Trading crypto futures is one of the best ways to make money in the crypto market. It allows you to take advantage of the market’s price fluctuations that happen all the time.

There are many cryptocurrency exchanges out there that let you trade crypto futures. However, in this article, we will be looking at how to trade futures on OKX.

OKX is one of the popular cryptocurrency exchanges out there that allows you to trade in different markets such as Spot, Margin, Futures, Perpetual Swaps, and more. However, the steps for trading in any of these markets remain the same.

How To Trade Futures on OKX?

Trading futures on Okx is a pretty straightforward process. You first need to create an account, deposit funds, find a suitable pair, and set your preferred leverage, and you are good to go.

To help you out, here is a step-by-step guide:

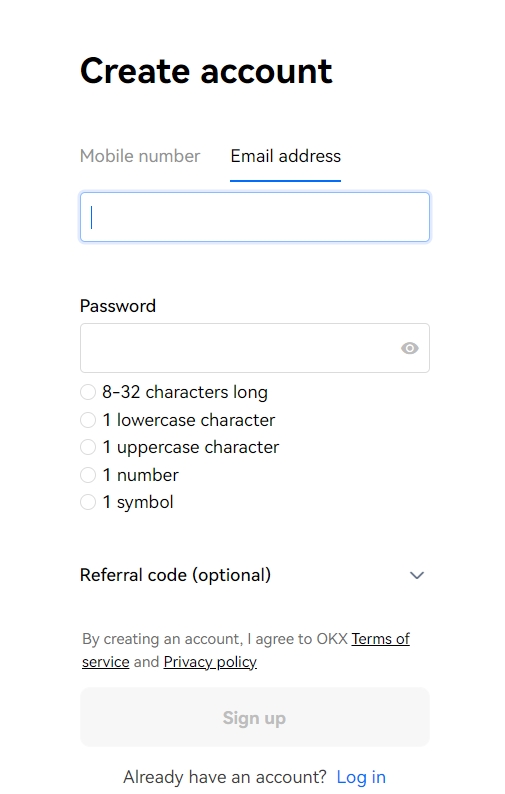

1. Create OKX Account

First, you have to create an OKX account if you don’t have one already.

Go to OKX.com and click on the Signup button and fill in your information and follow the onscreen steps to create your account. You will also be required to complete KYC, so do complete that.

