Bybit is a leading centralized cryptocurrency exchange that began operations in March 2018 and offers spot trading, Futures, Options, and Margin trading along with an NFT marketplace.

It has an ultra-fast order-matching engine, quality customer service, and multilingual support on the exchange itself.

Its 10 million customers are proof enough that the exchange is also one of the more trusted ones out there.

This article takes you through the various processes of shorting Bitcoin with Margin, Futures and Options trading.

By the end of reading this, you should be ready to make money off of the downward price movement from Bitcoin.

Shorting Bitcoin Crypto On Bybit Margin Trading

If you are on the desktop, follow the below bybit tutorial to start Margin trading and make your first successful Bitcoin short trade on Bybit. Also, if you don’t have a Bybit account yet, make sure to sign-up first.

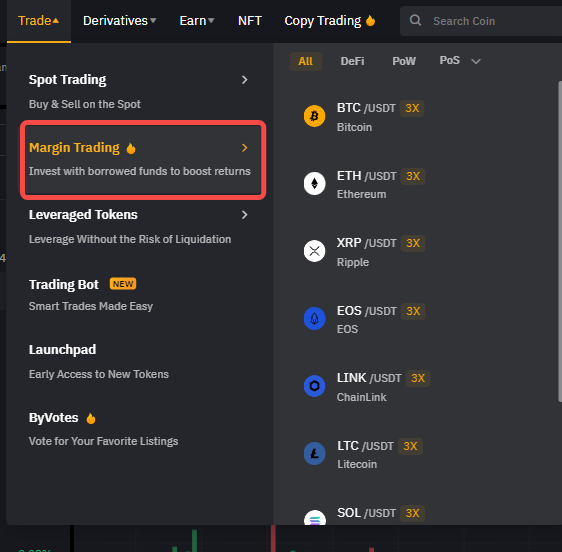

- Navigate to Margin trading

Navigate to ‘Trade’ in the top bar and then to ‘Margin Trading’. Here, you will be able to select the trading pair you want to trade or search for it if you can’t find it in the list.

In this case, we can see the BTC/USDT pair right there which is the one we want to trade. So, click on it.

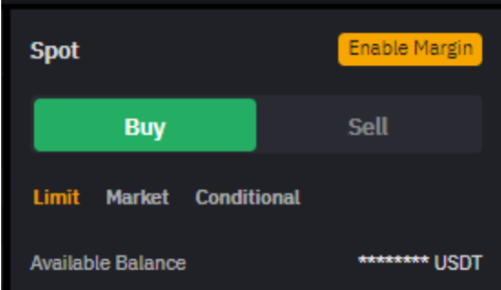

- Enable Margin trading

This step only applies if this is your first time doing Margin trading and you will have to enable it by clicking ‘Enable Margin’ as shown in the screenshot below.

Once you click this, the exchange will prompt you with a ‘Margin Trading Service Agreement’.

Please make sure to read through the agreement and only click the ‘Acknowledge and Enable Margin Trading’ button if you agree with everything in the agreement.

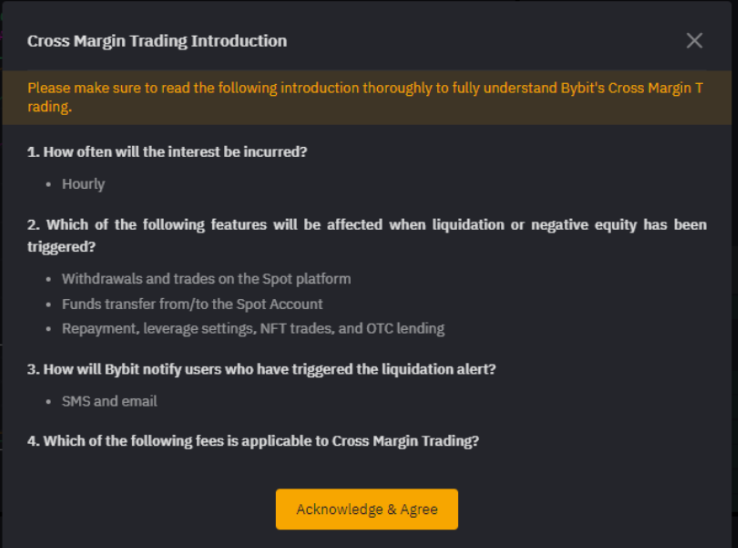

After this, you will be required to read through a quick introduction regarding Margin trading which you will also have to ‘Acknowledge and Agree’ to.

