If you follow the crypto space closely, then you must have heard of Coinmama, a cryptocurrency brokerage platform. It allows you to purchase a wide range of cryptocurrencies for debit/credit cards anywhere in the world.

This must have raised your eyebrow because there are only a handful of exchanges that support fund transfer through credit/debit cards, that too in the specific economic regions.

So, without further addon, let’s get into reviewing Coinmama and what other unique features does it offer.

Coinmama Exchange Review 2021

Coinmama is an Israel-based leading crypto brokerage firm and operating in the space since 2013.

More than a crypto exchange, Coinmama calls itself a digital financial services company that enables it to offer fund transfer through debit/credit cards.

The one thing particular about Coinmama is, the platform only supports buying cryptocurrencies using credit/debit card or bank transfer. Neither does it support trading of cryptocurrencies, nor does it allow selling of cryptocurrencies on its platform. In other words, you can say, it is like a P2P crypto exchange but you don’t have to interact with other buyers or sellers on the site.

And, all purchase orders received from customers are completed from the company’s holdings that ensure buy orders are filled instantly and in a more secure manner.

According to its website, the services of Coinmama are available in 190 countries, including the United States (select states) and have served over 1.6 million customers since its launch.

New to trading cryptocurrencies? Learn How do Bitcoin futures contracts affect bitcoin prices?

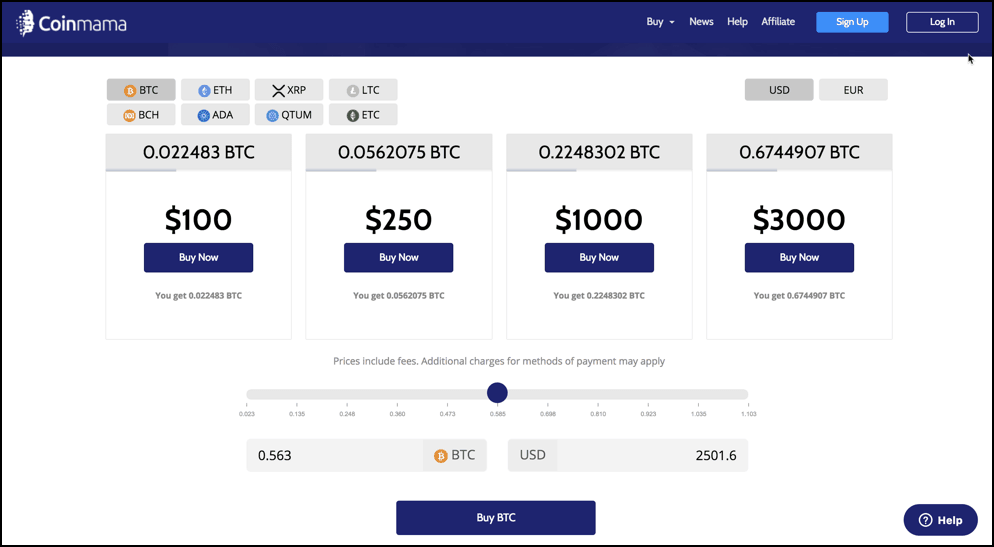

Coins Available On Coinmama

Coinmama offers a limited number of cryptocurrencies for purchase on its platform, but these are popular enough to satisfy your needs. They are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

- Qtum (QTUM)

- Cardano (ADA)

- Ripple (XRP)

One point that every user should keep in mind that unlike other crypto leverage exchanges, Coinmama does not have an inbuilt wallet for any of the cryptocurrencies available on its platform.

The user should have their secured wallet ready before placing their buy orders, which is an excellent step to encourage users to have their custodial wallets in place, ensuring their safety.

