When it comes to trading crypto, there are too many options available out there. Among them, two of the popular choices are Binance and UniSwap.

Both these platforms allow you to exchange and trade crypto seamlessly. While the basic functionality of both exchanges remains the same, you will find a lot of differences between these two.

Hence, you may wonder, Binance vs UniSwap, which one should you choose?

To answer this question, I have compared Binance Futures and UniSwap in various key areas below:

Binance vs UniSwap: At A Glance Comparison

Binance stands out as your one-stop solution for every crypto need.

Using the exchange, you can trade in spot, crypto futures and options. Plus, you can enjoy other crypto features like DeFi Staking, Crypto loans, liquidity farming, and so on. Also, it is known as the biggest crypto derivatives exchange by trading volume.

As a result, it offers you deep market liquidity.

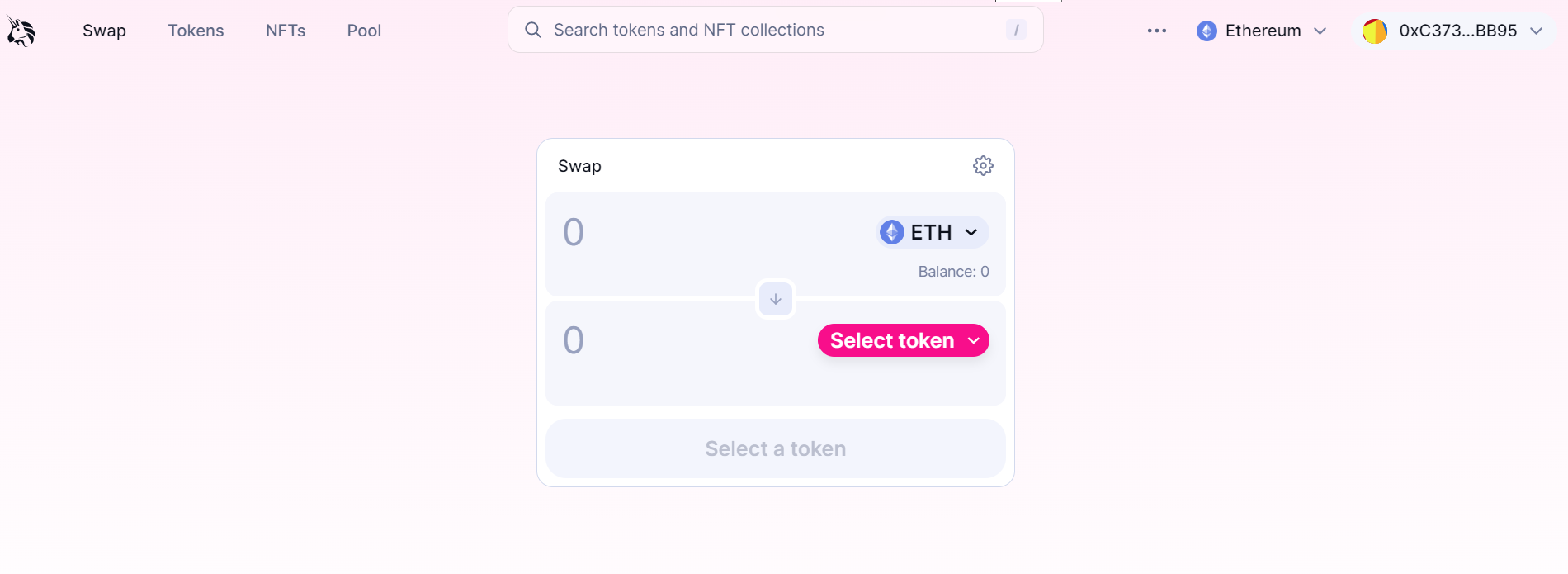

UniSwap is a decentralized cryptocurrency exchange that uses smart contracts to execute trades on the exchange.

It is not like a regular exchange but falls under the category of DeFi products because of the involvement of smart contracts.

On UniSwap, you can swap, earn and build. Plus, you can try out different dAPPS or decentralized apps on the exchange.

Binance vs UniSwap: Trading Markets, Products & Leverage Offered

Both exchanges are far different from each other when it comes to product offerings.

