Bybit is a popular crypto exchange platform that has been in operation since 2018 and has over 2 million users. And although it offers most of the traditional crypto exchange products you would get from other top platforms, leverage trading is one of the most popular products.

As a beginner or even experienced trader thinking of giving their leverage trading product a try, you should start by understanding what it is all about and how it works.

This guide provides a comprehensive overview of Bybit’s leverage trading by answering some of the crucial questions many traders have, starting with what the product is all about.

What Is Bybit Leverage Trading?

Leveraged trading allows you to trade crypto at a higher position than your actual investment. The primary aim of Bybit’s leverage trading is to enable traders to get high returns from relatively smaller investments.

While leverage trading magnifies the potential earning from a long/short position, it also increases the risk for the traders.

For example, crypto traders with a $200 investment that decide to go long on bitcoin with 100x leverage will earn 100 times more if the market goes their way.

If the long position is for a 10% increase in the price of Bitcoin, 100x leverage means you will get $2,000 (20 x 100) instead of the $20 you would gain without leverage.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

How Much Leverage Does Bybit Give?

Bybit provides a leverage of up to 100x, which is among the highest in the market.

What this means is that if you open a Bitcoin position or any other asset that supports leveraged trading with $100 at 100x leverage, the value of your full position is $10,000.

That said, you do not have to trade at the maximum leverage levels as many traders find it less risky but still highly rewarding to open positions at lower leverages like 10x or 25x.

It is also worth noting that the 100x maximum leverage is for Bitcoin as the maximum leverage you get for Altcoins is 50x.

New to ByBit? Learn How to connect Bybit to TradingView?

Bybit Leverage Trading fees

Bybit charges a 0.075% taker fee for market orders. Also, there is a -0.025% maker fee, meaning the company will pay you to use their limit order. Therefore, it is always better to use their limit order instead of market order to save on transaction fees.

Also, If you don’t know what’s a maker and taker order, this Maker vs Taker fee guide will help you out.

As a trader on the Bybit platform, you also need to know that the company charges its fees on the full position and not on your initial margin.

For example, if you want to invest $100 with 10x leverage, the platform will calculate the fee on $1,000, as this is your full position.

What all this means is that the higher the leverage you use when trading on Bybt, the higher the transaction fees you will pay.

What Can You Trade with Leverage On Bybit

The Bybit platform supports over 20 different coins and tokens, from primary ones like ripple and bitcoin to others like Uniswap and Woo Tokens. However, the platform only allows leverage trading for specific pairs.

Bybit seems more focused on two main trading pairs for their leverage trading: ETH/USD and BTC/UHD. However, crypto traders can also trade with leverage on other pairs like XRP/USD, EOS/USD, BTC/USDT, and ETH/USDT.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

How To Trade On Bybit With Leverage

There is more to trading on Bybit with leverage than just buying coins and waiting to sell when the price suits your position.

It is vital to understand how trading with leverage works to make good returns on your investment, and here is a quick Bybit tutorial of the main steps to follow.

Step 1: Choose Your Order Type

The first step when trading with leverage on Bybit is choosing your order type. The crypto exchange offers three main order types, and as a trader, you have to understand what each type entails before getting started.

Limit Order: A limit order makes you a market maker meaning you will be adding liquidity to the exchange’s books.

However, the order does not execute immediately as you have to wait for the crypto price to get to the limit order price level. As a market maker, you will not need to pay any transaction fees.

Market Order: If you opt to open a market order, you become a market taker since you will be taking out liquidity from the company’s books.

This order type attracts a 0.075% transaction fee, but the order will execute immediately, and you will get the best price in the platform’s books.

Conditional Order: A conditional order is a limit or market order that will open if the market goes a certain way or meets a specific condition. You can use factors like last traded price, index price, and mark price to trigger your conditional order.

