As a centralized crypto exchange, Phemex was launched in 2019 with headquarters in Singapore by former executives from Morgan Stanley.

Since then, they have built a project that has gained popularity quite quickly because of the low platform fees, deep liquidity, and user-friendly interface, as well as the spot, contract, and margin trading markets.

An added advantage is that the exchange does not require you to provide any KYC details for trading.

With these features, you will be able to use the margin borrowed from the exchange to make money off of Bitcoin’s fall in price. You can trade Perpetual Futures contracts using USD, USDT, or a coin as collateral.

New to crypto? Learn the difference between Crypto Perpetuals vs Quarterly Futures

Short Bitcoin Crypto On Phemex

Phemex Futures contracts are divided into two categories, one that is settled in cryptocurrency and one that is settled in USD.

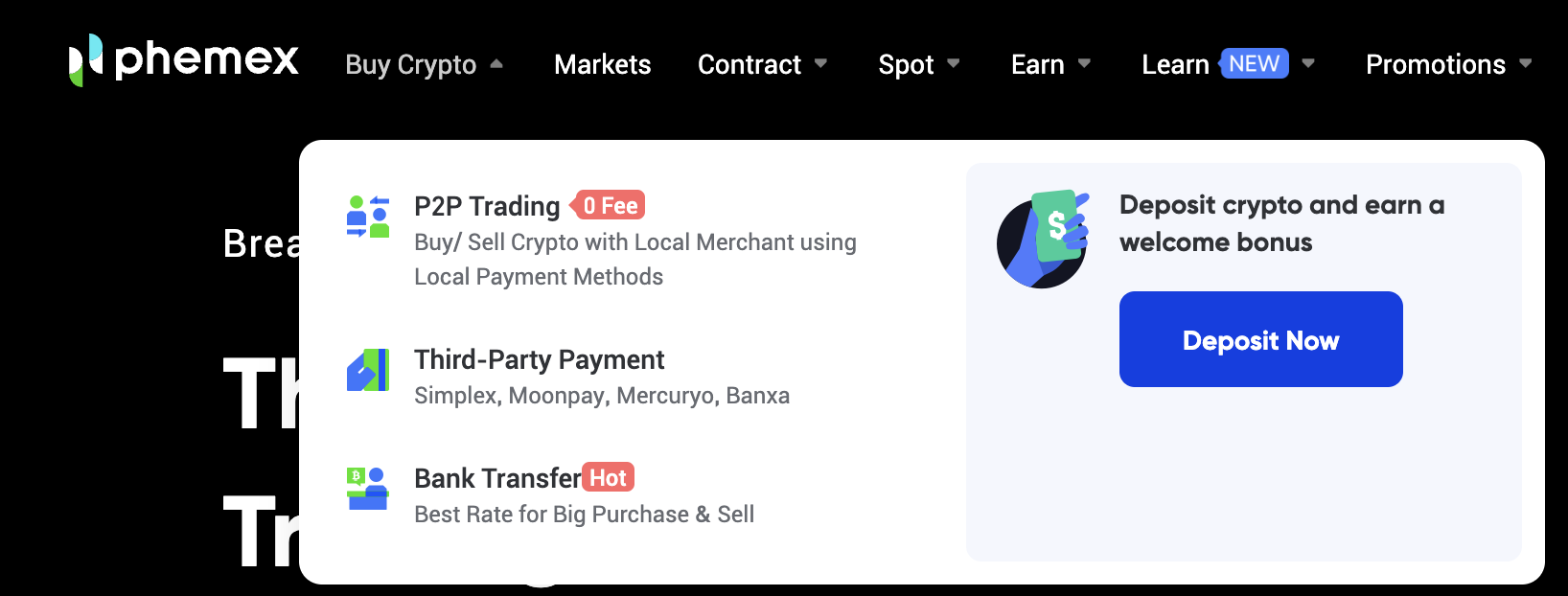

To take your first trade on Phemex, you will either have to buy cryptocurrency from the exchange by clicking on the ‘Buy Crypto’ button in the navigation bar.

Then you can decide between using either P2P Trading, Third-Party Payment, or Bank Transfer.

- P2P Trading

If you select this option, you will be able to look at and select the best local merchant to transfer funds into your account.