Product Offerings By Binance

- Spot Market Trading

- Margin trading with 10x leverage for isolated & 3x leverage for cross trades.

- USD-M Futures & Coin-M Futures contracts with leverage raging between 1x to 125x.

- European-style Crypto Options.

Product Offerings By UniSwap

Being a DeFi or decentralized finance product, UniSwap cannot act or work as a full-fledged crypto exchange. Hence the product offerings are limited to the following:

- Swap Tokens: Buy, sell, and explore tokens on Ethereum and Polygon blockchains.

- Trade NFTs

- Buy Crypto

- Earn

- dApps

The winner, in this case, would be Binance.

As many people use an exchange for trading crypto, and Binance serves that purpose very well. On the other side, on UniSwap, you can only buy and swap tokens. There is no trading.

Winner: Binance

Binance vs UniSwap: Supported Cryptocurrencies

When it comes to supported tokens, both exchanges support plenty of tokens. And there is only a slight difference between the number of tokens available.

Binance

Binance has more than 500+ supported cryptocurrencies with a mix of both majorly traded crypto tokens and new ones.

Also, the exchange is at the forefront when it comes to releasing new tokens into the market. Some of the popular coins you will find on the exchange are:

- BTC

- ETH

- USDT

- BNB

- USDC

- XRP

- ADA

- MATIC

- DOGE

UniSwap

UniSwap, on the other hand, is low on the number of tokens available. Being a DeFi, it only supports tokens from a few selected blockchain networks. As a result, you can only buy/sell a handful number of tokens that includes:

- DAI

- ETH

- MATIC

- USDC

- USDT

- WBTC

- WETH

As you can see, Binance supports more tokens. Hence it is the winner in this case. On the other side, UniSwap has a limitation on what sort of tokens it can support.

Winner: Binance

Binance vs UniSwap: Trading Fee & Deposit/Withdrawal Fee Compared

Both exchanges have different ways of charging you a fee. On one side, Binance follows a tired fee structure with different levels. Uniswap has a swapping fee.

Binance Spot Trading Fee

Binance has a tired fee structure with different levels. At different levels, you pay different trading fees.

And the level is decided by your last 30 days’ trading volume. So the more you trade, the less you have to pay as the trading fee.

On top of that, you also get a 25% discount on the spot trading fee when you choose to pay the fee using BNB. So the regular fee stands at:

- Maker Fee:1000%

- Taker Fee:1000%

Fee after 25% discount:

- Maker Fee:0750%

- Taker Fee:0750%

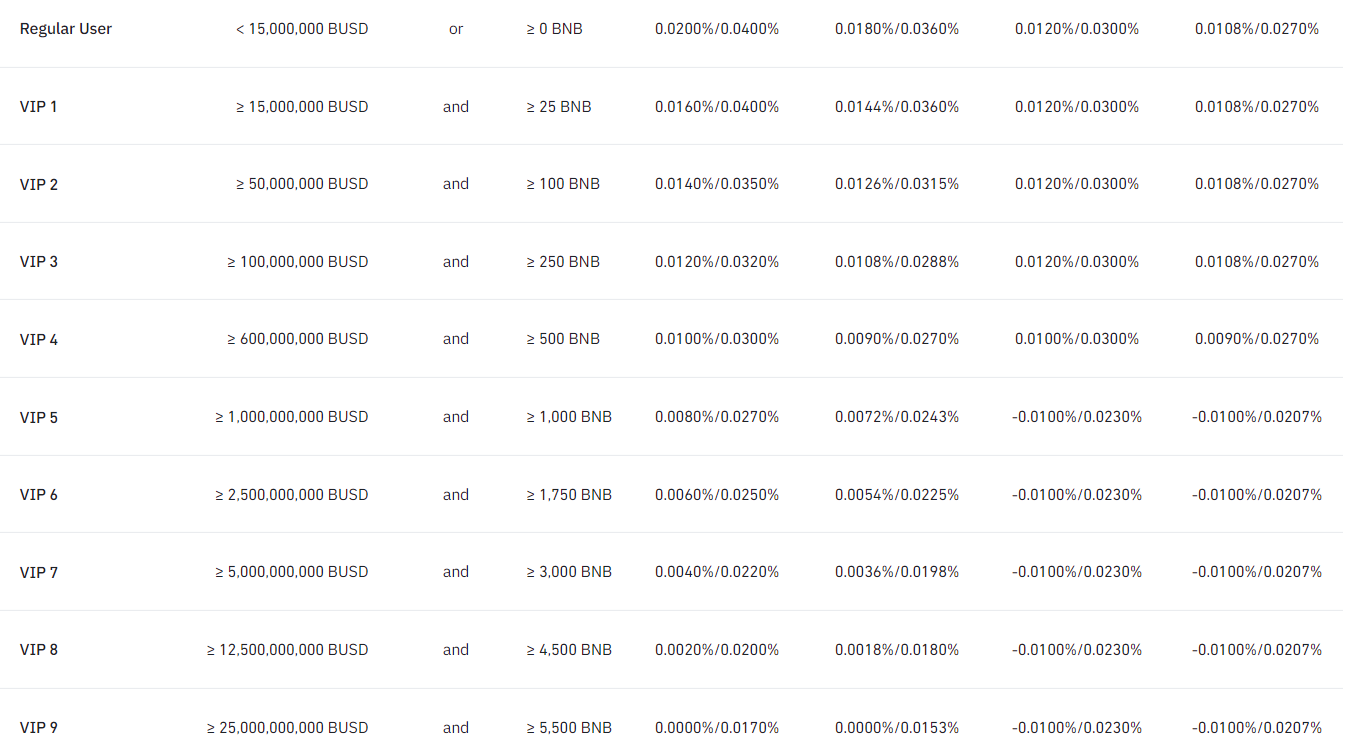

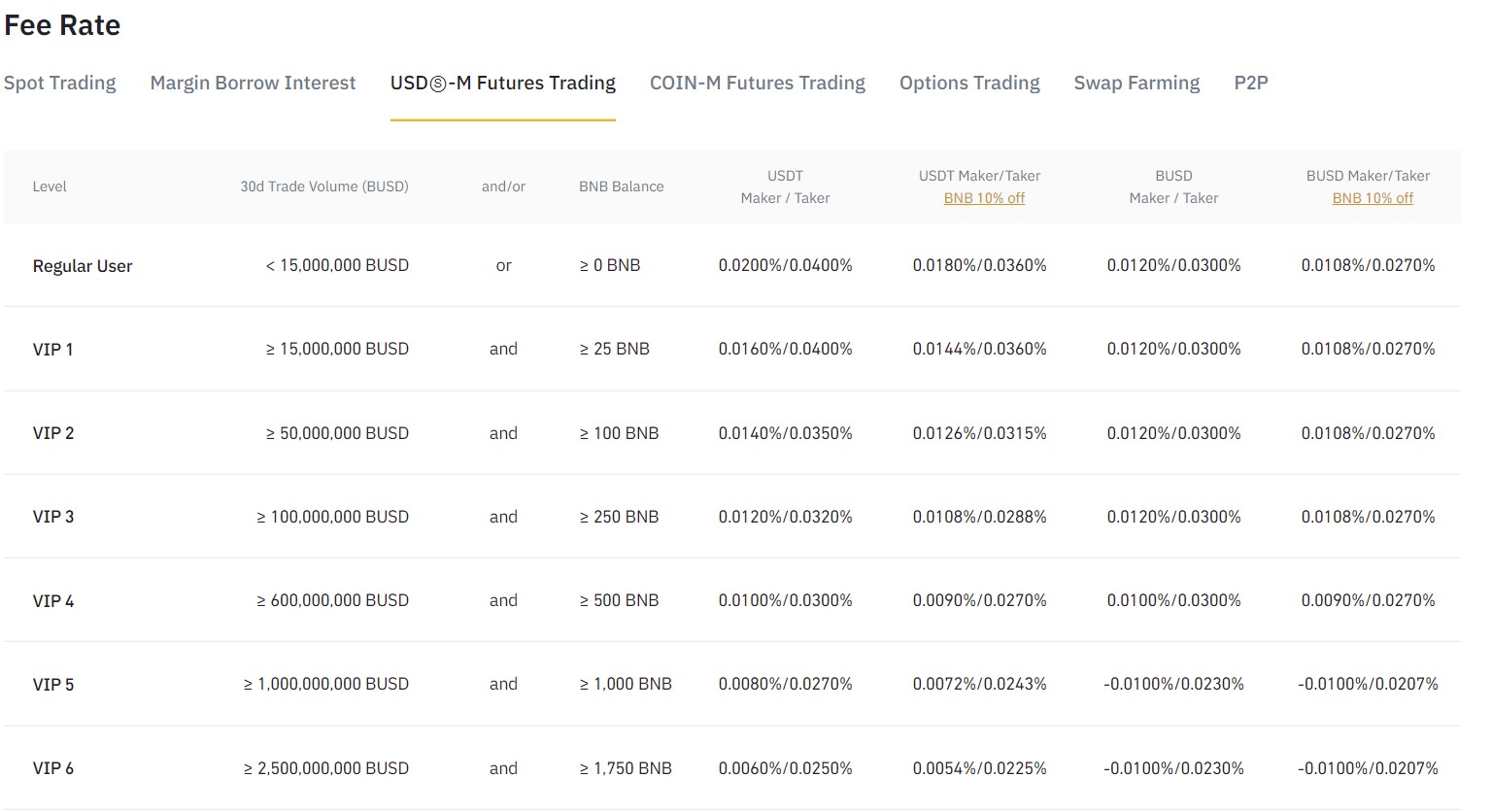

Binance Futures Trading Fee

When it comes to Binance futures trading fees, the exchange charges you differently for USD-M and Coin-M PERP contracts. Also, you get a 10% discount on a trading fee only for USD-M Contracts. So the fee stands at:

USD-M Futures Trading

- Maker Fee:0200%

- Taker Fee:0400%

With 10% BNB Discount:

- Maker Fee:0180%

- Taker Fee:0360%

COIN-M Futures Trading

- Maker Fee:0100%

- Taker Fee:0500%

Options Trading Fee

- Maker Fee:020%

- Taker Fee:020%

Binance Deposit & Withdrawal Fees

Binance doesn’t charge you for deposits. However, depending on your deposit method, you may be charged a transaction fee.

For instance, if you buy crypto using a credit/debit card, you will be subjected to fees charged by the card issuer.

Also, for withdrawal, there is no charge for most of the withdrawal options. But it completely depends on what payment methods you have locally available.

The best part of Binance is that it supports P2P trading. This enables you to deposit and withdraw funds without any fees.

UniSwap Token Swap Fee

UniSwap charges you a 0.3% fee for swapping tokens. The fee is split by liquidity providers proportional to their contribution to liquidity reserves.

UniSwap Buy Crypto Fee

When it comes to buying crypto on UniSwap, you will be subjected to network fees and processing fees. Both these fees depend on what crypto token you are buying and the quantity.

Overall, in this section, Binance is the clear winner. As it has a straightforward trading fee structure and is less expensive compared to UniSwap’s buy crypto option.

