Cryptocurrency spread is one of the basic concepts that every trader should know about. Spread represents the difference between two price points.

When trading an asset on a crypto exchange, you won’t always get the price you want to buy or sell an asset for since there is a constant negotiation happening between the buyers and sellers at different price points.

And this plays an essential role in creating a spread.

The spread refers to the difference between the bid and ask price in the order book. However, to help you know more, here is a brief explanation:

What Is Spread In Crypto Market?

Spread is one of the key factors of the trading ecosystem and it applies on all type of trading markets such as spot, margin & futures trading, options etc.

When we talk about market spread, we refer to the price difference between an asset’s current market and the price at which a trader is willing to buy or sell the asset at.

No matter which market you are trading in, the market will have two prices. The first price is offered by the seller, which is called Ask, and the other price is offered by the buyer, which is called Bid.

The difference between the ask price and the bid price is what creates a market spread. This is a common term that you get to hear in different markets apart from cryptocurrencies, such as Forex, CFD trading, and more.

To give you an example, you are willing to buy one Bitcoin at a price of $15,000.

But the seller is not interested in selling at your bid price. Instead, the seller offered an ask price of $17,000. Now there is a $2000 gap between both offers.

However, this works in a bit different way for the crypto market. Since, in a crypto exchange, there are thousands of traders performing exchanges constantly, the market spread concept isn’t as simple as it may sound.

