Crypto.com is one of the popular cryptocurrency exchanges out there based in Singapore.

The exchange allows you to buy, sell and trade cryptocurrencies across the spot, margin, futures, and warrants market.

However, many newbie traders on Crypto.com find it difficult when starting to trade on the exchange. One such trouble is shorting crypto.

So the question is how to short crypto on crypto.com?

Well, let’s find out all about it below:

How to Short Bitcoin (BTC) Crypto on Crypto.com?

Short via Margin Trading

Crypto.com allows you margin trading in which shorting crypto is allowed. Margin trading can be considered an extended version of spot trading.

Crypto.com allows you to use up to 3x leverage per Trade, and here is how you can execute your first margin trade on the exchange:

- Navigate to Margin Trading

First, log in to your Crypto.com account if you haven’t done so already. If you are new to the exchange, make sure to create your account first and then deposit sufficient funds to start trading.

To go to Margin Trading, click on Trade> Spot Trading to launch the trading terminal.

Since Crypto.com offers leverage trading for selected trading pairs, there is no separate window for Margin trading.

Also, the first time you log in to the Margin trading window, it will ask you to enable it, so do follow the onscreen steps to enable margin trading.

- Select A Trading Pair

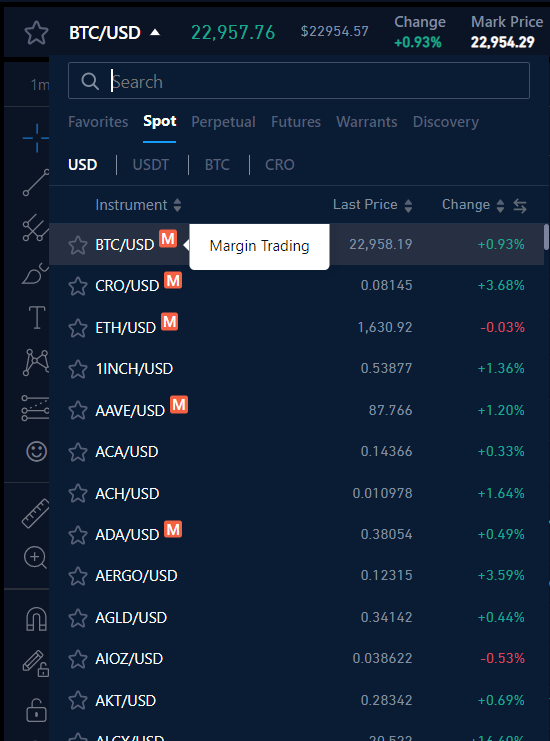

When you launch margin trading, by default, BTC/USD will be selected.

But you can always switch to any other trading pair by clicking on BTC/USD and then selecting any other trading pair.

Click on BTC/USD, and it will list down all the available margin trading pairs. Over here, you will find Margin trading pairs with an “M” tag.

Select any of the available margin trading pairs, and its chart will open up.

Also, across all the available trading pairs, there is a 3x fixed leverage, whereas in futures trading, the leverage varies from one trading pair to another.

- Place Your Trade

When it comes to placing a trade, there are two order forms – Buy order form and the sell order form.

As we are shorting crypto on crypto.com, we will have to use the sell order form. If you plan to go long on your trades, use the buy order form.

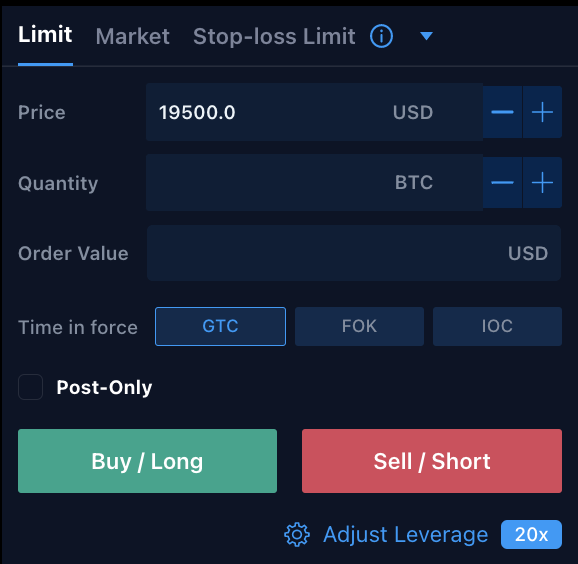

On the order form, you will first find different market order types, such as limit and market. These include Limit, Market, and Stop-Loss limits.