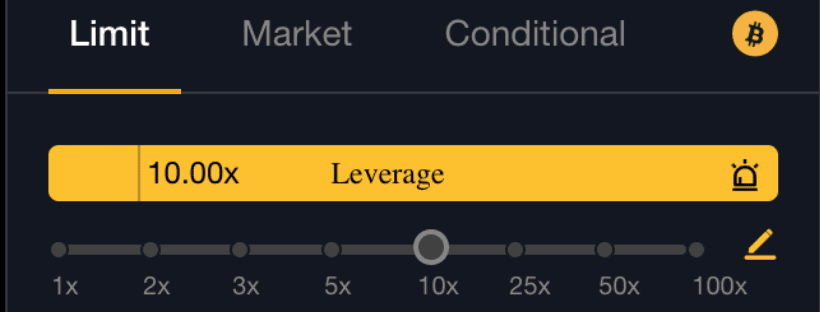

Once you decide on the order type you want to make, you must choose it from your trading interface. Additionally, you have to key in other things like your preferred leverage and order quantity (in USD).

Step 2: Take Profit/Stop Loss

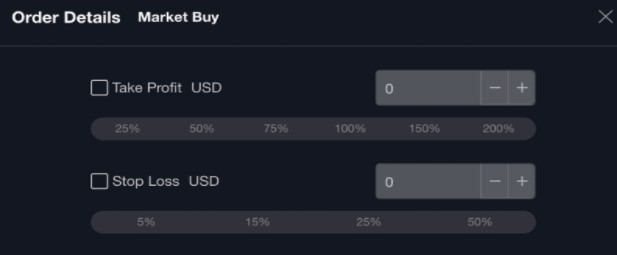

Once you fill up your order and click whether to go long or short, the take profit/stop loss window will open. Here you need to enter the take profit and stop-loss levels.

This step is vital at guaranteeing you profit when the market goes your way or that you do not make too much loss if things do not go your way.

