If you aim to profit from the price of Bitcoin or any other cryptocurrency asset without having to own it, trading futures is the way to go.

Although spot trading is still one of the major ways to invest in cryptocurrency, derivatives trading, including Futures and Options, has recently picked up steam. In general, Futures are established financial instruments traded on an exchange.

Binance Futures trading itself has close to $26 billion worth of contracts traded in a 24-hour period.

How Does Crypto Futures trading work?

Daily and long-term traders tend to speculate on what the price of the underlying asset will do in the future.

They come to this conclusion based on some metrics, also known as fundamental analysis, technical analysis, or a combination of the two.

This high conviction decision enables the trader to predict which way the underlying asset’s price fluctuations will take it on a particular day. As an example, you open a short position on a crypto futures trading exchange for Bitcoin today.

One of the many crypto traders who will take the other side of this trade, i.e. take a long position on Bitcoin’s price.

If the price today is $16,000 and the agreed price is $20,000 with an expiry of 23rd December, the seller will make a profit if the price stays under it while the buyer will lose money.

In case the price reaches $25,000 by this date, the seller will lose money while the buyers rake in the profits.

Once the expiry is reached, the contract must be fulfilled by both parties. You can only cancel a standard Futures contract by taking an opposite Futures trade to the initial one. A short contract cancels a long contract and vice versa.

Compared to spot trading, Futures trading allows traders to maximize their potential gains with proper risk management. This is called leverage trading, and you can borrow funds from the exchange you are trading on the increase the size of your trades.

Leverage is in multiples of the original trade size, and the maximum leverage is dependent on the exchange. It can go from 5x, 10x, to 50x, and even 100x in some cases.

Any kind of leverage Futures trading should be taken by advanced traders or futures traders that are looking to learn the game. If the price of bitcoin does not go in the direction of your trade, you will be liquidated and lose your funds.

What are Futures in crypto trading?

Futures contracts are part of the derivatives market which also includes CFDs (Contracts for Difference), Options, and Swaps. These contracts have been hugely popular in traditional financial markets as a way to make quick profits.

The Chicago Mercantile Exchange listed Bitcoin Futures contracts on its exchange starting in December 2017, and this has allowed institutional investors to get into something that was not a very liquid market.

A Futures contract is an agreement between a buyer and seller to buy or sell a particular asset, in this case, a cryptocurrency, at an agreed price at the predetermined expiry date. To simplify it further, a Futures contract is a bet on the future price of the underlying asset.

You would take a long position on Bitcoin Futures if you think the price will increase by the end of the monthly expiry.

If your analysis tells you that Bitcoin will suffer a price drop when the monthly expiry arrives, you will buy the Bitcoin Futures contract at the current price, essentially taking a short position.

When the expiry does arrive, the two involved parties will settle the contract as per the price and close the contract.

By definition, Futures contracts have an expiry date, but cryptocurrency futures have a separate category of contracts that do not have one. These are called perpetual contracts and behave the same as traditional cryptocurrency futures but without any expiry or settlement date.

The market price of perpetual contracts moves according to the spot price of the underlying asset and trades very close to it.

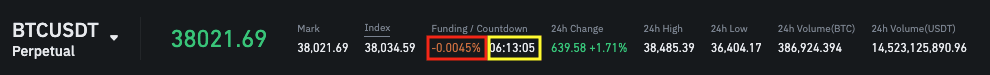

Even though there is no expiry date and hence no settlement for perpetual contracts, cryptocurrency exchanges have come up with a funding rate mechanism where shorts and longs pay each other regularly, depending on the market sentiment.

Types of crypto Futures contracts

Futures contracts have something for everyone, but it depends on your exchange of choice which ones are made available to you. The different types of cryptocurrency futures contracts are as follows:

- Standard Futures Contracts

These kinds of contracts borrow all of their aspects from standard Futures contracts that exist in the traditional markets, including expiry and settlement.

The Chicago mercantile exchange and the CBOE were the first traditional futures trading exchanges to launch Bitcoin Futures in 2017.

Today, a buyer purchases Bitcoin Futures and can select contracts with an expiry that suits them. All these contracts are settled in US Dollars when the expiry date comes up.

Most of the major crypto exchanges like Binance, Bybit, and Deribit provide standard contracts that have quarterly expiries. These contracts are also settled in US Dollars and are ideally used for swing trading.

- Futures with Physical Delivery

The other type of Futures contract’s expiry date triggers the physical delivery of the digital currency. This might seem like a mistake, but simply means that when the contract is settled, the underlying assets are credited to the trader’s wallet.

That is the key difference between these contracts and the standard ones.

The Intercontinental Exchange (ICE) has Bitcoin Futures listed by Bakkt and provides physical delivery of Bitcoin to customers who bought Futures contracts of the digital asset. These are cash-settled contracts and, due to that, aim to help the circulation of Bitcoin itself.

- Perpetual Contracts

These are one of the most popular contracts in terms of trading volumes as they do not rely on expiry for settlement. All major exchanges that carry cryptocurrency Futures carry these contracts, including BitMEX, Bybit, and Binance.

