Are you interested in exploring the exciting and profitable world of crypto Futures trading?

It’s a way for investors like you to capitalize on the cryptocurrency market by leveraging price movements and benefitting from bullish and bearish trends.

By using crypto futures exchanges, you can go long or short on the underlying assets, enabling you to make money in a non-trending market.

It’s important to note that crypto Futures trading involves certain risks due to high volatility, margin calls, and potential liquidation scenarios.

However, with the right trading strategies, skillsets, and effective risk management techniques, overcoming these challenges and achieving consistent returns is possible.

Understanding Crypto Futures Trading

In Crypto Futures trading, you can buy and sell contracts for the future delivery of digital assets like Bitcoin, Ethereum, or other altcoins.

You can take a long or short position on these contracts to profit from the investments.

Key Elements of Crypto Futures Trading:

Contracts: Futures contracts are used to explain the details of the trade, what is being traded, the associated cost, and the expiration date.

Long and Short Positions: When someone goes “long,” they are purchasing a contract with the belief that the asset’s price will increase.

On the other hand, going “short” involves selling a contract in anticipation of a price drop.

Leverage: Traders can utilize leverage to control a larger position with smaller capital, magnifying potential profits while also increasing the level of risk involved.

Margin: Traders must deposit a specific amount of capital, known as margin, to initiate a Futures position.

Additionally, they must maintain a maintenance margin to keep the position open.

Settlement: Contracts can be settled in two ways: physically, which involves the actual delivery of the asset, or cash-settled where the difference between the contract price and the market price is considered.

Market Orders and Limit Orders: Market orders execute at the current market price, while limit orders allow traders to specify their desired price or a better one.

However, they may not be executed immediately if the market does not reach that specified price or better.

Let us take an example of Bitcoin Futures.

In the scenario where Bitcoin is valued at $40,000, and you predict its increase in the upcoming month, they can engage in a long Futures contract for 1 BTC at that price.

If the contract reaches maturity with a price of $45,000, a profit of $5,000 (fees not considered) can be generated.

However, should the price plummet to $35,000 instead, you will face a loss of $5,000.

Factors Affecting Crypto Futures Trading Profitability

Market Volatility: High price fluctuations increase profit potential but also risk.

Example: Bitcoin’s price surged from $20,000 to $40,000 within a few months.

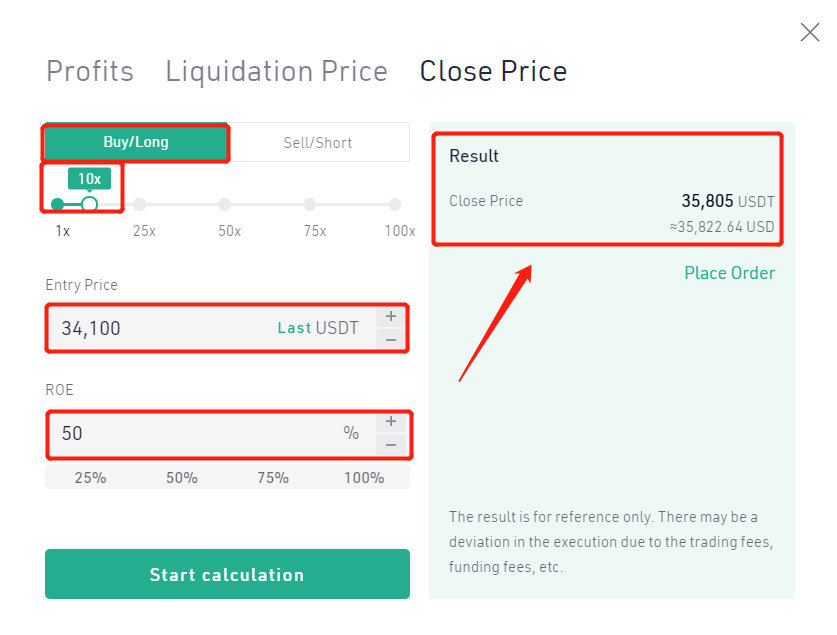

Leverage and Margin: Higher leverage amplifies profits but also magnifies losses.

Example: A 10x leverage turning a 5% gain into a 50% profit.

Market Trends: Riding trends maximizes profits, but mistimed trades lead to losses.

Example: Profits from shorting Ethereum during the 2018 bear market.

Funding Rates: Positive rates benefit longs, while negative rates benefit shorts.

Example: Traders earning funding payments during prolonged uptrends.

Market Sentiment: Positive news can drive bullish sentiment, influencing profitability.

Example: Elon Musk’s tweets impacting Dogecoin’s price movements.

Regulatory Changes: Favorable regulations boost confidence and drive profits.

Example: SEC approving a Bitcoin ETF, leading to increased demand.

