Considering Deribit for your cryptocurrency trading needs? In this thorough review, we’ll explore all Deribit offers to help you make an informed decision.

This platform is well-known for its robust offerings, particularly in Options trades and Futures.

However, it’s essential to look beyond the reputation and delve into key elements such as trading features, security measures, fees, and customer support.

Let’s embark on this detailed exploration of Deribit to determine if it aligns with your unique crypto trading needs.

With a comprehensive approach, we’ll decode the strengths and potential drawbacks of Deribit in this meticulous review.

So, should you use Deribit for trading cryptos?

Here’s a detailed Deribit review to help you make the right decision.

![]() Deribit Review 2023: Supported Currencies and Trading Pairs

Deribit Review 2023: Supported Currencies and Trading Pairs

Deribit allows Options and Futures trading for Bitcoin, Ethereum, and 16 other currencies.

Deribit users have recently been introduced to spot trading.

Currently, its spot trading arm only has three trading pairs and supports Bitcoin and Ethereum as the only cryptocurrencies.

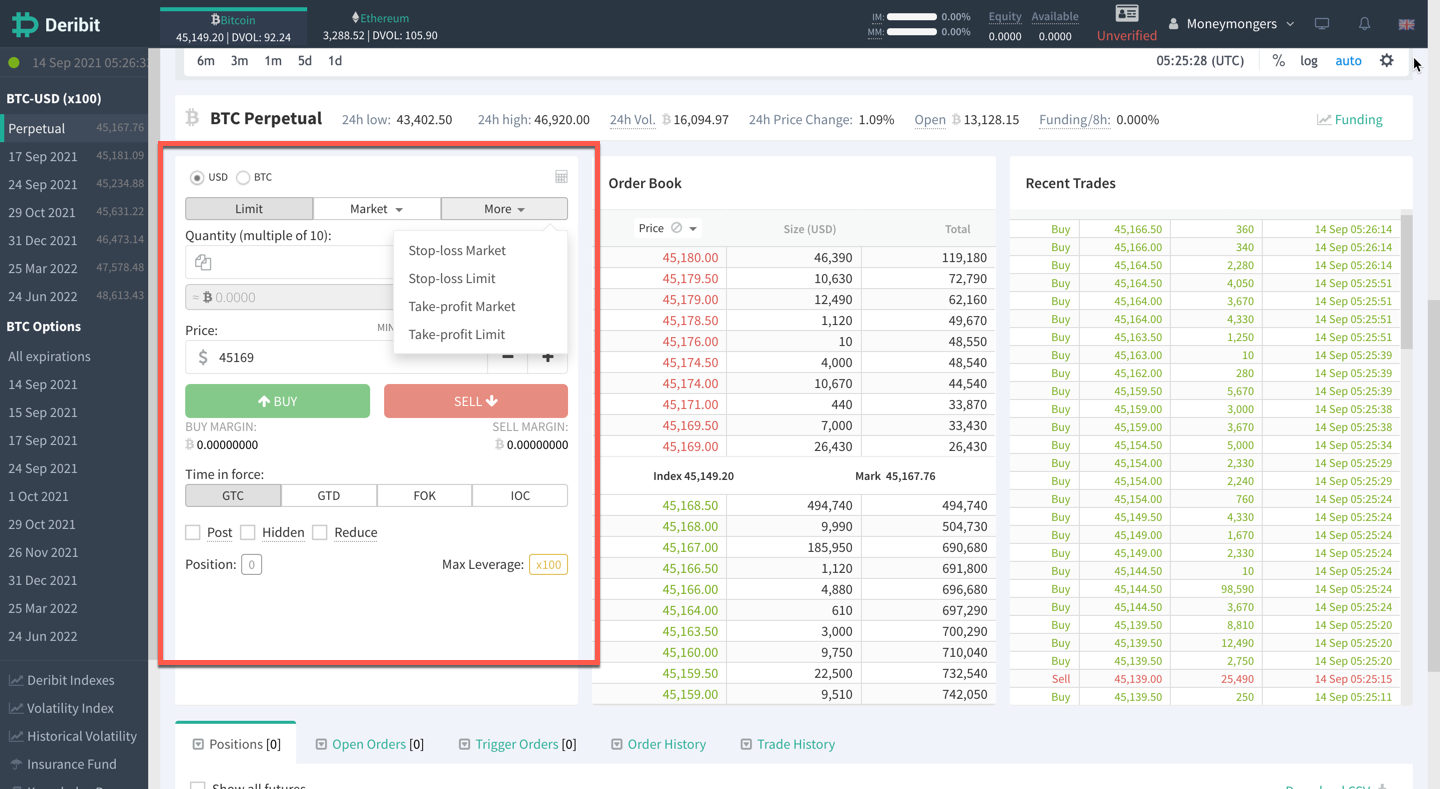

Deribit: Order Types

Deribit is a cryptocurrency exchange that supports various order types for Futures and Options trading that allow you to control your trades better.

The following order types are available on Deribit.

- Limit Orders

- Market Orders

- Stop-Limit Orders

- Stop-Market Orders

- Take-Profit Orders

Apart from these, Deribit also supports advanced order types, including:

- Good-Till-Cleared (GTC) Orders

