If you’ve been around the crypto block, you’ve probably heard the term DEX thrown around quite a bit.

But what exactly is a DEX, and why should you care?

As someone who’s navigated both centralized and decentralized platforms, I can tell you that understanding the nuances of DEXs can be a game-changer for your crypto journey.

In this article, we’ll unpack everything you need to know about decentralized exchanges—from how they work to their pros and cons and why they’re becoming increasingly popular in the crypto ecosystem.

So, let’s get started!

What Is a Decentralized Exchange & How It Works?

So, what exactly is a DEX platform?

Great question.

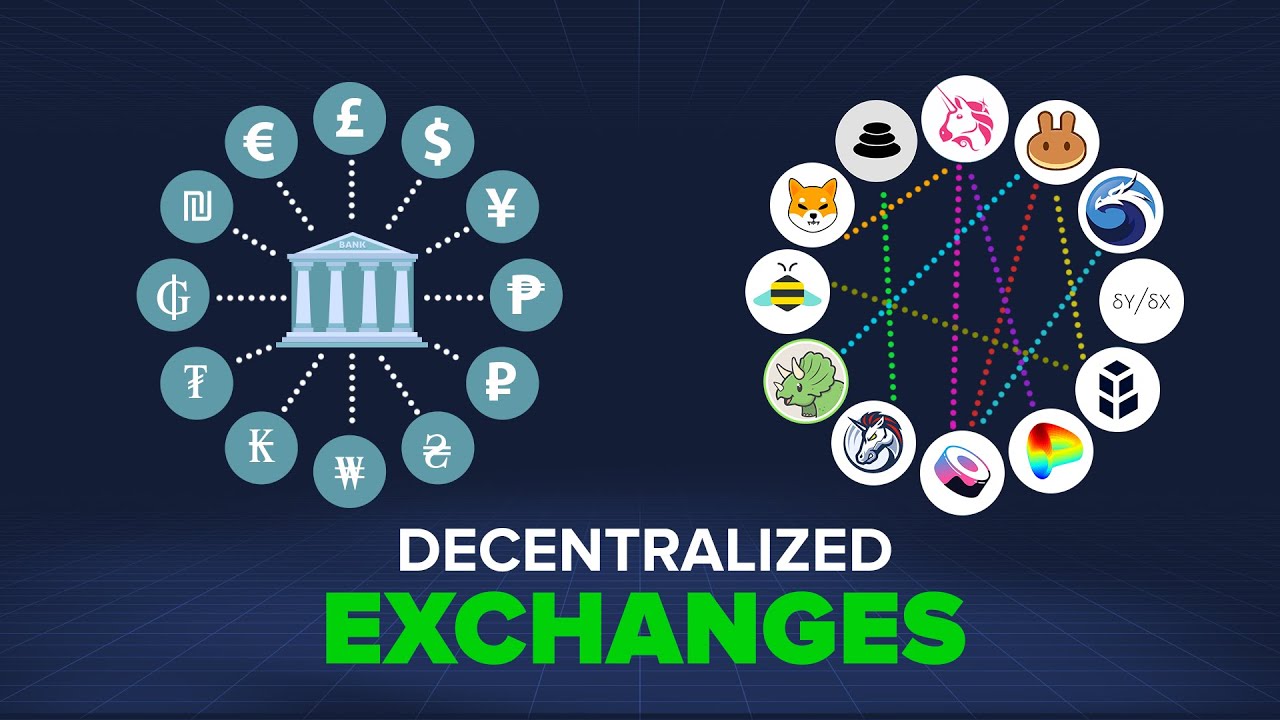

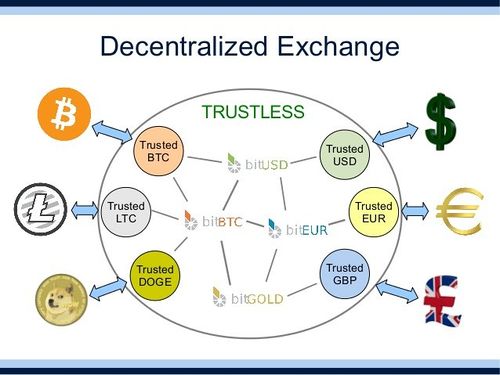

A DEX is a cryptocurrency exchange that works without a central authority or middleman.

Instead, it uses the blockchain network and smart contracts to facilitate direct peer-to-peer transactions for your digital asset.