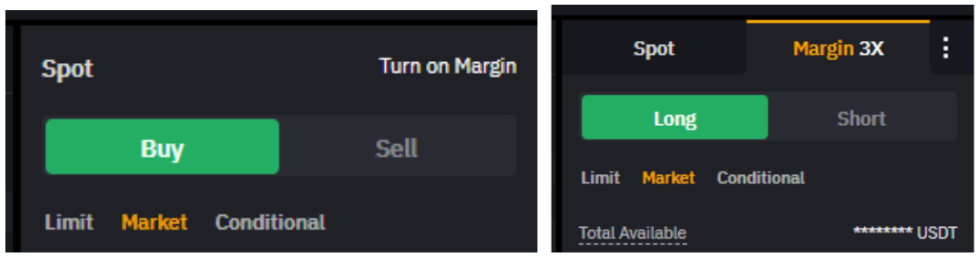

- ‘Turn On Margin’

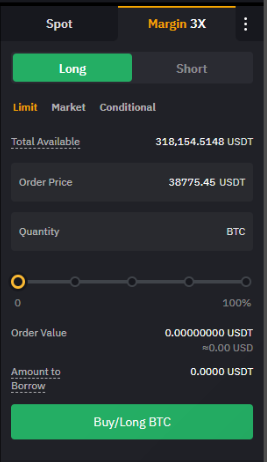

Once Margin trading has been turned on, and you have followed the steps as shown above, your User Interface will look a little different. Below is what you should expect to see.

- Place your order

Now that your account has enabled Margin trading, the next steps are to take your first Bitcoin short trade. So, select the Short trade in the UI.

Next, you will select the type of order you would like to place. Your options are Limit, Market, or Conditional.

Then you will enter the order price at which you want your order to be filled. You can only do this in the case you select Limit or Conditional orders.

In the Market orders, your trade is filled at the current market price itself.

After this, you can enter the quantity of Bitcoin you would like to purchase for this order or use the percentage bar (shown below) to adjust the size of your position.

Finally, click on the ‘Sell/Short BTC’ button to confirm your order.

Unlike Binance, where you have to perform the borrowing process yourself, Bybit will borrow the required funds from the exchange and either execute the order or make it part of the order book to be filled when the price reaches the Order Price.

Shorting Bitcoin with Futures trading

For Futures trading on Bybit, you can decide between using USDT and USDC as the base currency.

