Cannot decide between Binance or Revolut? Looking for the best crypto exchange to trade on, or do you want to know about these exchanges in depth?

Don’t worry; I have answers to all your questions.

I will tell you about these cryptocurrency exchanges and compare them on various segments that will help you to choose which among Binance and Revolut will best suit your trading needs.

So without further delay, let’s get started with a glimpse of what these exchanges are known for and how they emerged.

Binance vs Revolut: At A Glance Comparison

Binance

Starting in 2017, Binanceis among the most popular decentralized crypto trading exchange that was originally based in China. Binance is the largest day trading cryptocurrency exchange in the world by trading value.

Binance is available around the globe and offers a designated trading platform for the US market.

The exchange has a user base of more than 120 million.

It is loaded with crypto trading tools and products with additional crypto-related services like crypto loans, liquidity farming, DeFi staking and more.

Revolut

On the other hand, Revolut was introduced in 2015 with an aim of providing a mobile and online banking platform transformed into a full-fledged crypto trading space.

The exchange is available in more than 200 countries worldwide, where you can start trading with just $1.

There are more than 25 million people registered on the platform using the application both on PC and mobile phones.

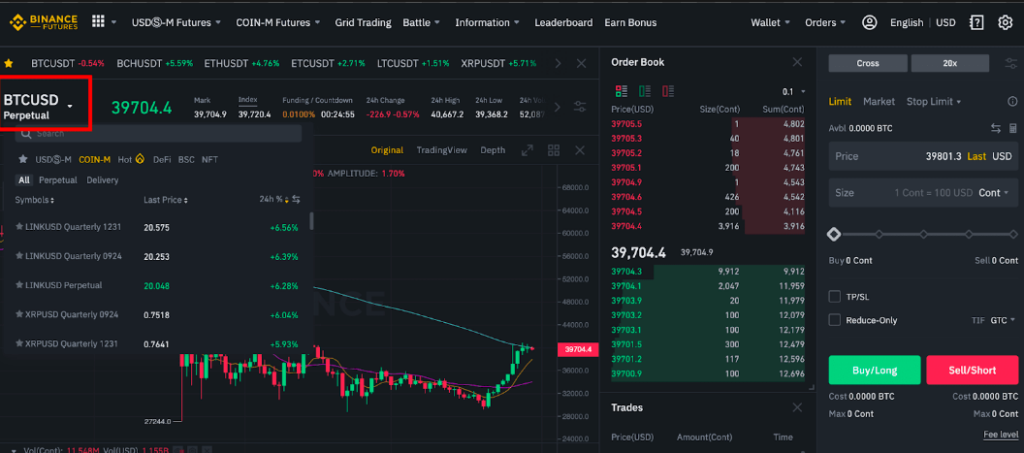

Binance vs Revolut: Trading Markets, Products & Leverage Offered

Binance

Beginning with Binance Futures has a long list of crypto trading products available to trade with; these are:

- Leverage Trading: Up to 20x of maximum leverage available on the majority of the assets.

- Spot Trading: Trade a wide range of assets, including BTC, XRP, ETH, SOL and many more.

- Futures Trading: There are Coin-M and USD-M futures settled in USDT or BUSD.

- P2P Trading: Trade USDT with the lowest transaction fees of <0.10% for all markets accompanying 700+ payment methods.

- Staking: Flexible DeFi staking with up to 6.38% and an additional 1.5% APR.

Revolut

Revolut has a lot to offer as an overall trading ecosystem, like stock and indices, but let’s stick to crypto trading.

- Spot Trading: Buy/sell crypto and send it to friends with a touch of a button with no hidden fees.

- Crypto Staking: Put your crypto to work with earning rewards of up to 11.65% APY.

Verdict: Binance is the better choice if you are looking to diversify your crypto portfolio, as it offers a wider range of crypto trading products with leverage trading capabilities.

Binance vs Revolut: Supported Cryptocurrencies

Now, let’s discuss what the available crypto assets on these crypto exchanges with leverage are.

Binance

Beginning with Binance, the exchange has a long list of available assets, counting to more than a whopping 350 of them; some of the most renowned ones are:

- Binance (BNB)

- Bitcoin

- Ethereum

- Solana

- Litecoin

- Polygon

- Cardano

- Ripple

- Dogecoin

- Shiba Inu

- Cosmos

- Dash

- Link

Revolut

Now coming to Revolut, there are limited crypto assets counting to more than 30, but it has all the popular ones, like:

- Bitcoin

- Ripple

- Ethereum

- Shiba Inu

- Cosmos

- Dash

- Link

Verdict: Binance is for sure the clear winner in this segment, with a lot more crypto assets to choose from than Revolut.