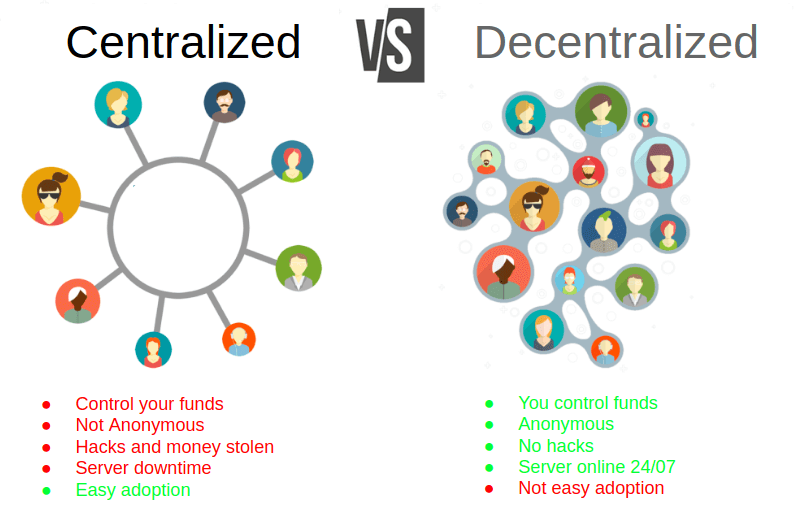

Unlike centralized exchanges, where the exchange itself holds your funds, DEXs allow you to maintain full control over your assets with the power of decentralized finance (DeFi).

The types of DEXs are Automated Market Makers, DEX aggregators, and Order Book DEXs.

This means you’re not depositing your funds into a third-party service, but rather, you trade directly from your crypto wallet.

In essence, a DEX aims to provide the same services as a centralized exchange—like trading, buying, or selling cryptocurrencies—but does so without an intermediary and in a way that prioritizes user control and autonomy.

Intrigued?

Keep reading to discover why DEXs are gaining traction and how they differ from centralized platforms.

How Decentralized Exchanges Work

Are you curious about the inner workings of a decentralized exchange?

You’re not alone.

Understanding how DEXs operate can give you a clearer picture of why they’re becoming increasingly popular.

So, let’s break it down into three key components: Peer-to-Peer crypto Trading, Automated Market Makers (AMMs), and Smart Contracts.

- Peer-to-Peer Trading

Unlike centralized exchanges, where the platform itself acts as an intermediary, DEXs facilitate direct transactions between users and their cryptocurrency wallets.

How does this work?

When you place a trade using decentralized exchanges, you interact with another user who wants to take the opposite side of your trade.

The platform merely serves as a matching engine, connecting buy and sell orders without holding their funds.

- Automated Market Makers (AMMs)

AMMs set the price of a token based on a mathematical formula, usually considering factors like supply and demand.

Traditional exchanges rely on order books to match buyers and sellers, but AMMs remove the need for an order book altogether in crypto markets.

Instead, they use liquidity pools to facilitate trading, making it easier and more efficient to trade even less popular tokens using smart contracts on the blockchain.

- Smart Contracts

Smart Contracts are self-executing contracts with terms directly written into code.

In the context of a DEX, smart contracts are used to facilitate, verify, or enforce credible transactions.

What’s the big deal?

Smart contracts automate the trading process, making it secure and transparent without the need for a third party.

Advantages of Decentralized Exchanges

So, you’ve gotten a grasp of how decentralized exchanges work.

Now, you’re probably wondering, “What’s in it for me?”

Good question.

Let’s dive into the key advantages that make DEXs increasingly appealing to users.

- Security and Control

One of the biggest favourable points of decentralized applications is that you maintain full control over your assets.

How?

Because your funds are never stored on the decentralized crypto exchange itself.

Instead, they remain in your personal wallet until a trade is executed via smart contracts.

This minimizes the risk of access to your assets without authorized access.

- Privacy and Anonymity

Next, let’s talk about Privacy and Anonymity.

In a world where data breaches are all too common, the privacy features of DEXs are a breath of fresh air for your crypto assets.

Most types of decentralized exchanges don’t require you to undergo rigorous KYC (Know Your Customer) checks, and you are not required to submit any personal information either.

This is one of the advantages of using a dex for those who prioritize privacy in their financial transactions.

- Open and Permissionless

What does this mean?

Essentially, anyone can use a DEX to execute trades regardless of their location or status.

No gatekeepers or centralized entities control crypto trading who can or cannot use the platform.

All you need is an internet connection and a compatible crypto wallet, and you’re good to go.

- Censorship Resistance

Because DEXs are decentralized and operate on blockchain technology, they inherently resist censorship, surveillance services, and interference from governments or other centralized authorities.

This ensures that your ability to trade is not easily compromised.

In a nutshell, the advantages of using a decentralized exchange boil down to enhanced security, greater privacy, and more freedom.

Intrigued?

Wait until you hear about the disadvantages and risks involved.

Keep reading!

Challenges and Limitations of Decentralized Exchanges

While the advantages of DEXs are clear, it’s equally important to understand their limitations.

After all, no system is perfect, right?

Let’s dive into some of the challenges to DEX adoption and the limitations that crypto traders might face when navigating decentralized exchanges.

- Liquidity Issues

One of the most common challenges with DEXs is the lack of liquidity compared to their centralized counterparts.

Why does this matter?

Higher liquidity can minimize slippage on large orders, while low liquidity can make it more challenging to execute big trades without impacting the market price.

This can be a significant hurdle for traders looking to move sizable amounts at the best price.