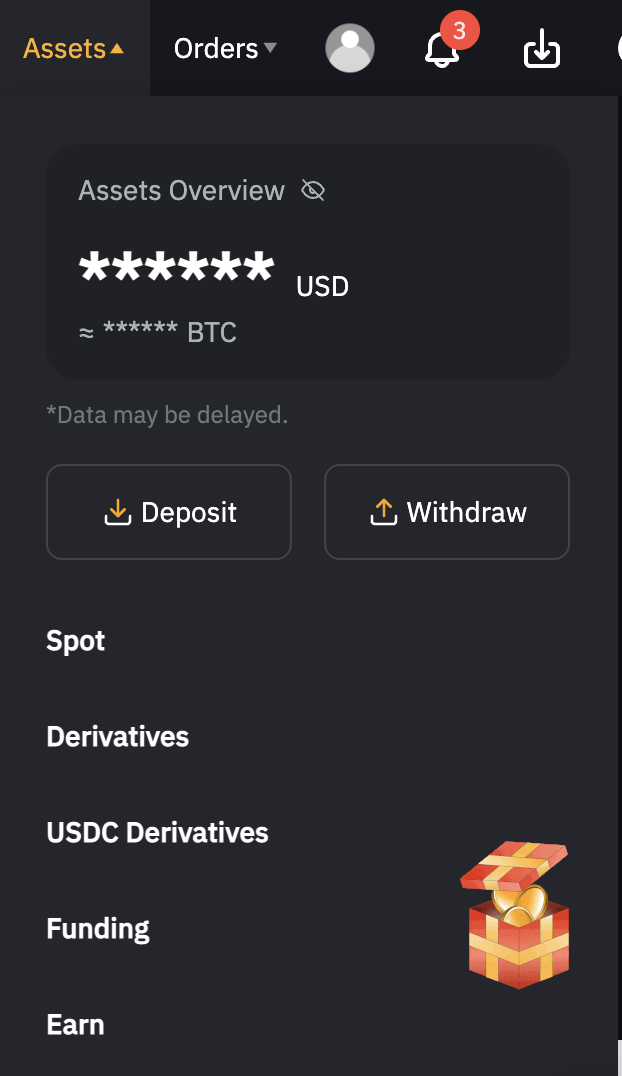

If you are planning on using USDT, you will click ‘Assets’ in the navigation bar and then Derivatives to transfer in USDT or move it from one wallet to another.

For USDC, choose the USDC derivatives option in the Assets section and deposit your USDC there.

In this guide, we will look at placing Bitcoin short orders using USDC, but the process for placing short orders on Bitcoin using USDT is the same but just under another menu.