UniSwap Deposit & Withdrawal Fees

Unlike other exchanges, you don’t deposit funds to your UniSwap wallet. Instead, you connect your crypto wallet to the exchange.

As a result, you are required to deposit funds into a crypto wallet and withdraw it to some other exchange to cash out. And the whole process would be subjected to a network fee.

Winner: Binance

Binance vs UniSwap: Order Types

When it comes to market order types, Binance is again the winner. Being a full-fledged crypto exchange, you get all sorts of order types that help you enhance your trading experience. On Binance, you get order types such as:

- Limit

- Market

- Stop Limit

- Stop Market

- Trailing Stop

- Post Only

- TWAP

On the other hand, UniSwap is not offering any trading activity. As a result, there is no order type except the basic swapping and buying crypto.

Winner: Binance

Binance vs UniSwap: KYC Requirements & KYC Limits

KYC is made mandatory by Binance. Without verifying your user account, you are not allowed to deposit, trade, or withdraw funds.

But UniSwap doesn’t require you to verify your user account since it is a decentralized exchange.

KYC Limits

On Binance, you have three types of KYC levels with different Fiat limits. These levels include:

- Verified: Fiat limit of 50K USD Daily, and it requires personal information, Govt ID, and facial recognition verification.

- Verified Plus: Daily Fiat limit of 2M USD Daily and it requires proof of address verification.

- Verified Plus: Unlimited Fiat transaction limit, and it requires enhanced due diligence.