Technological Factors: Network upgrades affect usability and influence trading decisions.

Example: Ethereum’s transition to proof-of-stake affects its market dynamics.

Macro-Economic Factors: Global economic events impact crypto markets.

Example: The COVID-19 pandemic caused a market crash followed by a rapid recovery.

Profitable Aspects of Crypto Futures Trading

Crypto Futures trading offers profitable opportunities for investors to capitalize on price fluctuations without owning the actual assets.

Several key factors contribute to maximizing profitability, including:

Leverage Advantage: With leverage, traders can effectively control larger positions while investing a smaller initial amount.

This strategy amplifies the potential gains they may achieve.

For example, with 10x leverage, a $1,000 investment can control a $10,000 position.

A 10% price increase leads to a 100% profit.

Diverse Trading Strategies: Various trading strategies are available, from day trading to trend following.

These strategies enable traders to take advantage of different market conditions.

Hedging Possibilities: You can mitigate the impact of price volatility and minimize risk exposure within your cryptocurrency portfolio.

By employing hedging strategies, you can effectively protect against potential price fluctuations.

For example, a trader holding Bitcoin can short Bitcoin Futures to mitigate losses if its price declines.

Liquidity: In major crypto Futures markets, high trading volume facilitates easy entry and exit for traders.

That enhances the convenience of managing positions effectively.

Notably, you can employ long positions to capture gains during a bullish trend.

Conversely, you can utilize short positions to yield profits in a bearish phase.

As a trader, you can boost your chances of success in the ever-changing realm of crypto Futures trading by understanding and effectively utilizing these profitable aspects.

Non-Profitable Aspects of Crypto Futures Trading

In the fast-paced world of cryptocurrency Futures trading, where profit possibilities are aplenty, it becomes imperative to grasp the potential dangers.

Let us now delve into the less lucrative aspects of this trading practice, shedding light on what demands caution.

Lack of Knowledge and Research: Insufficient knowledge about the market and current trends may result in poor decisions, causing financial losses.

It is essential to thoroughly understand the market and stay updated on trends to make informed choices and avoid unfavorable outcomes.

High Volatility Amplification: When market volatility reaches extreme levels, it can result in margin calls and liquidations, potentially eradicating one’s investments.

This volatility poses a substantial risk to your financial holdings.

Over Leveraging: Excessive leverage significantly increases the risk of losing more than what you originally invested.

This risk is particularly amplified during periods of price swings and volatility.

Poor Risk Management: When you neglect risk mitigation tools like stop-loss orders, the potential for amplified losses in unpredictable markets increases.

Understanding the importance of these tools and their role in minimizing risk is crucial.

Emotional Trading: Allowing your emotions to guide your decisions can result in impulsive trades and compromised judgment.

This tendency may lead to making irrational choices without considering the potential consequences.

Lack of Patience: If you hastily exit due to impatience, you may hinder long-term gains and worsen losses.

Remember, impulsive actions can undermine your progress and accumulate setbacks in the process.

To successfully navigate the crypto Futures market, you must know the non-profitable aspects.

By prioritizing strategic planning and disciplined execution, you can effectively manage risks and increase your chances of achieving profitable outcomes.

Risk Management Strategies

Implementing effective risk management strategies to safeguard your investments and ensure long-term profitability is crucial.

Given the volatile nature of this market, where unpredictable price swings and market fluctuations are common, mitigating risks becomes paramount.

Let’s explore some essential tactics for managing risk:

Position Sizing: To prevent significant losses in adverse market movements, you need to limit the size of each trade relative to your total capital.

This will help ensure that your trades are appropriately sized and manageable.

For example, If you have a total capital of $10,000, consider risking only 2% ($200) per trade to protect your overall investment.

Stop Loss Orders: To minimize potential losses, you should consider implementing stop loss orders that automatically exit a position when the price reaches a predetermined level.

This strategy ensures protection by promptly closing positions and mitigating risks.

For example, set a stop loss at 5% below your entry price. If you entered a trade at $1,000, your stop loss would trigger at $950.

Diversification: You should diversify your investments by spreading them across different cryptocurrencies or assets to minimize the impact of poor performance in a single asset.

This strategy helps reduce the potential risks and ensures balanced returns.

For example, instead of putting all your funds into a single cryptocurrency, allocate your capital among Bitcoin, Ethereum, and other major coins.

Hedging: Consider employing Options contracts or taking short positions as hedging strategies to safeguard against potential losses from price declines.

By doing so, you can effectively offset any negative impact and even capitalize on such downward movements in the market.

For example, If you’re holding a long position on a cryptocurrency, you can hedge against potential losses by opening a short position on a related asset.

Risk-Reward Ratio: Before entering a trade, evaluating the potential gains compared to the potential losses is essential.

