When it comes to Bitcoin trading, you will often find a slight price difference between Bitcoin’s spot market price and the future price market.

Although, both futures and spot markets are two different things. But not many know that the Bitcoin futures contract has an effect on the Bitcoin price.

So the question is, how do Bitcoin futures contracts affect Bitcoin prices?

Well, this is what we will be looking at briefly below.

How Do Bitcoin Futures Contracts Affect Bitcoin Prices?

- Price discovery

Bitcoin futures help traders to buy and sell assets at a fair price as futures contracts provide more transparency and liquidity to the market.

This gives the traders an idea about the ongoing demand and supply of the asset, and it can lead to a more accurate reflection of the underlying value of Bitcoin, which can affect the spot price.

Also, when we trade Bitcoin futures, we are making speculations on the future price of the underlying asset.

This can provide more information about the market sentiments and what traders are really expecting from the market, which can also affect the current spot price of Bitcoin.

Another reason for increased liquidity could be when a future contract is launched on a regulated market, and it increases the awareness of the asset.

As a result, more investors would be attracted, turning into active market participants.

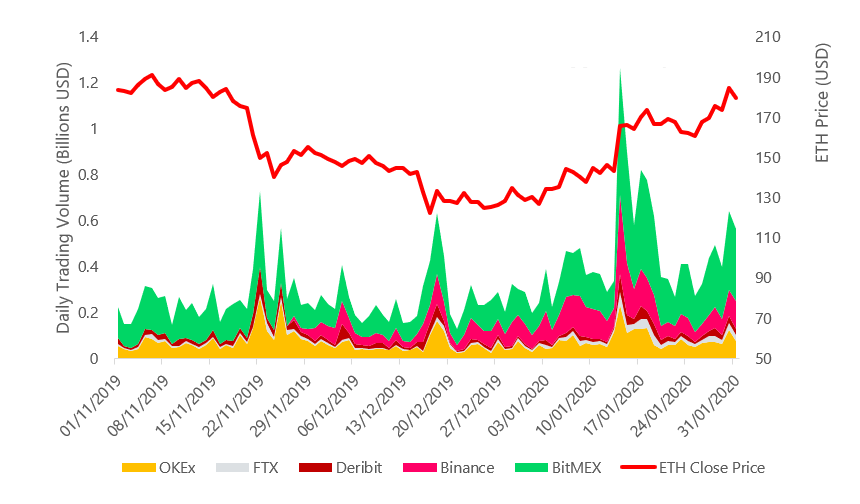

- Increased trading volume

Bitcoin futures can also increase the overall trading volume for Bitcoin. As more and more investors and traders would participate in the market.

This would reflect significant market interest and create a higher demand for Bitcoin. The increased demand can increase the price of Bitcoins.

Also, a higher trading volume would bring higher liquidity to the market, resulting in reduced volatility.

- Hedging

Hedging is known as a risk-managing strategy as it allows traders to deal with short-term market volatility and offset their position.

When market participants hedge their position with future contracts, they are focusing on gaining profit from the future price of Bitcoin. As a result, they can reduce their exposure to price fluctuations in the spot market.

For example, if a trader is holding Bitcoin in their spot wallet and believes that Bitcoin price will fall.

Then they can short Bitcoin futures contract and gain profit from it while having a loss in their spot wallet. This way, the trader can control their potential losses.

Moreover, this can also lead to less volatility in the spot market as traders can offset their risk by using futures contracts, and they won’t indulge in panic buying/selling activities.

- Speculation

Speculation is another factor that can affect Bitcoin’s spot market price. Since when trading Bitcoin futures, we are taking a bet on the future price of the asset.

As a result, market participants will actively participate in the market, and a lot of trading activity will happen.

For example, if the traders believe that the price of Bitcoin will go up, they will buy Bitcoin futures contracts at a lower price than the current spot price.

This will create a demand for the asset and increase the spot price.

Similarly, if traders believe that the asset price will fall, they will sell Bitcoin futures at a higher price than the current spot market. Again, this will increase the asset’s supply, pushing the asset’s spot price down.

By speculating on the price of Bitcoin, traders will introduce more volatility to the market as they will actively buy and sell the asset as per their speculations.

It is also worth mentioning that there are a lot of other factors that affect the spot price of Bitcoin than Bitcoin futures.

Some key reasons could be market conditions, investor sentiments, news and media, and many more.

What Factors Influence BTC price?

There are many essential facts that can influence Bitcoin’s price.