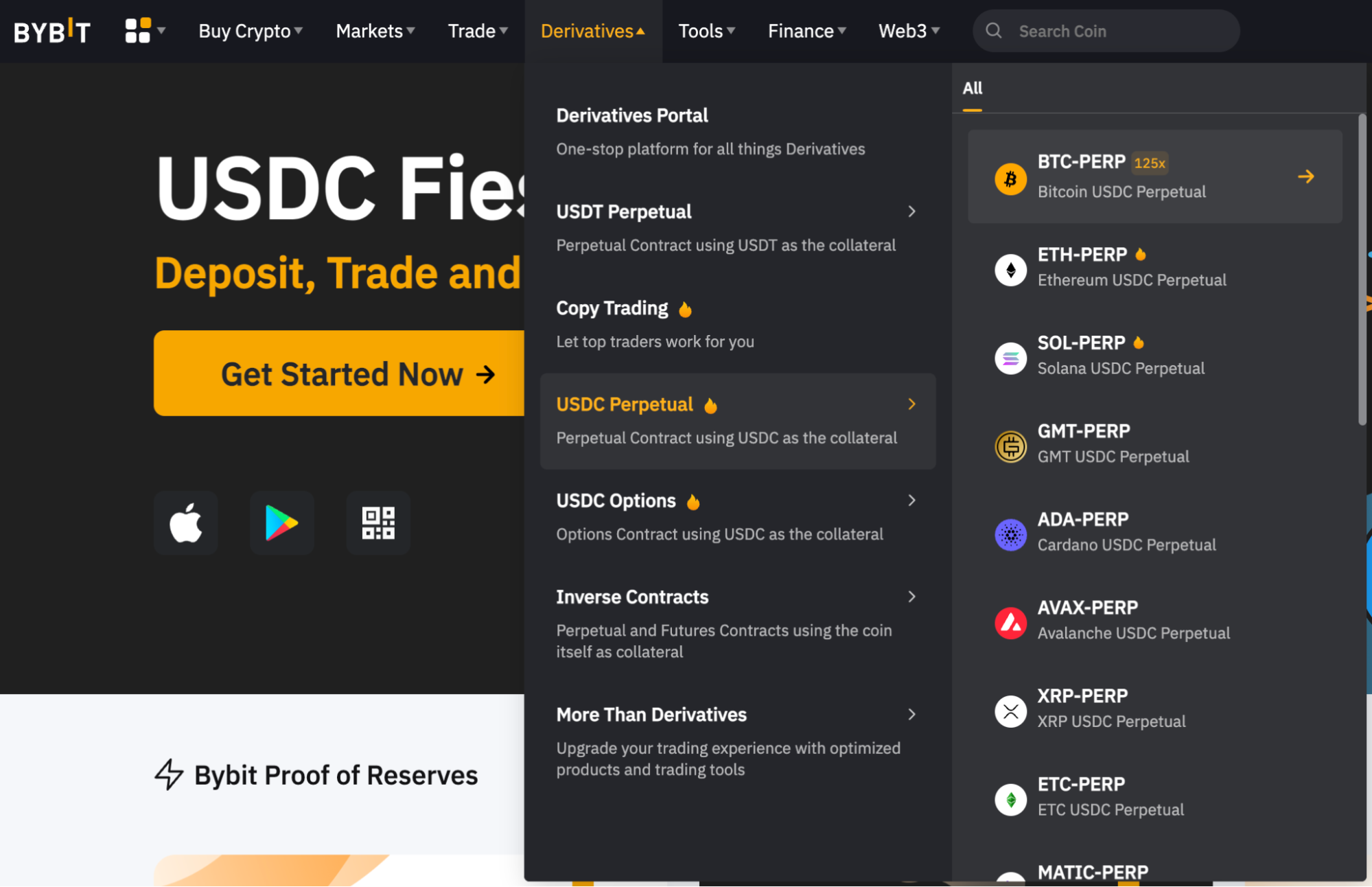

On the Bybit homepage, click on Derivatives in the navigation bar and on the contract type you wish to trade.

In this case, we are going to pick the USDC Perpetual Trading page as we will look at shorting Bitcoin futures without an expiry date.

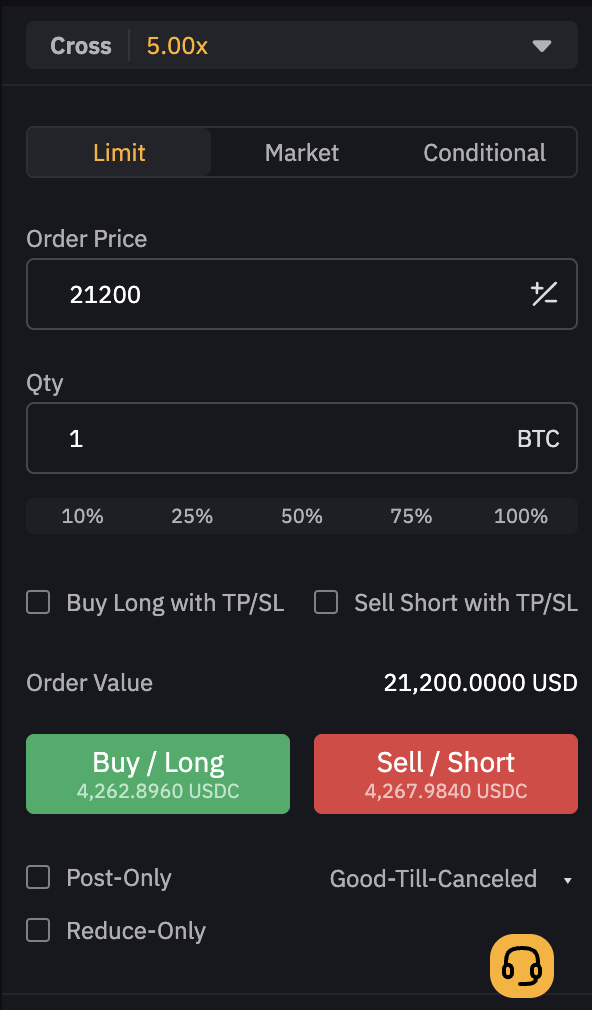

Now you can place an order with the Order zone on the right side of the page. In this, you can decide between placing a Limit, Market, or Conditional Order.

For the purpose of this example, we will be placing a Limit order to place a short Bitcoin order at $21,200.

The first step in placing this order is to select the amount of leverage you would like to use. For this example, we have picked a leverage of 5x.

Then you are going to decide what kind of order you would like to place, what your Order Price will be, and what quantity of BTC you would like to buy.

Here, we are placing a Limit order at $21,200 for 1 BTC.

In case you do not want to add a Take Profit or Stop Loss when placing the order, you can click on Sell/Short, provided you have the required 4,267.984 USDC in your trading account.

This places your order in Bybit’s order book and will be filled when the Mark Price reaches that price.

Once your order is filled, you will be able to see your current order in the Positions tab at the bottom of the page.