Binance vs Revolut: Trading Fee & Deposit/Withdrawal Fee Compared

Coming to the most important topic, let’s see what trading on these platforms will cost you.

Binance-Trading Fees

Now, starting with Binance, there are two types of fees associated when your trade, which is:

On Binance, when you hold BNB tokens in your wallet, you will receive an exciting flat 25% discount, so if you have a high trading volume, it’s good to go for this option. But the standard fee on the platform is 0.1%.

Deposit and Withdrawal Fees

When it comes to depositing fees on Binance, there are none, but to withdraw, you will be charged certain fees, which is dynamic and depends on the market’s trend.

Revolut

Coming to Revolut, the exchange has a subscription-based fee structure classified under the:

|

Subscription Type |

Subscription Fee | Add Money | Card Transfers | Overall Crypto Fees |

| Standard | Free | Free | live fees here |

1.99% |

|

Plus |

$4.99/month or $36.99/year | Free | live fees here | 1.99% |

| Premium | $9.99/month or

$79.99/year |

Free | live fees here |

1.49% |

|

Metal |

$15.99/month or 139.99/month | Free | live fees here |

1.49% |

Verdict: Binance’s fee schedule is more affordable and structured than Revolut, but it’s up to your choice whether you prefer a subscription-based fee structure with fixed pricing or one depending on your trading.

Binance vs Revolut: Order Types

Now I will let you know what order types you can use to take advantage of market trends.

Binance

Beginning with Binance, this platform comes with various order types, including both basic and advanced ones, that can be integrated with all your trades. Here are all of them:

- Limit Order

- Market Order

- Stop Limit Order

Advanced Order Types

- Stop Market Order

- Trailing Stop Order

- Time Weighted Average Price (TWAP)

- Post Only Order

Joining Binance? Know How to day trade on Binance?

Revolut

- Market Order

- Out of Hours Order

- Limit Order

- Stop Order

Verdict: Binance is undoubtedly better in this segment, with both advanced and basic order types readily available on the platform.

Binance vs Revolut: KYC Requirements & KYC Limits

Coming to KYC requirements, let’s see whether Binance and Revolnut allow anonymous trading or do they mandate KYC.

Binance

On Binance, KYC is mandatory, and as soon as you open an account, you can only trade if your account is KYC-compliant. You can submit the following documents in order to be verified:

- Passport

- Social Security Number

- Voter ID Card

- PAN Card

- Driver’s license or Government issued ID

There are 3 different verification levels on which your trading limits are set which are:

- Basic: $300 Lifetime Buy Crypto and Fiat Deposits/Withdrawal Limit and Max. 0.06 BTC withdrawal limit.

Requirements:

Personal information

- Intermediate: $50,000 Daily Buy Crypto and Fiat Deposits/Withdrawal Limit, Max. 100 BTC withdrawal limit and P2P/Over counter/Binance Card Perks.

Requirements:

Basic Information

Facial Verification

Government ID

- Advanced: $200,000 Daily Buy Crypto and Fiat Deposits/Withdrawal Limit, Unlimited BTC withdrawal limit, and P2P/Over the Counter/Binance Card Perks.

Requirements:

All intermediate requirements

10 days review time

Proof of address

Revolut

Revolut also doesn’t give you an anonymous trading option, and actually, from a trader’s point of view, it is necessary.

As soon as you register a free account, you’ll need to complete the KYC procedures by submitting the following documents:

- Photos of your official government-issued ID, passport or driving license.

- A clear selfie; make sure that there is no glare and that your face is clearly visible.

Binance vs Revolut: Deposits & Withdrawal Options

Binance

Coming to account funding and withdrawal methods, Binance offers all the essential options to withdraw and deposit crypto right on the platform, which are:

- Credit/Debit Cards

- Direct Crypto Transfers

- Wire and Interac Transfers

All of the payment gateways through which your payments go through are the industry’s best and 100% legitimate.

New to crypto trading? Know What is spot and futures trading?

Revolut

On the other hand, Revolut offers all the crucial funding methods as well, which are:

- Debit/Credit Cards

- Inbound bank transfer (only domestic)

Binance vs Revolut: Trading & Platform Experience Comparison

Binance

Coming to the UI and UX, Binance is designed for high-volume trading and comes with advanced trading capabilities with an instant convert section to exchange crypto with ease.

It comes with two charting systems one is Binance’s very own, and the other is TradingView, which is a well-known charting system, quite popular among traders from around the world.

