Both Bybit and Coinbase claim to have more than a million traders on their websites, making them some of the largest crypto exchanges in the world.

But, despite these being large and popular exchanges, it is essential to have a deep understanding of what they are all about and what they have to offer before using them.

Bybit vs. Coinbase: Introduction

Bybit started operation in 2018, and it has its headquarters in Singapore. Also, the company has offices in a few other countries, including Taiwan and Hong Kong.

Although the company is developing other products, its main line of business is cryptocurrency derivatives exchange. To sign up on the exchange, you can also use Bybit referral code to get sign-up bonus.

Coinbase is among the largest players in the crypto exchange business and one of the oldest as it has been in operation since 2012.

With its powerful trading platform and deep liquidity, given the average 24-hour trade volumes that exceed 2 billion, this American exchange guarantees to give traders an exceptional experience.

Bybit vs. Coinbase: Product Offerings

For many seasoned traders, the product offering is often one of the first factors to consider when deciding the best platform to day trade crypto.

Hence the fact that Bybit and Coinbase provide quite different trading products means the choice between them should be easier for an experienced trader.

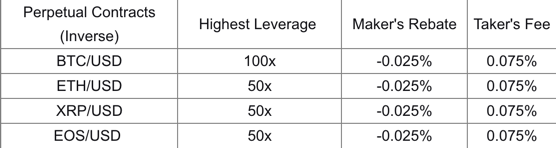

Bybit specializes in cryptocurrency derivatives, and they allow traders to take short and long positions. Crypto traders can get three types of derivative products on the Bybit platform: inverse perpetual contracts, inverse futures contracts, and linear perpetual contracts.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

The inverse perpetual contracts have 4 margined coins, including bitcoin/USD and Ethereum/USD, while inverse futures contracts are for quarterly BTC/USD exchanges. The linear perpetual contracts have 13 USDT margined options.

It is also worth noting that Bybit has spot trading in beta testing and will probably add a fully-fledged spot market to its product offering soon.

With Coinbase, it is all about spot trading since the company does not have a derivatives market. However, there are still more than enough opportunities to make money on the platform, given they support all the major cryptocurrencies.

You can trade over 40 cryptos for bitcoin, and there is also a stablecoin you can deal with using over 10 different cryptocurrencies.

Bybit vs. Coinbase Trading Fees

Given the ever-increasing competition, most cryptocurrency exchanges try to keep their trading fees as low as possible. Bybit keeps its fees standard with what you would expect to pay when trading on other leading exchanges.

For Bybit futures trading, the fees are 0.025% maker’s rebate and 0.075% taker’s fees for both perpetual contracts and USDT contracts. Also, it is worth mentioning that Bybit has a maximum leverage of up to 100x on BTC/USD and up to 50x for other currencies.

Although their spot trading is still in beta testing, Bybit has set the maker’s rebate at 0% and the taker’s fee at 0.1% for all the cryptocurrencies.

Coinbase has a relatively higher trading fee for its spot market compared to Bybit.

The exchange charges a spread fee of about 0.5% for the crypto sales and purchases on their platform. However, the rate highly depends on market fluctuations and can go as low as 0.04%.

Bybit vs. Coinbase Deposit & Withdrawal Fees

What you pay to deposit or withdraw from your crypto exchange matters a lot as it determines the value you get for each buck. While both Bybit and Coinbase make the process of depositing or withdrawing relatively straightforward, their fees vary significantly.

Bybit charges a withdrawal fee for all the currencies on the platform. The actual amount you pay depends on the specific coin you are withdrawing.

For BTC, they charge the industry standard 0.0005 BTC, while the fee for ETH is 0.005, and for XRP, it is 0.25. But it is important to note that these fees often originate from blockchain loads.

Bybit does not charge any deposit fees, and neither does it have restrictions on the minimum deposits traders can make.

However, in some instances, there can be a small miner’s fee charged. Also, note that the platform will not handle the fiat deposits directly as they use gateway partners like Banxa.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Although Coinbase makes most deposits free, some can attract a small fee. If you use the Coinbase card to purchase crypto, the platform does not charge any fees.

However, other channels, including ATM withdrawals, attract a 2.49% flat rate as the transaction fee.

Coinbase withdrawal fees largely depend on the region you are transacting from and the channel you are using. In the USA, instant card withdrawals have a 1.5% transaction fee, while withdrawing to a US bank account has a 1.49% fee.