To close a position, you can either set a Buy/Long order for your intended price target or you can set a Take Profit in the position itself.

For example, if you want to close your position when the price reaches $18,000, you will make a profit of (21,200-18,000) * 1 = 3,200 USDC not considering the fees you will pay to the exchange.

Shorting Bitcoin On Bybit With Options trading

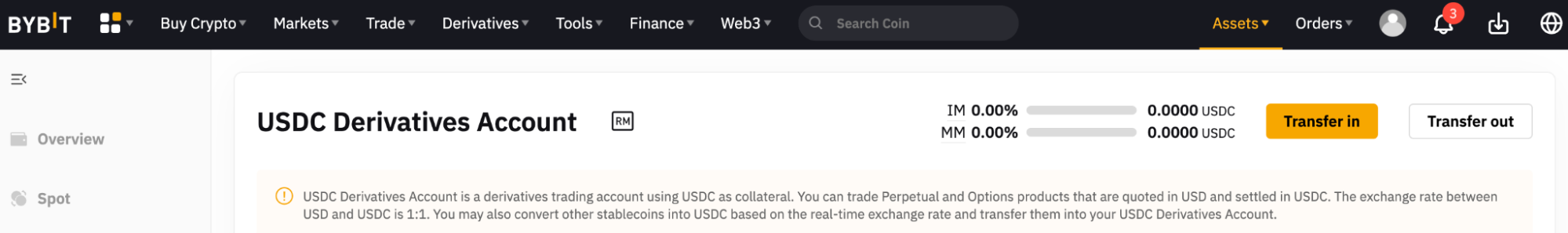

Before you start trading Options on Bybit, make sure to transfer USDC to your USDC Derivatives wallet. That will decide how much Margin you can borrow from the exchange to use in your trades.

To do this, click on Assets in the top-right corner of the home page and then click on USDC derivatives.

Then click the ‘Transfer In’ button to begin the process of adding USDC to your wallet.