What keeps these contracts close to the spot price is the funding rate. As part of this mechanism, traders on both sides pay each other based on their open positions when the funding timer expires.

This difference between the spot and the future price is what determines which side pays and which side gets paid.

If the rate is positive, traders holding long positions pay the ones in short positions, and when the funding is negative, the shorts pay the longs.

Types of fees in crypto Futures trading

A trader can either be a taker or a maker, depending on if they provide liquidity to the crypto market or if they take liquidity from it.

- Maker Fees

These are paid when you place a limit order above or below the current market price. Maker fees are generally lower than the taker fees.

- Taker Fees

These are paid when you use the market’s liquidity from the order book by placing orders at market price. An example of a taker is a hedge fund whose trading strategies revolve around trying to benefit from short-term price changes.

- Funding Fees

These fees are paid in addition to the maker or taker fee and only when you trade perpetual contracts that do not have an expiry.

Traders on the long side pay the ones on the short side, or vice versa depending on the funding rate. Longs pay shorts if the rate is positive, and shorts pay longs if it is negative.

How are crypto Futures contracts priced?

In theory, the price of a Futures contract closely tracks the price of the asset it is based on, but this value can vary as the settlement date approaches. The difference in price may be caused by market volatility.

Lack of market liquidity in some contracts can also lead to the widening or shrinking of spreads in some futures contracts that are affected.

The crypto markets are open for trading 24/7 so ‘gaps’ are more difficult to come by but are fairly common on traditional platforms like CME that have specific trading hours.

If the price of an asset shows large growth in the closing hours, you can be sure that when trading opens next, a ‘gap’ will appear in the price and consequently on the chart.

How To Trade Futures In Crypto?

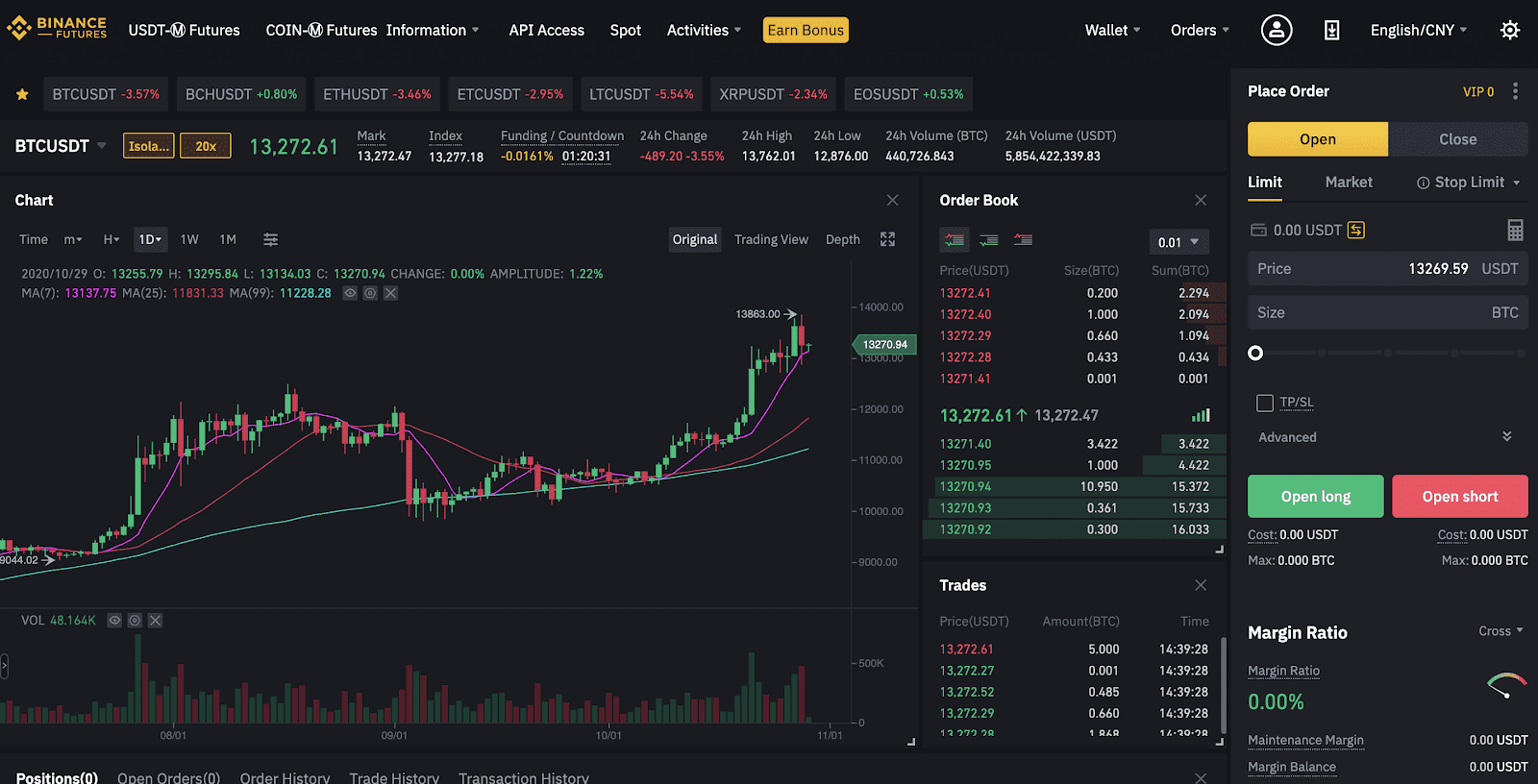

If you have made up your mind to begin trading crypto futures, you should spend some time learning the basics of the process.