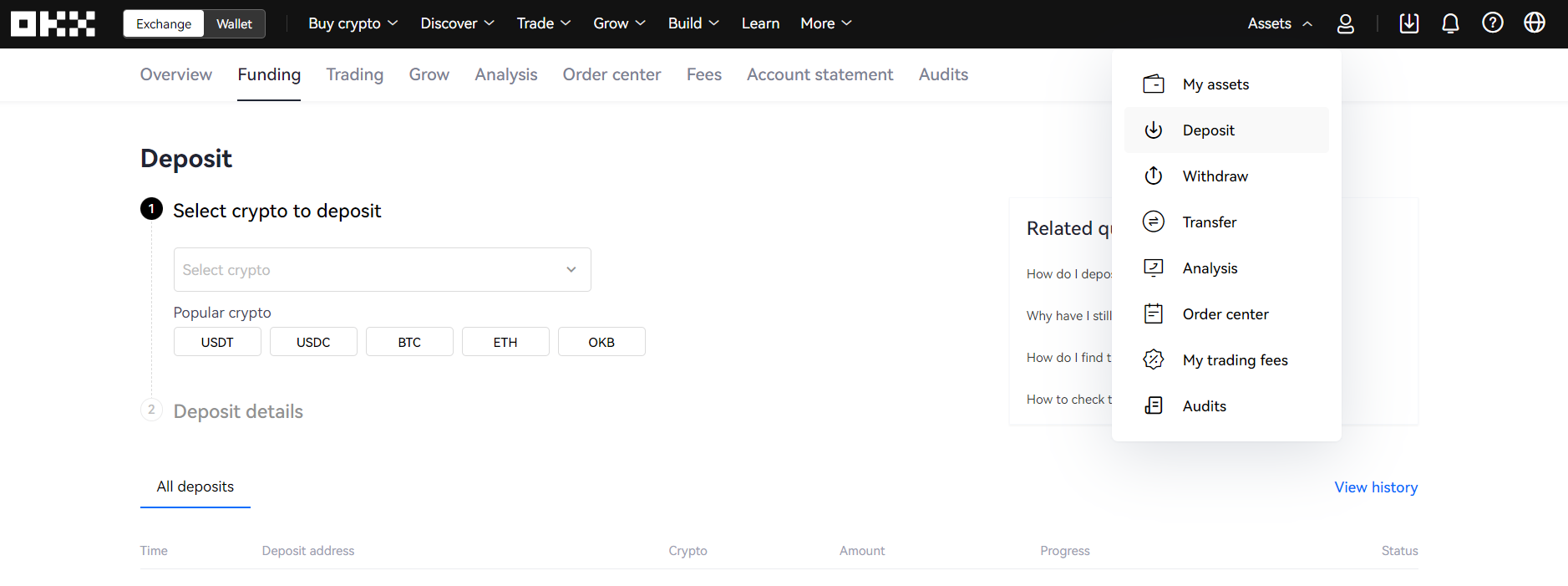

2. Deposit Funds

Once your account is created, you will need to deposit funds into your account. So from your OKX dashboard, go to Assets > Deposit to add funds to your account. Alternatively, you can go to Buy Crypto > P2P to deposit funds through the peer-to-peer protocol.

