Cryptocurrency exchanges, especially derivatives exchanges, are incredibly generous in offering leverage to traders. One such exchange is BitMEX. BitMEX offers leverage on almost all its products, with the leverage being higher for derivatives.

However, if you’re a new trader, you may not be familiar with the concept of leverage and how it works. Though leverage is no less than a gift for traders, misusing it can lead to detrimental results.

Here’s a complete guide to leverage trading on BitMEX and how to use it properly.

What Is BitMEX Leverage?

Leverage refers to the funds you can borrow from the exchange to trade cryptocurrency assets. The exchange or broker lends you funds to place a trade and takes back those funds after you exit the trade. The trader gets to keep all the profit.

BitMEX offers up to 100x leverage on its trading products. The available leverage varies from product to product, and we’ll come to that in a second. But first, let’s understand what BitMEX leverage is.

Suppose you have $1,000 in your trading account, and you want to buy BTCUSD perpetual futures. If you choose 100x leverage, you can take a position 100 times your trading amount. Hence, you can place an order worth 100,000.

Now, suppose the position you take moves 1% in your direction. Let’s calculate the profits. If you traded without leverage, your profit would be 1% of $1,000, which is $10.

However, if you traded with 100x leverage, your profit would be 1% of $100,000, which is $1,000. As you can see, using 100x leverage in trading means you can multiply your profits by 100%.

However, using leverage also increases your exposure to loss. If you trade with $1,000 and the position moves 1% in your direction, you’ll lose only $10. But if you use 100x leverage, the loss will be $1,000, and you’ll blow up your entire account.

Hence, it’s crucial to use leverage properly.

The leverage provided by BitMEX depends on the underlying asset. For instance, it offers 100x leverage on BTC and ETH perpetual and regular futures. The maximum leverage is 50x for XRP and BCH contracts and 33.33x for ADA contracts.

The lowest leverage is 20x for AVAX and SHIB futures.

How Does BitMEX Leverage Work?

Having discussed what BitMEX leverage is and how it affects your profits and losses, let’s delve into how it works.