- Immediate-Or-Kill (IOC) Orders

- Fill-Or-Kill (FOK) Orders

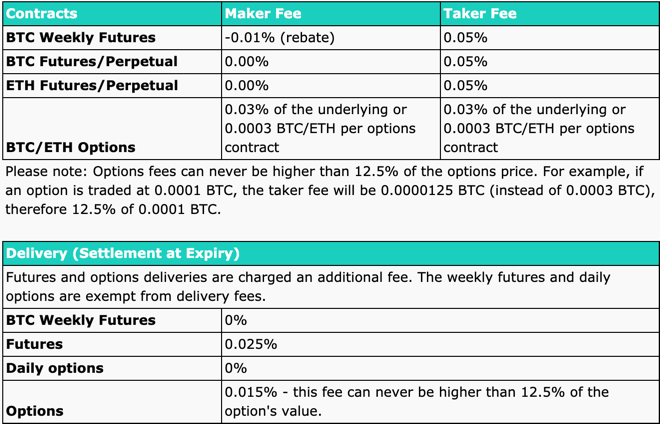

Deribit: Trading Fees

Like most crypto derivatives exchanges, Deribit follows a market maker-taker fee model. Here is how the model works.

That said, here’s what the Deribit fee structure looks like.

For perpetual contracts:

- Market Maker Fee: 0%

- Market Taker Fee: 0.05%

For traditional Futures:

- Market Maker Fee: – 0.010% (rebate)

- Market Taker Fee: 0.05%

For Options:

- 0.03% of the underlying or 0.0003 BTC per Options contract

- 0.03% of the underlying or 0.0003 ETH per Options contract

Options traders should remember that the trading fee on Deribit can’t increase beyond 12.5% of the option’s price.

Deribit: Liquidation Mechanism

Deribit has an automated liquidation mechanism like all other modern-day derivatives exchanges.

Crypto exchanges have an auto-deleveraging system that forcefully liquidates a trader’s open position if their initial margin falls below the maintenance margin requirements.

Since derivatives exchange like Deribit specializes in offering leveraged trading with up to 100x leverage when trading Bitcoin Futures, forced liquidation is common in leverage trading.

The leading cause for forced liquidation is a sudden market fluctuation due to some piece of news or malicious price manipulation.

Deribit implements a robust liquidation mechanism to protect its users from forced total liquidation.

Deribit’s liquidation mechanism involves:

- Incremental Liquidation

Deribit uses incremental liquidation, or partial liquidation, to ensure that liquidation occurs in fractional steps.

