Derivatives trading is one of the most popular ways for crypto traders to make money. Trading in derivatives and CFDs (contracts for difference) allows traders to amplify their gains by opening leveraged positions.

If you are just getting into this segment of cryptocurrency trading, you will come across the terms cross and isolated margin. The two are the main modes of margin management in many exchanges, and many leading crypto exchanges make them interchangeable.

Traders need to know what the two margin management modes are all about, as this makes it easy to decide what to use when opening their positions. This guide looks at what the two margin modes in more detail.

What Is Cross margin In Cryptos?

Cross margin means that the margin will be shared across all open positions. With cross margin, all the funds in your available balance can be utilized regardless of your initial margin when opening the position.

Cross or spread margin, as many traders will also refer to it will utilize any funds in your available balance to avoid liquidation.

The cross margin mode is handy for crypto traders hedging on their existing positions and for arbitragers that want to prevent exposure on one side of their trade-in case of liquidation. Cross margin helps minimize liquidation risk as the crypto traders use their account balance as a source of extra margin.

While cross margin has many benefits, it will also give the traders less control when managing the available funds in their accounts.

That said, traders need to note that any unrealized profits from your open positions will not be part of the available funds in your account. Therefore, these funds cannot be utilized for cross margin. However, any profits already realized from other positions can be utilized in cross margin for other positions using the same settlement crypto.

Note: The cross margin mode will be default for all positions in most crypto leverage trading platforms. Therefore, you should remember to change it to open an isolated margin position.

What Is Isolated margin In Cryptos?

When a crypto trader opens an isolated margin trade, the initial margin required to open the position will be kept separate from the account’s available balance. The margin is also separate from what you use to open other positions.

What all this means is that with an isolated margin, your position will be liquidated as soon as your margin goes below the required maintenance margin. With an isolated margin, other funds in your available balance cannot be used to restore the margin to the maintenance level to prevent liquidation.

An isolated margin offers more security and gives traders peace of mind when opening speculative positions that are riskier. The traders will never lose more than their initial margin with an isolated margin. This margin mode never taps into your available balance account regardless of the situation.

Another advantage of isolated margin is that the traders get more control over individual positions, unlike when using cross margin.

Like cross margin, the initial margin also has its shortcomings. Among these shortcomings is that using it when opening positions with high leverage puts you at a more significant liquidation risk. For example, if you use an isolated margin to open a position with 100x leverage, just a 1% fall in price is enough to trigger liquidation.

How Does Cross Margin/Leverage Work?

Cross margin or leverage will utilize the total amount of funds in the trader’s available balance account to prevent liquidation if your position goes below the maintenance margin.

The cross margin will be calculated using the maximum leverage allowed for the trading pair when using the cross margin mode. However, all the positions need to have similar settlement crypto for cross margin to work.

An example should make it easier to understand cross margin. Suppose you have 2 BTC in your account and want to open a cross margin position with 0.01 BTC using a platform with 100x maximum leverage.

In this case, the value of your full position is 1 BTC (0.01 x 100) when using maximum leverage. You will need an initial margin requirement of 0.01 BTC if the company requires 1% to open the position.

If there is a decrease in BTC Futures price by a small percentage, the trader’s position will not be liquidated. Instead, the cross margin mode will utilize the 1.99 BTC remaining in your account to increase the margin.

Cross margin will keep utilizing the funds in your account to increase your margin if the price keeps dropping. Hence, you can lose both the amount you use to open the position and what is in your available balance with cross margin.

How Does Isolated Margin Work?

With an isolated margin, you can only increase your margin by adding more funds to your position as you cannot utilize what is in your available balance. While this means you can only lose what you use to open the position, it also means your position can get to liquidation level quickly.

Suppose you have 2 BTC and want to open an isolated margin position with 0.01 BTC using 100x leverage in a platform that supports it. In this case, the size of your full position will be 1 BTC (100 x 0.01).

