The crypto futures market is volatile.

Hence, risk management becomes a very crucial element of crypto trading.

There are various risk management strategies.

Among them, hedging is one of the top popular ones. It allows the traders to hold onto their positions for a longer time while minimizing their risks.

However, many newbie traders are unaware of what hedging is or how to use crypto futures for hedging.

If the same goes for you, then below you will find a detailed explanation of crypto hedging:

What Is Hedging?

The crypto futures market is extremely volatile.

This helps in creating a continuous chain of price movements, resulting in generating buying and trading opportunities.

You will often find cryptocurrencies moving up and then falling slightly down and then moving up. Or sometimes, the market moves unexpectedly.

To protect yourself from such unexpected market conditions, hedging is a popular risk management strategy that many traders apply to their systems.

Hedging is a pretty simple concept to understand. However, it is an advanced risk management strategy.

In hedging, a trader opens a position on the opposite side of an existing trading position. Or you can say you are taking a trade against your open trading position.

For example, if you have a long position open, you would take a short position if you believe that the market will not perform well and vice versa.

To explain further, if you believe that Bitcoin will move up but for a limited time, there will be a fall, so you keep an existing long position open.

But on the other side, you take another position to short crypto on the exchange.

Now, if bitcoin moves as per your predictions, then you can close your short position taking a slight loss while making a significant profit with your existing long position.

However, if the market moves against you will end up facing a loss in your long position. But since you have shorted the market, you will be able to make a profit with your short position.

The only drawback of hedging is that it limits your profits.

Since you will be taking a loss in one of the two positions. But the other trade will help you to limit your losses as one of the two trades will make you some profit to cover it up.

How To Hedge While Going Long & Short Using Futures Contracts?

The Crypto derivatives market is the perfect market type where hedging can be done.

As Derivative markets like futures and options let the traders buy and sell an underlying asset. One can hedge portfolios to minimize losses.

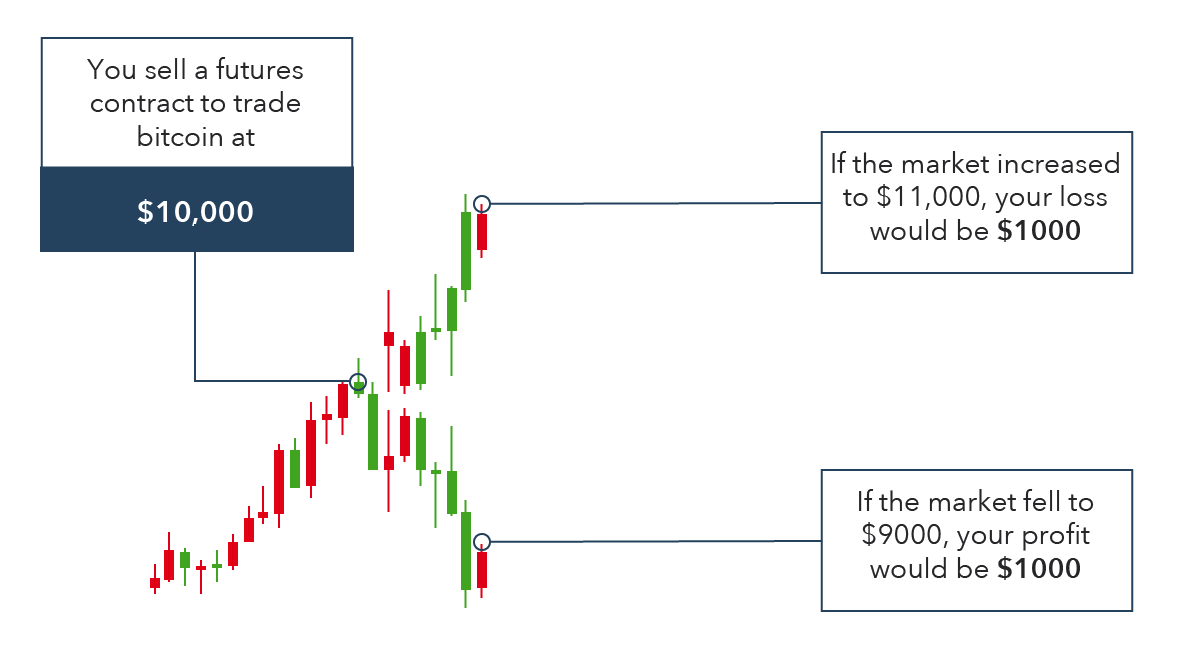

The reason hedging is possible in the crypto derivatives market is when you trade crypto futures, you don’t trade the assets but a contract. There is no need to own, buy or sell an asset. Instead, you buy and sell a contract.

Crypto futures lets you go long and make a profit when an underlying asset’s price goes up. Or go short and make a profit when the underlying asset’s price comes down.

Now we do know that the crypto market is volatile, and often, the market moves on the opposite side of our trade.

So as a crypto futures trader, you have purchased one Bitcoin futures contract at $16,000, and you are hoping that the contract price will move to $17,000, making you a $1,000 profit.

However, all of a sudden, you hear negative news regarding Bitcoin or the crypto industry. For instance, a large crypto exchange made an unexpected exit.

So this means many crypto investors will panic sell and exit from the market and take down the price of all the cryptocurrencies. This will also make the contract price go down.

As a result, you decide to take a short position on Bitcoin’s contract while keeping your long position open. So when the price of the Bitcoin contract price goes down, you will be in profit.

New to trading crypto? Know What is going long and short in a crypto trading?

Although on your long trade, you will face a loss, this is where your short trade will help you to minimize your overall loss.

However, you should know that opening an additional position would come with a cost. If you are trading crypto futures, it will be a trading fee.

Or, if you are trading perpetual swaps which is available on major exchanges like Phemex or ByBit then you are then required to pay a funding fee for both trades along with the trading fees.

To avoid major losses, you should be very clear when you want to hedge. The decision can be made by reading the technical charts or news.

Plus, you should know that the market does make temporary moves to the opposite side of your open positions, so hedging your position might not always be a great idea.

Trying to understand futures contracts? Know What is Crypto Perpetuals & Quarterly Futures?

FAQs:

- Can You Hedge Your Bitcoin Position Using Futures?

Yes, it is possible to hedge your Bitcoin position using futures. Since in futures trading, buying and selling of an asset is allowed.

You, as a trader, need to open a trading position on the opposite side of your existing trade. For instance, if you have a long Bitcoin trading position open, then you need to take a shorting position and vice versa.

- Why Hedge Cryptocurrency Futures?

Hedging cryptocurrency is an effective trading strategy. It allows a trader to hold onto their existing position for a more extended period without taking a significant loss.

For example, if you are planning to hold onto a position in Bitcoin for a few months, then it is normal for the market to move against you during the short term.

In that case, you can hedge the market to make short-term profits and avoid facing a significant loss.

Conclusion

So that was all for what’s hedging and how to use crypto futures for hedging.

Hedging is an effective risk management trading strategy that will help you minimize your risks.

But it also limits your potential gains. So make sure to properly understand the market and its sentiments before you decide to hedge your existing positions to avoid significant losses.

Starting with Futures Trading? Know Whether crypto futures trading halal or haram?