New to crypto trading? Learn What does Long & short mean in crypto?

Limit refers to placing your order at a desired price, market orders refers to executing the order at the current market price, and stop-loss limit refers to executing your Trade at a desired price with stop-loss values.

If you have selected a Limit order, you need to enter the price you want your Trade to execute at, and it will instantly show you the amount for your Trade.

Also, you can use the slider to adjust the amount of money you wish to borrow for your Trade. Also, after your Trade is closed, you need to repay the borrowed amount.

After placing all your order details, click on Sell / Short button to place your order, and your short order is placed.

Short via Perpetual & Futures Trading

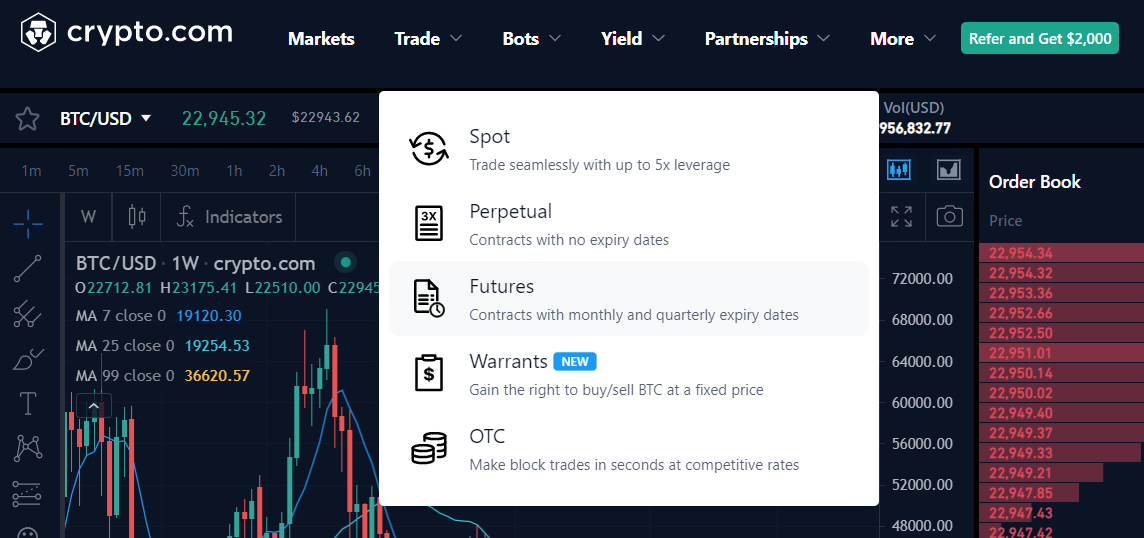

The next one is perpetual and futures contracts. Perpetual contracts are the most popular crypto trading instrument, giving you easy access to crypto futures trading.

As these contracts don’t have an expiry date.

But if you want to trade futures with an expiry date, Crypto.com has got your back too. The trading process remains the same for both contract types.

For a detailed guide, you can follow these steps:

- Transfer Funds To Derivatives Wallet

First, you need to transfer funds to the derivatives wallet. Just like many other exchanges, Crypto.com too has separate wallets for different markets.

So when you first deposit funds to your Crypto.com account, it will go to your Spot wallet account. And then, from there, you are required to transfer funds to the derivatives wallet.

So go to Derivatives, and on the left side of your screen, you will find a Transfer button. Click on it and follow the onscreen steps to transfer funds from your spot wallet to your derivatives wallet.

- Navigate to Perpetual Trading

The next step would be to navigate to the perpetual trading window. For this, click on Trade > Perpetual from the navigation bar. By default, the BTCUSDT-PERP will open up.

If you are trading futures, then you need to go to Trade > Futures and all the further trading steps remain the same.