The charting system shows you the real-time trading data with some of the other features readily available on the screen like:

- Order Form

- Order Book

- Depth Chart

- Indicators

- Order Menu

Also, to know more about the exchange you can check this Binance futures trading guide.

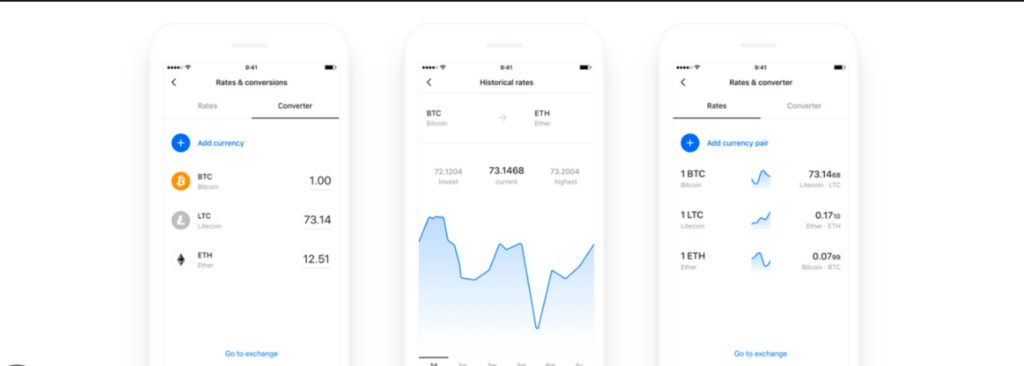

Revolut

On the other hand, the Revolut trading platform offers a better alternative to the traditional exchange with a unique user interface that is designed to be convenient for all its users.

Revolut has an inbuilt charting system that works fine, providing lag-free, precise data. The trading engine is well equipped with a powerful, fast, yet easy-to-use interface.

Binance vs Revolut: Customer Support

Binance

Binance has quite a vast help centre that is filled with FAQ and Learn sections which you can reach out to you anytime you need clarification regarding something or to learn using various tools and features available on the exchange.

Additionally, there is 24×7 virtual chat support as well as you can anytime raise a support ticket and send them an email.

Getting started with Binance? Know How to short Bitcoin on Binance?

Revolut

Similarly, customer support on Revolut is quite good, with a dedicated customer support team available 24×7. You can reach them out via automated phone line and email them anytime; they’ll reach out to you pretty quickly.

Binance vs Revolut: Security Features

Binance

When it comes to security, Binance is not a joke; I said this because security and privacy on Binance is quite rigid, with zero tolerance. The platform comes with the industry’s best security features, which include:

- Regular Audits

- Advanced-Data Encryption

- Real-Time Monitoring

- Multi-Factor Authentication

- Organisational Security

- Secure Cold Storage

Revolut

On the other hand, Revolut is an FCA-regulated platform. It stores and processes your private details utilising third-party servers that are shielded by firewalls limiting access of any kind other than the user.

Additionally, all data passed between the mobile apps, servers, and third parties are all SSL encrypted, making sure optimum security of the exchange.

Is Binance a Safe & Legal To Use?

The most subtle answer to this is that, yes, Binance is undoubtedly the safest platform in the stream. It is regulated by various reputed authoritative boards from around the world.

The user base and popularity of this exchange are proof that this exchange is going nowhere. Adding more to it is that it has state-of-the-art security features and FDIC insurance, which makes it just unbeatable in the market.

Is Revolut a Safe & Legal To Use?

Safety and legitimacy are not at all a question on Revolut; the exchange is regulated and is FDIC insured as well.

The exchange offers cold storage capabilities with state-of-the-art encryption capabilities by default, so you know your crypto is safe with Revolut.

It has a foolproof track record with top-notch security features making this exchange a completely legitimate and safe platform.

Revolut vs Binance Conclusion: Why not use both?

Both Revolut and Binance are among the most popular choices in the cryptosphere, offering unique and feature-rich trading interfaces.

But when it comes to choosing the best crypto platform for you, the decision lies solely on your trading needs.

If you are a beginner to the cryptosphere looking for basic crypto trading or solely are looking for just a spot trading compatible exchange to trade on a mobile phone, then you can choose Revolut.

The crypto staking rewards and all the crucial order types are just what you’ll need.

On the other hand, if you are looking for an advanced trading platform that comes with the best charting system and a varied variety of crypto assets as well as products, then Binance is the best choice for you.

So, without any further doubt, explore these platforms and start trading today.

See how Binance & Revolut compares to other similar crypto exchanges:

- Binance vs Bybit

- Binance vs Phemex

- Binance vs KuCoin

- Binance vs Bibox

- Binance vs BitMEX

- Binance vs Bitso