If the platform you are using requires a maintenance margin of 0.5%, you need to maintain a margin balance of 0.005 BTC (0.5% of 1 BTC). If the price of the coin decreases and market forces reduces your margin to the 0.005 BTC minimum maintenance margin requirement, further decline in price leads to automatic liquidation of your position.

If things do not go your way, you will only risk losing the 0.01 BTC that was your actual investment. The 1.99 BTC remaining in your account will not be used to increase your margin unless you choose to add some of your coins to the position to prevent liquidation.

What is Cross Margin in Binance?

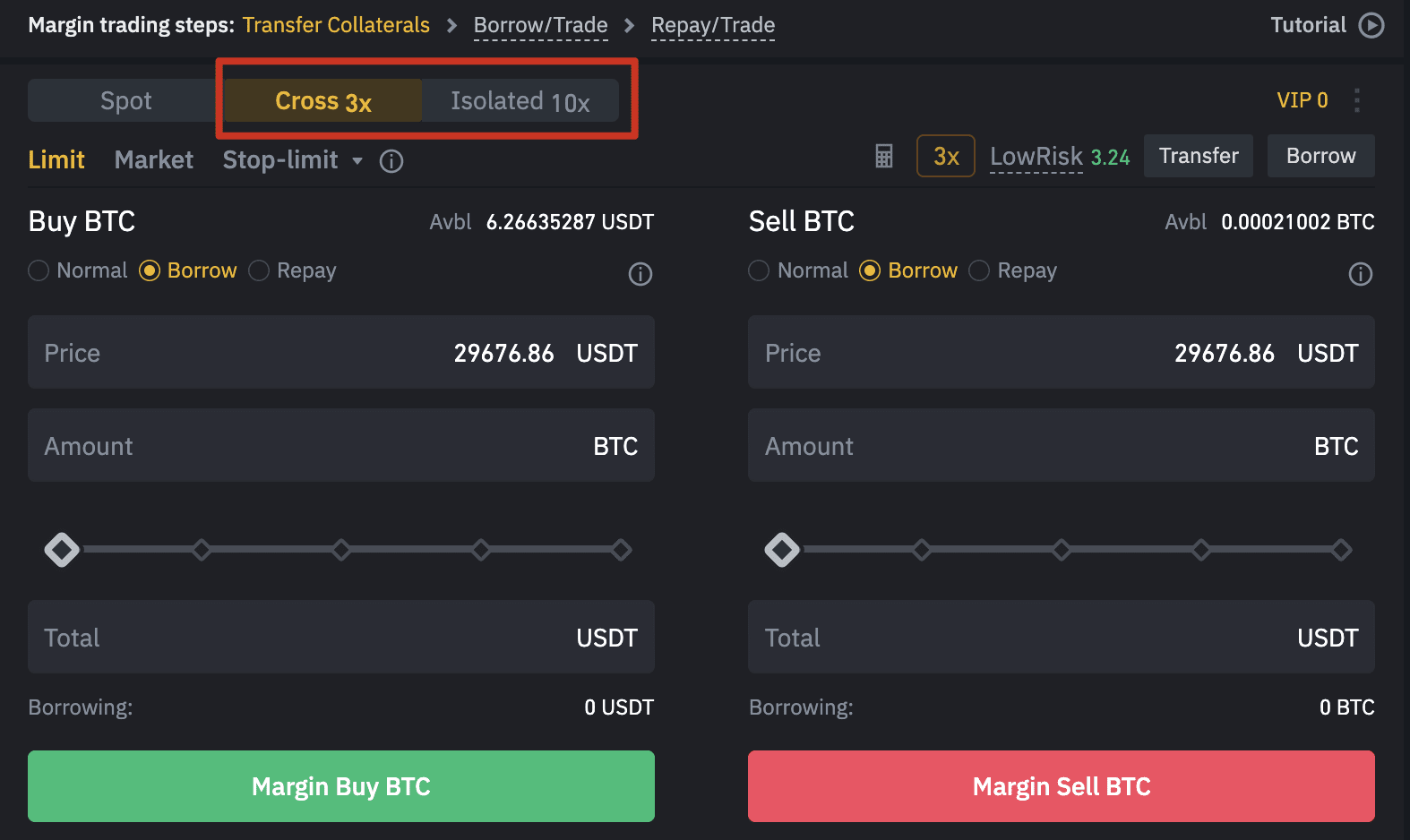

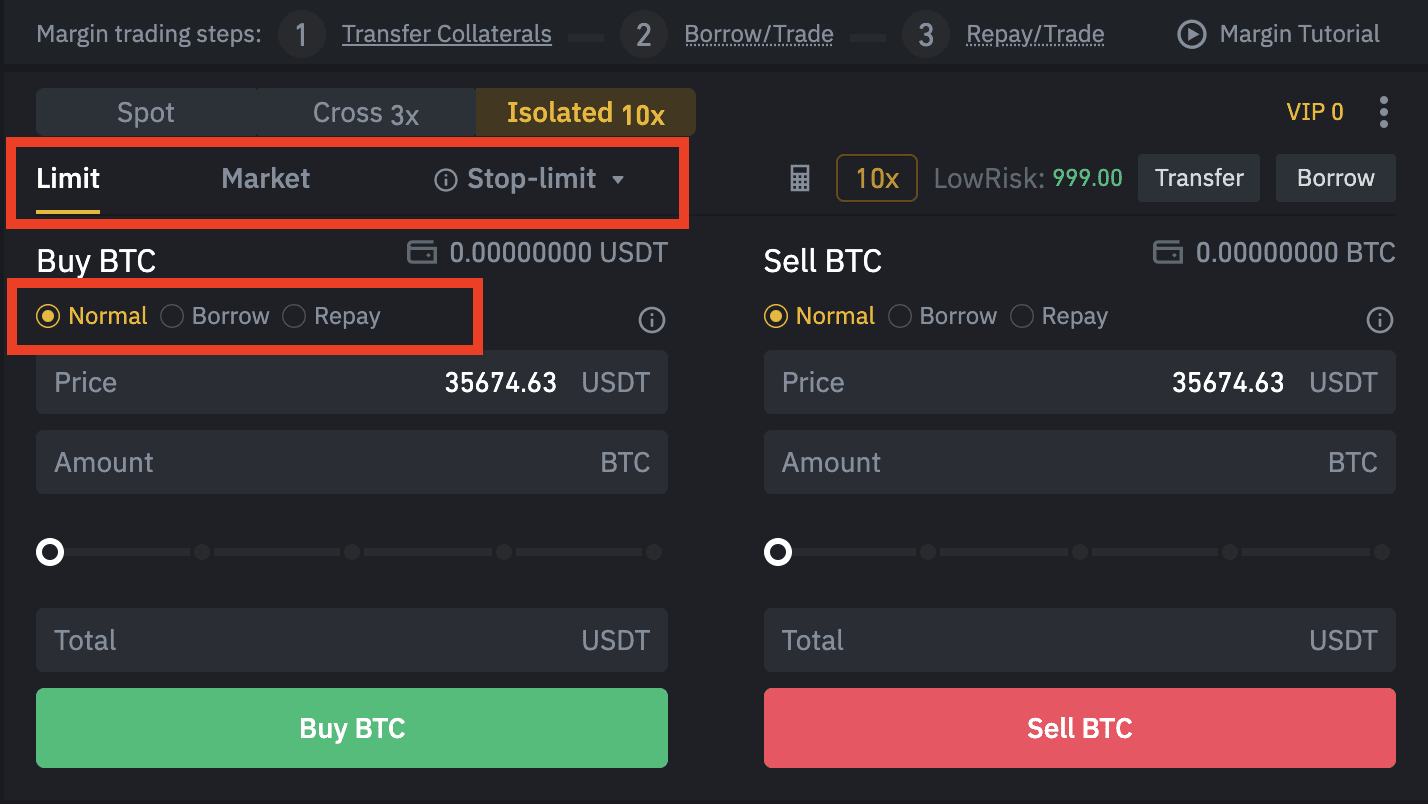

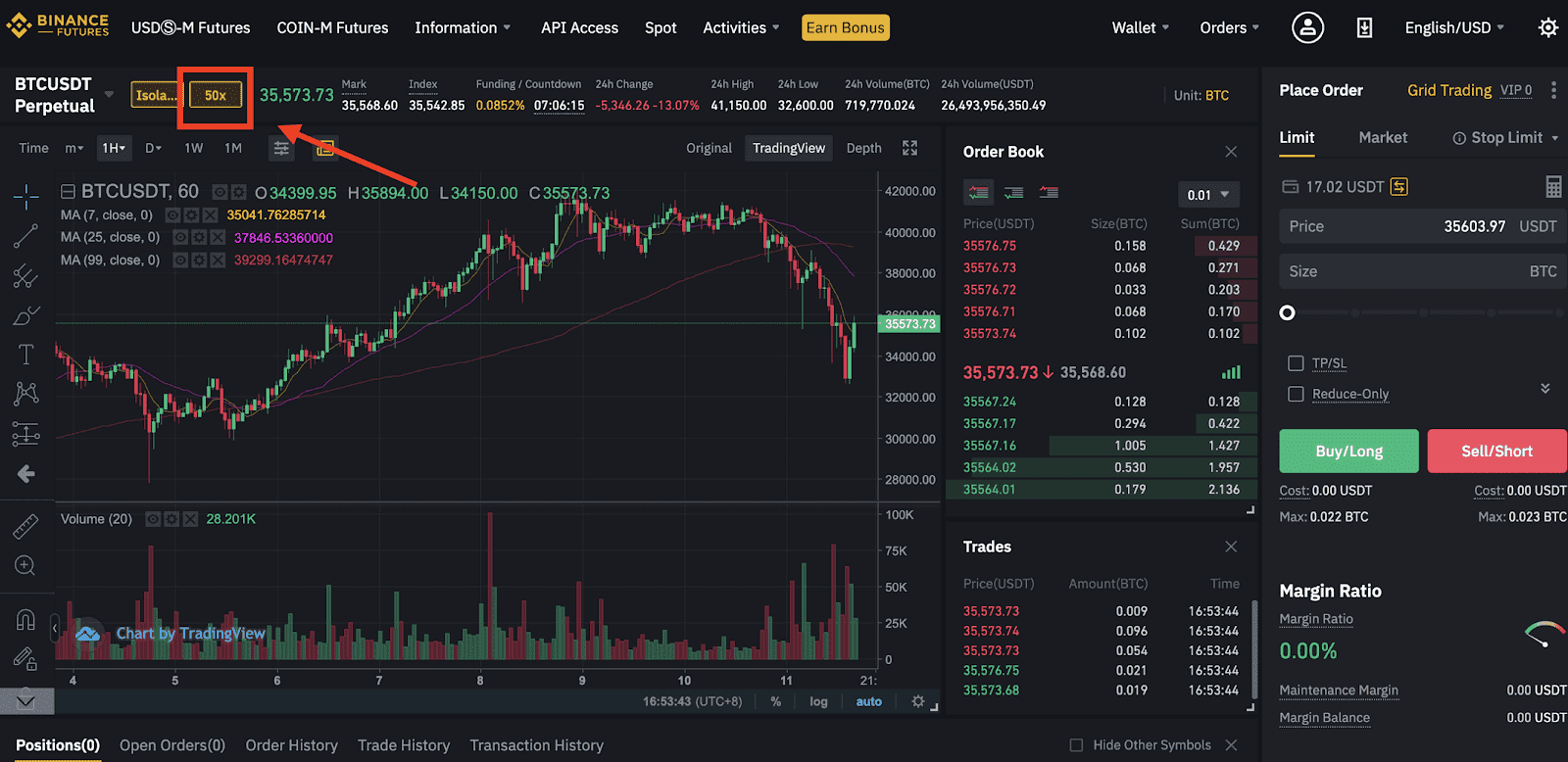

Binance Futures supports both cross and isolated margins. Better still, they make it easy to choose between the two on your trading page. The margin in the cross margin mode will be shared among your margin accounts.