There is a lot of understanding required regarding fees, what contracts to choose, when to take an entry, and where to set take profits and stop losses.

It also helps to religiously go through tutorials on exchanges like Binance that explain the screens and UIs you will use to place and track your trades.

The next step is to create a Futures account that is different from your spot account. You can then deposit digital assets that you wish to use or fiat from your bank account.

Once you have funds in your Futures wallet, you are all set to place your first trade.

Risks of Crypto Futures Trading

Cryptocurrency Futures trading carries with it an inherently high risk as trading cryptocurrencies itself is a volatile and risky endeavour. The use of leverage can increase your potential gains but without proper risk management also empty your Futures wallet quickly.

When you start making Futures trades on your favourite exchange, you will have to set aside an initial margin.

The exchange keeps custody of this money and only gives it back when you close the trade and pay back the exchange’s funds borrowed for the leveraged position.

In such cases, when the Futures trade goes against you and there is no margin available in your wallet, the exchange will automatically liquidate your position to close the trade. This results in the loss of initial margin and hence the advice to trade according to risk appetite.

Benefits Of Crypto Futures Trading

Convenience: Compared to the risks involved with cryptocurrency trading, you do not need to store your coins in a secure wallet or have access to the depth of a market. This is part of the reason the trading volume in the Futures market is 2x larger than regular trading volume.

Higher profits: As futures trading gives you access to leverage, you can then trade cryptocurrency Futures worth $1,000 with only $10 of your financial resources. This increases the potential gains but also carries the risks associated with the use of high leverage.

Hedging: When used properly, Futures trading allows experienced traders to hedge their spot positions in Bitcoin or Ethereum by taking opposing positions in Bitcoin and Ether futures. This helps to cover up any losses that might occur due to unfavourable price movement.

What should be considered before trading crypto futures?

Before you start your crypto Futures journey, you should aim to understand some portions of this domain completely.

- Leverage Trading

Although it helps you maximize your profits when used correctly, the associated risks are directly proportional to the leverage involved. As a trader, you need to use it wisely and find out what level of leverage works for you.

- Liquidity

When looking to trade cryptos that are not in the top 50 coins, it becomes necessary to determine the amount of liquidity in the market. This will tell a good trader how easy it will be to enter and exit positions without excessive price slippage.

- Portfolio Diversification

The addition of cryptocurrency futures trading to your portfolio helps you diversify your holdings so as to not have all your eggs in one basket. Using Bitcoin futures in conjunction with positions in other coins will help create a diverse bundle of contracts.

This mitigates the risk associated with exposure to a single asset and the unexpected price advance or decline.

FAQs: Crypto Futures Trading For Beginners

- How Are Bitcoin & Crypto Futures Settled?

Depending on the type of cryptocurrency Futures you choose to trade, your contract can either be a cash settlement or the physical delivery of the digital assets after expiry.

- What are the Bitcoin and crypto Futures trading hours?

The cryptocurrency market is widely known to be the only 24/7 trading market. This applies to the Futures market on any cryptocurrency futures platform like Binance, Bybit, eToro, and Kraken.

The only place where trading hours will matter to a trader is when you are trading Bitcoin futures contracts on the CME platform, where regular market hours apply.

- Is crypto Futures trading gambling?

Crypto Futures trading is a legitimate trading market used by experienced traders to bet on the direction of price movement.

There are some advanced tools like high leverage, which can be lucrative for inexperienced traders and cause it to be used as a gambling tool to make quick profits.

It might work in your favour if you are supremely lucky, but for the most part, it does not end well.

- Are crypto futures regulated?

The contracts traded on the Chicago Mercantile Exchange are regulated by the Securities and Exchange Commission. The contracts on major cryptocurrency exchanges, on the other hand, are not regulated.

Conclusion: Who Should Trade Crypto Futures?

You must keep in mind that at any point in your Futures trading journey, you will not own or trade the actual asset. You will only speculate on where you think its price is headed.

To be good at this speculation, you will need advanced knowledge of both the market and the asset itself.

Technical analysis and its reasonable predictions allow you to place your bets on whether to buy or sell an asset. So Futures trading is best for experienced traders who have immersed themselves in this space.

As a novice trader, you should focus on taking small bets and learning the inner workings of the Futures markets before aiming to make profits.