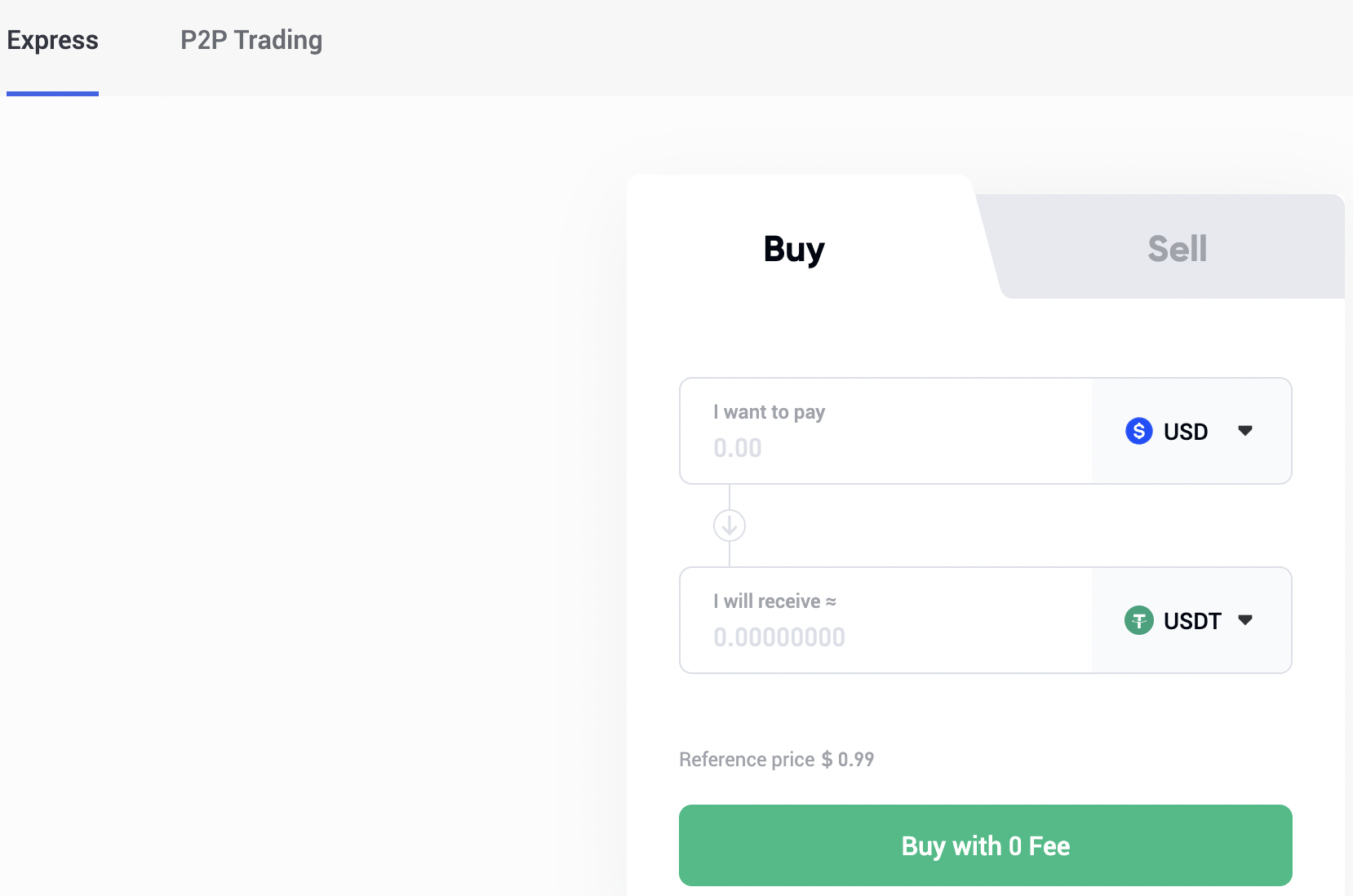

On the P2P Trading screen, you can select the Express tab to get your transaction done quickly.

On this screen you would enter the amount of USD you would want to pay and then get the equivalent amount of USDT, BTC, or ETH according to your selection

In this case, the system will auto-match you with the best local merchant. If you are more of an advanced user or you just want to see your options, click on the P2P Trading tab.

You would pay them using local payment methods and in turn, they would transfer USDT, BTC, or ETH to your trading account.

