If you’ve dabbled in DeFi, you’ve likely heard the term “liquidity pools,” but what exactly are they, and how do they work?

As someone who’s been navigating the crypto space for a while, I understand that these concepts can seem complex.

That’s why I’ve put together this comprehensive guide to break down the mechanics of liquidity pools in decentralized crypto exchanges.

Understanding Liquidity Pools

So, you’re intrigued by the concept of liquidity pools and want to know why are liquidity pools important?

Perfect, you’re in the right place.

Let’s start by breaking down what liquidity pools are and understand the part liquidity pools play in removing the problem of low liquidity, then delve into their key components.

Definition

First things first, what exactly is a liquidity pool?

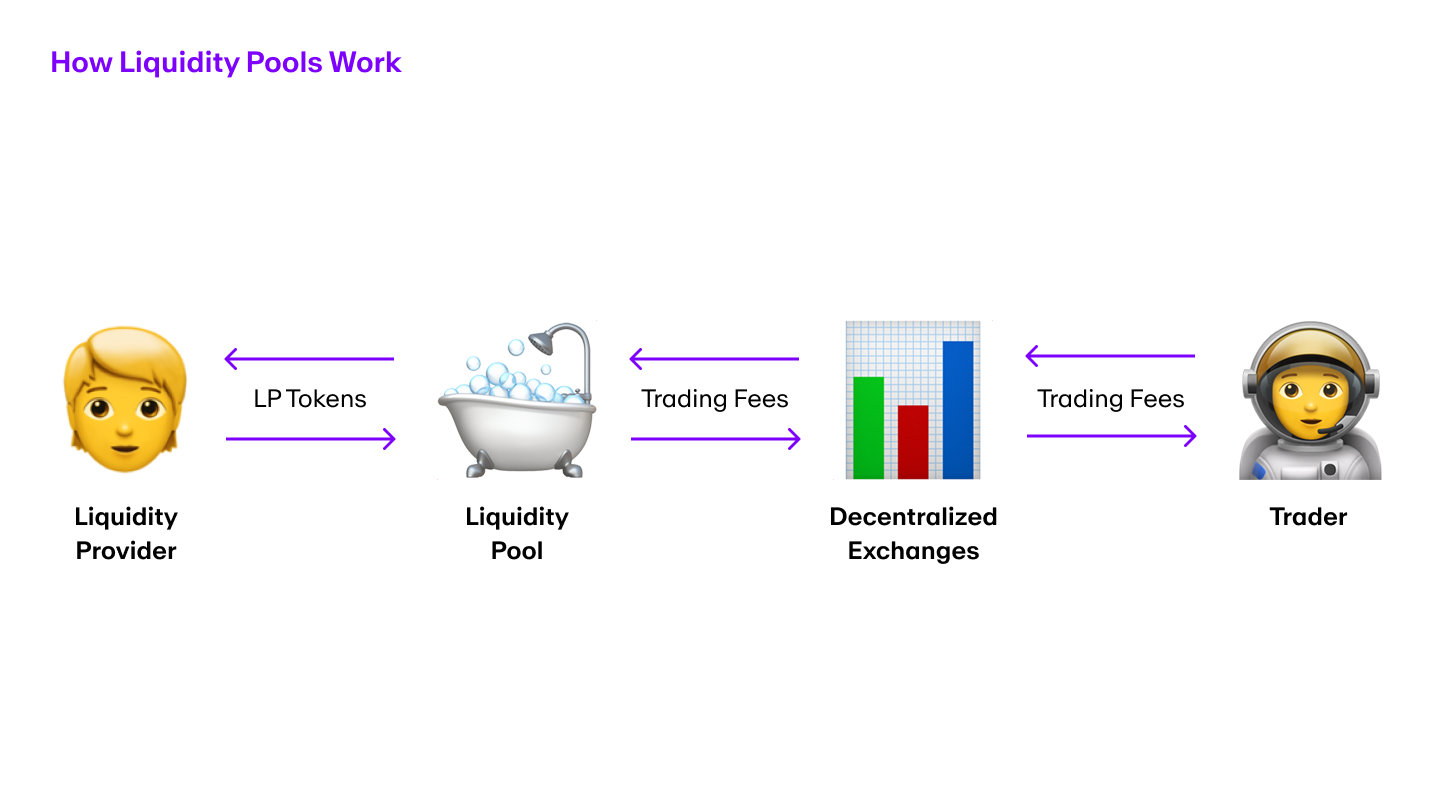

In simple terms, a liquidity pool is a smart contract-based reserve of funds that facilitates trading by providing liquidity to a decentralized exchange (DEX).

Liquidity pools also provide the service Unlike centralized exchanges that rely on order books to match buyers and sellers, liquidity pools eliminate the middleman and enable instant, on-chain trading.

