trading, depending on the daily trading volume.

Kraken’s customer support is accessible 24/7 via live chat and email. It also provides a comprehensive help center with a wide range of guides and FAQs.

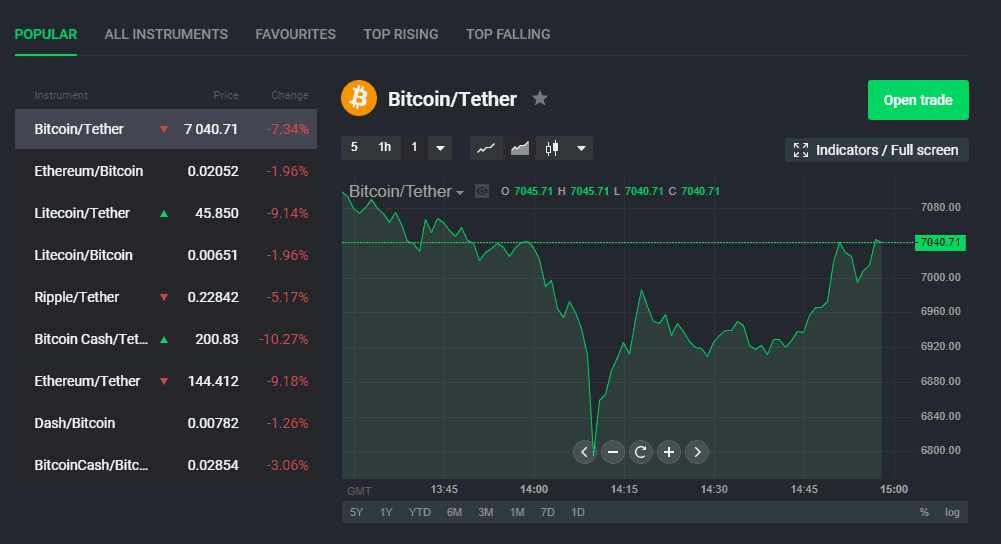

11. Cex.io: An Easy-to-Use Platform with Competitive Leverage

CEX.io is another reputed cryptocurrency exchange based out of the UK, and now it provides the ability to leverage trade cryptocurrencies.

Cex.io, established in 2013 as a Bitcoin exchange, has evolved into a comprehensive cryptocurrency trading platform, and it will continue to be a strong contender in the crypto margin trading scene in 2023.

The platform provides leverage up to 10x for various cryptocurrencies, including Bitcoin, Ethereum, and others. Although the maximum leverage may not be as high as some other platforms, it can be ideal for traders seeking a balance between potential returns and risk.

Cex.io supports a wide range of cryptocurrencies and trading pairs, offering traders plenty of options to diversify their trading strategies. The platform also supports a variety of currencies, making it easy for traders to deposit and withdraw funds.

The interface of Cex.io is user-friendly and intuitive, suitable for both beginners and experienced users.

Advanced charting tools, real-time price alerts, and comprehensive trading indicators make it easy to analyze market trends and make informed trading decisions.

When it comes to security, Cex.io has a strong record. The platform uses a combination of cold storage, two-factor authentication, and encryption technology to protect users’ funds and personal data.

The fee structure at Cex.io is transparent and competitive. The platform uses a maker-taker model, with fees ranging from 0.10% to 0.25%, depending on the trading volume.

Cex.io provides 24/7 customer support through live chat, email, and a comprehensive help centre. This ensures that traders can get the assistance they need at any time.

12. Poloniex: A Veteran Player Offering Attractive Leverage Options

Poloniex, an established name in the cryptocurrency exchange landscape since 2014, is another robust option for crypto margin trading in 2023.

Poloniex provides a leverage of up to 5x on selected cryptocurrencies through its Futures platform. This range of maximum leverage may not be as extensive as other platforms, but it is a practical choice for traders who prefer to maintain a balanced risk profile.

One of Poloniex’s strengths is its wide range of supported cryptocurrencies.

With over 100 cryptocurrencies available for spot trading, and several choices for Futures trading as perpetual contracts, it offers ample opportunities for traders to diversify their portfolios.

Poloniex’s platform is well-designed, providing a comprehensive set of tools for both novice and experienced users. Its advanced charts, real-time data, and detailed market analytics help traders make informed decisions.

In terms of security, Poloniex employs industry-standard practices, including two-factor authentication, cold storage for user funds, and stringent verification processes to ensure user safety.

Poloniex operates on a maker-taker fee model, offering competitive fees that range from 0.00% to 0.15% for makers and 0.01% to 0.25% for takers, depending on trading volume.

Poloniex’s customer support is available 24/7 through a ticketing system. Although it does not offer live chat, it provides a detailed FAQ section where users can find answers to the most common queries.