- Third-Party Payment

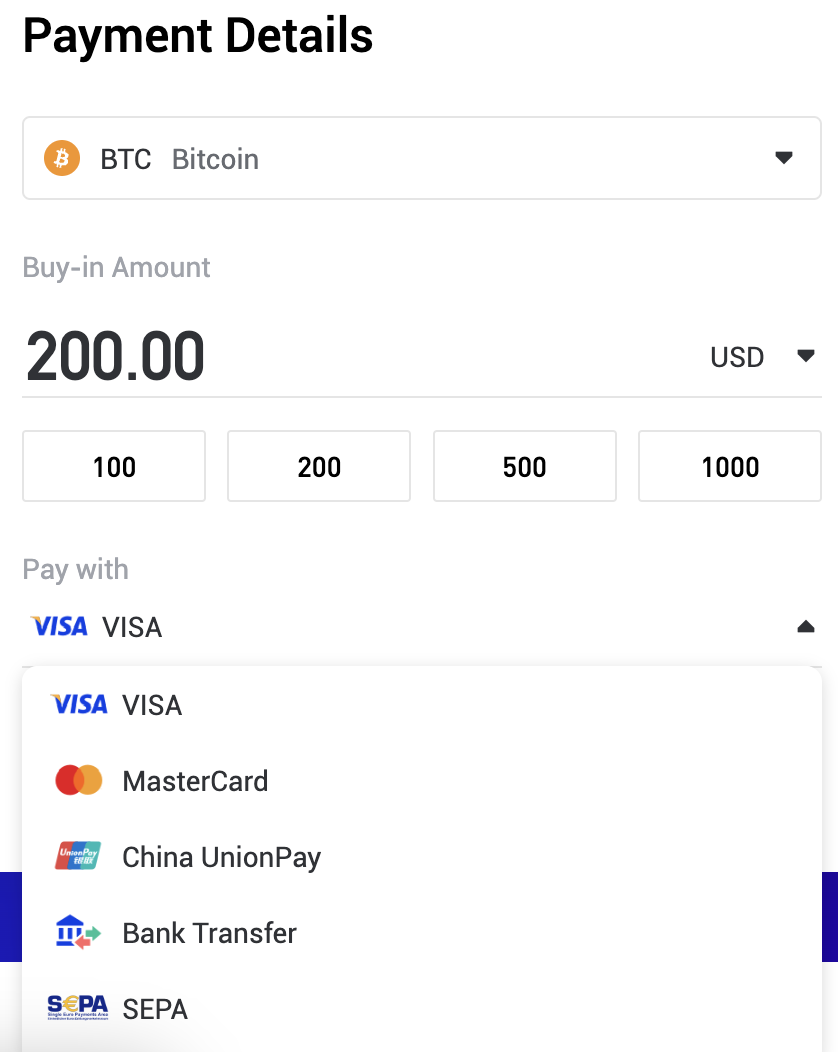

#1. Select the crypto you want to purchase

To buy crypto on Phemex via third party payment, you will select the crypto you want to buy. In our case, it will be USDT which we will use as margin for our short trading position.

You can make the payment via Debit cards, Credit cards, Apple Pay, direct Bank transfer, or SEPA.

#2. Choose the best available offer

Once you have chosen the amount of crypto you would like to buy, the next screen gives you options of different offers available to complete this purchase.

Choose the one that you like the best and confirm your payment details.

#3. Wait for the crypto to arrive.

The crypto will arrive in your Spot wallet once the payment is completed.

