While the terms “long” and “short” may be basic to an experienced trader, the same is not the case for anyone just getting into crypto trading. Unless you have experience with the terms from other markets, such as stock trading, chances are they will be pretty confusing at first.

That said, both are pretty easy terms to understand once you acquaint yourself with how crypto trading works and how to open a position for a new trade.

Going long or short is all about choosing whether to buy an asset and hope to sell it when the price increases or waiting for the price to fall before buying it.

This guide explains the two terms and how to go long or short on a crypto exchange when trading to clarify things for beginners and some experienced traders that still find them confusing.

What is Long & Short in Crypto Trading?

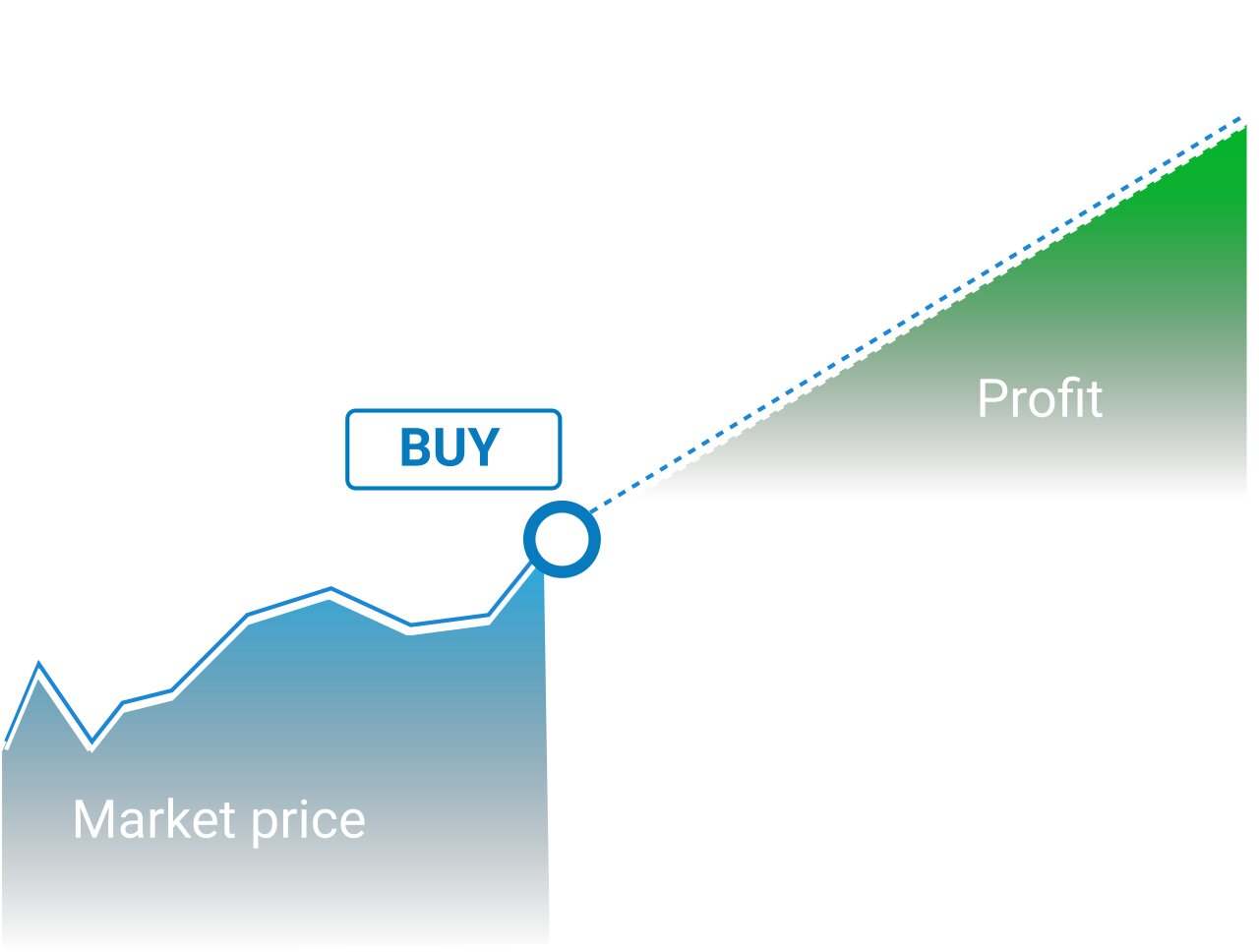

Long and short indicate the two possible directions that a crypto’s price needs to move for the trader to make a profit. Going long means the trader will buy and hold a crypto asset and hope the price goes up to sell it for a profit.