Bybit vs. Coinbase Trading Platform Comparison

The modern-day crypto trader does not want to struggle to figure out a trading platform and instead prefers to spend more time trading. Bybit and Coinbase seem to understand this as their platforms are as straightforward to use as possible.

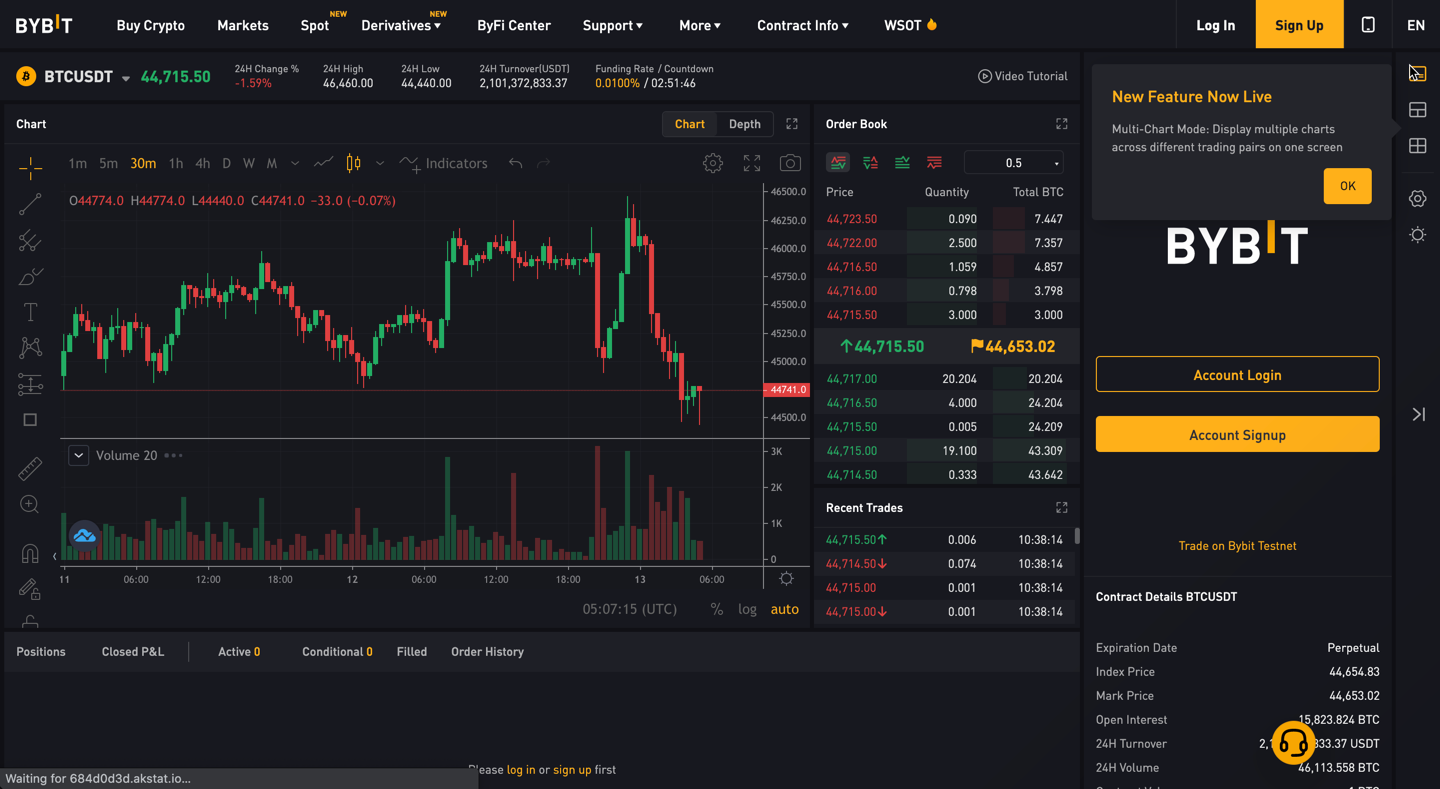

Bybit provides a highly user-friendly trading platform but still has some highly advanced trading tools and capabilities.

Hence, it works well enough for both beginner and experienced traders. Additionally, the platform works for both mobile app and web browsers to ensure user convenience.

Another outstanding element of the Bybit platform is that it has a 99.9% availability record. What’s more, traders can expect to get many other features like advanced technical indicators, customizable charting tools, and an easily customized interface. To know more about the exchange, check this Bybit tutorial.