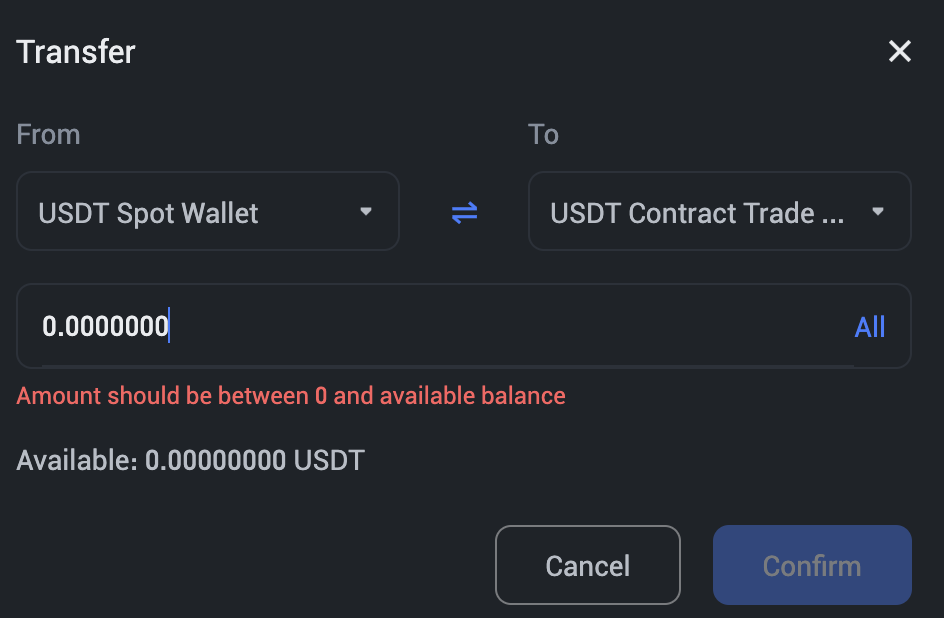

Once the crypto you bought or transferred is in your Spot trading account, you will need to transfer it to your Contract Trade account so that you can place your first Futures contract order.

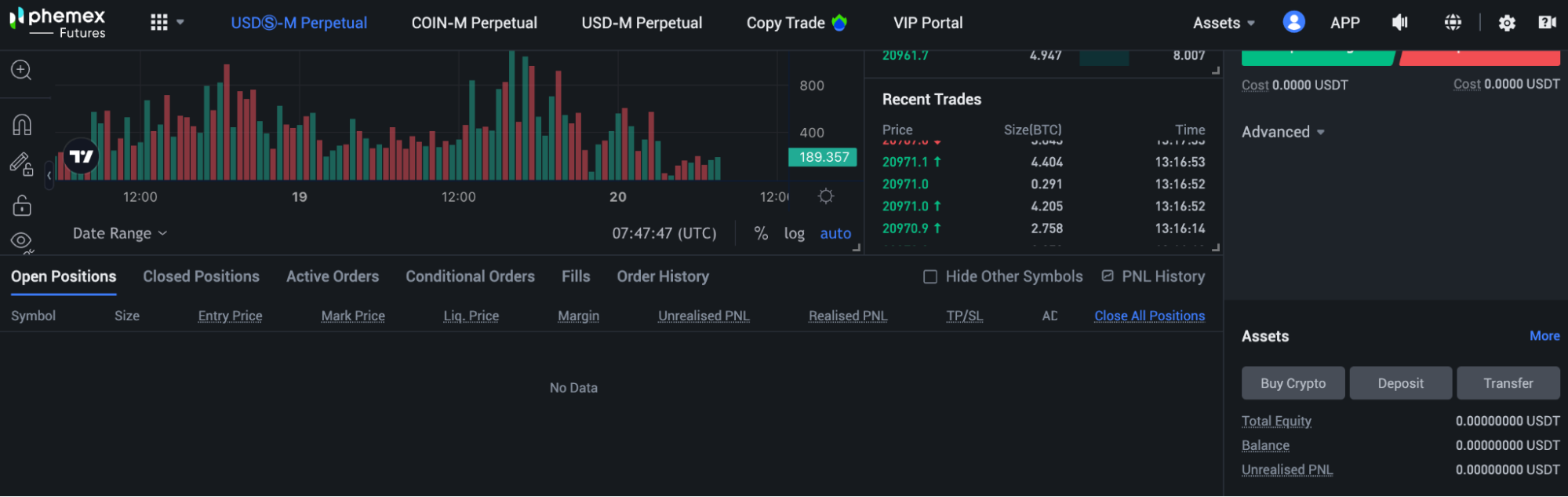

Navigate to the ‘Contract’ menu in the Navigation bar and click on USD(S)-M Perpetual option.

Then you will see the screen below where you can click the ‘Transfer’ option to get USDT from your Spot wallet to the trading wallet.