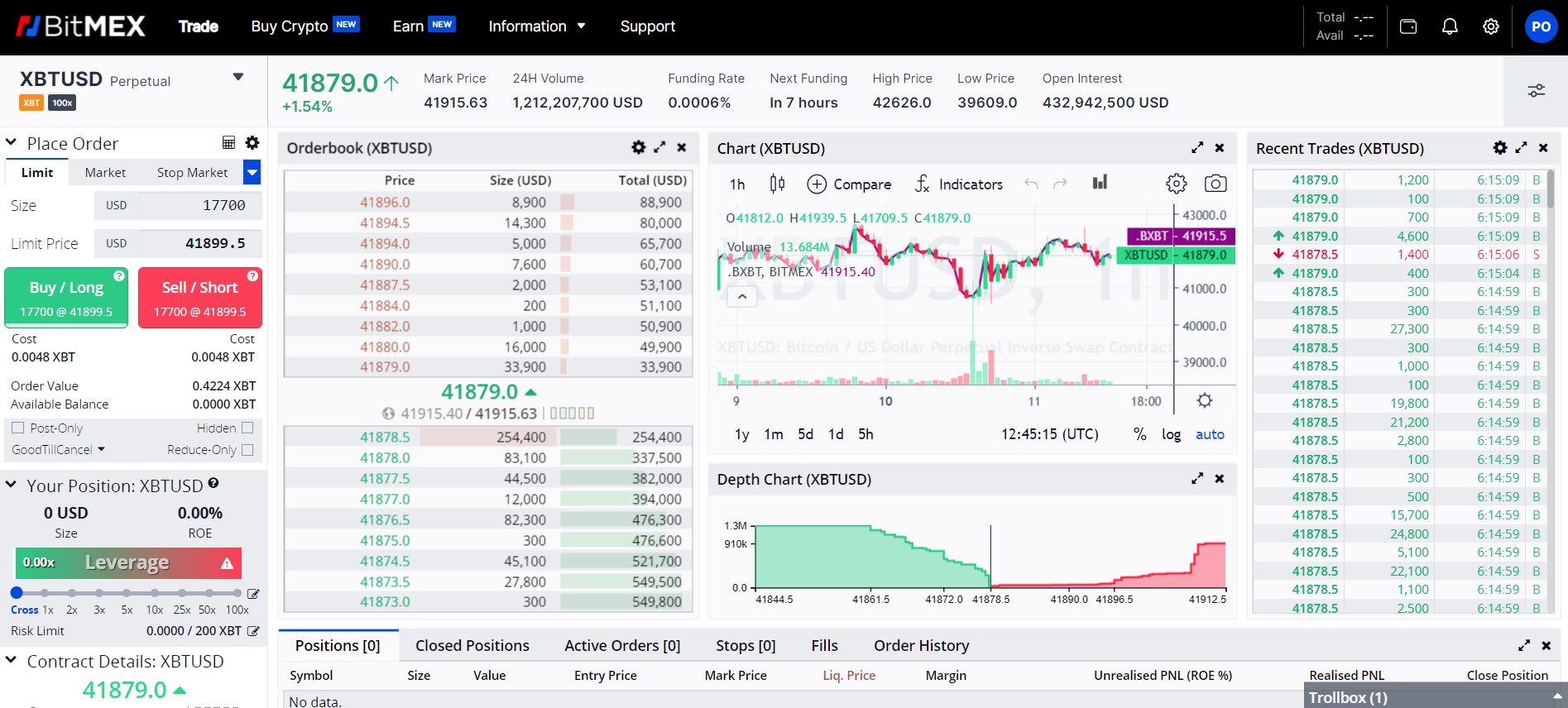

BitMEX allows you to adjust leverage from the order form itself. When placing an order, you can select the leverage you want to use. The order form has a Margin Options section where you can use the dragger to choose the leverage you want to use.

Apart from selecting the leverage, the process of placing an order is the same. You need to choose the market and contract, quantity, price, and order type. Once you fill the order form, you need to place a buy or sell order.

Please note that the maximum leverage you can use depends on your isolated and cross margin. If you’re new to these terms, stay tuned, as the next section talks about them.

Understanding Isolated & Cross Margin

Before delving into the concept of margin, let’s understand the difference between margin and leverage, as many traders confuse both terms.

Margin refers to the percentage of the total order amount you should have in your trading account in order to execute a trade. Leverage, on the other hand, is the funds you can borrow on your initial margin.

Here’s an example for your better understanding. Let’s suppose the required initial margin is 2% of the total order amount, and the needed maintenance margin is 1% of the total position.

If you have $1,000 in your BitMEX account, you can use up to 100x leverage and take a position of $100,000. But since the required initial margin is 2%, you need at least 2% of $100,000 — $2,000 — in your trading account to execute the order. Also, since the maintenance margin is 1%, you’ll need to have at least 1% of $100,000 — $1,000 — in your trading account after the order is executed.

The margin in cryptocurrency trading is of two types:

Cross Margin: If you choose cross margin, the margin is shared between all your open positions with the same settlement cryptocurrency. So, if you have two positions: BTCUSDT and ETHUSDT, cross-margin will be applicable.

Isolated Margin: If you choose the isolated margin, the margin will be separate for each position.

If you’re a beginner, it’s better to choose the isolated margin, as choosing the cross-margin could affect your other positions.

How to Use Leverage in BitMEX Trading?

Now that you have understood how leverage works and what the margin requirements are, let’s look at a step-by-step procedure of using leverage in BitMEX trading. Follow these steps:

Open an Account

If you haven’t yet opened a BitMEX account, create an account first. It’s free, and it only takes a few minutes. Please note that BitMEX has mandatory KYC requirements, so you’ll need to verify your identity first. The KYC process could take a couple of days.