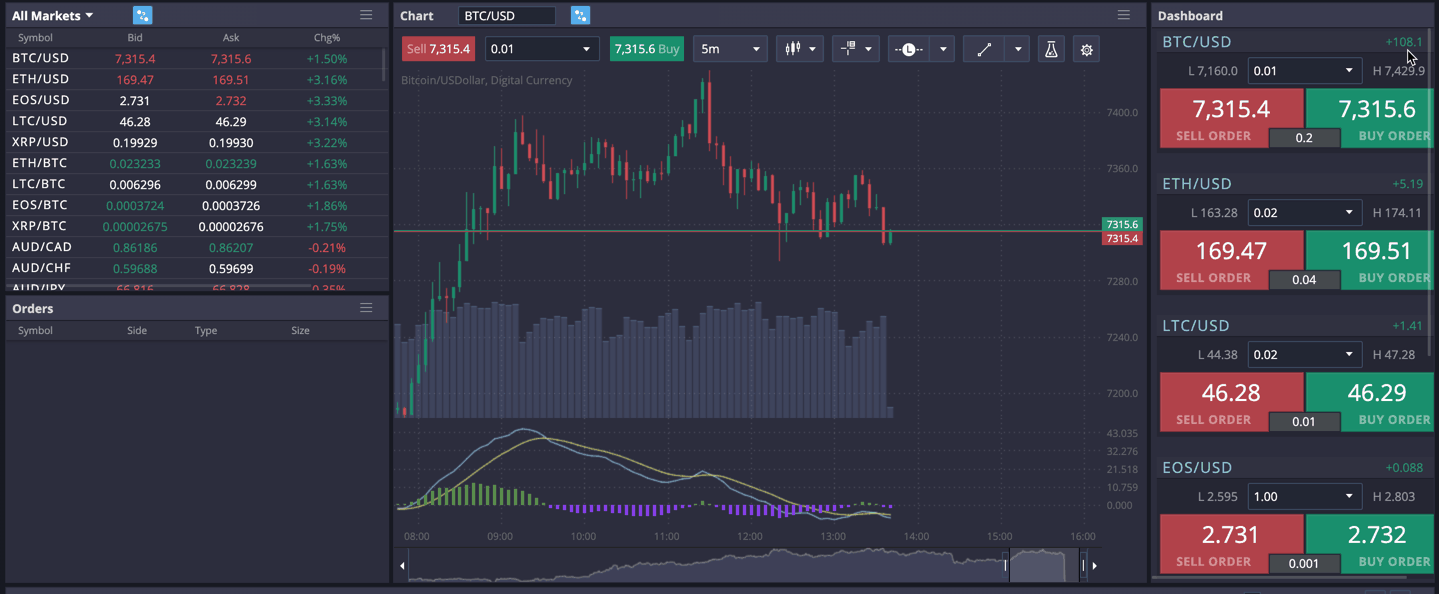

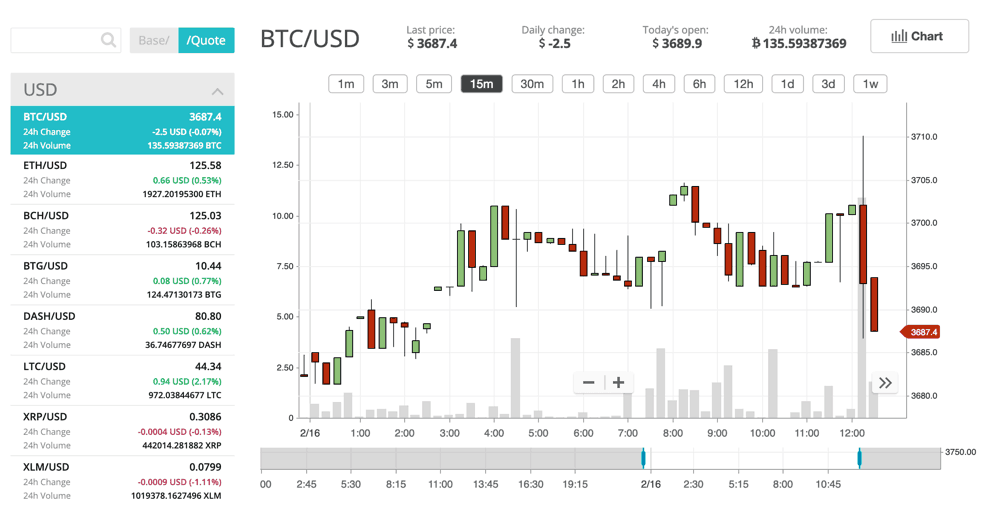

What Is Bitcoin Margin Trading?

If you want to understand the nuts and bolts of crypto margin trading platforms, their associated trading fees, and leverage trading, then stick around, as this article will explain everything from the beginning.

Cryptocurrency markets themselves are risky, but margin trading on crypto exchanges is even more dangerous.

