The ability to trade with a larger position than you have in your account can be exciting, and the potential for big profits is tempting.

But how exactly do you calculate leverage in crypto trading?

And how does that translate to potential profit?

I found myself asking these questions.

In this article, I will break down the steps to calculate leverage and understand how it can impact your profit, using Bitcoin as an example.

How to Calculate Leverage in Crypto Trading?

I will walk you through the process with step-by-step examples for long and short Bitcoin positions.

So, let’s dive right in.

1. Understanding the Formula:

First, you need to understand the formula for calculating leverage.

It’s quite simple. Leverage is the ratio of the size of your position to the amount of capital you’ve invested.

Here’s the formula:

Leverage = Position Size / Capital Invested

2. Calculating Leverage in a Long Position:

Let’s say you’re going long on Bitcoin and want to control a position worth $10,000.

You’ve deposited $2,000 into your trading account.

Using the formula, your leverage would be calculated as follows:

Leverage = Position Size / Capital Invested

=> Leverage = $10,000 / $2,000

=> Leverage = 5x

In this example, you’re trading with 5x leverage.

For every $1 the price of Bitcoin moves, your position will move by $5.

And here’s the exciting part: if the price of Bitcoin goes up by 10%, your profit would be $1,000 ($10,000 * 0.10) instead of just $200 ($2,000 * 0.10).

3. Calculating Leverage in a Short Position:

Let’s assume you’re going short on Bitcoin and want to control a position worth $15,000.

You’ve deposited $3,000 into your trading account.

Let’s calculate your leverage:

Leverage = Position Size / Capital Invested

=> Leverage = $15,000 / $3,000

=> Leverage = 5x

In this case, you’re also trading with 5x leverage.

However, since you’re going short, you’re betting on the price of Bitcoin to go down.

If Bitcoin’s price falls by 10%, your profit would be $1,500 ($15,000 * 0.10) instead of just $300 ($3,000 * 0.10).

But hold on a second! If the market moves against you, the loss in your position will be magnified like your profit.

Now that you know how to calculate leverage, let’s move on to how it affects profit in crypto trading.

Stay with me as I break down this crucial aspect of leverage trading.

How To Calculate Profit In Crypto Leverage Trading?

Calculating profit in crypto leverage trading may seem daunting initially, but it’s not as complicated as it might seem.

Armed with a little knowledge and some math, you can easily figure it out yourself.

So, let’s dive right into it!

1. Understanding the Formula:

The basic formula to calculate your profit in leverage trading is:

Profit = (Closing price – Opening price) * Position size

In leverage trading, the position size is much larger than your initial margin, thanks to the borrowed funds.

2. Example with a Long Position:

Suppose you open a long position with Bitcoin at $40,000 with a margin of $1,000 and 10x leverage.

Your position size would be $10,000.

Now, let’s say the price of Bitcoin rises to $42,000, and you decide to close your position.

Your profit would be: ($42,000 – $40,000) * ($10,000/$40,000) = $500

That’s right!

A $2,000 increase in Bitcoin’s price resulted in a $500 profit on your $1,000 margin.

That’s the power of leverage!

3. Example with a Short Position:

Let’s consider the opposite scenario.

You open a short position with Bitcoin at $40,000 with a margin of $1,000 and 10x leverage.

Your position size is still $10,000.

This time, the price of Bitcoin drops to $38,000, and you close your position.

Your profit would be: ($40,000 – $38,000) * ($10,000/$40,000) = $500

Once again, you made a $500 profit on your $1,000 margin, even though Bitcoin’s price dropped!

4. Taking Fees into Account:

It’s important to remember that crypto derivatives exchanges charge fees for leverage trading.

These fees can include funding rates, interest, and transaction fees.

You’ll need to subtract these fees from your profit to get the net profit.

Now you know how to calculate profit in crypto leverage trading!

Leverage can be powerful, but it should be used wisely.

Remember these principles, and you’ll be on your way to becoming a successful crypto trader.

Recommended Read: Is crypto leverage trading safe, legal & taxable?

Importance of Margin in Leverage Calculation

As you continue your journey into crypto leverage trading, there’s an essential concept you can’t afford to overlook: Margin.

But what exactly is margin, and why does it play such a critical role in leverage calculations?

Allow me to explain.

1. Margin Defined:

At its core, the margin represents the initial deposit you need to open a leverage position.

It acts as collateral for the funds that you borrowed which then allows you to control a more substantial position than your capital would permit otherwise.