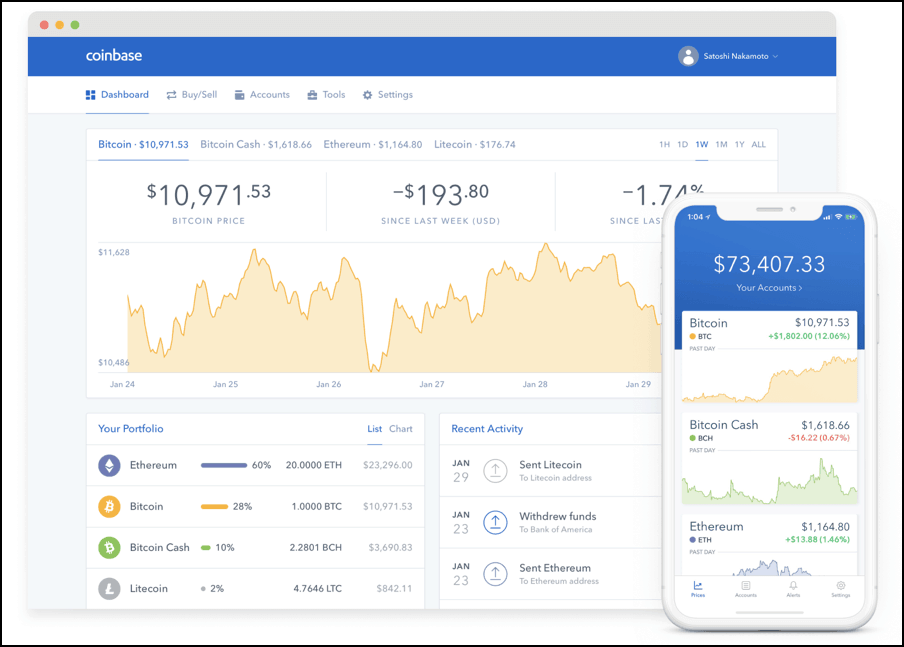

Trading on the Coinbase platform is straightforward, and even an absolute beginner will take very little time to figure things out.

Although the platform is all browser-based, you can still access it through iOS and Android devices, which means you can trade even on the go.

Besides the standard Coinbase platform, the company also has an advanced platform: Coinbase Pro.

But, both platforms boast a highly intuitive interface with all the buttons well-arranged and marked clearly. Also, they have handy tools like overlays and indicators to support trading.

Bybit vs. Coinbase Account Opening Process

You will hardly ever need to spare more than a few minutes to set up your account and start trading when using popular exchanges like Bybit and Coinbase. Here is the straightforward process for opening accounts on these platforms.