Incremental liquidation gradually closes open positions instead of reducing a trader’s open position to the zero-equity point.

- Insurance Fund

In some cases, the price at which the losing trader is liquidated differs from the price at which the winning trader has their target.

Deribit has an insurance fund to fill this gap, ensuring the winning traders get paid.

- Socialized Loss System

If the insurance fund runs out of funds, Deribit has a socialized loss system as a backup.

After the depletion of the insurance fund, all the losses are socialized – distributed equally among profitable traders.

- Daily Settlement

Deribit also has a daily settlement system, and settlements occur every day at 8:00 UTC.

This ensures that the socialized loss system doesn’t affect long-term traders.

Deribit: Funding Rates/Fees

Since perpetual Futures contracts don’t have an expiry date, they can trade away from the underlying asset’s price for a long time.

This could make the market one-sided. To avoid this, Deribit implements a funding rate mechanism.

Here’s how the funding rate works.

When the price of the perpetual contract is higher than the spot price, long traders have to pay a funding fee to short traders.

This discourages traders from buying, thereby dominating the sellers and bringing the price close to the spot price.

Similarly, if the price is below the spot price, short traders will pay a funding fee to long traders, making the buyers dominant.

Now, how is the funding rate calculated?

Deribit uses key data related to Futures trading and a Mark Price mechanism to calculate the funding rate.

This includes measuring the percentage difference between the Mark Price of the contract and the Deribit BTC Futures Index.

Please note that the funding fees are exchanged between traders, and Deribit does not accept any of these fees.

Deribit refreshes the funding rates every eight hours.