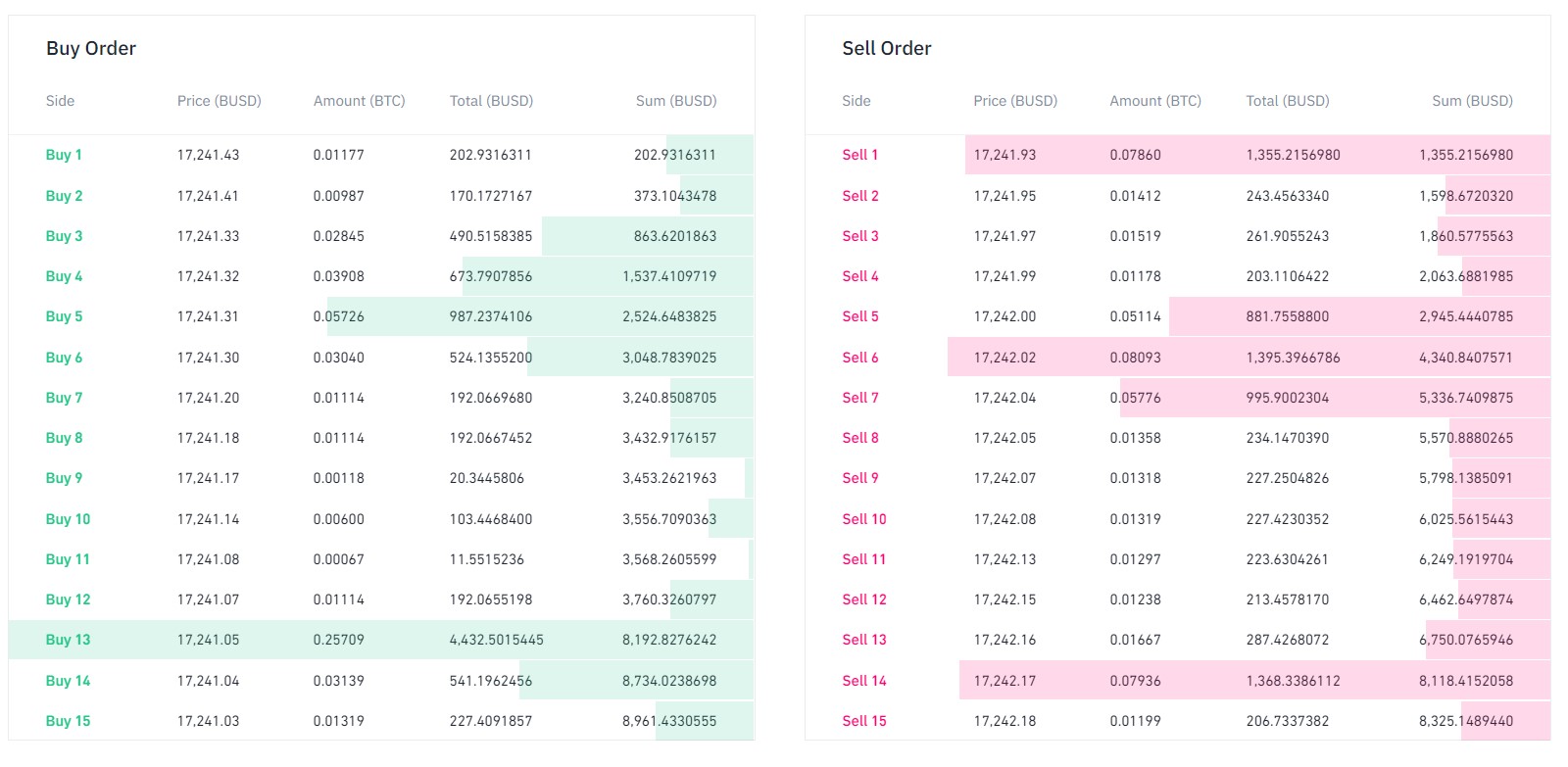

In the order book, you will find thousands of different orders with different Bid and ask prices for an underlying asset.

Now talking about the spread is calculated between the traders with the lowest asking price and the highest bid prices.

Also, the lowest asking price is applied to a short position. On the other hand, the highest bid price is applied to a long position.

Don’t Know what are long and short positions? Learn What does long & short mean in crypto

How Is Spread Calculated In Crypto Market?

Calculating market spread in the crypto market is extremely easy. As all you have to do is subtract the highest selling price from the lowest asking price. And the difference would be your spread.

So the formula stands at:

Market spread = Lowest asking price – Highest Bidding price

Let me share an example, BTC/USD is one of the most traded assets across exchanges. Now on your preferred crypto exchange, if you look at the order book, you will have a list of all buying and selling orders.

Now, if the lowest ask price is, $16934.07 and the highest Bid of BTC/USD is $16933.95.

Then the market spread would be $0.12. However, this is just a raw number, and you will see that the order book’s highest Bid and lowest ask price is constantly changing.

Furthermore, you can also calculate the spread as a percentage. For this, the formula would be:

Market Spread Percentage = (Spread / Lowest Asking Price)*100

During real-time trading, the spread wouldn’t be as huge as in our previous example. Instead, it will be in a fraction of the dollars, as stated above.

Hence, it would be a good idea to calculate the crypto market spread in Percentage to get a better view of the market.

To help with an example, in the above example, we found out the spread value is $0.12. Now for the Percentage, you need to divide the number with the lowest asking price ($16934.07) and then multiply it by 100.

0.12 / 16934.07 = 0.0000070863

0.0000070863 * 100 = 0.00070863%

However, to get a better understanding of this, we would recommend you try it out with real numbers taken from the live market.

Learn Whether crypto futures trading is halal or haram

How Does Spread Impacts Your Buying/Selling or Crypto Strategy?

Many traders think that trading fee is what impacts their trading gains or losses the most. However, the market spread is a bigger threat to them.

If we talk about the spread, if the market has a high spread, then it refers to low liquidity.

Or when the market has a low spread, it means high liquidity. And having an understanding of market liquidity can shape your trading strategy for good.

For instance, you decide to trade in BTC/USD tokens. Now, if BTC’s lowest ask price is, $16,000 and the highest bid price is $15,9000. Then there is a spread of $200.

So if you go with the calculation:

(100 (spread) / 16000 (lowest ask price)) = 0.00625. 0.00625 * 100 = 0.625%

As a result, if you bought Bitcoin for $16,000, you purchased the asset at a 0.625% premium. But if you had waited a while for the market to come down, you would have bought the asset at a fair price.

Now, if Bitcoin’s price moves to $16,100, then you would only make a profit of $100 if you purchased it at $16000. But if you waited and purchased it at a lower price, your profit would have been bigger.

However, a $100 spread is considered a bit risky because you need the market to move significantly to book great profits.

But let’s say the market spread is only $1. Then you would only need the price to move a bit to be in profit.

However, the market spread isn’t the only factor that you should consider while executing a trade. But you can pair it with trading indicators and strategies to place better trades.

Conclusion

So that was all about what is spread in cryptocurrency trading.

Spread is a pretty simple concept to understand. But it can come in handy for determining the market volatility and trading at a better price point.

Also, in some crypto exchanges, you generally find a high spread.

This is because little buying/selling is happening. Hence, to trade better, choose cryptocurrency exchanges with high liquidity.