Intrigued?

Well, it gets even more interesting.

Recommended Read: What is liquidation in crypto trading?

Components of Liquidity Pools

Now, let’s talk about the nuts and bolts—the components of a liquidity pool.

Essentially, a liquidity pool consists of two main parts:

1. Reserve Assets: These are the actual cryptocurrencies that give liquidity to the pool. Typically, a liquidity pool will contain two different tokens to facilitate trading between them. For example, a pool might contain both ETH and USDC.

2. Smart Contracts: These are the automated, self-executing contracts that govern the pool and pool tokens. They handle the trading logic, fee distribution, and other rules of the pool. Smart contracts make it possible for liquidity pools to operate without the need for intermediaries.

Liquidity pools provide a backbone to decentralized exchanges, providing enough liquidity for traders while offering an opportunity for liquidity providers to earn fees in exchange for providing liquidity.

How much do liquidity providers earn, you ask?

Well, the earnings of liquidity providers can vary widely depending on several factors, including the specific platform, the total value locked (TVL), the trading volume, and the fees charged by the platform.

Functioning of Liquidity Pools

Alright, you’ve got the basics down, but how do popular liquidity pools actually function?

What makes them tick?

Trust me, it’s simpler than it sounds.

Automated Market Makers (AMMs)

AMMs are algorithms that set the price of tokens within a liquidity pool.

Unlike traditional exchanges that use order books, AMMs enable instant trades by setting prices according to a mathematical formula.

This formula usually depends on the ratio of assets in the pool.

AMMs are the engine that powers liquidity pools, allowing for quick and decentralized trades of your digital assets.

Adding and Removing Liquidity

So, how do you get involved?

Liquidity pools are created when users lock their cryptocurrency into smart contracts, allowing users to deposit pool tokens on the DEX.

If you’re interested in becoming a liquidity provider, you will need to deposit liquidity pool tokens to a pool.

This usually involves depositing an equal value of both tokens that make up liquidity in the pool.

For example, if you’re contributing to an ETH/USDC pool, you’ll deposit both ETH and USDC stablecoins.

This locks your digital assets into a pool, and a portion of the fees that are generated from trading activity is used to pay investors who have invested in the pool.

In return, liquidity providers get what are called liquidity tokens, which represent your share of the pool.

But what if you want out?

Removing liquidity is just as straightforward.

You’ll simply return your liquidity tokens to the pool and withdraw your proportional share of the reserve assets.

Why is this important?

Adding and removing liquidity allows you to actively participate in the DeFi ecosystem, either by facilitating trades and earning fees as a liquidity provider or by seamlessly trading assets as a user.

Understanding these aspects will not only make you a more informed trader but also open doors to new opportunities in the peer-to-peer trading DeFi space.

Recommended Read: How to calculate crypto futures liquidation price?

Benefits of Liquidity Pools

So you’ve grasped how liquidity pools work, but you might be wondering, “What’s in it for me?”

Great question!

I knew I liked you for a reason.

Liquidity pools offer a range of benefits, from constant liquidity to earning opportunities and more.

Let’s dive in.

- Constant Liquidity

One of the biggest advantages of liquidity pools is that they provide constant liquidity in DeFi exchanges.

This means you can trade assets at any time without having to wait for a matching buyer or seller.

Sounds convenient, right?

It is.

This constant liquidity is especially beneficial to support trading for less popular or newer tokens that might not have a high trading volume on traditional exchanges.

- Earning Opportunities

If you’re a liquidity provider, you stand to earn a portion of the trading fees generated by the pool.

These fees are usually distributed proportionally based on your share of the liquidity pool.

This offers a way to earn passive income on your crypto assets, which is always a plus in my book.

- Decentralization and Censorship Resistance

Because liquidity pools operate and are governed by smart contracts on a decentralized network, they resist censorship and centralized control.

This means that, theoretically, anyone can create a typical liquidity pool or trade assets if they deposit their digital assets and write a smart contract, without the need for approval from a central authority.

Feeling empowered?

That’s the beauty of decentralization.

A liquidity pool is a collection of benefits: it ensures constant liquidity, provides earning opportunities, and upholds the principles of decentralization and censorship resistance.

Whether you’re a trader looking for more flexibility or an investor seeking new avenues for income, liquidity pools are an essential part of your journey.

Challenges and Risks Of Liquidity Pools

Alright, so we’ve covered the good stuff, but what about the challenges and risks?

Let’s try to answer the question of ‘Are liquidity pools safe?’

Let’s get into it.

- Impermanent Loss

Ever heard of impermanent loss?

If not, you’ll want to pay close attention.

Impermanent loss occurs when the price of tokens within a liquidity pool changes after you’ve deposited them.