Your aim should be to achieve a favorable risk-reward ratio, ensuring that potential profits surpass the possible losses.

By assessing these factors diligently, you can make informed decisions and optimize your trading outcomes.

For example, before entering a trade, assess if the potential reward, say 10%, justifies the potential risk of 5%.

Stay Informed: It is essential to stay updated on current news and trends to navigate the market effectively.

Unexpected changes can significantly impact prices, so being well-informed enables you to make timely decisions.

Keeping up with market news and trends is crucial for making informed choices in a rapidly changing environment.

For example, if a major regulatory announcement is looming, you might want to adjust your positions to account for potential market reactions.

Case Studies: Profitability vs. Non-Profitability

Crypto Futures trading has the potential for profitability or lack thereof, which largely depends on several key factors.

We will now delve into various case studies that shed light on both profitable and non-profitable instances of crypto Futures trading.

Case Study 1: Profitable Long Position

In crypto Futures trading, taking a long position implies that you anticipate the price of the underlying cryptocurrency to increase.

For instance, consider a scenario where a trader purchases a Bitcoin Futures contract with a one-month expiration at $50,000 per Bitcoin.

The contract size is 0.1 Bitcoin, requiring an initial margin payment of $5,000.

With a leverage ratio of 10x, the trader can control $50,000 worth of Bitcoin using only $5,000 in funds.

After one month, the price of Bitcoin has surged to $60,000 per Bitcoin. As a trader, you decide to close your position by selling the contract at the prevailing market price.

Let’s calculate your profit from this successful trade:

Profit = (Final Price – Initial Price) x Contract Size x Number of Contracts

Profit = ($60,000 – $50,000) x 0.1 x 1

Profit = $1,000

You have successfully generated a profit of $1,000 from this trade, indicating a 20% return on your initial margin.

This is an exemplary illustration of a profitable long position in crypto Futures trading.

Case Study 2: Non-Profitable Short Position

If you take a short position in crypto Futures trading, it means you believe that the price of the underlying cryptocurrency will decrease.

For example, imagine you sell an Ethereum Futures contract set to expire at $4,000 per Ethereum in one month.

The contract size is 1 Ethereum, requiring an initial margin payment of $4,000.

With a leverage ratio of 10x, you can control $40,000 worth of Ethereum by using only $4,000.

After a month, the price of Ethereum has risen to $5,000 per Ethereum.

You decide to close your position by purchasing the contract at the current market price.

Let’s calculate the loss from this trade:

Loss = (Initial Price – Final Price) x Contract Size x Number of Contracts

Loss = ($4,000 – $5,000) x 1 x 1

Loss = -$1,000

You have experienced a loss of $1,000 from the trade, resulting in a 25% decrease in the initial margin.

This serves as an illustration of an unprofitable short position in crypto Futures trading.

Strategies for Profitable Futures Trading

To achieve profitability in crypto Futures trading, adopt a meticulous approach and employ effective strategies.

Let me share some key strategies that can help you navigate the intricacies of the market.

Trend Following: You need to identify and follow the prevailing trends in the market to make informed decisions.

Use technical analysis tools such as moving averages and trendlines.

These tools can provide valuable insights into market movements.

For example, if the market is experiencing an upward trend, it may be beneficial to consider going long.

Risk Management: Ensure you set concise boundaries for potential losses and secure gains by establishing clear stop-loss and take-profit levels.

It is essential only to invest an amount you can afford to lose in a single trade.

Diversification: To minimize risk, it is advisable not to invest all your funds in a single trade.

Instead, consider spreading your investments across multiple assets.

For example, if you have a bullish outlook on Bitcoin, it would be wise to diversify by considering Ethereum or other altcoins.

News and Fundamental Analysis: Stay informed about the latest news and events that could impact the crypto market.

Take regulatory changes or technological advances, for instance; they can significantly influence prices.

Leverage Wisely: It’s important to consider the impact of leverage on your trading endeavors to enhance your understanding.

While leverage can amplify profits, it also comes with an increased risk of losses.

Therefore, exercise caution when using leverage.

Backtesting: Test your strategies on historical data to evaluate their performance.

This process will allow you to refine your approach and uncover valuable patterns that can boost your profitability.

Adaptability: Always aware of market dynamics and be prepared to adapt your strategies as conditions evolve.

Flexibility is key to seizing emerging opportunities.

Long-Term vs. Short-Term: Consider whether your aim is short-term gains or long-term growth.

Your chosen horizon will determine the appropriate strategy for your endeavor.

Final Words

To sum up, crypto Futures trading offers both potential profits and risks.

It can be profitable to make the correct decisions respecting risk management principles.

Using leverage, analyzing trends, managing risks, and staying informed are vital strategies.

Maintaining a balance between seeking gains and practicing cautious risk management is crucial to successfully navigating this volatile market.