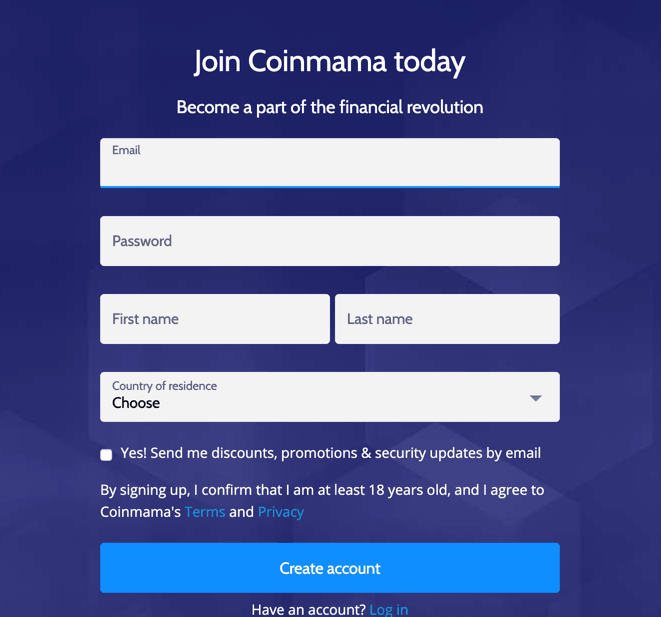

Registration Process

The account set-up process on Coinmama is quite easy that includes creation, securing, and verification (KYC) of account.

To register, click on the Sign-up button present on the Coinmama homepage, and enter your valid email-id, create a password, name, and country of residence.

And, then click on Create Account.

A confirmation mail is sent to your inbox, that you must confirm before logging in to your account.

After you first log-in to your account, secure your account via 2FA and SMS authentication

Then, you need to confirm your identity for KYC purposes using a government-issued identity certificate, namely passport, national identity card, or driver’s license.

It requires filling up a verification form that requires details like name, date of birth, gender, address, and details of credit/debit card.

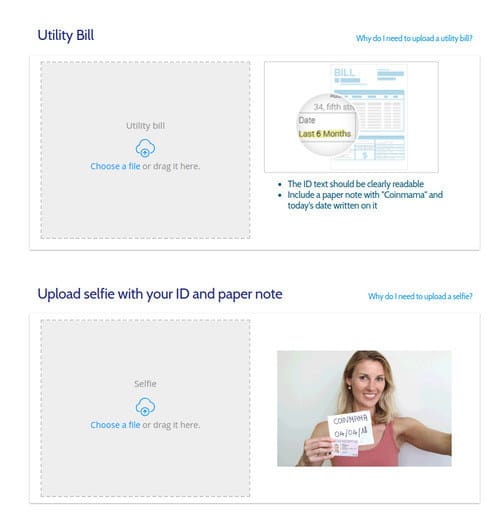

To complete the verification process, you need to upload a scanned image of your identity card, and the following points must be noted before uploading the document.

- Identity card should be visible entirely

- High image quality (images that are 3000dpi and higher)

- Valid document and expiry date should be mentioned

- The maximum file should not exceed 8 MB

The initial registration process takes as much as 10 minutes, and the final verification process is completed could take up to 6 hours during business hours. However, after the initial verification, you can start using Coinmama and place your purchase order.

Recommended Read: Basis trading in crypto

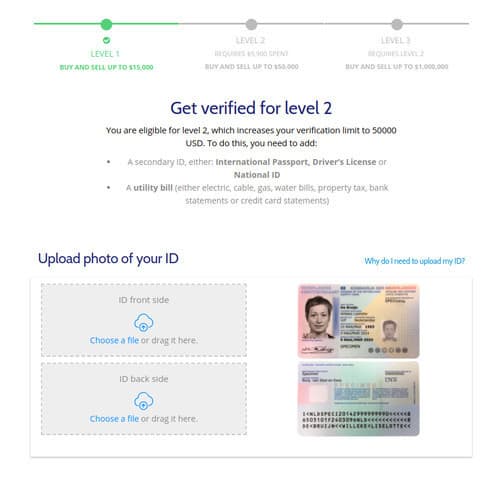

Purchase Limit

Through Coinmama, you can buy a large number of bitcoins and other cryptocurrencies with much ease. A verified user can buy up to $5,000 worth of cryptocurrency in a day and up to $30,000 in a month. And, the minimum purchase order should be $60 and equivalent in EUR.

