What Is Crypto & Bitcoin Lending In 2020?

There is an opportunity cost for everything in the world.

When you buy and decide to HODL Bitcoin, there is an opportunity cost involved.

Let say you bought 1 BTC for $3000 and now when you HODL it you are holding 1 BTC which otherwise could have been invested somewhere more to earn interest on it to make it 1.1 BTC.

But some would argue that there are things like crypto trading to make your investment grow from 1 BTC to 1.1 BTC or more…

Yes, of course, there are, but not all are comfortable and used to trading crypto.

Enter Bitcoin lending !!

Everyone knows about lending, and the same concept of lending if applied to Bitcoin makes it as Bitcoin lending. Moreover, in this type of lending, you have your underlying Bitcoin as collateral.

In simpler terms when someone lends their USD or EUR or stablecoins to a borrower on an agreed rate of interest for an agreed duration against their Bitcoin collateral, this is Bitcoin lending.

Similarly, when someone borrows extra cryptocurrencies or USD or stablecoins against their cryptocurrency holdings, it is called Bitcoin borrowing.

Now that you know the introductory part of Bitcoin borrowing and lending let’s dwell into how Bitcoin lending works !!

Bitcoin Lending: How Does Crypto Lending Works?

The working of Bitcoin lending is quite straightforward.

The borrower needs to collateralized his/her cryptocurrencies (Bitcoin) as collateral and as per the agreed rate, duration, and LTV, he/she is issued the crypto loan.

For the lenders also it quite easy as they need to decide to lock-up their funds for the agreed duration of lending as per the agreed rates. This enables them to earn extra interest on their capital that they were just holding previously.

Moreover, there are no rigorous KYC checks or credit history inquiries that undergo before carrying on Bitcoin lending. This is precise because the Bitcoin loans are already overcollateralized as well as the borrowers don’t have a single source of truth that can act as a reliable credit history source.

And when it comes to Bitcoin lending, the process is similar to lending/borrowing any other cryptocurrency. But since Bitcoin is the pioneer cryptocurrency much of the crypto lending market exists around it.

Plus there are better lending/borrowing rates and better LTVs available while using Bitcoin. Moreover, the custodial storage infrastructure is much robust and readily available for Bitcoin in comparison to other cryptocurrencies.

Now, that you know how the Bitcoin lending cycle works, it is indeed imperative to understand the working of Bitcoin lending platforms which facilitate this lending.

So let’s dive into it:

How Do Bitcoin Lending Platforms Work?

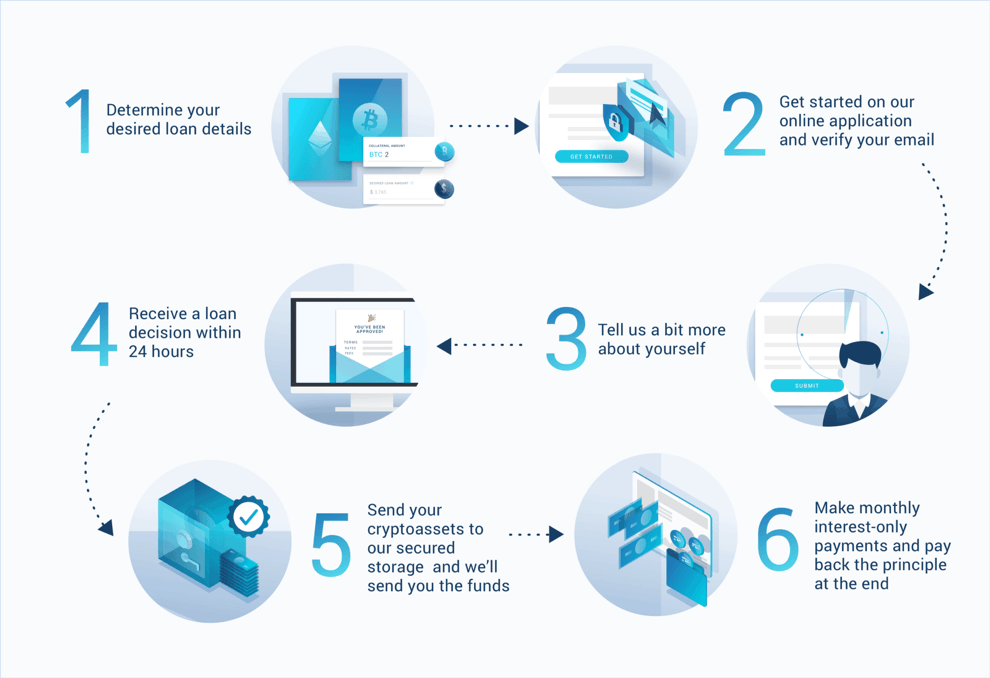

Almost, all Bitcoin lending services work similarly except a few processes that they might follow in-house. But if we generalize, here is a brief insight into their workings:

#1. Of course, first, you need to register with the Bitcoin lending platform using your email.

#2. Then you need to complete their KYC process by submitting relevant photo ID proofs.

#3. Once your KYC is complete, tell them about your loan requirements and submit an application.

#4. Receive a loan decision within 24 hours including the LTV you are eligible for and the rate of interest you will be required to pay.

#5. Now, you can send your Bitcoin to their safe custodial solution.

#6. Once the Bitcoins are settled on the blockchain, you will receive the promised loan amount in your bank account or stablecoins withing 90 minutes.