Step 3: Review and Confirm Your Order

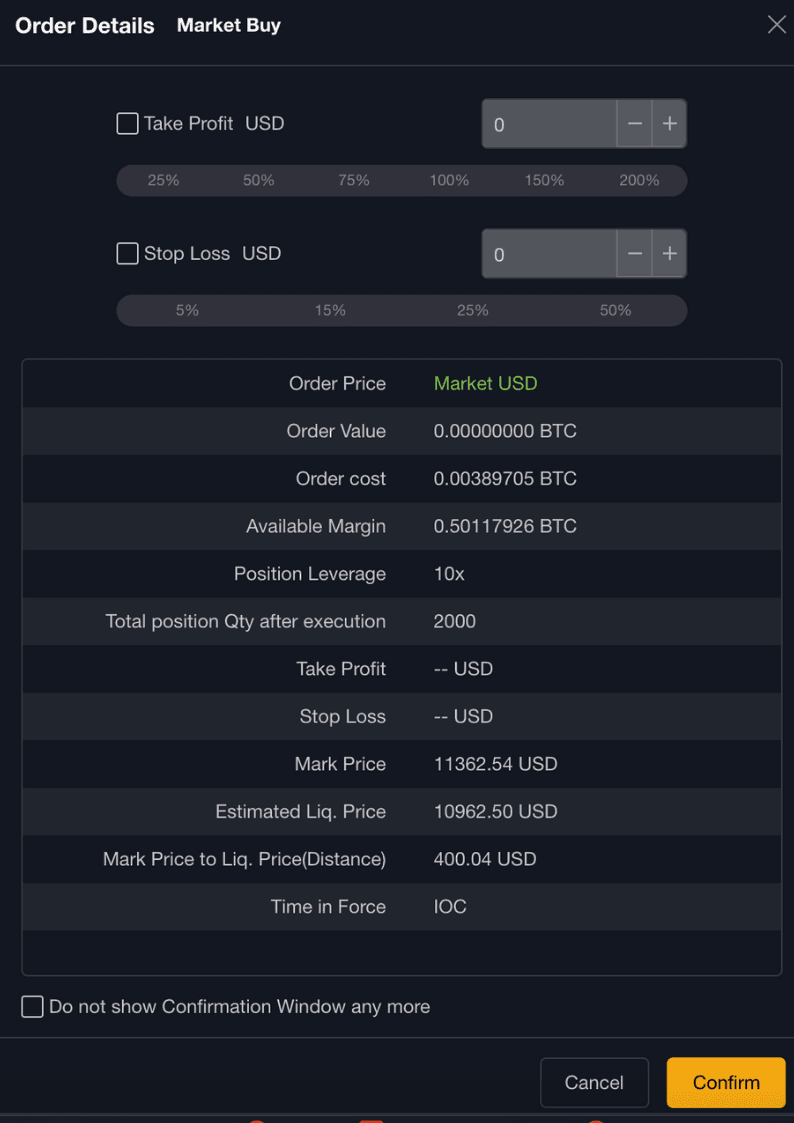

Next, you need to review your order details. The order information will be below the take profit/stop loss section.

Here, you have to make sure you are comfortable with leverage, liquidation price levels, and stop-loss price. If everything is okay, you can click on the “confirm” button to open your position.

Step 4: Keep Track of Your Open Positions

Once you have an open position on Bybit, you can view and keep track of things. You can view your current position at the bottom of the trading screen. The P&L section shows you your current profit or loss, and so you might want to keep a closer eye on this.

When it is time to close your positions, you can use market or limit orders, which should also be relatively straightforward. These buttons will be at the bottom right of your Bybit trading screen. To learn more about the exchange, you can check our how to use Bybit exchange guide.

What Is Initial Margin in Bybit?

An initial margin on Bybit is the margin you will require to open your position. The initial margin you need depends on the position size and the leverage you prefer to use for the trade.

The initial margin you will need also depends on the contract option you are using. Bybit provides three perpetual contract options: inverse perpetual, USDT perpetual, and inverse futures.

Interested in Futures trading? Learn How to trade futures on ByBit?

Bybit provides a clear breakdown and an easy way to calculate your initial margin requirement for the different contract options and order types in their contract rules.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

What Is the Maintenance Margin in Bybit?

The maintenance margin is the minimum amount you will need to maintain your open position when trading with leverage on Bybit. Also, it determines the specific price that will trigger liquidation.

You have to use the maintenance margin rate (MMR) to calculate your maintenance margin. It is essential to remember that as the margin tier increases, the MMR of each position will also rise.

That said, regardless of your position, the maintenance margin you need will always be equal to MMR multiplied by the contract value (using the open position price).

Anytime the available margin is lower than the maintenance margin, you cannot continue holding the position, and it will liquidate automatically.

One more thing to remember is that the maintenance margin you need will also depend on the specific crypto you are using for your leverage trading on Bybit.

For example, a maintenance margin of around 0.5% is often enough for BTC, but for other coins like ETH and XRP, you need at least 1%.

How To Get Started & Use Bybit Leverage?

The first step should be to create an account on ByBit. You can do this easily by following the simple steps below.

- Go to https://www.bybit.com/ and click on the “Register” button at the top right. Also, you can use ByBit coupon to enjoy sign-up bonus

- Enter your email address and create a password

- Verify email using the confirmation code you receive

Once your account is ready, you need to deposit funds to your Bybit wallet to start trading, and here is how to do it.

- Click on “Assets” at the top right corner on the Bybit home page

- Choose the currency you want to add and then click “Deposit”

- Now you can add the funds by entering the wallet address or scanning a QR code

- Give the funds around an hour to reflect in your Bybit wallet

When you have the funds or crypto in your Bybit wallet, you can follow the step-by-step guide above to trade on Bybit with Leverage.

ByBit Offer: Get upto $30,000 Bonus on your First Deposit using this link to sign up. |

Conclusion

Bybit is one of the leading crypto exchanges globally for traders looking to trade with leverage. With a maximum leverage of up to 100x, traders can make huge returns on their investments with minimal capital.

Crypto traders looking to give Bybit leverage trading a try should start by understanding what it is all about and how it works, and this guide should be a perfect starting point.