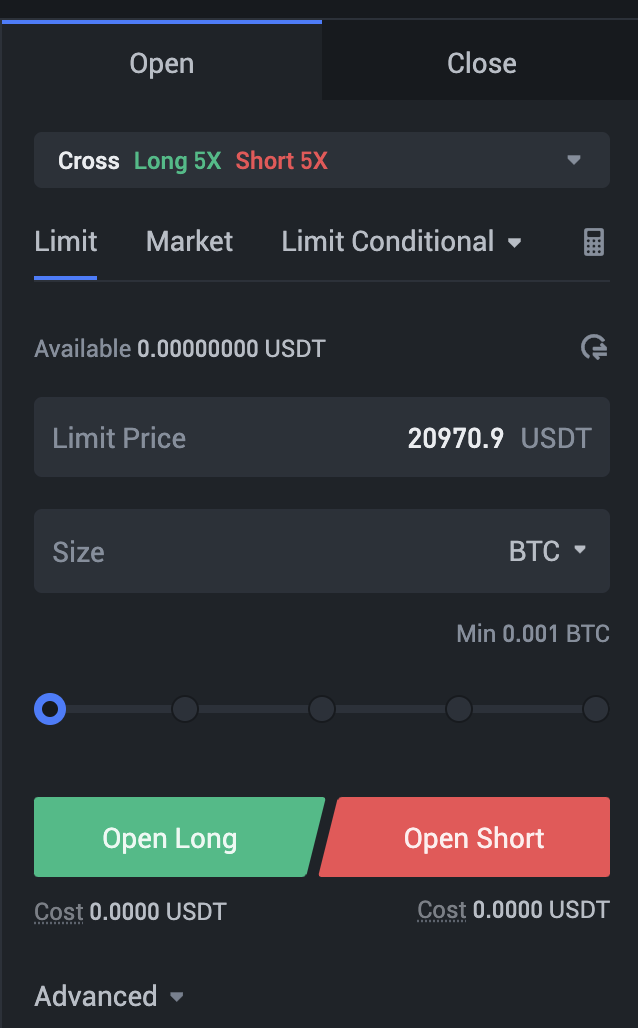

Next, you will decide on what pair you would like to trade. In our case, we will pick the BTCUSDT pair to take a short position on.