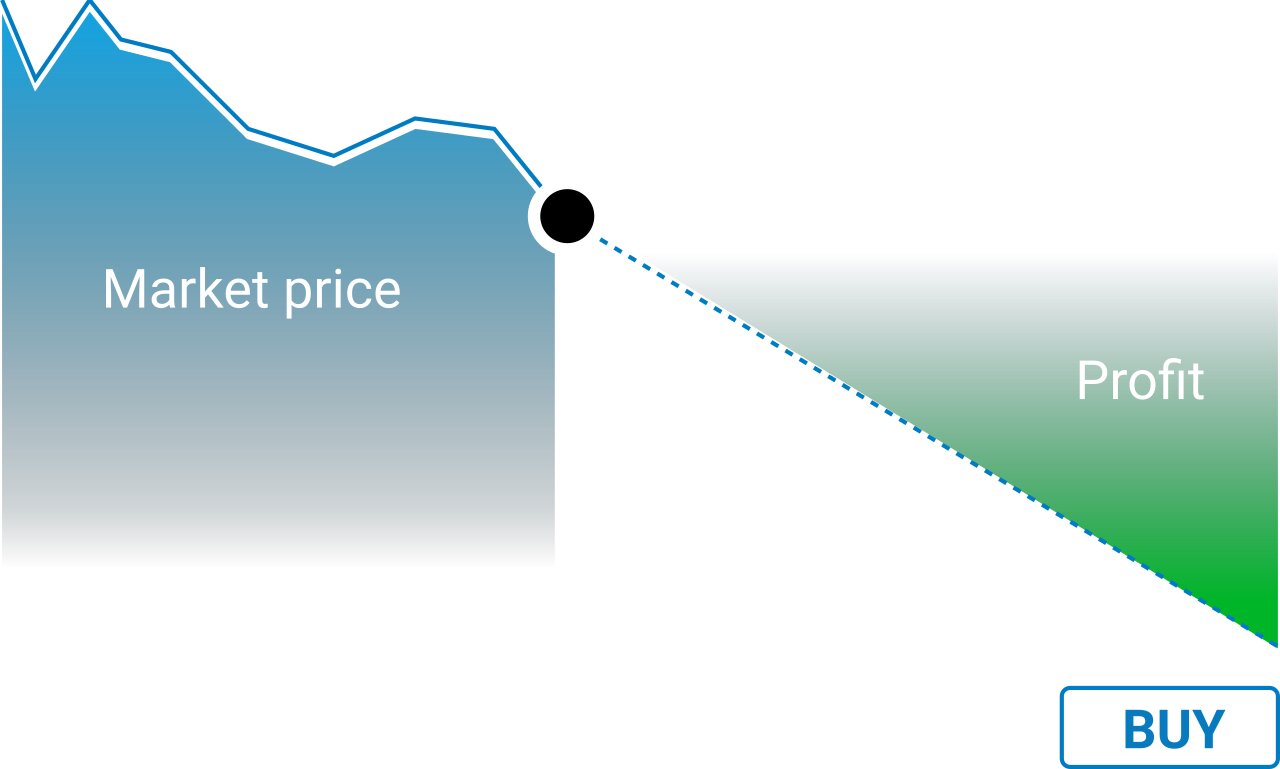

Traders that open a short position hope that the asset’s price will drop so they can buy it at a lower price. The crypto traders can also profit from the price drop when trading crypto futures that allow them to go short.

However, the most crucial thing when short or long trading is to read the market correctly. If you understand the market and know how to observe trends beyond your trading interface, you can profit on crypto regardless of the price movement direction.