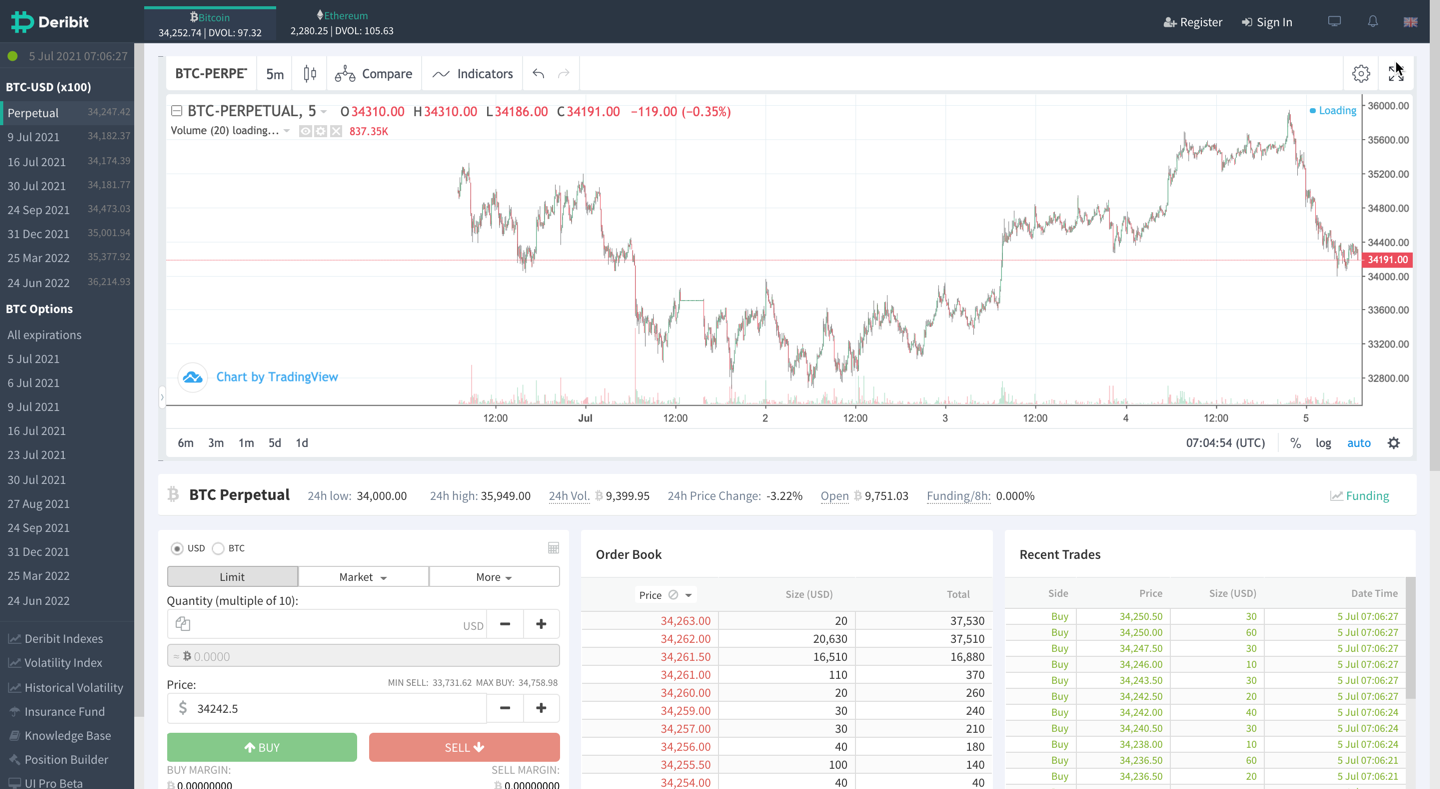

Deribit: Trading Platform & Tools

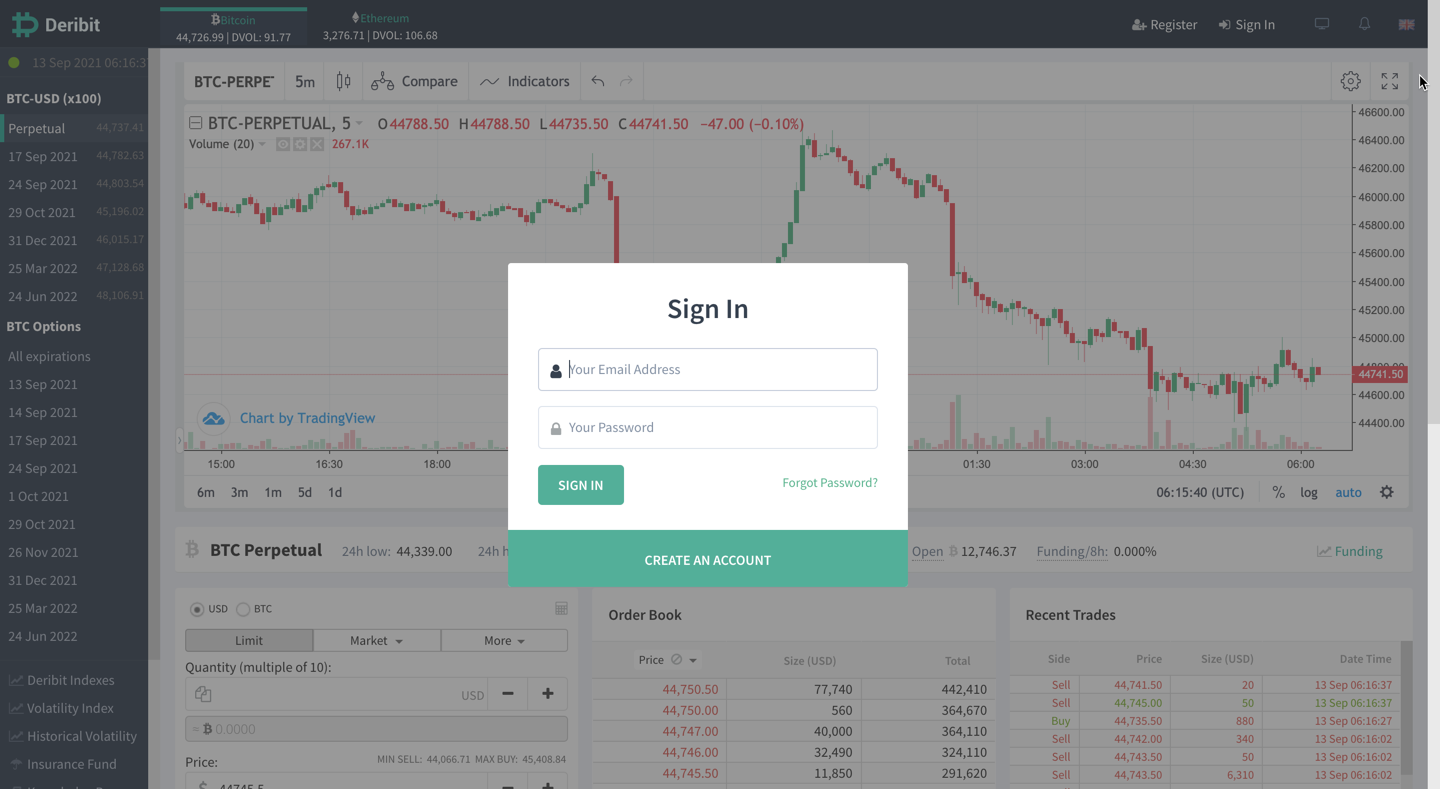

Deribit has a powerful web-based trading platform and an interface accessible from the Deribit website.

The platform comes with less than 1 ms latency and cutting-edge technical analysis tools that enable traders to devise trading strategies and make informed trading decisions.

Deribit implements the TradingView charting system, which is the industry standard used by every leading exchange in the crypto market.

Key features of the Deribit trading view for trading Bitcoin derivatives are:

- Multiple time frames: Deribit supports time frames from 1 minute to 1 day, allowing traders to analyze historical chart data across various time frames.

- Multiple Chart Types: Deribit supports numerous chart types, such as line charts, area charts, candlesticks, Heikin-Ashi, etc., to get a clear market view.

- Indicators: Deribit has hundreds of built-in technical analysis indicators that enable seamless analysis and helps you make informed trading decisions.

- Drawing Tools: Deribit includes various drawing tools, such as horizontal/ vertical lines, trend lines, price/date range, long/short position, Fibonacci retracement, etc.

Now, look at the essential tools available on Deribit’s trading panel.

Below the chart is the Order Form, where you can set leverage, select order types, and place Buy or Sell orders.

Below the Order Form is the Order Book, where you can check the market depth and track Buy and Sell orders in real-time.

Toward the end, Deribit gives you a section to manage your open positions, open orders, trigger orders, order history, and trade history.

The only drawback of Deribit’s trading platform is that it was designed with more experienced traders in mind.

It’s excellent for beginners as well; however, there is a learning curve that beginners will need to go through when they begin trading in general on Deribit.

Deribit Mobile App

Deribit also offers a mobile app that allows traders to fully manage their trading operations from their mobile devices.

The Deribit app is available on both Android and iOS platforms.

You can perform numerous activities from the mobile app, such as opening a new account, taking positions, depositing and withdrawing funds, etc.

Deribit Testnet

Another standout feature of Deribit exchange is the Testnet, which allows you to do Futures trading and Options trading in a simulated environment with demo currency.

New traders may not be comfortable doing derivatives trading with real money, and such traders can leverage the Testnet to understand how Deribit is currently set up to work, place orders, use indicators, etc.

Once you gain enough confidence with cryptocurrencies as financial instruments, you can deposit funds into your main trading account and begin trading with real money.

Deribit: Deposit Methods and Deposit/Withdrawal Fee

Deribit only accepts deposits in Bitcoin. You can deposit funds in your trading account from a Bitcoin wallet.

