Leveraged tokens have been around for a while now, and they are one of those hotly debated topics in the crypto trading environment.

While many exchanges support their trade, Binance seems to take a different approach with their BLVT (Binance Leverage Tokens), as they try to address the many shortcomings of these tokens.

That said, you have to have a good understanding of the Binance leveraged token before investing your assets. As a trader, you have to know what they are all about, how they work, and other crucial things like fees.

What Are Binance Leveraged Tokens?

The Binance Leverage Tokens (BLVTs) are tradable assets listed in the exchange’s spot market as the other coins and tokens. The company created them to address the many issues with trading the traditional leveraged tokens.

BLVTs make managing leveraged positions less intricate as the traders will not need to place any collateral or maintain a margin. Moreover, there is virtually no risk of liquidation, meaning you get to enjoy the benefits of holding a leveraged position without worrying about its management.

Each BLVT you buy will represent a basket of open perpetual contract positions. Therefore, one can also rightfully call them tokenized futures positions.

BTCUP and BTCDOWN

The BTCUP and BTCDOWN are the two first available BLVTs in the Binance platform. The BTCUP aims to give traders leveraged gains when the bitcoin price increases. The BTCDOWN token will generate leveraged gains for the traders when the crypto price goes down.

These and all other tokens that Binance offers are listed and tradable on the Binance platform only. Also, the tokens will not be issued on-chain, and you cannot withdraw them to your cryptocurrency wallet.

Joining Binance? Know How to trade futures on Binance?

Variable Target Leverage

Unlike other leveraged tokens managed by other crypto exchanges, the BLVTs will not maintain constant leverage, which aims to minimize the effects of volatility drag.

Volatility drag is a massive problem for leveraged tokens that maintain constant leverage. For example, most will maintain constant leverage of 3x, and so if the price of the underlying asset increases by 5%, the leveraged token goes up by 15%.

However, if the price goes down by 5% the next day, the leveraged token will go down by 15%. In the end, the token will lose at least 2% despite the price not changing much compared to the starting point.

With BLVT, you get variable leverage between 1.25% and 4%. The variable leverage helps ensure you get maximum profits when the market goes your way and minimizes losses if not.

How do Binance Leveraged Tokens Work?

Once you know how the variable leverage on the BLVT works, you should clearly understand what these tokens are all about and how to make money on them.

Traders also need to know that the BLVTs will be traded on the Binance spot market, and they can redeem them for the value they hold. However, you are always better off exiting your position instead of redemption as the latter is more expensive.

With that said, it is also essential to know how to buy and trade the tokens, and here is a step-by-step breakdown of everything you will need to do.

Step 1: Log In/Sign Up on Binance

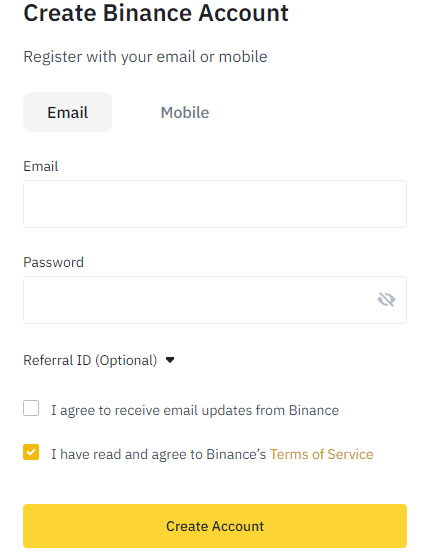

The first step is to go to https://www.binance.com and log in to your account or register a new Binance account if you are not already a member.

If you are a new Binance user, you will need to fill up your email address, create a password and agree to the terms before clicking the yellow “Create Account” button.

Once this is done, you can verify your email using the code they will send, set up 2FA to secure your account, and do KYC verification to remove limits from your account. All this is easy to do from your profile section and will most entail following the prompts.

Step 2: Select Leveraged Tokens

Once you log in to your account, you need to locate the leveraged tokens. For the new users, it is essential to remember to fund your wallet with at least the amount you wish to invest in the BLVT before getting to this step. Binance provides several deposit methods and accepts fiat and crypto deposits, so this step should be easy.

To get to the leveraged tokens page, you should hoover over the “Derivatives” tab on the top bar, which then opens a drop-down menu. The leveraged tokens will be the 6th item in the list just below the Vanilla Options, so it is hard to miss.

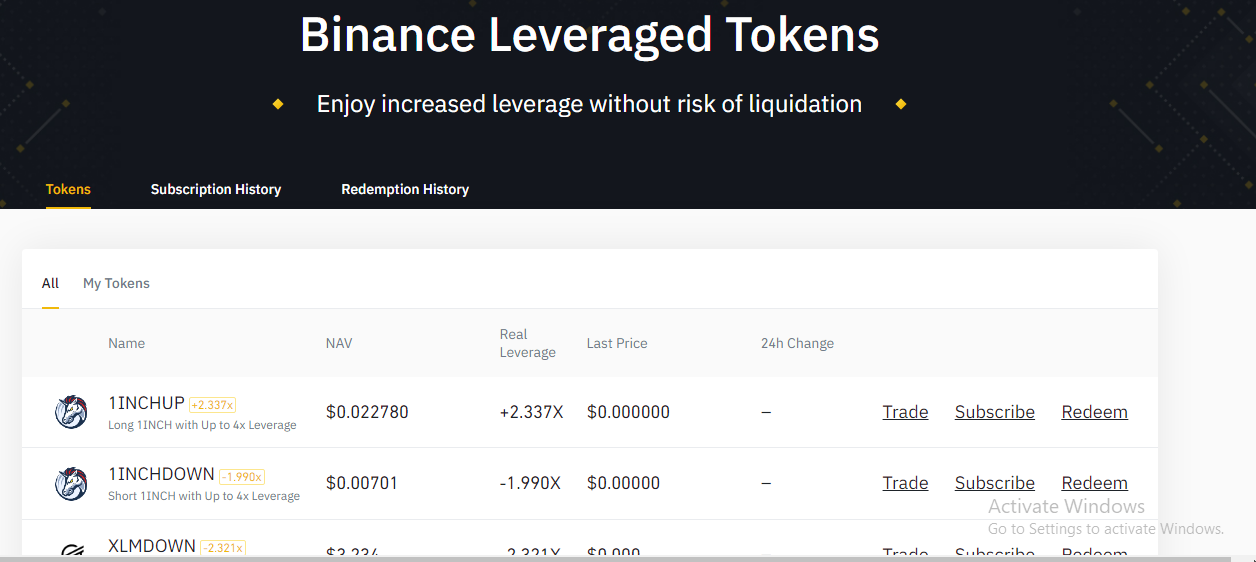

When you open the Binance Levaage Tokens, here is what you will see:

Binance has a long list of all their available tokens, and they keep updating it regularly. You can see more information on the token, such as basket, funding rate, and leverage target by clicking on it.

New to Binance? Know How to trade margin on Binance?

Step 3: Choose your Trading Pair

It is a good idea to go through all the BLVTs available before deciding on the token you would like to trade. Even if you already have one in mind that you wish to trade, it is still better to check others out to ensure you do not miss out on more promising ones.

You can use the historical NAV chart to track the token’s performance for a more informed choice. The chart also includes technical indicators that will be highly useful.

Step 4: Buy the BLVTs

Now you can buy your preferred BLVT by simply clicking on the yellow “Buy” button at the top right of its landing page.

When you click on the buy button, you will be redirected to the platform’s advanced trading interface. Here is what it looks like:

You should fill up your order on the order book on the right of the interface by filing up the amount you wish to invest in the fund and your bid price and then click the buy button.

Step 5: Read the Risk Disclaimer

Leveraged trading is highly risky, and so before you start trading, you will need to read the risk disclaimer and check the box to show you understand what you are getting into.

Also, when you click on the buy button next to a token you want to buy, you have to take a quiz on leverage trading. Traders have to pass the quiz to show they know what they are getting into, but Binance provides a video that will explain all the key things you need to know about BLVT.

Step 6: Monitor and Trade the BLVTs

Once you get to this step, you should now be able to buy and trade BLVT with ease. The process is just the same as trading crypto in the spot market. Also, the more you do it and learn to read market trends, the better you get and hence the more profitable the trade will be for you. Furthermore, to get a complete understanding of the exchange, you can check this Binance guide.