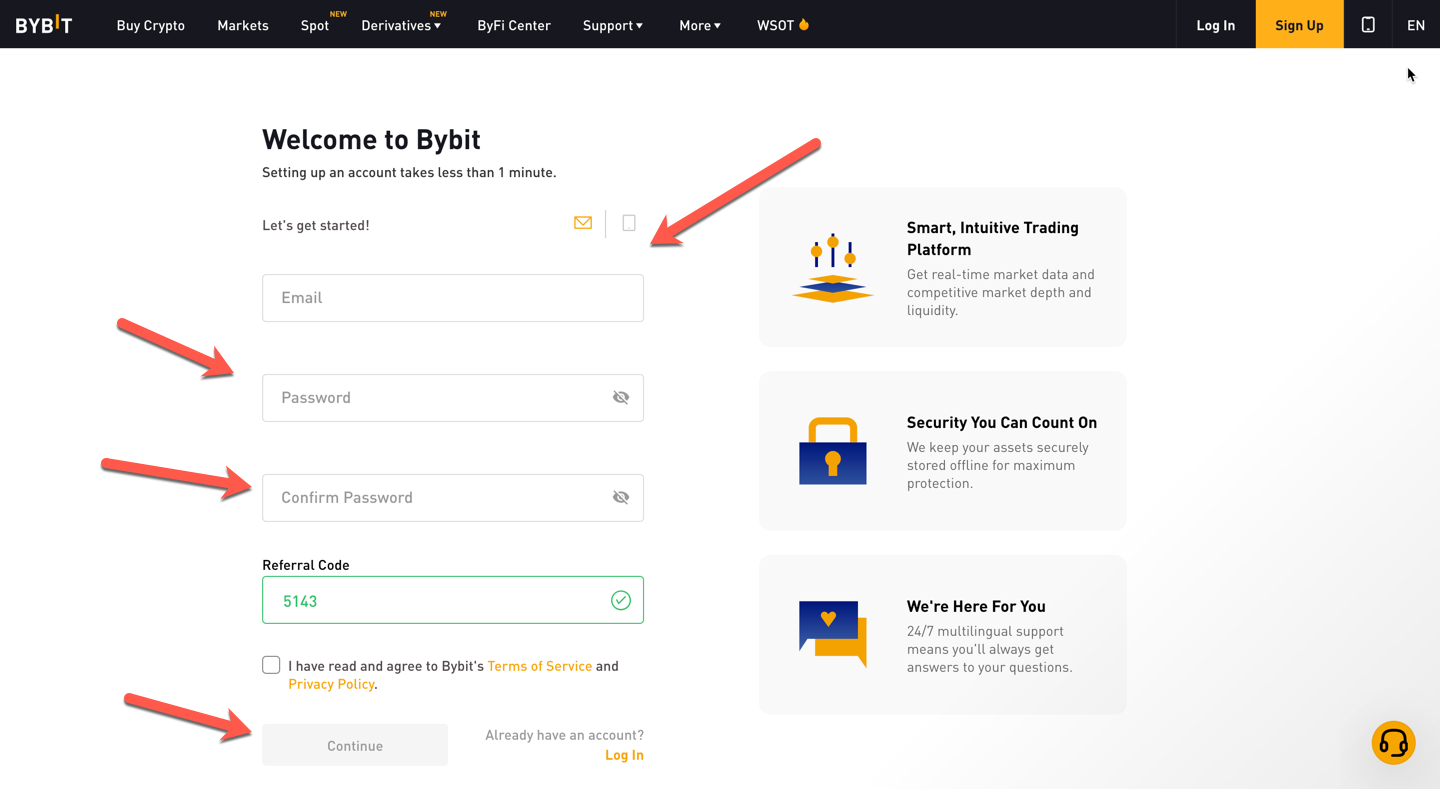

Opening Bybit Account

- Navigate to the registration window on Bybit.com

- Choose whether to create an account with an email or phone number

- Submit a referral code if you have any

- Enter verification code from email/phone number

- Make a deposit and start trading with no KYC required

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Opening Coinbase Account

- Create an account by filling in the required details and reading the user agreement

- Verify your email by clicking the provided link

- Add and verify your phone number

- Fill up personal information

- Verify ID and set up 2-step verification

- Link a payment method to deposit and start trading

Coinbase Offer: Get $10 in free Bitcoin when you buy or sell $100 or more in crypto using this link to sign up. |

Bybit vs. Coinbase Customer Support

Customer support is one of the core pillars of every business, and you can trust that crypto exchange platforms understand that.

If you run into issues when using Bybit or Coinbase, you can be sure of speedy resolution as both provide multiple customer support channels.

Bybit has support available round the clock as their live chat works 24/7.

Hence, no matter what time of the day you prefer to trade, there will always be someone to answer your queries if you have an issue. Also, the support is multilingual to cater to traders from all over the world.

With Coinbase, the live chat is only available during US working hours. However, they have an edge when responding to customer emails as they try to always send the responses in under 24 hours.

Bybit vs Coinbase Security Features

Crypto platforms continuously enhance their security by embracing modern technologies that help them deal with the many risks in the business, such as hackers. With both Bybit and Coinbase, you can rest easy knowing your cryptos are always secure.

Bybit provides a highly dependable security system to safeguard trader funds.

The company has 100% of the funds in a multi-signature cold wallet that eliminates the risk of traders ever losing their money to hackers. What’s more, there is a stringent offline signature function that makes unauthorized withdrawals super hard.

Coinbase also uses several security features to safeguard trader funds. These features start with the 2-step verification. The platform also has at least 98% of user funds in offline cold storage and provides insurance to cover traders in case of a breach.

Conclusion

Bybit is a reliable bitcoin derivatives exchange, while Coinbase is the go-to platform for spot trading globally. Hence, choosing between the two brands should be easy if you already know what you want to trade.

However, things are not that straightforward as you need to consider various other factors like the user-friendliness of their platforms, fees charged, and security.

If you can give both platforms a try before deciding, it is better to make a more informed choice using firsthand experience.

Learn how does Coinbase and Bybit stack up against the competition.

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023