The maximum leverage you can use for cross-margin trading is 5x for the master account and 3x for the others. The leverage you choose to use determines whether you can borrow and trade or just trade only. Also, it affects your ability to transfer funds to your exchange wallet or out of your margin account.

Binance provides clear cross margin trading rules, which every trader that wants to give it a try should go over before they start trading.

What is Isolated Margin in Binance?

Like many other platforms supporting the mode, the Binance isolated margin mode will be independent for every trading pair and position you open.

Each trading pair will have an independent isolated margin trading account, and you can only transfer particular cryptos to it. For example, if you open an isolated trading account for BTC/USDT trading pair, you can only transfer BTC and USDT to the account.

However, traders can have several isolated margin trading accounts if they want to open different positions.

The margin levels will be calculated for each of these accounts independently. Also, even if you have enough funds on other accounts, they cannot be transferred to one in danger of liquidation unless you do it manually.

Like their cross-margin trading accounts, Binance also has rules for isolated margin trading, which every trader needs to know.

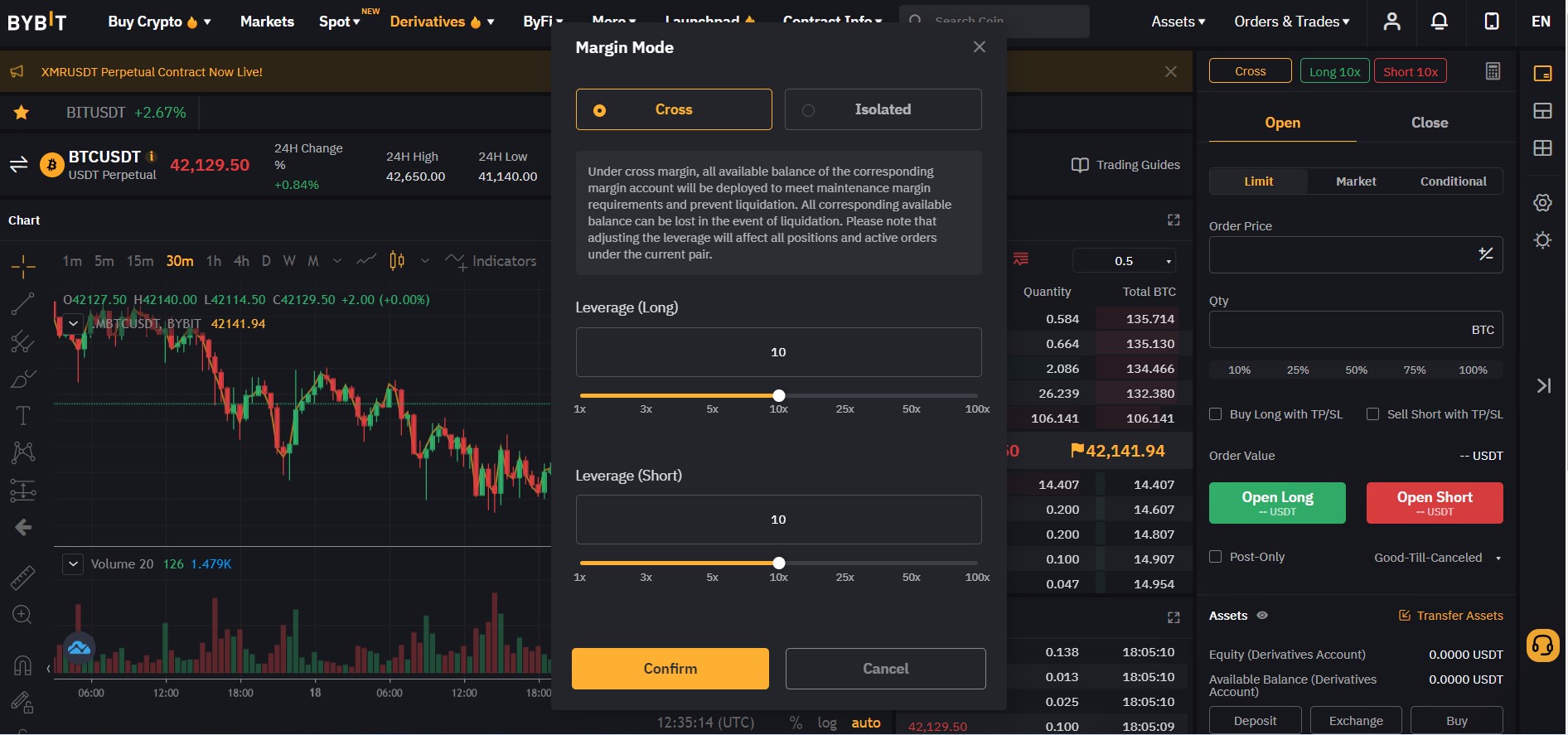

What is Cross Margin in ByBit?

Cross margin is the default margin mode when using the ByBit exchange platform. Therefore, it is essential to remember to change it if you want to open an isolated margin position.

Like with cross margin on other exchanges, the ByBit cross margin will use any available balance in the user’s account that supports settlement in the same crypto as the open position to prevent liquidation.

For example, if your open a BTC/USDT position, in the event of liquidation, you will lose all your USDT, including what is in your available balance, since it is the currency used to settle the account.

What is Isolated Margin in Bybit?

You can easily change from the default cross margin to isolated margin in ByBit. All you need to do is go to the order zone. However, making the change affects your liquidation price. Therefore, it is vital to ensure you will not trigger immediate liquidation before making the change.

Using isolated margin on Bybit will allow you to manage your risk as the maximum amount you can lose is the position margin you place for that particular open position.

For example, if you open a position on ByBit with 0.1 BTC at 3x leverage, the value of your open position will be 0.3 BTC, and the maximum you can lose in case of liquidation is 0.1 BTC. The only disadvantage is that you have to increase the margin manually to prevent liquidation.

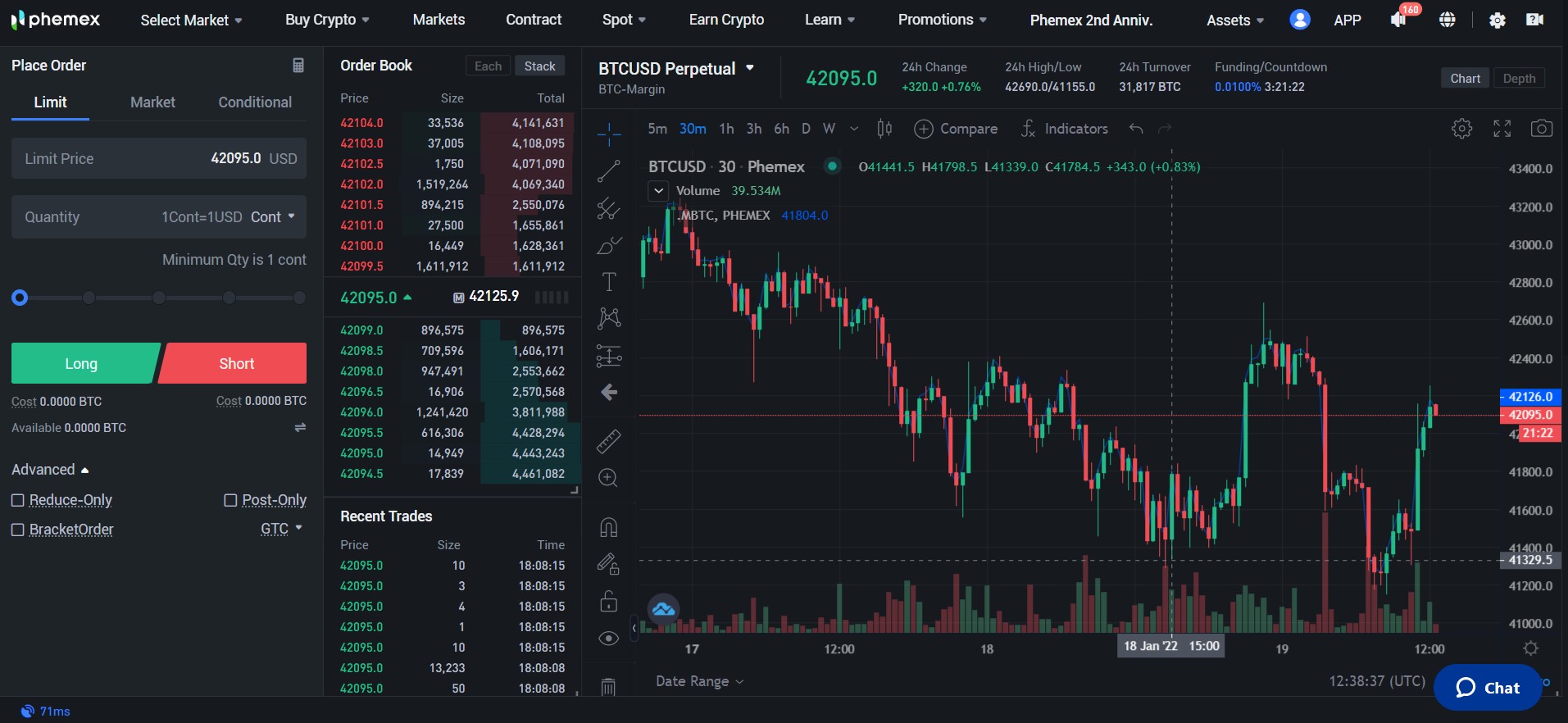

What is Cross Margin in Phemex?

Phemex also provides both cross and isolated margins. When using their cross margin mode, you will never need to increase your margin manually. The trading system automatically adds funds to the position to prevent liquidity.

Traders can only get liquidated when the available balanced drains up. However, this also means that the cross margin traders can lose their entire initial margin plus what is on their available balance.

Although the cross margin is the default on Phemex, trades can still change it in their trading interface. Additionally, Phemex allows different positions to use different margin modes, and traders can also have varying margins for sub-accounts.

What is Isolated Margin in Phemex?

Phemex uses its isolated margin mode to limit the user’s loss to the amount of margin allocated to the losing position.

Hence if you have any balance in your available funds account that you do not allocate to the position cannot be used to prevent liquidation. However, Phemex allows traders to assign more margin to a position on the “Positions Panel” to avoid liquidation.