As UniSwap doesn’t require you to verify your user account, it is a winner for this section.

Winner: UniSwap

Binance vs UniSwap: Deposits & Withdrawal Options

Both exchanges have different ways of depositing or withdrawing funds.

Binance

- Method 1: Buy crypto using Credit/Debit cards or other locally available payment methods.

- Method 2: Use P2P trading to deposit or withdraw funds.

- Method 3: Transfer crypto to Binance’s wallet from another exchange or wallet.

UniSwap

On UniSwap, you can deposit or withdraw funds in two ways.

- The first one is to use UniSwap with a crypto wallet. So you have to deposit funds to your crypto wallet, which is different for each crypto wallet.

- The other option is to buy crypto using a debit/credit card, and the funds will get deposited straight into your connected crypto wallet.

The winner in this section would be Binance, as it offers you multiple deposit and withdrawal options, including P2P, which make things much easier.

Winner: Binance

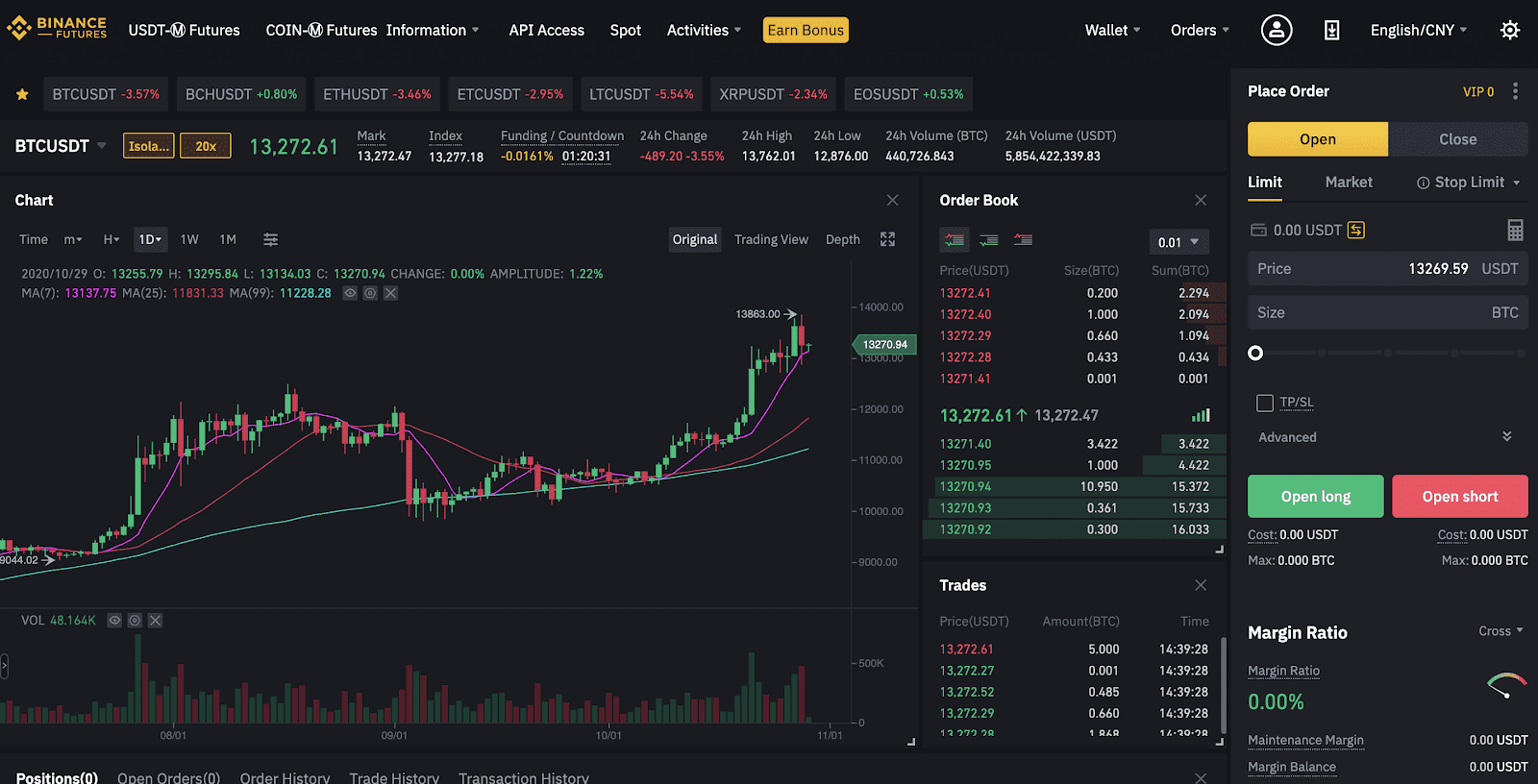

Binance vs UniSwap: Trading & Platform Experience Comparison

Binance, on the one side, is a full-fledged crypto exchange, while UniSwap is a DEX. Hence, there is a huge difference between the trading and platform experience.

Binance

On Binance, you have everything to trade crypto properly. Be it an advanced charting option, order book, order history, leverage, multiple trading pairs, and more.

Some of the key features that can be found on Binance are:

- Order Book

- Multiple charts, including TradingView

- Recent orders

- Trading pair details

- Easy-to-use order menu

- Multiple order types

- Easy-to-use mobile app

To know more about the exchange, you can check this quick guide on how to day trade on Binance.

UniSwap

UniSwap being a decentralized crypto exchange, there is no trading. As a result, you don’t get features like an Order book, leverage, or technical charts. Instead, it allows you to buy or swap crypto with a few clicks only.

Since Binance is rich-in features from the trading point of view, I am declaring it the winner for this case.

Winner: Binance

Binance vs UniSwap: Customer Support

When it comes to customer support, Binance is a better choice. The exchange has made it extremely easy to get help.

You can reach out to their customer support through their chat portal, where you can find both helpful guides and the option to connect with a live support agent.

Alternatively, you can reach out to Binance’s customer support through email or using social media channels like Twitter.