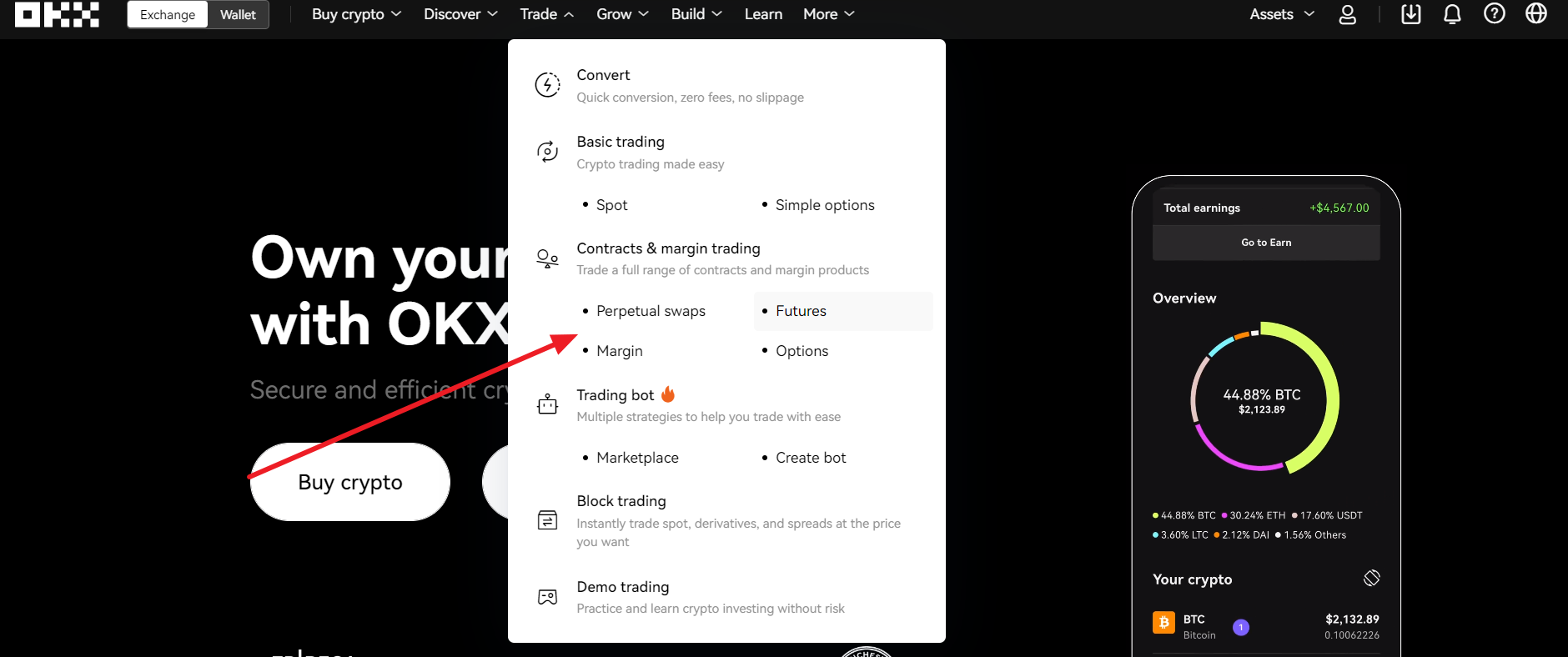

3. Open the Futures Trading Terminal

Next, launch the Futures trading Window by going to Trade> Futures. If you are opening the terminal for the first time, it will ask you about your trading experience, so answer it, and you are good to go.