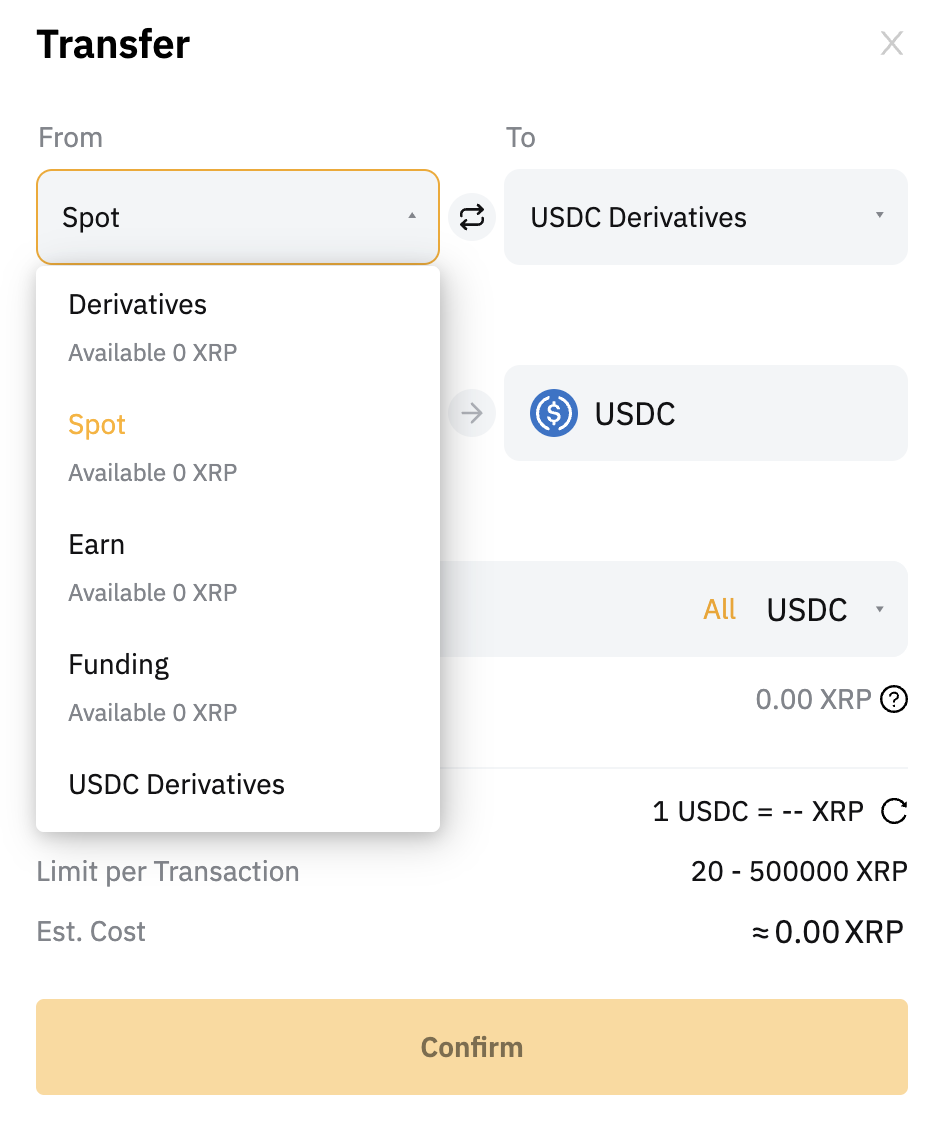

On the resulting page, you can either transfer USDC from your Spot wallet or any of the other wallets on the exchange. You can also convert your spot USDT to USDC with the assistance of a real-time exchange rate.

Once you have made this transfer, you will be able to place your first Options trade to be able to short Bitcoin.

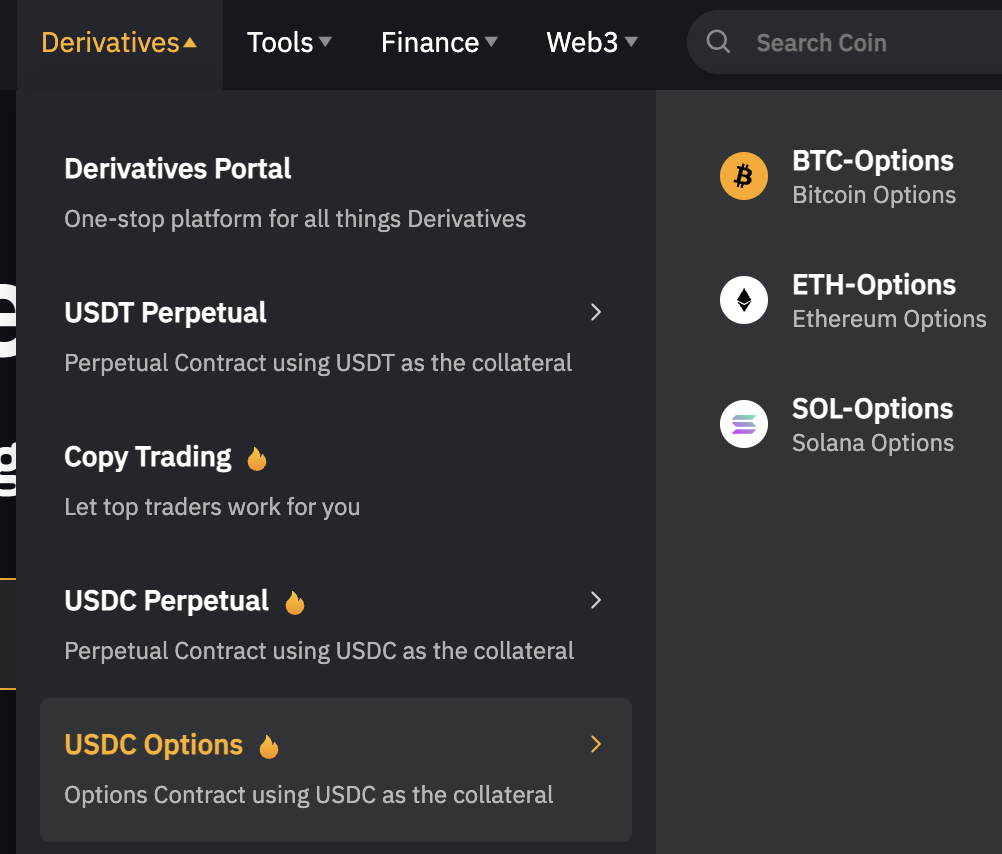

Go to Derivatives on the navigation bar on the homepage and then click USDC Options. Alternatively, you can click on BTC-Options as we know that is what we want for this example.