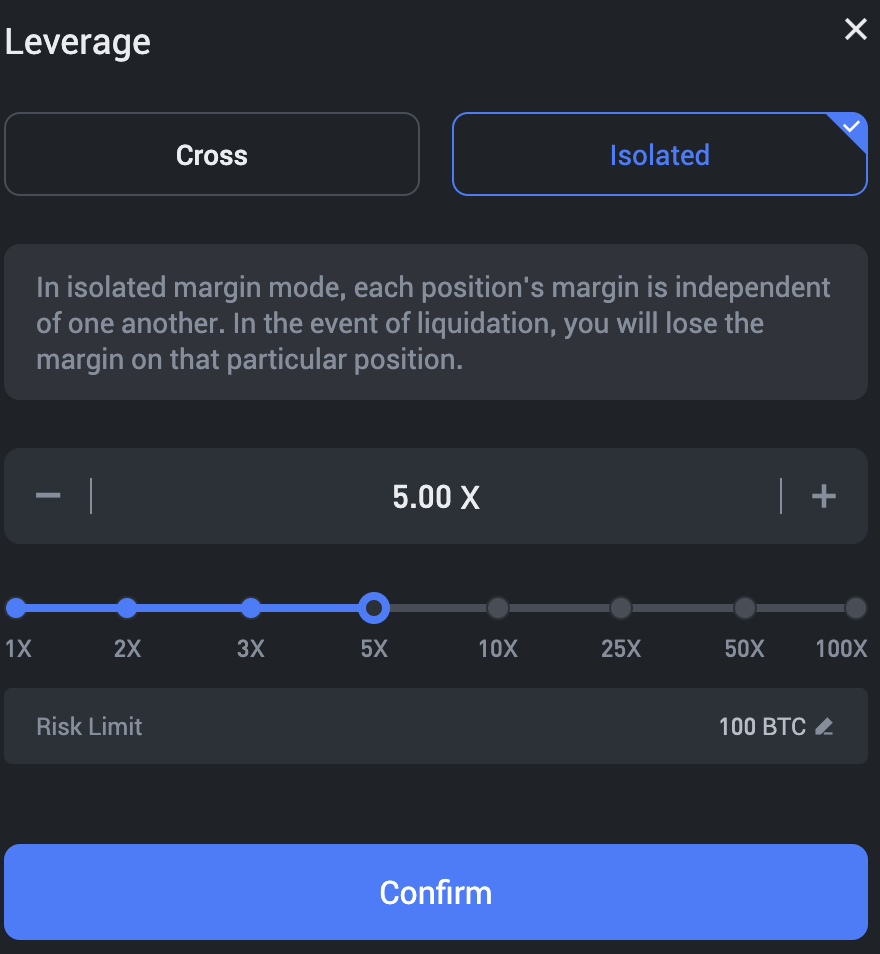

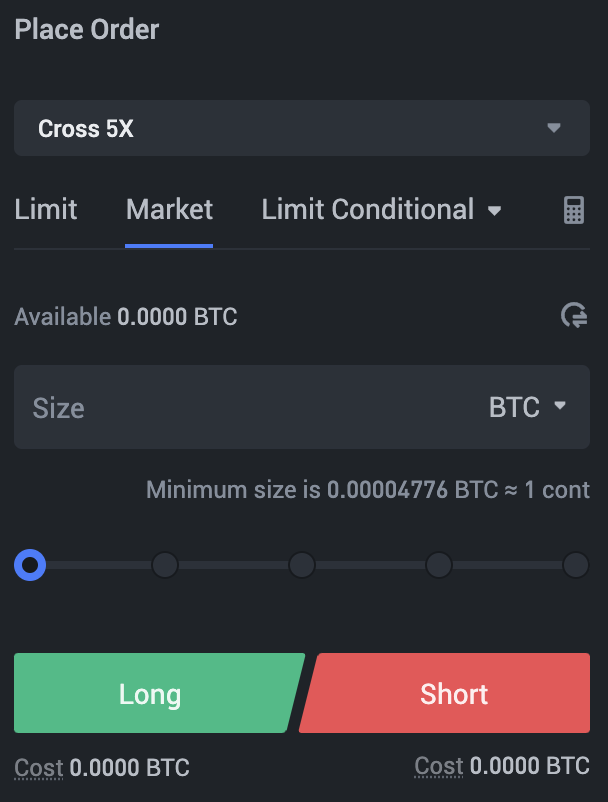

To start the process, you will first decide what amount of leverage and whether you want to take an Isolated margin or cross-margin trade.

With an Isolated margin trade, the margin invested in the position will be your only exposure.

But in case you choose to place a trade in the cross-margin mode, all the money in your trading account will be used to prevent the liquidation of any open positions. In this case, your exposure is all of the margins in your trading wallet.

We have selected leverage of 5x for this position keeping in mind that high-leverage trades on BTC are very susceptible to liquidation.

You will then select the type of order to place. In this, you have the options of either a Limit order, or a Market order, Limit Conditional order, or a Market Conditional order.

For this example, we are placing a Limit short order for BTC.

Then you will decide at what price you would like your orders to be filled. Here, we will enter a price of 20,970.9 USDT.

Next is what quantity of BTC you want to short, which in our case is 3 BTC. This makes the position worth 20,970.9 * 3 = 62,912.7 USDT.

Because we have used 5x leverage on Phemex, the margin that will be used from the wallet is 62,912.7/5 = 12,582.54 USDT, plus any platform or margin fees that might apply to the position.

The last step in this process is to close your position. If there are any profits in the position, they will remain unrealized and not available for use until you close the position.

There are two ways that you can close the position, either by placing a Market order which will close your position at the best available price in the Order Book.

The other option is to place a Limit order which will aim to fill your orders at the entered price.

This gives you an advantage of getting the exact amount of profit from the position as calculated rather than filling at Market price and getting an order filled at a different price.

In this case, we will close the position with a Limit order which will be triggered when the price of 1 Bitcoin reaches 18,000 USDT. When the position is closed, the profit will be (20,970.90 – 18,000) * 3 = 8,912.70 USDT.

Once the position is closed, the margin used in the order, as well as any profit you made from it will be available in your wallet to use in the next trade.

Here, we have opened and closed a Bitcoin short trade using USDT as collateral.

If you click the ‘USD-M Perpetual’ option under ‘Contract’ in the navigation bar on the homepage, you will land on a similar order page where you can use USD instead of USDT as collateral for your trades.

