Unlike the crypto spot market, futures trading is entirely a different thing theoretically. Although, the trading process is similar across different trading markets.

But when you trade futures, you don’t really trade your own digital assets. Hence, it is a common question to ask how long you can hold crypto futures contracts.

When we trade crypto futures, we are not trading digital assets. Instead, we are buying and selling a contract, and when the contract ends, you will either book a profit or a loss.

However, to help you understand better, let me share a detailed explanation below:

What Is Expiry In Crypto Futures?

Crypto future is about buying and selling a contract that bonds two parties to buy or sell an underlying asset at a predetermined price and date.

However, these contracts do have a limited lifespan, and after a while, the contract will expire.

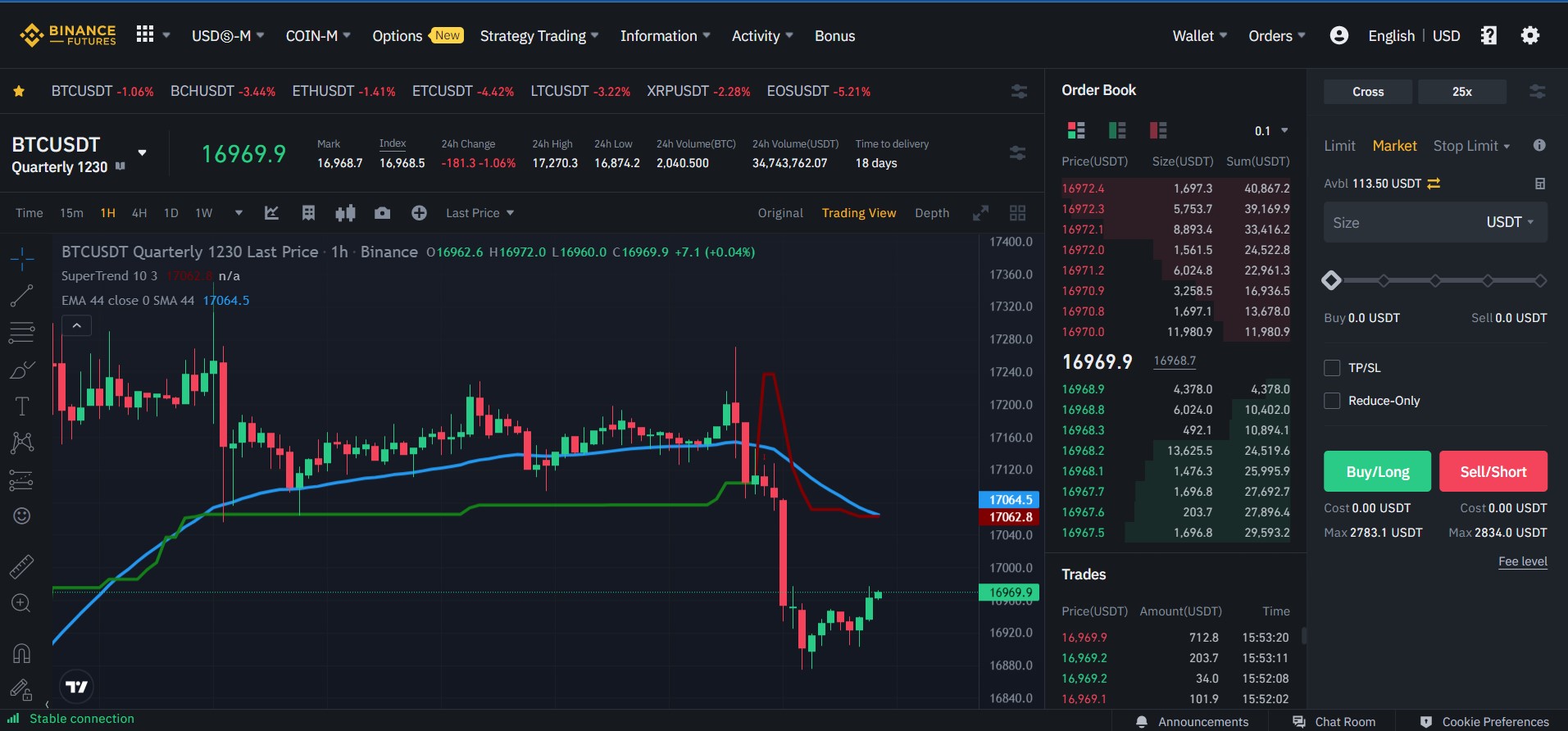

There are different types of futures contracts available in the market that have different expiry dates. For example, one common crypto futures contract would be the Quarterly Futures.