If you don’t own Bitcoin, you can head to an exchange like Binance or Coinbase to convert your fiat currency into Bitcoin.

Currently, Deribit doesn’t allow fiat currency deposits using third-party gateways.

The same goes for withdrawals. Deribit only supports Bitcoin withdrawals to a Bitcoin wallet, and there is no fiat support.

Regarding the fees, Deribit doesn’t charge any deposit or withdrawal fee. However, a blockchain network fee may apply when withdrawing funds.

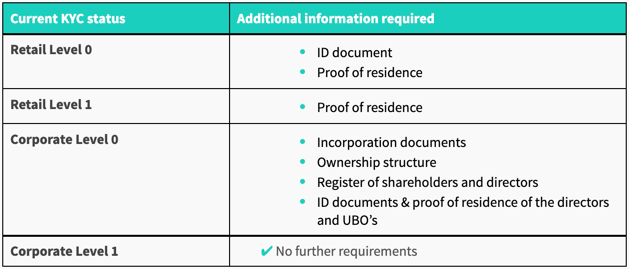

Deribit: Trading Accounts and Limits

Deribit is one of the many exchanges that have mandatory KYC requirements.

There are four levels of KYC status:

- Retail Level 0: ID document and proof of residence needed

- Retail Level 1: Proof of residence needed

- Corporate Level 0: Incorporation documents, ownership structure, register of directors and stakeholders, and ID documents of directors and stakeholders needed

- Corporate Level 1: Same requirements as Corporate Level 1

The distinctions between Level 0 and Level 1 accounts, such as daily withdrawal limitations, ability to perform block traders, etc., no longer exist.

Corporate-level account users can create sub-accounts under the main trading account to accommodate multiple traders and test different strategies.

These accounts have rate limits based on the seven-day trading volume.

Accounts with a seven-day volume of less than USD 1 million have a rate limit of 5 matching engine requests per second.

The limit increases to 10 p/s for a trading volume of less than USD 5 million, 20 p/s for a trading volume of less than USD 25 million, and 30 p/s for more than USD 25 million.

Each sub-account has a 20 p/s rate limit for non-matching engine requests with a burst of 100.

How to Start Trading on Deribit?

Now that we have discussed the particulars of Deribit let’s explore how you can start trading on the platform.

Follow these steps to get started.

1. Create a Trading Account on Deribit

You can visit this page to create an account on Deribit. Upon registration, you’ll be asked to complete identity verification.

Once you submit your documents, the Deribit team will approve your KYC within a few hours.

After your KYC is approved, you can start trading on Deribit.

2. Deposit Funds

The next step is to deposit funds.

As discussed, you can only deposit Bitcoin.

So, if you don’t own Bitcoin, you must buy it first. Once you have Bitcoin, you can deposit it in your Deribit account from your BTC wallet.

3. Place Your First Trade

Once you have funds in your account, you are ready to trade.

Head to the trading panel and fill out the Order Form. You’ll need to enter the following details:

- Order type

- Quantity (in BTC or USD)

- Price (for limit orders only)

- Maximum leverage

After filling out the Order Form, click on Buy or Sell to decide the direction of the trade.

When your order gets executed, you’ll enter a position.

Your open position will be visible in the “Positions” section of the trading panel.

4. Exit Your First Trade

The final step is to exit your trade, which you can do in two ways.

You can exit your trade manually by placing a market order against your open position.

Else, you can place stop-loss or take-profit orders.

If your trade goes against your prediction, your stop-loss will trigger, and you’ll incur a loss.

If your trade goes in your direction, your take-profit will trigger, and you will earn a profit.

5. Keep Practicing

The most important step to becoming a successful trader is to keep practicing.

It’s normal to incur losses, especially in the initial trading days.

New traders must focus on getting used to trading the Futures and Options market and get a gist of how all the financial instruments work.

Slowly, you should adopt trading strategies and take a systematic approach to trading cryptocurrency Futures.