Binance Leveraged Tokens Rebalance

Binance keeps its target leverage variable and is not visible to traders. This aims to ensure that the tokens are never forced to rebalance unless the market conditions deem it necessary.

By hiding the target leverage, Binance also eliminates the front-running problem. If the tokens do not rebalance at predefined intervals, no trader can take advantage of the event at the expense of others.

The leveraged tokens on Binance will only rebalance in extreme volatility in the market. Other leveraged tokens have to rebalance every day in response to changes in the underlying asset price, which often worsens the volatility drag.

With BLVTs, you can rest easy rebalancing only happens to minimize losses when the market is not going your way, so there is no liquidation. Also, the tokens rebalance to maximize your gains in upswings.

Binance Leveraged Tokens Limit

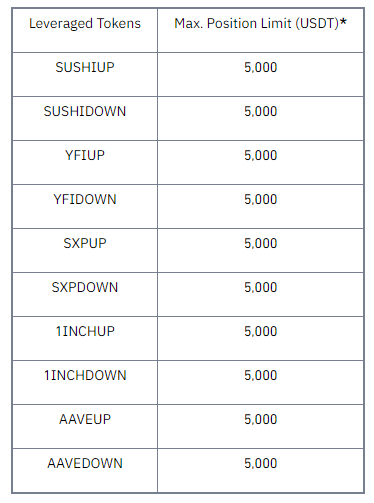

Binance imposes some leveraged token limits to keep the market under control and minimize market risk. Here is a table of some of these limits:

Once you reach your maximum allowable position, the system will reject any buy order you make. However, there are some cases where Binance allows you to hold a position higher than their maximum limit.

For example, market fluctuations can make your position larger than the maximum allowed when you calculate it using the current NAV. Binance will make adjustments in such cases, but the trader cannon place new orders.

Binance Leveraged Tokens Fees

Fees should always be at the top of your mind when trading, as you need to ensure they are not too high, so they do not eat up your profits. BLVTs promise higher short-term returns, but this does not make fees insignificant.

When trading these tokens, you will need to pay the trading fees like with other coins and tokens since they are in the spot market. Binance Futures uses a tiered system for its trading fees, and they have 10 levels from VIP 0 to VIP 9.

VIP 0 traders are those that have a 30-day trade volume of less than 1,000,000, and they will have to pay at least 0.0750% in maker and taker fees. For the VIP 9 trades with a 30-day trade volume of over 5,000,000,000, the maker and taker fees are 0.0150% and 0.0300%, respectively.

Besides the trading fees, another fee is the management fee, which comes from the act that the tokens represent an open position in the futures market. The management fee is 0.01% per day or 3.5% per annum.

Depending on how you choose to exit your position, there is also a 0.1% redemption fee. The redemption fee is charged when you prefer to redeem your tokens for the value they hold instead of selling them in the spot market.

Risks & Benefits of Leveraged Tokens

Volatility decay is the most significant risk of leveraged tokens. Hence, traders should not ignore its impact when trading leveraged tokens. If you are not careful, volatility decay can quickly wipe out your entire investment within a short time.

Regular rebalancing also poses a significant risk to leveraged tokens. Rebalancing increases or reduces the token’s exposure to the underlying asset. In doing so, any investor who holds a leverage token for longer than one day can see a dramatic increase or decrease in their original investment value.

That said, the most significant benefit of a leveraged token is that you can grow your initial investment faster and with a bigger margin than regular spot trading when the market goes your way. Also, you never have to go through the hassle of managing leveraged positions.

Conclusion

There is no doubt that leveraged tokens are highly volatile and pose a greater risk, but the potential returns are also higher, and this is more so if you choose well-structured ones like BLVT.

The Binance Leveraged Tokens offer variable leverage and only rebalance during periods of extreme volatility, which can be highly useful at dealing with issues like volatility decay.

If you can read the market correctly, BLVTs will offer you a relatively easy way to amplify your gains without having to invest too much of your capital. But, like every other crypto product, you should always start with a good understanding of how these tokens work and the risks involved.

Getting started with Binance? Know the difference between Binance margin and futures trading