#7. Keep paying the interest-only payments monthly and pay the principal altogether in the end. Some companies like Nexo, don’t require you to pay the interest also in the beginning and you get the option to pay the whole amount back in the end too.

This is how typically the lending process works inside a Bitcoin lending platform. For more example, see this short video of Nexo lending, where it explains the Bitcoin lending process in three simple steps:

Moreover, these lending platforms are also giving 6-7% interest on deposits that you make with these platforms. For example, Nexo is offering 6.5% interest on the stablecoins that investors deposit with them. The eligible deposit stablecoins are DAI, PAX, USDC, USDT & TUSD.

On the other hand, BlockFi is offering, BlockFi Interest Account (BIA) which is interest-bearing savings account for Bitcoin lenders. You just need to store your BTC or ETH with BlockFi to earn 6.2% compounding annual interest rate on your deposit that you will receive monthly.

Bitcoin & Crypto Lending Regulations

When it comes to regulatory talks around Bitcoin, the situation becomes a bit tricky.

As of now the regulation around Bitcoin is highly fractured and fragmented across the globe and for Bitcoin lending services it is no different.

Many of the Bitcoin lending services are operating only in one or two jurisdictions where there is some regulatory clarity.

For example, BlockFi is operating in 45 states in the USA and is compliant with both the federal and state-level guidelines. Another big player in the Bitcoin lending space, i.e., Nexo claims to be regulated by SEC because they have their native security token. Also, they have different legal entities in different countries as it services 200+ jurisdictions across the globe.

For the rest companies also they are operating in their small arena untill the regulatory framework is set on a global scale.

Country Wise Scenario of Bitcoin Lending

- Bitcoin Lending In The United States (US)

In the U.S., lending is regulated on the state level for non-banks and fintech companies. This regulation is similar to the MSB state-by-state approach used by Bitcoin exchanges. So any crypto lending company which aims to do Bitcoin lending must adhere to this.

- Bitcoin Lending In The UK

Bitcoin lending companies are mushrooming in the UK too and just like crypto exchanges need to comply and obtain a license for FCA, Bitcoin lending companies need to comply with the FCA

- Bitcoin Lending In South Africa

Bitcoin lending is unregulated in South Africa, but Bitcoin itself is allowed. Of course, there are other taxes such as capital gain taxes on Bitcoin in South Africa.

- Bitcoin Lending In India

India is relatively backward in terms of cryptocurrency regulations. In 2018, the RBI severed the relationship between banks and crypto businesses which has led to chaos in the cryptosphere of India. Regarding the lending of cryptocurrencies like Bitcoin too, there is no clarity in the Indian ecosystem. However, you will find some Indian exchanges dealing with margin lending and trading.

- Bitcoin Lending In Australia

Bitcoin lending in Australia is regulated. For example, Helio Lending is a licensed and regulated cryptocurrency lender, based in Australia. This lending service provides holders of Bitcoin a safe and secure way to access fiat funds, without selling any of their Bitcoin. Helio Lending issues loans under an Australian Credit License (ACL #391330).

- Bitcoin Lending In Canada

Canada has been particularly generous towards Bitcoin-like cryptocurrencies, and that’s why you will find Bitcoin lending services like Ledn operating from Canada.

Bitcoin & Crypto Lending Risks

Bitcoin lending has many risks to start with but they dwarf the advantages, and that’s the reason you have many companies starting-up in this space.

But the main risk of Bitcoin lending is about custody.

There are not many reliable custodial solutions for safely storing Bitcoin and moreover giving someone the custody of your Bitcoin is quite counter-intuitive to many because this goes against the whole ethos of ‘your keys, your coins.’

But anyway, I see it this is the major risk as of now in the Bitcoin lending space.

Bitcoin & Cryptocurrency Lending Challenges

Apart from custody, there are many other challenges that the Bitcoin lending industry needs to address before it can think to go for mainstream adoption. Some of these challenges are:

- Regulatory Unclarity: There is no single international body or regulatory framework to treat cryptocurrencies like Bitcoin. That’s the reason that many lending services are acting in their fractured way in their native jurisdictions.

- Blockchain Is Immature: The blockchain infrastructure is still immature to inculcate a complex business like lending and borrowing. We don’t know who is writing these smart contracts and what’s their authenticity and reliability.

- Volatility: Cryptocurrencies are wildly volatile and the time it takes Bitcoin collateral to change address is enough to move markets 10-20%. This can result in margin calls to the borrowers who have borrowed money by keeping their cryptocurrencies as collateral. And in drastic volatility, the borrower will be expected to increase the collateral or liquidate some of his/her collateral to rebalance the loan. This can result in an unpleasant experience for the borrower who never wanted to sell his/her bitcoins for a loan.

So these are some of the challenges and risks that I perceive that Bitcoin lending space might face in the coming days. Having said that, Bitcoin lending will someday become the predominant form of lending because this is natively peer-to-peer.

Moreover, Bitcoin lending gives credit access to billions of people who don’t have decent credit scores or history with credit bureaus.

So that’s all from TheMoneyMongers in this edition of Bitcoin lending. We shall be back soon with more exciting guides on Bitcoin lending, untill that time, keep learning about the Bitcoin revolution with us !!

If you like this post, do share it with your friends on Facebook & Twitter!

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023

- Best Cardano (ADA) Wallets To Use In 2024 - May 7, 2023

Contents