Getting a good grasp of technical analysis can significantly boost your trading performance and profitability.

Note: Most derivatives exchanges like Deribit allow for Options trading, traditional Futures contracts, or Futures contracts without an expiry.

Deribit Security Features: Cold Storage, Insurance Fund, and More

Security is one of the most important factors before registering for a cryptocurrency Futures exchange offering leveraged trading.

Since its launch in 2016, Deribit has offered its users a safe and secure trading experience.

Because of these reasons, Deribit is growing in popularity slowly but steadily.

- Cold Storage

Deribit stores over 90% of its users’ funds in multi-signature cold storage.

Then when a user sends a withdrawal page request, the Deribit team manually authorizes the deposit address.

This eliminates the risk of cybersecurity attacks associated with storing funds in a hot wallet.

- Two Factor Authentication

Deribit encourages all its users to activate two-factor authentication (2FA).

To get login access, users must demonstrate the Deribit account ownership twice.

This prevents unauthorized access to user accounts and helps keep Deribit safe.

- Deribit Insurance Fund

As discussed, Deribit has an insurance fund that protects traders from forced liquidations while ensuring that profitable traders get paid.

This also covers the losses of bankrupt traders that their accounts may not have the funds for.

- Secure Protocols

Deribit implements cutting-edge security protocols to protect its web-based platform and mobile app from brute force attacks and DDOS attacks.

It also uses IP whitelisting, SSL encryption, and other security best practices.

- Notifications

Deribit also allows users to turn on desktop and in-app notifications.

This way, users can get notified in case of an unauthorized login or other actions.

Deribit Customer Support

Customer support is also an essential aspect of choosing a cryptocurrency exchange.

If you’re new to cryptocurrency trading, you will likely encounter issues using the Deribit platform.

Thankfully, Deribit has a skilled support team that offers 24/7 customer support through email.

On average, the team can take one to two hours to respond to your query.

Deribit also has a presence on social media channels like Telegram, Twitter, and Reddit.

So you can write your queries to the Twitter account or Telegram group and get them resolved faster.

Additionally, Deribit has a vast knowledge base that comprises FAQs and blog posts to answer commonly asked questions regarding Futures contracts and trading.

The only drawback of Deribit’s customer service is that there is no live chat feature offered by various exchanges.

-

Is Deribit Regulated?

No, Deribit is not regulated.

However, it requires all users to go through a KYC process, ensuring that their entire user base is verified.

You cannot use Deribit without having your KYC procedure completed.

-

Where Is Deribit Located?

Deribit has its headquarters in Panama City, Panama.

-

Can You Use Deribit in the US?

US residents are not allowed to use Deribit.

-

How Does Deribit Make Money?

Deribit makes money from the trading fee it charges on each trade.

Deribit doesn’t have a secondary revenue model like Phemex (premium version), Bitfinex, Bitstamp, Binance, or ByBit.

Deribit: Review Summary

Let’s quickly recap this review by discussing the pros and cons of trading on Deribit.

Coming to the pros first, Deribit has a standout trading platform that delivers institution-grade performance.

If you’re looking for a platform that supports fast execution and scalping, Deribit is an ideal pick.

Another key feature of Deribit is the demo account.

If you’re a beginner, the lack of a demo account functionality can be a dealbreaker.

A novel way to use it is to test your trading strategy using trading bots that can be used later on the live account via the Deribit API.

Lastly, Deribit offers all the standard benefits, such as margin trading at up to 10x leverage, low trading fees on all transactions, and zero deposit and withdrawal fees.

Now, let’s talk about the cons.

One major drawback of Deribit is that it has limited trading options. You can only trade a few Futures contracts or Options before expiration.

Also, the Deribit trading platform isn’t very beginner-friendly, and new users will have to go through a learning curve.

Deribit is an excellent exchange for professional and beginner traders looking to trade Bitcoin Futures (offers up to 100x leverage) and Options.

You might also like: