Anyone who wants to make significant profits in the crypto market prefers trading in the futures market.

This is because the futures market allows traders to trade with high volume and allows a trader to buy and sell an asset to make profits.

There are also different types of crypto future trading types available.

But among them, perpetual contracts are one of the most popular ones.

This is because almost all the major crypto exchanges allow you to trade in perpetual futures markets, and it’s easier to get started with.

So the question is, what are cryptocurrency perpetual futures contracts?

Well, this is what we will be talking about in this article:

What Are Crypto Perpetual Contracts?

Before we talk about perpetual futures, you need to understand what futures contracts are.

A future contract is basically a contract between two parties that bonds them to buy or sell an underlying asset at a predetermined price and date.

These traditional futures contracts do come with an expiry date.

Meaning after the expiration date, the contract will no longer be valid, and the buyer or seller has to settle down the contract.

A Perpetual futures contract is a special derivatives trading product that does not come with an expiry date.

Just like a futures contract, Perpetual futures derive their value from an underlying asset.

Hence, perpetual futures contract works the same way as traditional futures contracts, as you have to bet on the future price movements of a specific contract to make a profit.

But since there is no existence of expiry date, it gives you a flexible way to trade cryptocurrencies as you don’t have to hold or own any crypto assets or worry about physical delivery.

Instead, you simply trade a contract that you can be held indefinitely.

However, as there is no existence of expiration date, there is a huge risk that the perpetual contract price will be different from the underlying asset.

To prevent this from happening, crypto futures exchanges have a funding rate mechanism in place.

The funding rate occurs every 8 hours in most exchanges, and it is a periodic payment made to the long and short-position holders.

Additionally, perpetual futures contract involves highly leveraged position. As a result, traders can open large-volume trades without investing a huge amount of funds.

Also, when you are trading perpetual contracts, you must be aware of a few extra terms. Such as:

- Initial Margin

The initial margin represents the minimum amount you must pay to open a leveraged position.

For instance, if Ethereum’s current market price is $1000, then you will need 10 USDT at 100x leverage to buy an ETH futures contract.

So your initial margin would be 100x of the total order. The initial margin would vary depending on how much leverage you have selected for your trade.

- Maintenance Margin

The maintenance margin represents the minimum of collateral you must have in your trading account to keep your positions open.

If your margin drops below the maintenance margin level, you will be required to add more funds to your account. Or your trading position will get closed, and your account will get liquidated.

In other words, to keep your position open, you need to have extra funds in your account.

These funds will be used when the trade goes against your assumption to cover up the losses. When the extra funds cannot keep the losses covered up, your trade will get closed.

- Liquidation

When the value of your collateral or extra funds falls below the maintenance margin, your future account will get liquidated.

So the higher leverage and funds you use, your trades will require a higher required margin.

However, to avoid liquidation, you can either close your position or add more funds before the trade value reaches the liquidation price.

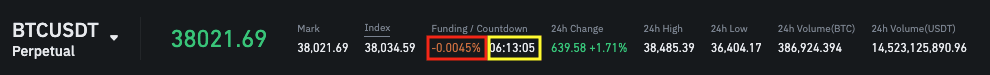

- Mark Price

The mark price refers to an estimation of the true value of a contract when compared to its actual trading price.

The mark price calculation helps in preventing unwanted liquidation that might occur when the market is highly volatile.

So while the index price is related to the price of spot markets, the mark price represents the true value of a perpetual futures contract.

In other words, you can say that the mark market is the computed value of the unrealized PnL (Profit and Losses) and liquidation.

- Funding Rate

The funding rate is one of the key metrics when trading perpetual futures. The funding rate is periodic payments between buyers and sellers.

When the funding rate is above zero (positive), traders with a long position will pay the short position holders. In comparison, when the funding rate is negative, the short position holders will pay to the longs.

Also, the funding rate consists of two things – the interest rate and the premium.

The interest rate may change from one exchange to another. In contrast, the premium varies according to the price between futures and spot markets.

How Do Crypto Perpetual Contracts Work With Examples?

Unlike the traditional futures market, you don’t buy and sell a digital asset.

But when you are trading Perpetual futures, you are actually buying and selling a contract.

Just like the futures market, as a trader, you have to bet whether the price of an asset will go up or down, and based on your speculation, you need to place a long or short order.

Now perpetual contracts do not have an expiry date, and you can keep your trading positions open for as long as you wish. But it will occur funding rates.

New to trading futures? Know How long can you hold Crypto Futures Contracts?

Also, Perpetual futures are always cash-settled, unlike regular futures markets, which require you to deliver the assets at the end of the settlement period.

In perpetual, you also have the option to use leverage which allows you to open high trading volume positions with a low initial margin.

To help you understand better, here is an example:

A trader named John purchased one BTC/USDT perpetual contract on 1st December 2022 at the market price of $16,000 on Binance. However, to fulfil this purchase, John didn’t add $16,000 to his trading account.

Instead, he used the advantage of leveraged position.

Since Binance offers 125x leverage for BTC perpetual. J

ohn only required a total cash investment of $128 (125 x 128= $16000, which is the contract price). Plus, he is required to keep additional funds in his account to avoid liquidation.