This can result in fewer returns compared to simply holding the tokens in your wallet.

Confused?

Don’t worry.

It’s a complex topic, but understanding impermanent loss is crucial if you’re considering depositing money in one, in which case you will be called liquidity providers.

Let’s say you decide to provide essential liquidity to a pool on Uniswap that trades ETH and USDC.

You deposit 1 ETH and its equivalent in USDC, which is $2,000 at the time of deposit.

So, you’ve contributed 1 ETH and $2,000 USDC to the pool.

Now, imagine the price of ETH skyrockets to $4,000.

In a liquidity pool, the product of the two assets should remain constant.

As the price of ETH rises, arbitrageurs will buy ETH from the pool and sell USDC until the ratio balances out.

This means the pool might end up with, say, 0.8 ETH and $2,500 USDC.

If you decide to withdraw your liquidity at this point, you’ll get back the 0.8 ETH and $2,500 USDC.

If you had held onto your 1 ETH, it would now be worth $4,000.

But instead, you have 0.8 ETH worth $3,200 and $2,500 USDC, totaling $5,700.

While you’ve made a profit in dollar terms, you’ve experienced impermanent loss in terms of ETH holdings.

- Smart Contract Vulnerabilities

Smart contracts are the backbone of any crypto liquidity pool, but they’re not infallible.

If there’s a bug or vulnerability in the smart contract, just like centralized exchanges, it could be exploited, leading to a loss of funds for liquidity providers and traders alike.

Concerned? You should be.

Always make sure to use pools that have undergone rigorous security audits.

- Concentration of Assets

When you deposit your crypto tokens into a liquidity pool, you essentially lock them up.

This can be risky if most of your portfolio is concentrated in a single decentralized liquidity pool or a couple of pools.

Why?

Because if something goes wrong—like a smart contract failure or a sudden price drop—you could face significant losses.

Sometimes, when the exchange does not want to go the route of liquidity pools, they choose to have “protocol-owned liquidity”.

Instead of making liquidity pools available, the exchange allows users to sell their crypto in exchange for its discounted protocol token.

Popular Platforms Utilizing Liquidity Pools

So, you’re sold on the concept of liquidity pools, and you’re itching to get started.

But where should you go?

Don’t worry.

I’ve got you covered.

- Uniswap

First on our list, Uniswap is often considered the pioneer in the decentralized exchange space.

What makes it so special?

Uniswap is a decentralized ERC-20 token exchange and uses an automated market maker model, eliminating the need for an order book, which liquidity pools serve to do.

This makes the trading process incredibly smooth.

It also has a governance token, $UNI, which allows the community to vote on various protocol upgrades and changes.

The platform is open-source, and its smart contracts have been audited multiple times, enhancing its security profile.

Still not convinced?

Uniswap also offers a high degree of decentralization, meaning no single entity controls the platform.

- Sushiswap

Sushiswap started as a fork of Uniswap but has since evolved into a full-fledged DeFi ecosystem.

What’s the big deal?

Beyond the basic swapping functionality, Sushiswap offers a range of products like SushiBar, where you can stake $SUSHI tokens to earn more $SUSHI, which is also called yield farming.

It also has Onsen, a program that incentivizes liquidity provision for selected pairs, and Kashi, a lending and margin trading platform.

The platform is governed by its community through the $SUSHI token, making it a decentralized endeavor.

- PancakeSwap

PancakeSwap is the Binance Smart Chain’s answer to Uniswap.

It offers much lower transaction fees, making it accessible for smaller investors.

PancakeSwap is not just a simple swap platform; it also offers features like Pancake Lottery, NFTs, and team battles.

It has its own governance token, $CAKE, which can be staked to earn additional rewards.

- Curve Finance

Curve Finance is a bit different from the others.

It focuses on stablecoin trading, offering extremely low slippage and fees.

This is a big deal for institutional traders and anyone dealing with large volumes.

Curve also has pools that support wrapped Bitcoin and other asset-pegged tokens and trading pairs.

Its governance token, $CRV, can be locked to earn veCRV, which allows you to participate in governance and earn additional rewards.

The platform is highly secure, with smart contracts that leading firms have audited.

Recommended Read: Centralized vs Decentralized Exchanges

Conclusion

So there you have it, a comprehensive look at liquidity pools in the world of DeFi crypto exchanges.

The primary goal of liquidity pools is to facilitate liquidity that is necessary for trading activity in the pool.

Liquidity pools are necessary for decentralized exchanges, in the absence of which all the trading would be without liquidity and quickly grind to a halt.

But remember, while liquidity pools offer exciting opportunities for earning and trading, they’re not without risks.

Do your homework, understand the risks, and choose platforms that have been rigorously audited for security.

So why wait?

Dive in, but always keep your eyes open.

Happy pooling!