These futures have a lifespan of 3 months upon the date of issuance. Plus, it will have an expiry date which refers to the last date for the contract to be valid.

On or before the expiration date, the traders have the opportunity to make a decision of what they want to do with their contract. Like a trader can either buy/sell the contract to book a profit or renew the contract for another term which is known as the rollover.

However, you should also know that there is one of the futures contracts that does not have an expiry date.

The contract is called perpetual futures or perpetual swaps.

Perpetual Crypto Futures

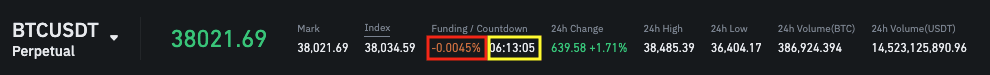

A perpetual contract is a special type of derivative product that does not have an expiry date. This is one of the most popular futures markets preferred by traders.

As it allows them to hold onto their positions for as long as they wish to.

The trading of perpetual contracts is based on an underlying index price. The index price consists of two things: the average price of the asset as per the major spot crypto markets and the relative trading volume.

But you should also know that this contract type does expire but requires no involvement from the trader’s side. In most exchanges like ByBit or Phemex, the contract expires every 8 hours, and upon expiration, the exchange automatically rolls over the position to the next contract.

However, when you carry forward a perpetual swap contract, you have to pay funding fees. The funding fees help in keeping the contract’s price stable.

Also, talking about the funding rate, you can say it is some sort of interest payment to the buyers/sellers. So long position holders pay the short position holders when the funding rate is positive and vice versa.

How Long Can You HOLD Crypto Futures Contracts?

Since crypto futures do have an expiry date, plus, it does not have any involvement in digital asset ownership. One cannot hold their crypto futures contracts for as long as they wish to.

Since derivative contracts or future crypto contracts are divided into several expiration dates throughout the year. You can only hold a crypto futures contract till the time the contract expires.

The expiry period can range anywhere between weekly, bi-weekly, monthly, quarterly, or bi-quarterly. But at the end of the contracts, traders also have the option to roll over their contract to a future date.

When you roll over a crypto futures contract, you are required to sell the front-month contract and then buy a similar contract with a longer time to expire.

All types of futures contracts do expire. However, when you trade perpetual contracts, specifically holding onto your contracts for a longer duration becomes easy.

To know more about Futures contracts, learn the difference between Crypto Perpetuals vs Quarterly Futures

The exchange itself takes care of this. But depending on your position type, you would need to pay funding fees, or you will earn funding fees.

What Is Rollover In Crypto Futures?

Rollover is a common method adopted by crypto traders. It is a move that traders make when they want to move their current position to another month in the future.

If a trader feels that they want to hold onto their Bitcoin futures contract, they simply roll over the contract. The decision comes after looking at technicals, news, or their own analysis or trading strategy.

And when the contract prices reach their desired level, the trader can exit the market to book their desired profit.

The rollover applies to any traditional crypto futures contract that has an expiry date. For instance, if you are trading a monthly or quarterly contract, you will have the option to roll over the contract for another term.

However, when you roll a contract forward, the trader will simultaneously offset his current position and establish a new position in the next contract month.

Conclusion

So how long do crypto futures last? Well, it depends on what exchange and type of contract you are trading. Since a crypto futures contract cannot be held for a long duration.

However, most exchanges like the CME group let you hold a crypto futures contract for six months. But if you are trading perpetual swaps, the longer crypto hold period comes with a fee.

Want to trade on CME? Know What’s CME Gap in Crypto?