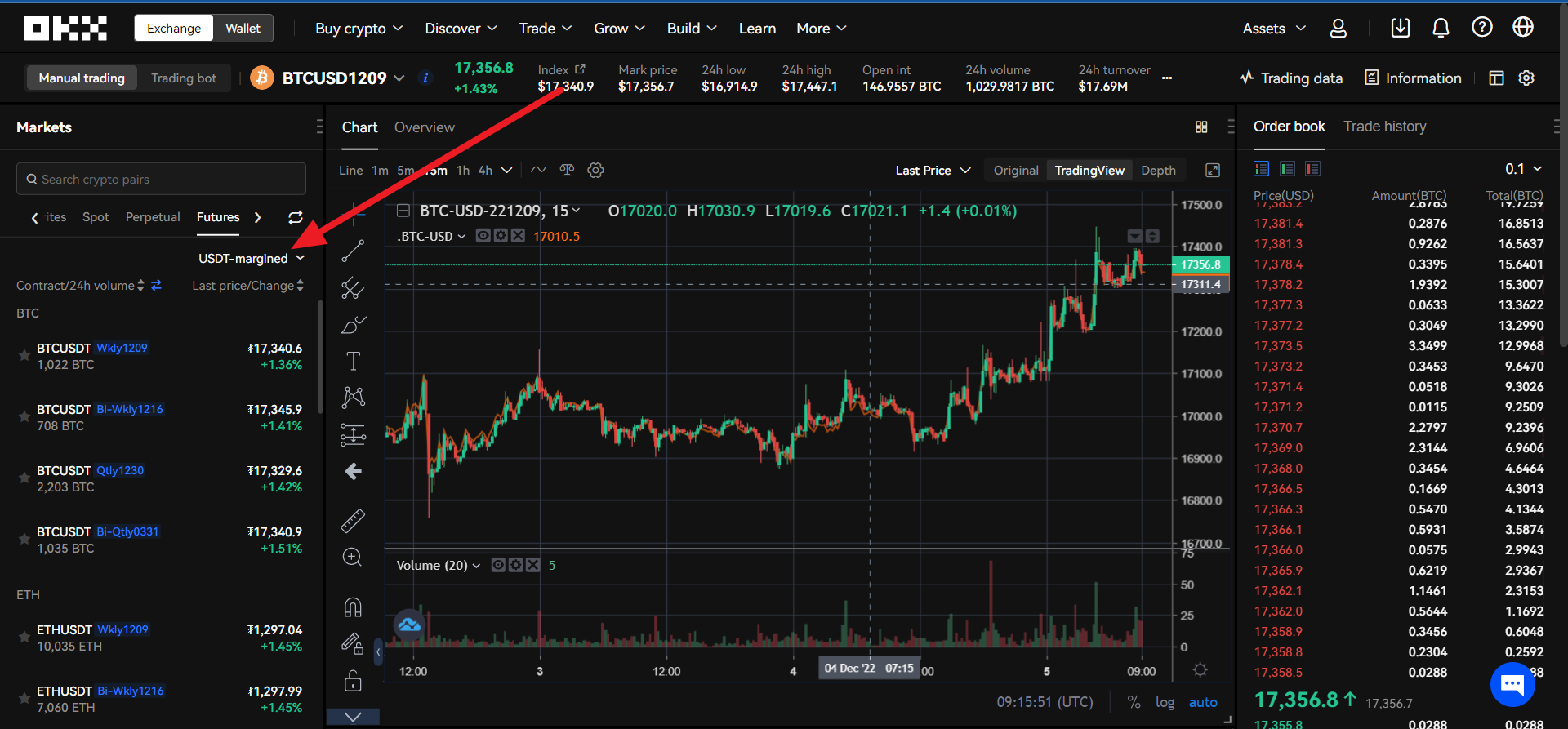

4. Select Trading Pair

4. Select Trading Pair

From the Futures trading terminal, on the left side of your screen, you will find a list of the available trading pairs. Search and click on the best futures trading coin you wish to trade, and its chart will be opened.

4. Fill Out The Order Form

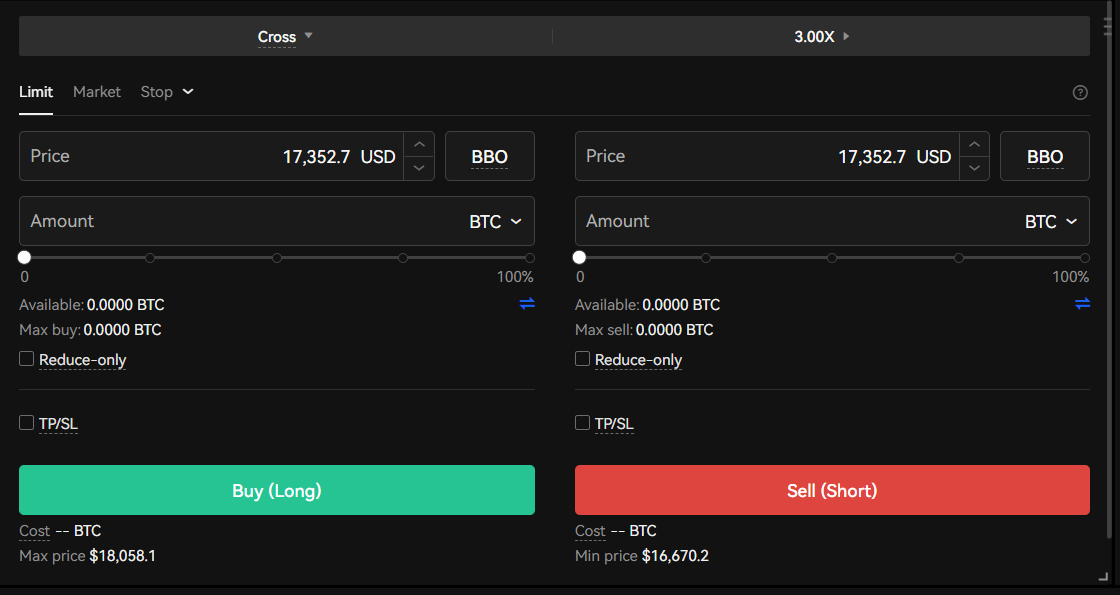

Next, if you scroll below the chart, you will find the order form. The order form is pretty self-explanatory.

You get different order times like Limit, Market, and Stop. And based on the order type, you will find different fields to enter your desired price and amount.