That’s why you should think twice before moving away from spot trading, and getting into crypto margin trading, and think thrice before you indulge in leveraged tokens or margin trade Bitcoin.

I know many of you might get lured into crypto trading because of the stories you hear from your friends and how they turned $1,000 to $10,000 by trading cryptocurrencies!!

But on the flip side, they forget to tell you how much risk they took on to achieve these kinds of returns and what its downsides are…

That’s why in this guide, let’s try to understand margin trading in cryptocurrencies, its risks, and how, if it is used correctly, it could serve you to achieve your investment goals.

How Does Crypto Margin Trading Work?

Margin trading is the act where crypto traders attempt to trade (stocks, bonds, or cryptos) using borrowed money from the crypto exchanges that are deposited into your margin account.

Well, let me give you a simple example:

Let’s say you are margin trading bitcoin worth $100,000, but you have only $1,000 at your disposal.

So, now you decide to margin trade using the leverage ratio of 100:1 (100x leverage means for every dollar you already have, you will get 100 dollars extra to invest).

Now picture this:

The next morning, after placing your margin trade, BTC’s price increases by 50%, so your initial investment is now $15,000. (assuming 1 BTC= $10,000 when you had placed your trade).

Now you can close your leveraged positions and pay back the extra $90,000 to the lender, which you have effectively leveraged on your initial reserve of $1,000.

So simple maths, you are now left with a profit of $5000, which you have earned by leveraged trading on the initial $1,000 you had.

But this is the hunky-dory scenario.

On the flip side, you could have lost everything, including your $1,000.

Let’s say the price of BTC decreases by 50% after you have made your trade, and in this case, your initial investment is reduced to $5,000, and now the lender needs to be protected.

So this remaining $5,000 goes to the lender, and you are left with nothing.

In this scenario, one would argue that the lender has also lost an extra $4,000 out of the original $9,000 that they had lent.

Still, in real life, the leveraged trading position is closed well before a 50% drop happens, thus saving the lender’s capital contribution.

So realistically, in the above scenario, the position would have been closed on a 10% BTC drop only, and the lender would have got his/her $9,000 back !!

Who Lends To Margin Traders & Why Do They Engage In Margin Trading Of Cryptos?

Brokers or people who want to earn an extra percentage of income on their cryptocurrency or Bitcoin holdings usually lend to these margin traders for a flat fee or interest rate via the crypto platform.

So whenever the portfolio of a margin trader is performing well, the lenders on the crypto exchange keep getting the promised fee or interest rate on their lending.

While on the other hand, if the portfolio performs poorly, then the position is automatically closed, and the remaining funds plus the interest is returned to the lender.

Now, I know some of you might be wondering how that happens automatically and who closes the margin trades to reduce further losses for the lender?

FAQ

Should I Margin Trade Crypto?

If you understand how to cross and isolated margin works, then you should participate in margin trading crypto.

Otherwise, one should not buy/sell cryptos like Bitcoin on margin. Even if it is possible to do, one should not do it as this trading strategy is not sustainable & especially for those who don’t understand margin trades.

Is crypto margin trading safe?

Crypto margin trading, which is offered by a number of crypto trading platforms, is an approach that can significantly amplify your profits, but it also comes with substantial risks.

Here’s what you need to consider about its safety:

Leverage Risks: When engaging in crypto margin trading, you’re essentially borrowing funds to increase your buying power on a crypto trading platform.

The more you leverage, the greater your potential profits or losses can be. Even a minor fluctuation in trading pairs can lead to a complete loss of the funds you’ve invested as your margin.

Volatility: The cryptocurrency market is known for its extreme volatility. This volatility can be profitable in the context of margin trading, but it also exposes you to the risk of massive losses.

Platform Risks: Another important aspect to consider is the platform itself. Even the best crypto exchange can be susceptible to hacking, going offline, or encountering other technical issues.

How do you find crypto trading exchanges offering margin?

Finding cryptocurrency trading exchanges that offer margin trading requires some research, as not all platforms provide this feature. Here are some steps to guide you:

1. Cryptocurrency Exchange Review Sites: Websites like CoinMarketCap, CoinGecko, or CryptoCompare provide extensive lists of exchanges and often include information about the features they offer, including whether or not they offer margin trading.

2. Online Forums and Communities: Cryptocurrency communities such as those on Reddit, Bitcointalk, or specific crypto Discord channels are valuable resources. Experienced users in these communities can share recommendations based on their experiences with different exchanges.

3. Directly Visit Exchange Websites: If you have a specific exchange in mind, visit their website or reach out to their customer service to inquire if they offer margin trading.

4. Look for Key Terminology: Exchanges that offer margin trading will often use terms such as “leverage,” “margin trading,” “futures,” “perpetual contracts,” or “derivatives” on their website.

If you liked this article, do share it with your friends & family !!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023