The other steps remain the same, right from needing to transfer USD from your spot wallet to your trading wallet to needing to close your position before being able to use any profits or the margin allocated to the position to open a new position.

Shorting Bitcoin with COIN-M Perpetual Futures contracts

A different way of taking a short position on Bitcoin would be through Futures contracts that are margined in the coin you are trading instead of USD or USDT.

For example, if you are trading the BTCUSD pair, you will mention the Limit price for the position in USD, and the settlement will happen in BTC.

If you are new to Phemex, you will have to either buy or transfer crypto or stablecoins with one of the methods mentioned earlier in the article.

Once the funds reach your Spot wallet, you will need to move them to the trading wallet to use in the next order you place.

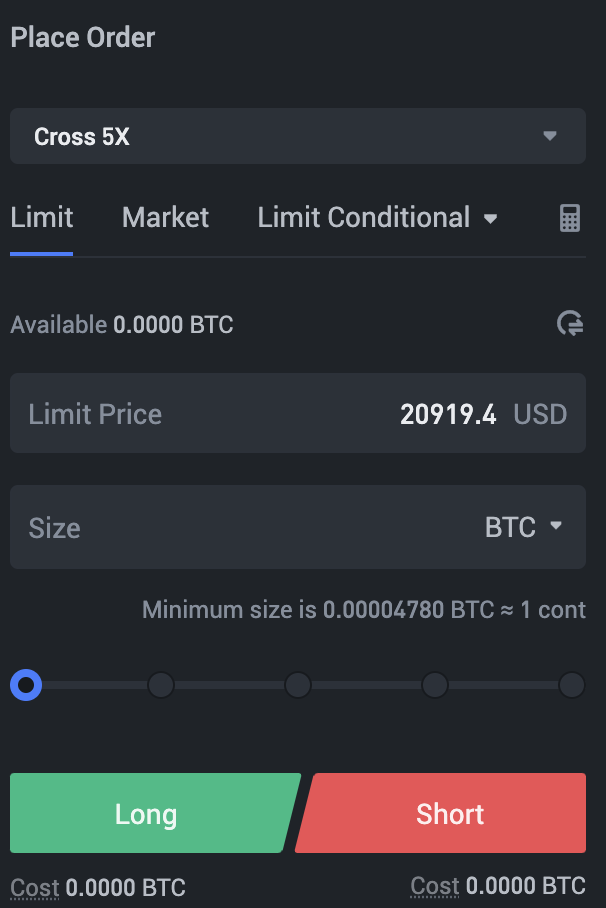

First, you will choose whether you will place an order in the Cross-Margin mode or the Isolated Margin mode and then how much leverage you would like to use in the following trade.

For the purpose of this example, we are using the Isolated Margin mode to take a 5x leveraged short position.

Next, you will decide what kind of order you would like to place. Your options are Limit, Market, Limit Conditional, and Market Conditional orders. For this example, we will be placing a Market order.

In a Market order, all you need to enter is the amount of BTC you want the position to be worth (shown below).

Phemex’s matching engine will automatically open a position of 3 BTC at the current market price according to its order book.

Once you have entered the 3 BTC in the Size box, you can press the Short button to confirm the position and let the matching engine do its job.

Let’s take, for example, that the average fill price for your 3 BTC position is 20,927 USD/BTC. So, your total position is worth 3 BTC.

And because you have taken the position with 5x leverage, the amount of margin deducted from your account will be 3/5 = 0.6 BTC plus any platform and margin charges.

To close the position, we have the option to use either a Market order or a Limit order, as discussed in the previous section.

In this example, we will use a Market order to close our position when the price of Bitcoin gets close to 19,000 USD.

Say that your position gets closed at 19,010 USD; your profit from this will be 0.3025 BTC or 50.10%.

Conclusion

Now you know how to short Bitcoin on Phemex using two different methods. After reading the article, you should have a pretty good idea of which method works for you.

Shorting of an asset is a little counter-intuitive as the majority of the market looks to only make money when the price of an asset goes up.

But if you can master the art of shorting as well as longing an asset as a trader, you can make money whichever way the asset price moves.

Phemex, as an exchange, has deep liquidity and an amazing order-matching engine that makes sure that your orders get filled at the prices closest to the current Market price or the Limit price you have entered.

There is little to no slippage involved in these transactions.