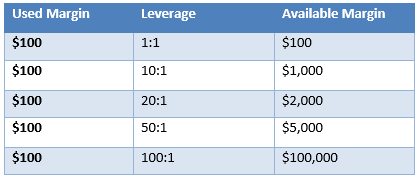

2. The Relationship Between Margin and Leverage:

Margin and leverage are closely linked, with leverage being the ratio of your position size to your margin. You have a $1,000 margin and want to open a position with 10x leverage. Your position size would be $10,000 ($1,000 * 10).

3. Margin Requirements:

But wait! The story of margin doesn’t end there. Your margin requirement is a crucial factor to consider when calculating leverage. It’s the minimum amount you must deposit to maintain an open position. This amount is usually expressed as a percentage of the position size and varies between exchanges and assets.

4. Margin Calls and Liquidation:

Understanding the role of margin is crucial because if your margin falls below the margin requirement due to losses, you may receive a margin call or face liquidation. These are measures exchanges take to minimize the risk associated with leverage trading. Trust me. You don’t want to be in either of these situations.

Tools and Software for Leverage and Profit Calculation

When calculating leverage and profit in crypto trading, having the right tools and software can make all the difference.

Fortunately, plenty of options are available to help you make more informed decisions.

Let’s dive in!

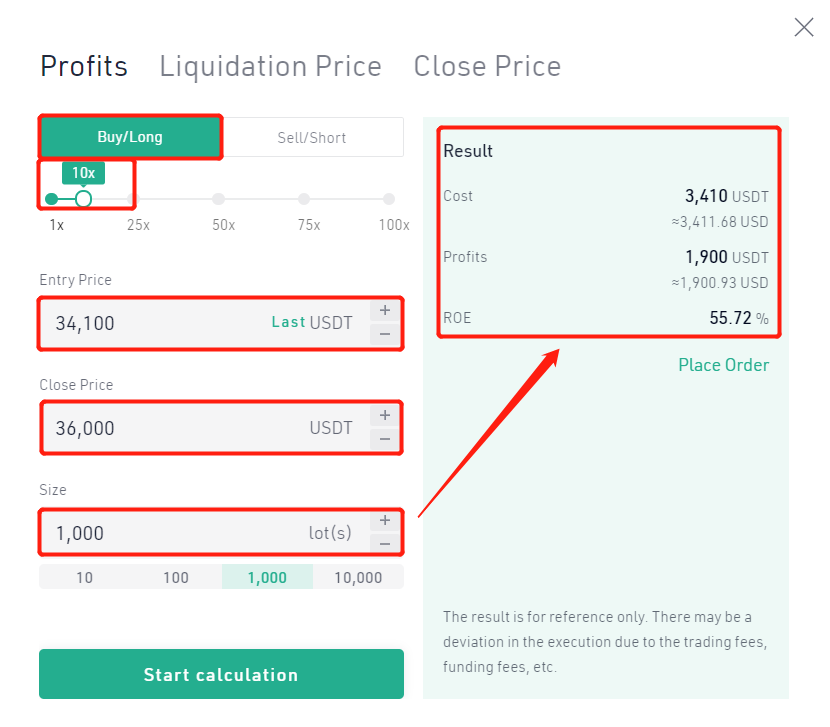

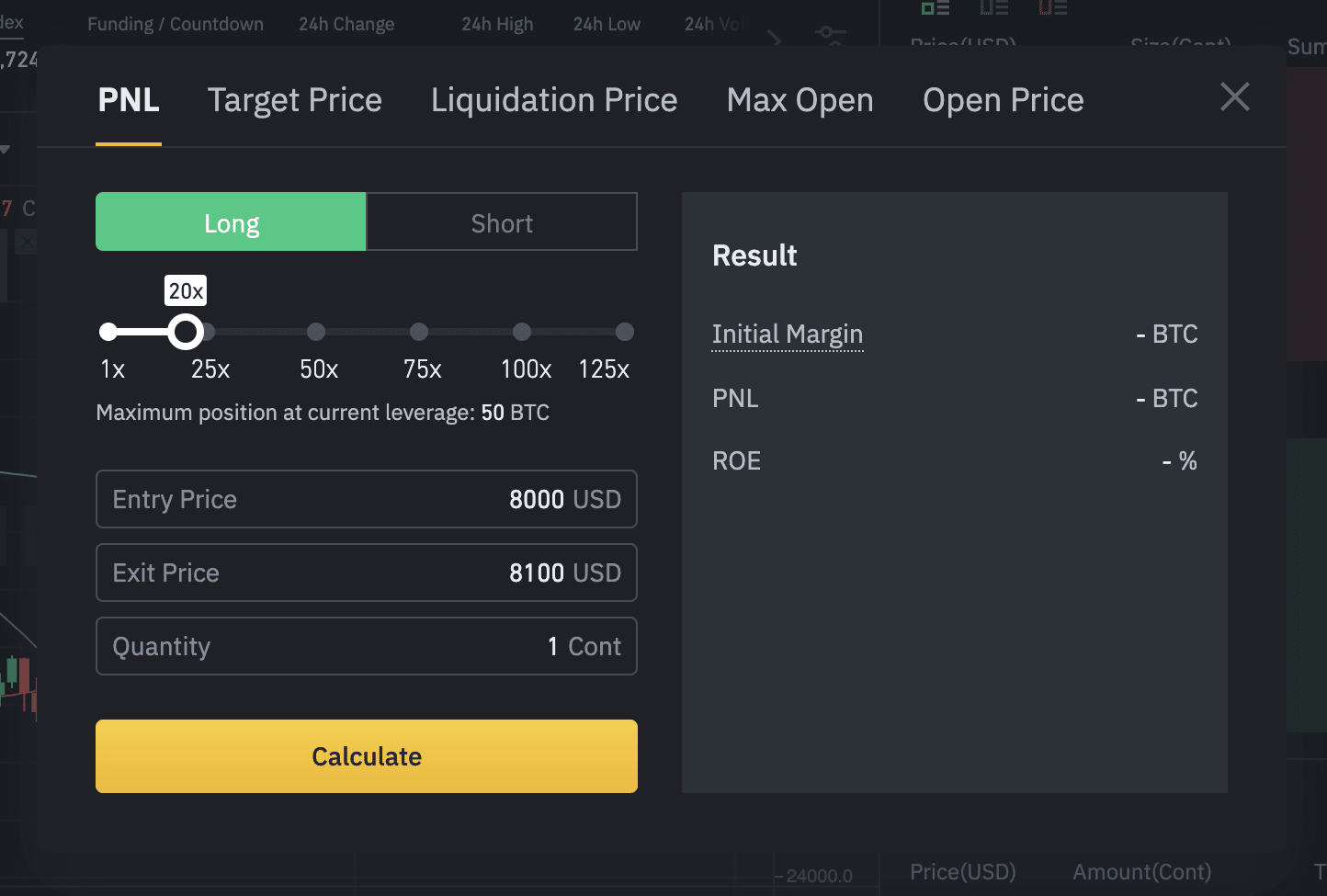

Online Calculators:

There are countless online calculators designed specifically for crypto leverage trading.

These tools allow you to select your desired leverage ratio, margin, and other variables and instantly see your potential profit or loss based on different market scenarios.

It’s a convenient way to assess different trading strategies and understand your risk exposure quickly.

But that’s not all!

Trading Platforms:

Most reputable crypto futures exchanges and trading platforms have built-in tools to help you calculate leverage and profit.

When you set up a leveraged trade, these platforms usually provide an overview of your margin requirements, potential profit, and possible losses.

This gives you an immediate snapshot of the trade’s potential outcomes before you execute it.

You might think, “What if I want to plan my trades?”