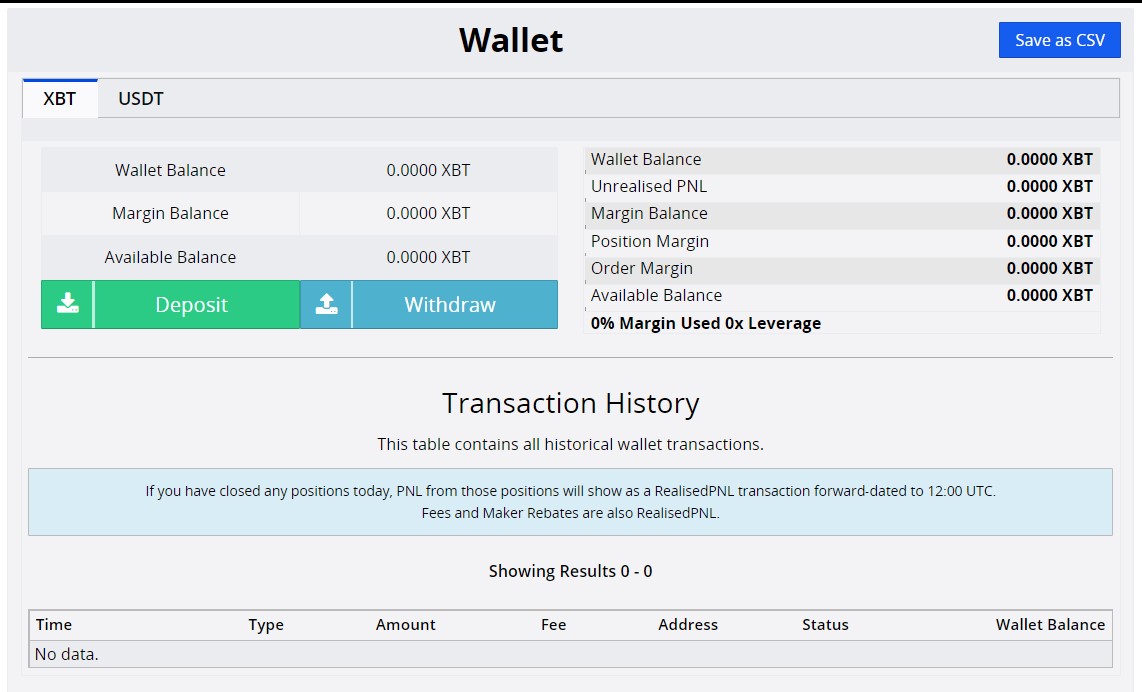

Add Funds

Once your account is up and running, the next step is to add funds to your BitMEX account. BitMEX has recently launched an exchange feature that allows you to buy crypto using fiat currencies through credit cards and third-party payment providers.

Choose a Contract

Now that your trading account has funds, the next step is to select the contract you want to trade. BTCUSDT Perpetual Futures is the most common contract among traders, but you can choose any contract of your choice.

Place an Order

Once you’ve chosen a contract, the next step is to place an order. To do that, go to the BitMEX trading terminal, select the contract, and head to the order form. In the order form, enter the amount you want to invest or the quantity you wish to trade.

You’ll see an option to adjust leverage. Drag the leverage scale to set the leverage as per your risk capacity and experience level. As discussed, the maximum available leverage will depend on your cross-margin or isolated margin.

Note: If you’re a beginner, avoid trading with high leverage. Ideally, 10x is safe leverage for new traders.

Now, select the order type. BitMEX lets you choose from market, limit, stop limit, and stop market orders. A market order is placed at the current market price, while you can place the limit order at a price of your choice.

Finally, place a Buy/Long or Sell/ Short order.

Benefits of BitMEX Leverage Trading

Leverage trading on BitMEX is beneficial in many ways. Let’s look at some benefits of leverage trading.

- Higher Profits

The apparent benefit of leverage trading is higher profits. When you use high leverage, like 100x, your profits multiply by 100 times. This helps you increase your profits and grow your trading account faster.

- Diversification of Assets

When traders have limited funds, they tend to put them all in one asset. Putting all your eggs in one basket isn’t the best strategy, as you rely on one asset’s performance only. Leverage enables you to diversify your assets and reduce your dependence on a single asset.