However, depending on your KYC verification level, you can buy cryptocurrencies worth up to $1 million.

Coinmama has three purchase limits for its users, and each level requires additional KYC requirements.

- Limit level 1: Up to $ 15,000

Following are the documents required under this limit category:

-A selfie with valid government-issued ID-card

-A note with “Coinmama” and date mentioned on it

- Limit level 2: Up to $50,000

In addition to the verification process carried out in level 1, you need to upload two government-issued ID cards and scanned images of a utility bill that includes electricity bills, gas bills, property tax receipts, bank statements, or credit card statement.

- Limit level 3: Up to $100,000

To get access to this limit, you need to fill out a short form by contacting [email protected] personally.

Coinmama Fee Structure

The Coinmama brokerage fee on each buy order is 5.9% of the total order value. Additionally, bank charges apply depending on the payment method used.

- Credit/Debit Cards

You also need to pay additionally 5% as a credit/debit card processing fee with a minimum cap of $10. Coinmama currently supports VISA and MasterCard debit and credit cards.

- SWIFT transfer

There is no processing fee for order value worth over $1000. But, the order value below $1,000 attracts a flat processing fee of 20 GBP.

Maximum daily limit: $30,000

- SEPA transfer

It has recently added SEPA (Single Euro Payments Area) for customers in 37 European countries, and the transfer charges are NIL without any lower limit.

Maximum daily limit: $30,000

- Faster Payments

Faster payments service is available for customers only in the UK, which allows users to buy crypto directly paying from their bank account and receive it within a day time.

Currently, Coinmama only supports purchase in EUR and USD. However, it accepts all fiat currencies, while customers have to pay for the applicable exchange fees.

Supported Countries

Coinmama services are available in 190 countries except for sanctioned countries and several states of the United States [Connecticut, Idaho, Iowa, New York, Utah, District of Columbia].

Customer Support

Coinmama has a dedicated page for its customers with an extensive list of FAQs to help with the common issues.

Additionally, you can also place a support request for issues that are not listed in the FAQ lists or those that require technical support from the Coinmama team.

All the support requests are generally attained within 24 hours but expect a longer response time on weekends and holidays. The business hour is Sunday to Thursday from 11 pm to 7 am Pacific Time.

Conclusion

Coinmama looks like an excellent platform for buying cryptocurrencies against fiat currencies with its ease of accessibility.

Some additional features of Coinmama which make it attractive are:

- Safety: Since Coinamam doesn’t have any inbuilt wallet, it forces users to store cryptocurrency on their secure wallet. And, for Coinmama, as they do not hold any users fund, chances of a security breach is very less compared to other exchanges.

- High buying limit: Users can buy up to $1 million worth of cryptocurrencies with much ease and speed

- Straightforward interface: The platform interface is very sleek with a minimalistic design feature

- Worldwide support: No crypto exchange currently can offer its services at the scale that Coinmama offers, enabling easy access to digital assets to every corner of the world

- No trading: The platform can be used only for buying cryptocurrencies, but you can also sell BTC. However, no margin trading or futures trading is allowed.

- A limited number of crypto: The platform supports buying of only eight major cryptocurrencies, a negative for crypto users in the ever-expanding cryptosphere

- Lack of mobile app: The lack of mobile app restricts users from buying cryptocurrencies on the go and restricts accessibility

- No anonymity: Coinmama does not offer anonymity feature, as all users are required to complete mandatory KYC

- No in-built wallet: Coinmama doesn’t have in-built wallets to store or manage your currencies, which a good step to encourage buyers to set-up their own non-custodial wallets.

In my opinion, apart from the in-built wallet thing, which is a convenience for many noob guys, Coinmama looks a great alternative to buy cryptocurrencies with much ease and speed.

Now you tell us: Have you used Coinmama before? How has your experience been? If not, you should give it a shot.

You might also like:

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023