Safeguarding your crypto assets should be your top priority as a crypto investor.

Thanks to the recent rise in crypto hacks, keeping your funds on a crypto exchange isn’t ideal.

Even if you are storing your funds in a crypto wallet, your wallet can get compromised in many ways.

So, how do you secure your cryptocurrency holdings?

Well, to help you with the answer, I have explained some key steps below that you must take to ensure your crypto holdings are safe:

Understanding the Threats to Your Crypto Holdings

The first step in securing your digital assets is understanding their associated risks.

First, if you own a large sum of crypto, you should avoid keeping it in a crypto exchange, thanks to the rising numbers of crypto exchange hacks.

Hence, it is an ideal choice always to use a cryptocurrency wallet to store your funds.

Also, there are different types of wallets, such as hardware, software, and paper wallets.

However, paper wallets are not relevant these days and are not the best option.

So, I am taking it out of the picture.

There are different types of risk when it comes to hardware wallets or software wallets, such as:

- Phishing attacks

This is one of the common ways hackers try to steal your wallet information. Often, you would receive emails or messages from the exchange or wallet you are using and ask you to log in. These emails and messages do look legit. However, they are designed to trick you into entering your wallet details. So before clicking on any crypto-related links, check the email address or contact info to distinguish between a fake and a genuine email. - Malware

While using a software wallet, you must look out for malware. Hackers can use malware to spy on your activity and steal your digital assets. - Social engineering

Lastly, there is a new type of hack attack called social engineering. In this, the hacker will pretend to be someone they are not, like a customer service person from your crypto company, to get private information from you. So avoid giving your confidential information away over calls or emails.

7 Best Ways To Secure Your Cryptocurrency Holdings

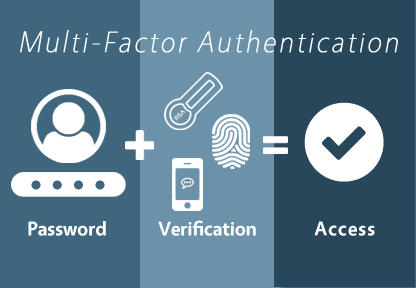

1. Use Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) or Two-Factor Authentication (2FA) is the best defense against hacks.

It is a multi-step account login process requiring more information than a password.

So, even if a hacker gets to know your password, they still need to figure out the MFA code to log in to your account.

So whenever you try to log in to a crypto exchange or crypto wallet, the crypto app will ask you to provide two or more verification codes to gain access to your account.

Also, these additional codes have a concise life. So they can only be used for a minute or less.

Usually, the code is sent to you through email or SMS, or it can be collected from an authenticator app.

To safeguard your crypto holdings further, you can use a physical key to secure your account.

So, using the physical key is necessary for everyone to be able to access your account, even if you give away your password.

This added security measure will help you further enhance the safety of your crypto holdings and ensure that you have complete ownership of your crypto.

New to crypto investments? Know How do I manage multiple wallets or addresses within a single crypto wallet?

2. Use Hardware Wallets

Using a hardware wallet to secure your cryptocurrency holdings is the best practice.

Hardware wallets are a mix of security and convenience and work best for anyone looking to hold crypto long-term.

A hardware wallet is a physical, electronic device that stores digital assets offline.

These types of wallets are cut off from the internet.

So, there is no way a hacker can access it or get affected through malware and phishing scams.

Also, to make any crypto transaction, one needs physical confirmation on the device itself.

So even if hackers gain access to your phone or computer, they cannot have access to the crypto wallet.

Furthermore, these types of wallets are usually protected by a PIN code, adding a layer of security.

After several failed attempts, the device will automatically wipe itself, preventing malicious attempts to gain access.

However, as a user, you don’t have to worry about the wallet wiping itself off, as you can always restore your funds by using your recovery phrase.

Moreover, if you are considering buying a hardware wallet, buy a reputable one like the Ledger Nano X from the manufacturer or authorized sellers.

Do avoid buying the wallet from any other sources to prevent tampered devices.

3. Regularly Update Software

It would be best to keep your cryptocurrency wallet software up to date to secure your digital assets.

Software updates don’t just bring new features to the app.

But they also come with critical security improvements, patches, new security features, and bug fixes that hackers can use to compromise your wallet.

Wallet developers work around the clock to identify new threats and security vulnerabilities, create a fix, and ship with a software update.