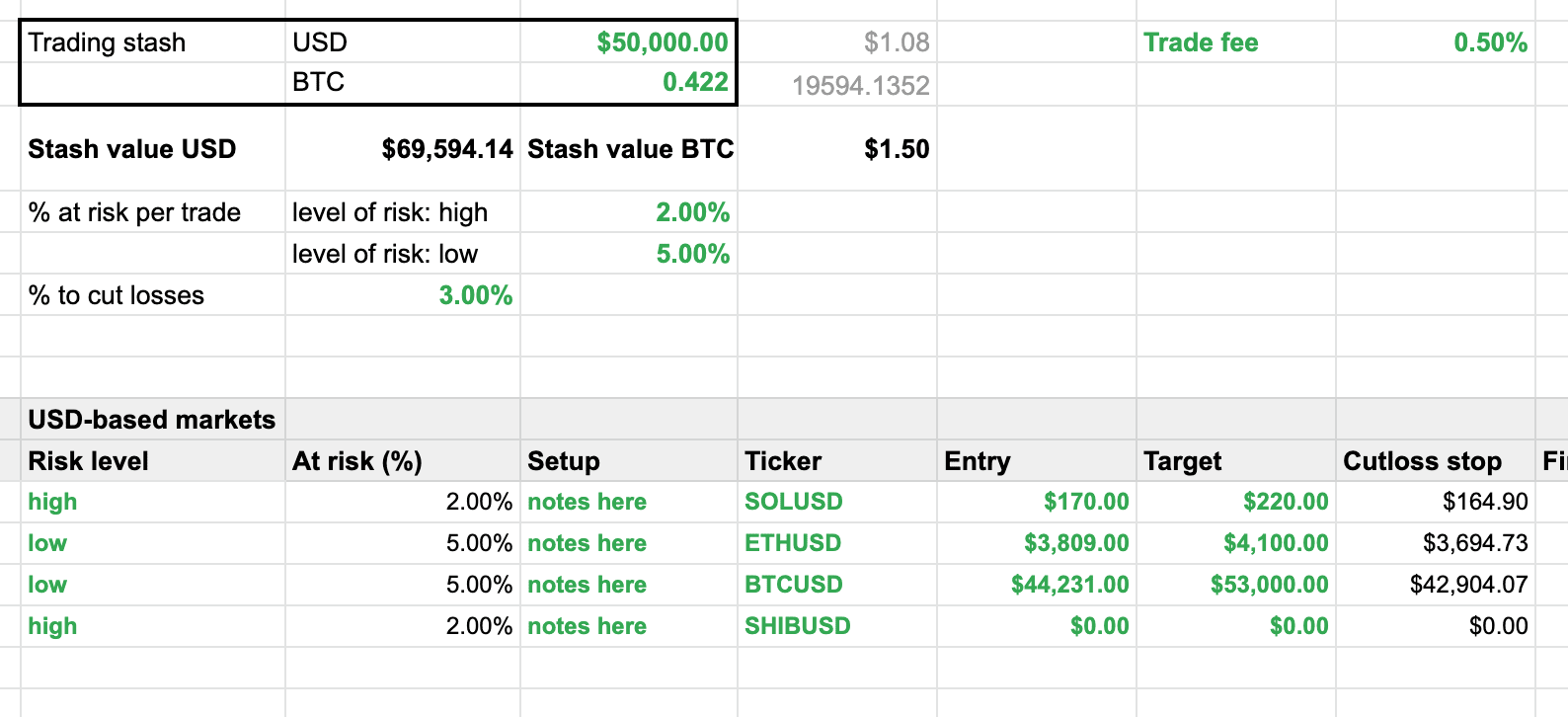

Spreadsheet Software:

For those who prefer a more hands-on approach, spreadsheet software like Microsoft Excel or Google Sheets can be invaluable.

You can create custom calculations, models, and scenarios to assess leverage ratios, margins, and potential profits or losses.

This allows you to plan and analyze your trades in advance, making more informed decisions.

But wait, there’s more!

While these tools and software can be incredibly helpful, it’s important to remember that leverage trading involves high risks.

Use them as a guide, but always research, understand the risks, and make decisions accordingly.

Recommended Read: What is the best leverage for Bitcoin trading?

Common Mistakes When Calculating Leverage and Profit

When it comes to calculating leverage and profit in crypto trading, there are a few common mistakes that can trip you up.

Avoiding these pitfalls will help you make more accurate calculations and informed trading decisions.

Let’s take a look at some of these common mistakes:

1. Overlooking the Role of Margin: Some traders underestimate the importance of margin in leverage trading. Remember, your margin is the collateral you provide to open a leveraged position. If you miscalculate your margin requirement, you risk getting a margin call or liquidating your position.

2. Ignoring Fees and Costs: Trading fees, funding rates, and other costs can significantly impact your profitability. When calculating potential profits, accounting for all associated costs is essential. Overlooking these can lead to an inaccurate assessment of your potential returns.

3. Misjudging Market Conditions: Leverage magnifies potential profits and losses. In highly volatile markets, the risks are even greater. It’s important to consider market conditions when deciding on your leverage level. High volatility can quickly turn against you, resulting in substantial losses.

4. Relying Solely on Tools and Software: While tools and software can help calculate leverage and profit, they’re not infallible. It’s essential to understand the underlying calculations and verify the results independently. Don’t rely solely on automated tools without understanding the math behind them.

5. Overleveraging: Some traders get carried away and use excessive leverage, hoping for big profits. However, high leverage also means higher risk. Using leverage responsibly and in line with your risk tolerance and trading strategy is crucial.

6. Failing to Consider the Impact of Liquidation: If the market moves against your position and your account balance becomes lesser than the required maintenance margin, your position may be liquidated. Failing to consider the potential impact of liquidation on your trading capital is a common mistake. So you better learn how to calculate crypto futures liquidation price.

Understanding the concepts, making accurate calculations, and considering all factors that can impact your trading outcomes is essential.

By avoiding these common mistakes, you can make informed decisions and reduce the risks of leverage trading.

Conclusion

In conclusion, understanding and accurately calculating leverage in crypto trading is crucial for informed decision-making and risk management.

From basic concepts like leverage and margin to more advanced calculations of potential profits and losses, you must equip yourself with the right knowledge and tools.

Whether you use online calculators, trading platforms, spreadsheet software, or automated trading bots, ensure you have a solid grasp of leverage.

You should also understand how to calculate it, especially in the volatile world of crypto trading.

Trade smart, and stay informed!