First of all, the market’s demand and supply decide the price of the asset. If there is too much supply and little demand, the price of the asset is more likely to fall.

Another thing that can influence bitcoin prices is news and media. Suppose there is any positive news about Bitcoin.

For example, if some well-known brand adopts Bitcoin, then the price of the asset will go up.

Also, BTC’s price can be influenced if there is any alternative cryptocurrency that can give tough competition to the asset, and then the price of Bitcoin may also see a fall.

What are Bitcoin Futures?

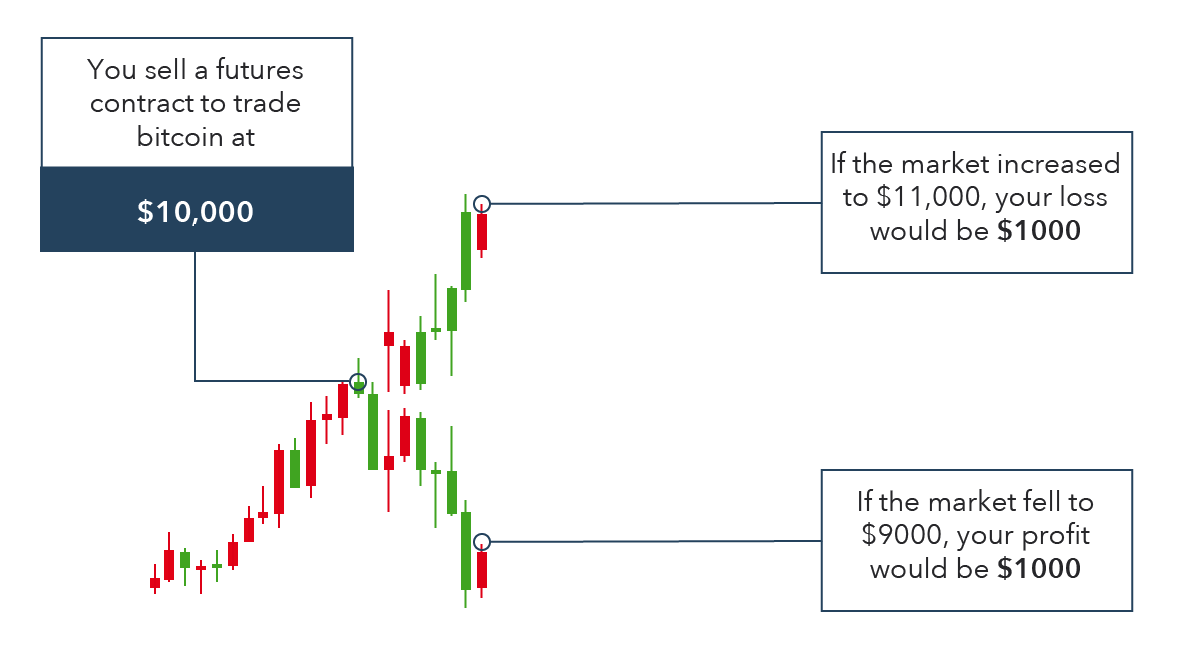

Bitcoin Futures is a contract that bonds two parties to buy or sell an underlying asset at a specific time, at a specific quantity and price.

It allows the traders to get exposed to Bitcoin trading without needing them to own any Bitcoin. As in Bitcoin futures, the trader is trading a contract and not the actual asset.

As a trader, your job is to predict the future price of Bitcoin and then take a trading position. For instance, the current market price of Bitcoin is around $18,000.

Now, if you believe that the price of Bitcoin will move to $18,500.

Then you will enter into a long position. And when the contract expires, if you had predicted the right market move, you will earn a profit. Else you will face a loss.

However, trading Bitcoin futures is different from trading Bitcoin.

Because Bitcoin is an asset and you would only make money when its price moves up.

However, in Bitcoin futures, you are allowed to go long or short.

Want to start trading Bitcoin Futures? Know How much money do you need to trade Bitcoin Futures

Conclusion

So that was all for how Bitcoin futures contracts affect Bitcoin price.

Bitcoin futures do play an essential role in creating a supply and demand for the underlying asset, which affects the price of Bitcoin.

If there is a huge demand for Bitcoin futures contracts, then spot market investors would think that Bitcoin is in demand; hence they should invest in it.

If the price of the Bitcoin futures is going down, then spot marketers may avoid getting into the market, which will translate into a higher supply.