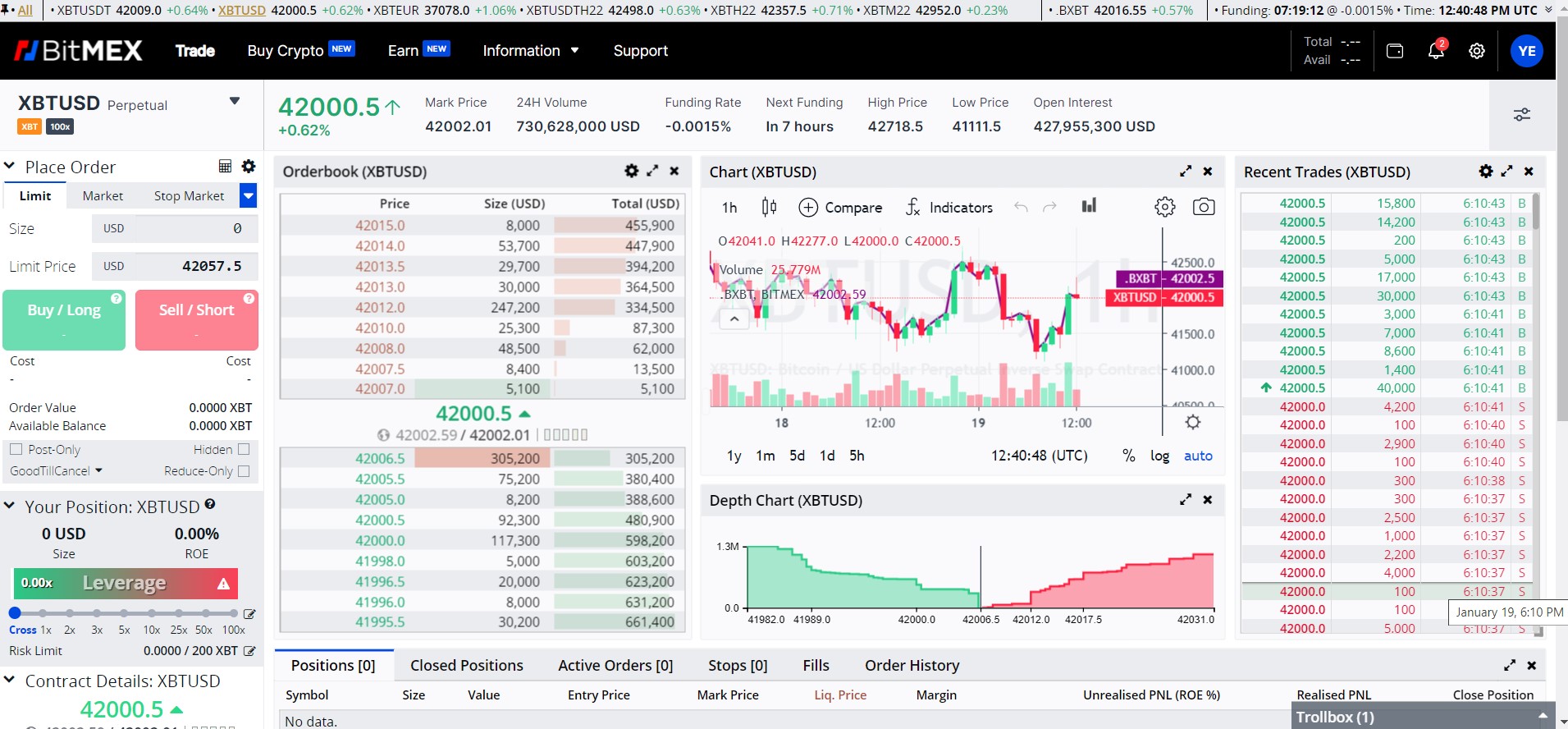

What is Cross Margin in BitMEX?

Like many other exchanges, BitMEX will have cross margin as the default mode for all positions. Also, their cross margin will utilize any funds in the available balance of the cryptocurrency you are trading to add to the liquidity in a losing position to prevent liquidation.

However, it is essential to note that BitMEX will not support portfolio margining. This means that any unrealized profits cannot be used to settle unrealized losses or as a margin to open a cross margin position.

Therefore, you must first close a position and realize the profit before using it to offset the losses on a different contract.

What is Isolated Margin in BitMEX?

The isolated margin on BitMEX also limits a trader’s liability to the initial margin posted. Hence, even if your position is liquidated, your available balance will not be used to add margin to the position to prevent liquidation.

BitMEX provides a leverage slider on the trading platform that allows you to adjust your leverage on open positions when using isolated margin. Also, the amount of margin you assign to any position is adjustable once you switch to BitMEX.

Conclusion

As a trader, you need to understand the difference between a cross and isolated margin before you open any position, regardless of the platform you plan are using.

Most exchanges will have cross margin as the default. It is harder to get liquidated when using cross margin as the trading system utilizes your available funds to increase the margin. However, the losses are higher if the position is liquidated.

Isolated margin minimizes what you lose as you cannot lose more than the initial margin you post. However, you can reach liquidation much faster if you do not add more margin manually.

That said, each margin mode has its merits and demerits, and hence the right one for you depends on the kind of trade you want to do.