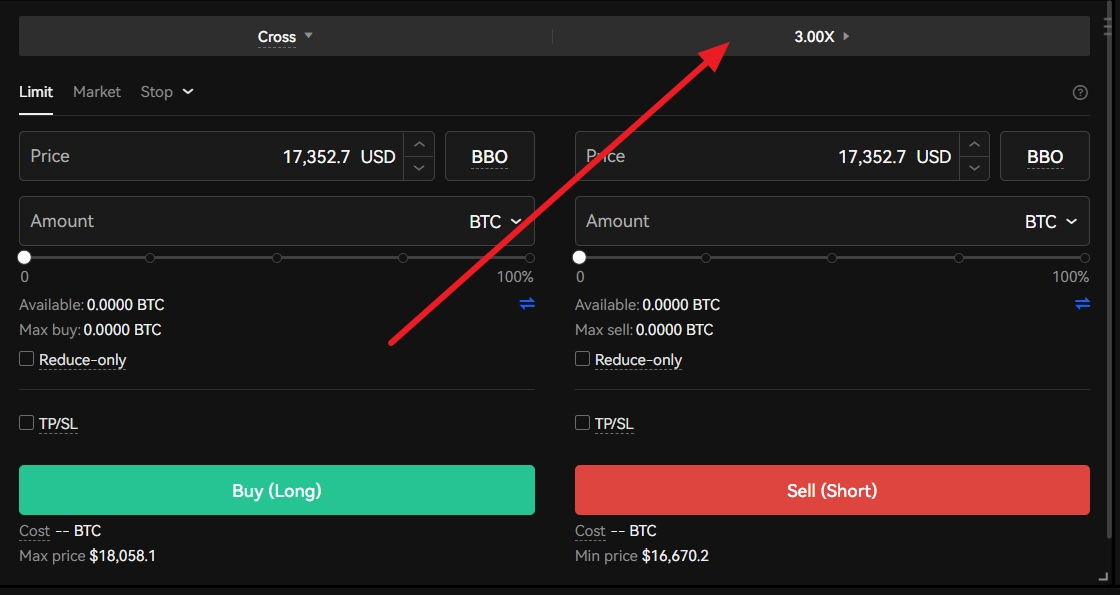

Also, on top of the order form, you will find two options Cross and something as 3.00X or 5.00X-like values. If you click on Cross, you can choose your margin type between Cross and Margin.

Talking about Cross and Isolated margins, Cross margin is the most used across exchanges. Your entire account balance is used in this mode to margin all your open positions. This is great for newbie traders.

However, with an isolated margin, you can allocate margin specifically to a position or trading pair. You must use this option if you believe that a trade would require more margin than your other trades.

Next to Cross, if you click on the X value, you will be able to adjust the leverage for your Trade. For different trading pairs, OKX offers different leverage, so having a look at it before placing your order would come in handy.

5. Place Your Order

Once you are done entering your order details, click on Buy (Long) if you believe that the contract’s price will go up. And click on Sell (Short) if you believe that the price of the contract will go down.

Also, once your order is placed, you will find all the details under the order form only. From there, you can modify, close, and cancel your orders.

What Are OKX Futures?

OKX Futures contracts are derivatives products launched by OKX to trade contracts of digital currencies such as Bitcoin. Each futures contract represents USD100 of BTC or USD10 for other digital assets such as ETH, LTC, and others.

As a crypto trader, you are allowed to open both long and short positions in the market. And you will find available leverages for futures contracts between 0.01-100.

What Are OKX Futures Fees?

Like many crypto exchanges, OKX, too, has a different trading fee for regular and VIP users.

Regular users are categorized into tires by their total OKB holdings, whereas 30-day trading volumes and daily asset balances categorize VIP users. This means the more you trade, the less you have to pay the trading fee.

Talking about the fees, if you are a regular OKX user with OKB holding of fewer than 500 tokens or 30-day trading volume of fewer than 5,00,00,000 USD, then you will be paying a maker fee of 0.020% and a taker fee of 0.050%.

For the VIP users, if your total asset counts as 1,00,000 USD or a 30-day trading volume of more than 5,00,00,000 USD, then you will be charged 0.010% as the maker fee and 0.030% as the taker fee.

The trading fees apply to all the market types, such as USDT-M Futures, Crypto-M futures, USDT-M perpetual, USDC-M perpetual, and Crypto-M perpetual.

Conclusion

So that was a quick guide on how to trade futures on OKX.

OKX is one of the popular yet beginner-friendly derivative exchanges out there that offers you good enough leverage for a wide range of trading contracts and has lower trading fees.

So go ahead and try placing your first futures order on OKX and see how it goes.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023