Now, on 1st January 2023, BTC/USDT perpetual price reached $20,000, and John decided to sell his contract.

However, we know that perpetual futures contract trading invites a funding fee, which is paid every 8 hours.

Meaning John made a profit of $4000 minus his funding fee for holding period of 30 days with his BTC/USDT trade when he closed his position

And let’s say the funding fee is 0.01% for 8 hours, so for 24 hours, it would be 0.03%, and for 30 days of the holding period, it would be (0.03%*30= 0.9%)

So 0.9% of the funding fee John would pay to the exchange or the seller of the contract over the amount he borrowed from them, which is $15,872 in this case, i.e. ($16000-$128) because originally, if you remember, John only had $128 over which he took leverage of 125x.

So over this borrowed amount of $15,872, John would be 0.9% of this amount as a funding fee, which would be $142.84 for holding the position for 30 days.

Now his actual profit would be $4000-$142.84 = $3857.16, which is pretty good for just having $128 of your own.

But remember, this could go just the other way around also, and you could incur a total loss of your funds in case the market moves against what you have bet.

Why Trade Crypto Using Perpetual Contracts?

- Margin

Unlike spot trading, trading in perpetual cryptocurrency markets requires low funds investment.

As a trader has the ability to trade on margin than having to have enough funds for large trading positions.

In spot markets, you can trade the maximum amount you have in your trading account.

But futures trading allows you to only invest a slight part of their initial margin balance per trade and make a significant profit out of it.

Trading perpetual futures contracts are much more capital efficient. Thanks to the high leverage offered by cryptocurrency exchanges.

- No Need To Own Any Asset

In perpetual trading, there is no need to own any asset for trading. In the spot market, you basically buy an asset and completely own it. But in futures trading, you are trading a contract that is based on an underlying asset such as Bitcoin.

You speculate on the contract’s price movements, and your trade will get settled in a stablecoin like the USDT, USDC, or BUSD.

- Take Trade In Both Directions

Another reason to choose the perpetual market over the spot market is the ability to trade in any direction. In the spot market, you are required to buy an asset and sell it at a higher price to book profits.

However, in perpetual futures contracts, you can either buy (go long) or sell (go short) an underlying asset’s contract. And depending on how the market moves, you will book your profit.

- Risk Management

Managing risk becomes much easier when you trade in the futures market. As you can hedge your positions, perform dollar cost averaging or DCA to minimize your losses.

Pros & Cons Of Crypto Perpetual Futures Contracts?

Pros

- No Expiration

Perpetual futures do not come with an expiration date. This allows traders to hold a contract for an extended period of time and only exit when they are satisfied with their profits and losses.

Unlike regular futures contracts, a trader does not have to worry about any settlement date. Nor do they have to worry about buying a contract on a specific date and holding it for a specific period of time.

- Hedging Possibilities

Hedging is one of the top risk management strategies, which is only possible in perpetual markets. Using hedging, a trader can take positions against their existing trades to minimize their risks and protect their portfolios from market volatility.

- Profit Potential

In perpetual swaps, a trader can trade in any direction of the market. This allows traders to make a profit out of the small market movements that happen almost every day.

Even when the market sentiment is positive or negative, traders have the option to take trades based on small market moves and book significant profits.

Cons

- Funding Rate

Although, Perpetual futures do not expire. But they have a funding rate mechanism in place, which occurs every 8 hours on a majority of exchanges.

As a result, if you hold your trading position for an extended period of time, you need to keep paying the funding rate, which can be a little costly.

Also, it will impact your liquidation price, so you are required to keep on adding funds to your account to keep your trading positions open.

- High Leverage

Perpetual futures have the involvement of high leverage. When you trade with maximum leverage, it will increase your buying power. As a result, you can open large-volume trades.

While this is great when the trade goes in your favour, but it can be extremely deadly if the market doesn’t perform as you assumed it.

If you use high leverage, the liquidation price for your trade will be closer to your entry price. As a result, there is a good chance that your account will get liquidated soon enough.

Plus, there is a risk that you will lose more than what you initially invested in opening the trade.

FAQs?

- Can you hold perpetual futures forever?

Since perpetual futures do not have a settlement date, you are allowed to hold a trade for as long as you wish to.

However, to hold it for an extended period of time, you are required to have enough margin balance in your trading account.

Plus, when you hold a perpetual contract for an extended period of time, it occurs funding fees you need to pay every 8 hours during your contract holding.

- What’s The Main Difference Between Crypto Perpetuals & Crypto Futures?

Both a crypto futures contract and a perpetual crypto contract are the same things in theory. However, what differentiates crypto perpetual from crypto futures is that it doesn’t have an expiration date.

Even though these derivatives don’t have an expiry date, Crypto futures exchanges use a funding rate mechanism to avoid major price fluctuations in the underlying assets.

In funding rate, shorts and long positions holders pay each other regularly depending on the market sentiment.

Conclusion

So that was all for a crypto perpetual futures contract. Perpetual contracts are pretty much the same thing as regular futures.

However, regular futures are traded on centralized exchanges like the CME. These exchanges do have an expiry date and require huge capital investment to get into.

In contrast, perpetual contracts are much easier to get into for newbies and require less capital, and you can trade perpetual across major crypto exchanges like ByBit or Phemex.