Going Long

Going long is the most popular way of making money using digital assets, as most traders are always hoping for the price to go up. Traders who are often more inclined to go long most of the time are referred to as bulls.

Bullish tendencies are also common because most digital assets continually expand despite the occasional dips in price. For example, the price of bitcoin hit an all-time high price of $67,549.14 in November 2021, despite being one of the most volatile cryptocurrencies.

Most other popular crypto assets like ETH futures have also hit new price records in recent years. These unprecedented price increases are constantly fueling bullish tendencies and encouraging more traders to go long on their trades more often.

Going Short

When traders expect the price of an asset to fall, they will go short. Going long in such a situation means you may end up having to dispose of the asset for a lower price than your initial investment and hence incurring a loss.

Short positions are less common, but in some instances, such as when the market is bearish, they can exceed the long positions. For example, if the price of BTC futures keeps falling for several days or weeks with no sign of it going up, many traders will opt to open short positions.

Long & Short Positions in Derivatives Trading

You do not need to own or sell an actual digital asset to go long or short. Traders can open long and short positions for derivatives on exchanges such as Binance or Bybit that support CFDs (contracts for difference), options & futures contracts.

With derivatives, you can open a long or short position without ever owning the underlying asset. For example, you can go long (commit to buying) or go short (commit to selling) on an asset at a predetermined price and size when trading in futures.

For CFDs, traders make money from the price difference. And so provided you read the market well, you can make a profit from a price rise or fall.

New to futures trading? Learn about Quarterly Futures vs Crypto Perpetuals

How to Long and Short Crypto?

Going long or short is relatively straightforward, especially if dealing with real digital assets and not derivatives contracts. Since, you cannot short in the spot market.

Here you only need to buy the asset and wait to sell it when the price increases or wait to buy it for a lower price. However, there is a little more to it than this.

New to crypto trading? Learn about Crypto Spot Trading vs Crypto Futures

How to Long Crypto?

An excellent way to understand how to go long is with an example. Suppose the current price of ETH s $3,000, and you believe the price will rise and hence opt to go long. To open a long position, you have to buy the ETH at the current price and hold them until the price rises.

If you are correct and the market goes your way, and the price of ETH gets to $3,050, you will make a profit. If you bought 10 ETH coins, you can calculate your profit easily by multiplying the difference between the opening and closing price with the number of coins you bought.

- $3,050 – $3,000 = $50

- $50 x 10 = $500

Hence, from the example above, you will make a profit of $500 if you go long.

It is also important to note that you will only need to cover the margin in most exchanges and hence do not need the entire $30,000 to open your long position. If the margin is 1%, $300 is all you need to buy the 10 ETH coins instead of $30,000.

How to Short Crypto?

Going short means you are hoping for the crypto asset price to go down. From our example above, if you think the price of ETH will drop from $3,000, you should go short.

Like opening a long position, you will also need to deposit to open a short position. However, some traders will go short by selling their assets and waiting for the price to fall before buying them at a lower cost. Hence they make a profit by spending less to acquire the same crypto-asset size.

From our example above, if you want to buy 10 ETH at the current $3,000, you will need $30,000, but with a 1% margin, your actual investment will be $300. If the price of ETH drops to $2,995, you will make a profit by buying back your 10 ETH at the current price.

Like with long positions, you can calculate your profit by deducting the closing price from the opening price and then multiplying this by the number of coins.

- $3,000 – $2,995 = $5

- $5 x 10 = $50

Your profit here is $50, and you will still have 10 ETH coins in your wallet that you can use for future long or short trades.

Conclusion

Profitable crypto trading requires a good understanding of the market. If you know how to read the market, you can make gains on your digital assets whether the price of the asset increases or falls.

When you read the market and think that the price of an asset will rise due to an upcoming event that will affect the industry, you should go long. Here you should buy the asset and wait to sell when the price increases.

However, if you think an upcoming negative announcement or something else will lead to a fall in the asset price, you should open a short position. Going short means you will sell and wait to buy back the asset at a lower price when the price drops, making a profit.