Also, the first time you launch the Futures trading terminal, it will ask you to enable futures trading. So make sure to follow all the onscreen steps, and you will be good to go.

- Select A Trading Pair

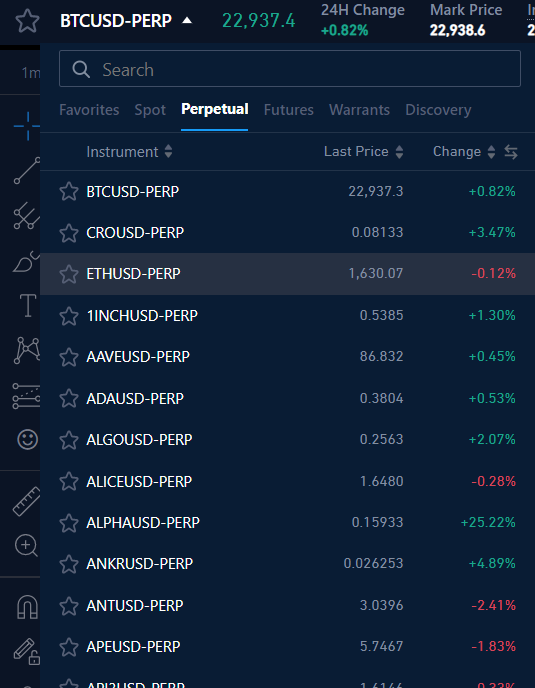

The next step would be to select a trading pair. For this, you need to click on BTCUSDT-PERP, and a Window will open up.

Make sure to select the perpetual tab, and you will find all the available trading pairs, such as ETHUSDT-PERP, AAVEUSDT-PERP, and many others.

Select a trading pair you are willing to trade, and its chart will open up.

- Place Your Order

Once you have verified and selected the right trading pair, the next step is to place your first perpetual contracts shorting order.

Now, if you look at the order form, you will find two separate windows for Buy and Sell orders. Since we are shorting, we need to enter values under the Sell order form.

Also, if you look at the top of the order form, you will find market order types. So select the ideal order type as per your trade.

Below that, you will find the Sell/Short button. However, if you look right below it, you will find an option that says Adjust leverage. Using this, you can adjust the leverage for your Trade.

Once you have entered all your order details and selected the right leverage, go ahead and click on Sell/Short button to place your order.

After the order is placed, if you look right below the technical chart, you will find all the open order details. From here, you can click, modify or close the order.

Short via Warrants Trading

The last trading instrument that crypto.com offers is warrant trading. Warrant contracts are derivatives products that enable users to purchase the right to Buy or sell an underlying asset, such as Bitcoin, at a pre-agreed or strike price.

To short a Warrants contract, you can follow the below steps:

- A Little Info

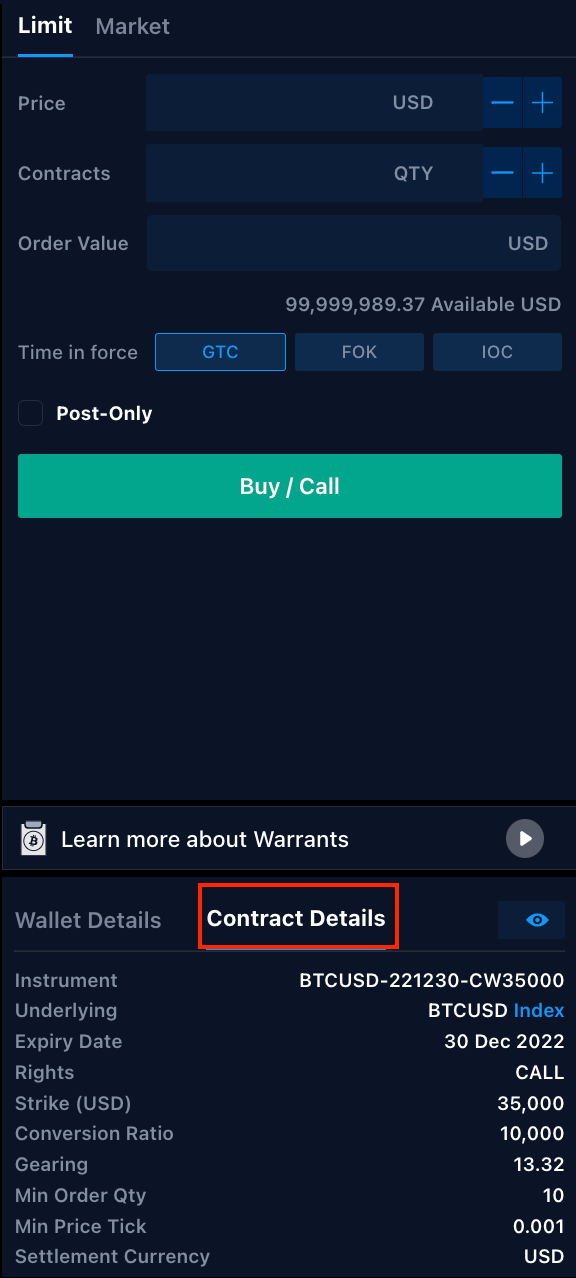

Each warrant listed on Crypto.com has specific contract details.

You can find the contact details on the trading page of the warrant instrument in question. The info is located under the contract details box below the order form.

Also, if you have ever traded Options, you must be familiar with the concept of Put, Call, and strike price. The same is applicable to warrant contracts.

Anyway, to launch Warrants trading, go to Trade > Warrants from the navigation bar.

- Select A Trading Pair

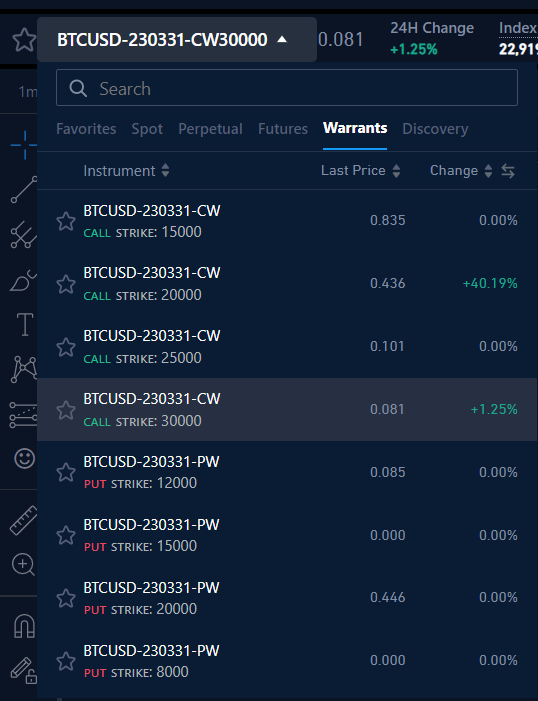

To get started with Warrants trading, you first need to select a trading pair. The trading pair refers to the Warrants contracts.

On Crypto.com, you will find a bunch of warrant contracts labelled as Call and Put. Now since we are focusing on shorting the market, you need to select Put.

Put in trading means you are buying the rights to sell an asset at a predetermined price.

- Place Your Order

On Crypto.com, you will only find limit orders and market orders for warrants trading. And you can create a position based on these two market types.

To place a Warrant order, you need to select the Limit or market tab and enter your input price, which you want to trade for the limit order.

The minimum price or tick size for a warrant order is 0.001 to 10 USD. It depends on the specification of each warrant.

Next, you have to enter the quantity of the warrant you want to trade with. The minimum order quantity is 10 BTCUSD Warrant contracts.

Also, in Warrants trading, there is no such concept of selling a contract at first and then buying it. Instead, you will always have to buy a contract.

You can obviously sell a contract to close the trade or limit your risks.

Once you have entered your order details, click on Buy / Put to place your order. And you can view it under the open position window located right below the technical chart of the contract.

Conclusion

Overall, Crypto.com is one of the best cryptocurrency exchanges out there.

It lets you trade in different markets and has a competitive trading fee.

The trading process pretty much remains the same across spot, margin or futures trading markets. However, it is the fundamentals that separate one market from the other one.

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023