- User Experience

While DEXs have come a long way in terms of usability, they can still be daunting for newcomers.

The decentralized nature often means a steeper learning curve, especially for those unfamiliar with on-chain blockchain technology, how to interact with smart contracts, and the financial services offered.

Navigating the interface, understanding gas fees, and managing control of their private keys can be overwhelming for some.

- Slower Transaction Speeds

Depending on the blockchain they operate on, DEXs can sometimes face congestion by trading volume, leading to slower transaction times.

Users may be frustrated, especially during times of high market volatility when every second counts.

- Smart Contract Vulnerabilities

While smart contracts automate the trading process, Decentralized exchanges can also be hacked with bugs or vulnerabilities.

If a smart contract is poorly written or has an undiscovered flaw, it could be exploited, leading to potential user losses.

While decentralized exchanges offer a plethora of products and services, they come with their own set of challenges.

It’s essential to weigh the pros and cons, understand the risks, and always stay informed to make it easy on yourself.

Recommended Read: What is liquidation in crypto trading?

List of Popular Decentralized Crypto Exchanges

So, you’re sold on the idea of decentralized exchanges and want to try them.

But where do you start?

Don’t worry; I’ve got you covered.

Let’s take a look at some of the most popular DEXs that have gained significant traction in the crypto community.

- Uniswap

First on our list is Uniswap, a trailblazer in the DEX space.

Operating on the Ethereum blockchain, Uniswap uses an automated market maker model (AMM) aka on-chain order books, to facilitate trades.

It’s known for its simplicity and user-friendly interface, making it a go-to choice for many.

- Sushiswap

Next up is Sushiswap, another Ethereum-based DEX.

Originally a fork of Uniswap, Sushiswap has since introduced a range of additional features, including yield farming and staking opportunities to allow users to trade directly from their wallets.

It’s a strong contender for those looking for more than just a trading platform and still have custody of their funds.

- PancakeSwap

Switching gears, let’s talk about PancakeSwap, a DEX that operates on the Binance Smart Chain.

Known for its low trading fees and fast speeds, PancakeSwap has become a popular alternative to Ethereum-based DEXs, especially for those looking to escape high network fees.

- Balancer

Last but not least is Balancer, a highly customizable DEX that also serves as an automated portfolio manager.

It allows users to create liquidity pools with multiple tokens, offering greater flexibility and potential for yield.

Each comes with its own set of features, supported tokens, and community, so it’s worth doing your research to find the one that best suits your needs.

Ready to make your choice?

Read on to find out about the future of DEXs.

The Future of Decentralized Exchanges

By now, you’ve got a pretty solid understanding of decentralised exchanges, their pros and cons, and even some popular options to consider.

But what about the future?

Where are DEXs headed in the coming years?

Let’s explore some exciting trends and developments that could shape the landscape of decentralized trading.

- Layer 2 Solutions and Scalability

As the crypto space grows, so does the demand for faster and more efficient trading platforms and lower transaction fees.

Layer 2 solutions like rollups and sidechains are emerging to tackle the scalability issues that plague many DEXs.

These could significantly speed up transactions and reduce costs, making DEXs even more appealing.

- Cross-Chain Interoperability

Imagine being able to trade assets across different blockchains seamlessly.

This is becoming increasingly possible as new technologies develop to facilitate cross-chain transactions for assets without transferring users’ funds to an exchange.

This could open up a whole new world of trading pairs and liquidity pools.

- Regulatory Developments

As decentralized crypto exchanges gain popularity, they’re also attracting the attention of regulators.

How governments choose to approach DEXs could significantly impact their growth and user adoption.

It’s a space to watch closely, especially for those concerned about anti-money laundering, compliance, and legality.

- User Experience Enhancements

As competition heats up, DEXs use their investments to improve their user interfaces, educational resources, and customer support.

The aim?

To make decentralized trading as straightforward and accessible as possible, even for crypto newbies.

In a nutshell, the future of decentralized exchanges looks promising, filled with technological advancements and these exchanges may be up for mass adoption.

However, it’s a rapidly evolving landscape, and staying informed is key.

Ready to dive deeper?

Stick around for more insights and updates on the world of decentralized trading.

Conclusion

Alright, you’ve made it to the end, and by now, you should have a comprehensive understanding of what decentralized exchanges are all about.

From their inner workings to their advantages and limitations and even a glimpse into their future, we’ve covered it all.

So, what’s the takeaway?

If you value security, control, and privacy in your financial transactions, DEXs offer a compelling alternative to traditional centralized exchanges.

But remember, they’re not without their challenges—liquidity issues, user experience hurdles, and potential smart contract vulnerabilities are all factors to consider.

Looking ahead, the future of DEXs seems bright, with technological innovations and regulatory developments poised to shape the landscape.

Whether you’re a seasoned trader or a crypto newbie, decentralized exchanges offer exciting opportunities for everyone.

So, are you ready to take the plunge into the world of decentralized trading?

Your next step could be as simple as choosing a popular DEX and giving it a spin.

Happy trading, and as always, stay informed and stay safe!