On the other hand, UniSwap isn’t really impressive when it comes to customer support. The only way to reach out to them is by raising a support ticket. There is no email support or support through their social media handles.

As Binance support is quicker and easier to reach out to, it is a winner for this section.

Winner: Binance

Binance vs UniSwap: Security Features

When it comes to security features, Binance offers you tons of options. But the same doesn’t go for UniSwap because it is a completely different platform than an exchange. To talk about the security features, here is what you get:

Binance

- Secure Storage

- Real-Time Monitoring

- 2FA

- Organizational Security

- Advanced-Data Encryption

- Regular Audits

UniSwap

UniSwap uses a crypto wallet for all its operations. So as long as your crypto wallet is safe and secure, there is no way you are going to lose your funds to hackers.

Also, UniSwap doesn’t store any of its users’ funds in their crypto wallet. But it remains on the user’s crypto wallet, which is again protected by 12-digit seed phrases, 2FA, and other security features.

Overall, as there are not so much of differences in security features, I am calling it a tie.

Winner: Tie

Is Binance a Safe & Legal To Use?

Being a global name, Binance takes care of user security extremely seriously.

Also, it has different licenses across globes and performs regular audits. It also keeps a vast amount of users’ funds in cold storage and has never faced a hack attack.

So Binance is definitely a safe and legal platform to trade crypto.

Is UniSwap a Safe & Legal To Use?

UniSwap is completely safe to use. It is more of a way to exchange your existing tokens for another one while you have full control over your funds.

There is no way one can get access to your private keys or funds unless your seed phrase is compromised.

All the operations on UniSwap happen through your personal crypto wallet. So there is no risk of using it.

Binance vs UniSwap Conclusion: Why not use both?

The bottom line is, Binance is the winner.

Since it is a full-fledged crypto exchange, it can be used for both investing and trading purposes.

As well as it offers you a low trading fee and has an extensive list of features like spot trading, crypto margin and futures trading.

But UniSwap is nowhere a loser. It is a decentralized exchange that comes with its own benefits.

But apart from being a DEX, it is a perfect way to build your crypto portfolio if you are an investor. But if you are a trader, UniSwap can’t help you at all.

Check out how Binance & UniSwap compares to other exchanges:

- Binance vs BingX

- Binance vs Kraken

- Binance vs Kucoin

- Binance vs dYdX

- Binance vs Revolut

- Binance vs Bitstamp