- Trading with Limited Funds

BitMEX leverage lets you trade with limited funds. Suppose you have $500 in your trading account, and you want to trade in BTCUSD futures. The average daily move in BTC is 2-3%. So, if you trade with $500 and earn a profit, you’ll earn $10-15 only.

However, when you use leverage, you can multiply that profit by 80, 90, or 100 times. Hence, a $10 profit can become a $1,000 profit. Leverage trading on BitMEX lets you earn handsome profits with limited funds.

- Risk Management and Discipline

Traders who trade with leverage get better at risk management. The risk with leverage trading is high, and many traders end up blowing their accounts. Over time, they learn to manage risk and trade with discipline, which are essential qualities for becoming a successful trader.

New to Leverage Trading? Know the difference between Crypto Margin Trading vs Crypto Futures Trading

Risks of BitMEX Leverage Trading

While leverage trading has many benefits, it also has some drawbacks, and risks traders should be aware of. Let’s look at some risks associated with leverage trading.

- Bigger Losses

Your profits are bigger in leverage trading, and so are your losses. Let’s use the same example we did in the previous section. If you trade BTCUSD futures with $500 and the price goes 2-3% in the opposite direction of your trade, you’ll lose $10-15 only. With 100x leverage, the loss will be $1,000-1,500, and you’ll end up blowing your account.

- High Risk

Leveraged trading is risky, and many new traders incur huge losses. Since leverage trading allows you to multiply profits, many new traders get lured into using high leverages to earn big money. However, the risk of losing money is also high. Many traders make losses and end up quitting.

- Risk of Blowing Up Your Account

New traders enter the trading world with limited funds, like $500 or $1,000. They are tempted to earn money quickly, and hence, they use high leverage.

As discussed, if you use 100x leverage, your initial margin will be entirely wiped if your position goes 1% in the opposite direction. A lot of traders blow up their accounts this way.

- Difficult for Newbie Traders

Finally, leverage trading is no walk in the park. It’s difficult and requires a lot of trading experience and discipline. Sadly, the opposite of this happens most of the time. New traders often start with high leverage and fail miserably.

Leveraged trading is difficult for new traders, and they should avoid it. It’s ideal to start with zero leverage and then use multipliers gradually.

New to crypto trading? Know What Is Spread In Crypto Trading?

Tips to Property Use BitMEX Leverage

Trading with leverage is a double-edged sword. You can make substantial profits and also huge losses. So, how can you use leverage to your advantage? Here are some tips to follow.

- Risk What You Can Lose

The holy grail of trading is to manage your risk properly. Most traders think about the profit they can make, overlooking the loss they’ll make if things go south. If you’re a new trader, your primary objective should be to protect your capital and minimize your losses.

So, you must only risk what you can lose. The golden rule is you shouldn’t risk more than 2-3% of your trading capital. So, if you have $1,000 trading capital, you shouldn’t take a loss of over $20-30 per trade. If your risk appetite is high, you can go till 5%, but not more.

- Only Use Leverage When You Are Certain

The next important rule is to use leverage only if you are 100% sure about your trade. If there is even a small element of uncertainty, don’t use leverage. But if you feel confident about your analysis, using leverage can help multiply your profits.

- 100x Isn’t the Only Option

Last, 100x is not the only leverage option on BitMEX. Since exchanges advertise their maximum leverage only, traders think that they should use the maximum leverage every time. Just because you can use up to 100x leverage, it doesn’t mean you should do it. You can set the leverage between 0x and 100x.

The next question is, how much leverage should you use? If you’re a new trader, don’t go beyond 5x. If you earn profits and gain confidence, you can gradually increase the leverage to 10x, 15x, and 20x. I don’t recommend going over 20x, regardless of how experienced a trader you are.

Conclusion

Crypto leverage trading is a concept that helps traders borrow funds from the exchange and multiply their profits. However, this also means they risk multiplying their losses.

Therefore, it’s essential to use leverage on BitMEX properly. If you’re a new trader, start with zero leverage and slowly increase your leverage to 5x. As you get experience and learn how to trade with leverage, you can increase the leverage to up to 20x.

Overall, leverage is a great tool to grow your trading account quickly, but it’s a double-edged sword, and traders should use it carefully.