So, they ensure the wallet is immune to recent threats whenever they release an update.

Also, by updating your wallet app, you can ensure that you are getting improvements to your wallet’s functionality.

Enable the automatic update option if available to ensure you never miss an update.

This will ensure your wallet is updated whenever the latest version is available.

However, checking it manually should be the last option if an automatic update isn’t available.

For instance, you can check for any software update once every month.

Also, ensure it is from the official website or verified app store whenever you download an update.

As a result, you can avoid downloading any malware.

Recommended Read: What is a Man-in-the-middle” attack for hardware wallets and how can it be prevented?

4. Keep Private Keys Offline

One of the critical aspects of crypto holdings security is the management of private keys.

Private keys are used for authorizing transactions and proving the ownership of a blockchain asset.

As a result, keeping your private keys offline can significantly reduce the risk of your funds being stolen.

Also, when the private keys are not connected to any online service, hackers cannot access them.

By storing your private keys offline, they are not the prime attack of online hacking attempts, malware, or phishing scams.

Also, keeping your keys offline would ensure complete control over your private and digital assets.

Also, there are multiple things that you can take into consideration to ensure that your private keys remain safe.

For instance, you can use a paper wallet or physical document that contains your private key or a QR code associated with the crypto wallet.

However, using a paper wallet isn’t a good idea as it can be damaged instantly.

Alternatively, you can use a hardware wallet to store your private keys offline on a physical device.

For instance, you can use Ledger’s ‘The Billfodl’ solid steel case to store and protect your private key.

5. Use Strong and Unique Passwords

Passwords are the first defense against any authorized access to your cryptocurrency holdings.

So, make sure you are using a strong and unique password.

By using a strong password, you can ensure that only you can access your crypto funds.

Also, hackers will take much longer to crack your password through hacking attacks like brute force.

To create a strong and unique password, make sure to add complexity.

A good password length should be 12 characters and have a mix of uppercase and lowercase letters, numbers, and symbols.

Also, you should avoid making any predictable patterns or sequences in your passwords that can be easily figured out if the hacker knows about your birthday, middle name, or any other information.

The best way to develop a solid and unique password is to use a password generator.

However, remembering the password can be a hassle.

To solve this, consider using a reputable password manager to store and manage your passwords.

Whichever password manager you choose, ensure it has no history of password leaks.

6. Encrypt Your Wallet

Encrypting your wallet is another line of defense that you can set up to protect your crypto holdings.

Encrypting your wallet will set up a strong password that must be entered before anyone can view or spend your funds.

This way, you can secure your private keys, and only someone with the right encrypted key can access your funds.

Also, if your computer or hardware wallet is stolen, encryption can prevent hackers from accessing your funds.

To encrypt your crypto wallet, you must start using a strong password.

Hint: you can use a password manager for this.

Secondly, you will need to use wallet software with encryption features.

Most reputable wallet software services offer you an option to encrypt your wallet.

Finally, you must take a backup of your wallet before you encrypt it.

In case something goes south, your funds won’t get locked.

Additionally, it would be best to store your encrypted password somewhere safe and regularly test the access.

You can do this every six months or so.

Moreover, you must also ensure that you are keeping your wallet recovery phrase or seed safe and any other data required for encrypting the hardware wallet.

Recommended Read: What is a watch-only address in a crypto wallet?

7. Educate Yourself on Security Practices

Last, you must keep yourself educated about the best security practices.

The security landscape keeps changing, and staying updated will ensure that you take the utmost measures to safeguard your crypto holdings.

Also, when you look at the crypto landscape, hackers are developing new ways to access your funds.

So when you keep yourself updated, you can adapt to new security measures, ensuring topmost security.

It would be best to use new security tools occasionally and not fall for common pitfalls.

Additionally, it is also a good idea to make use of two different crypto wallets.

You can use a software wallet for your day-to-day transactions or short-term holdings.

However, it would help if you used a hardware wallet for the large sum of crypto and long-term investment.

Conclusion

You can secure your crypto holdings in multiple ways.

The best option is to use a hardware wallet and apply all the security practices on top of it.

You must also make a security checklist to review and measure your security implementations regularly.

However, apart from securing your crypto wallet, you must also secure the recovery phase of your crypto wallet and private keys.

Securing these is as important as your crypto wallet.

If you lose access to your private keys or seed phrase, you won’t be able to recover your funds.