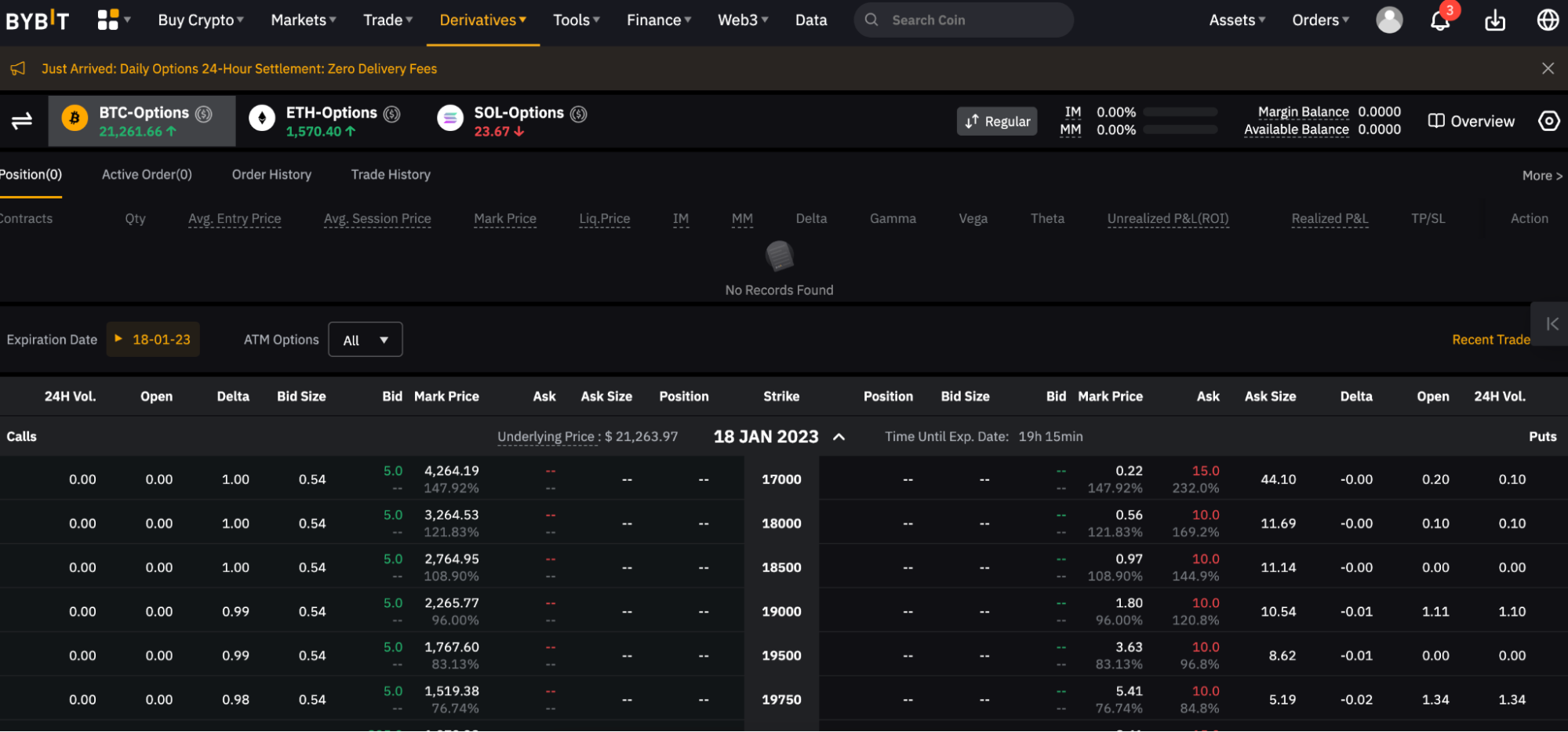

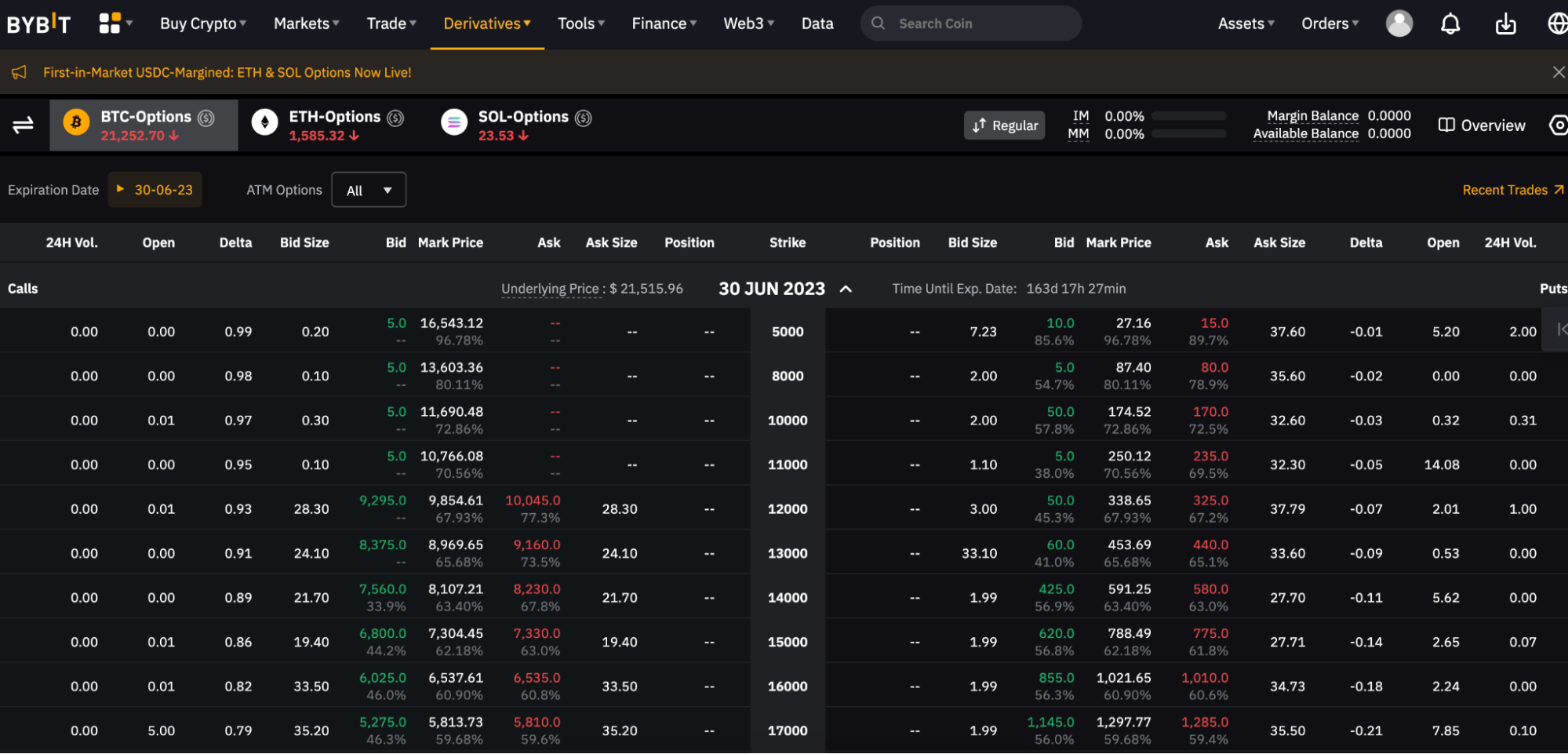

That will get you to a page (shown below) with two major sections: the Summary section and the Options chain section.

The Summary section gives you an overview of the trades you have taken to date, the Position Summary, Expiration Date, and Trade History amongst other information.

The Options chain section displays information more relevant to the clicked asset (in this case BTC-Options) including Underlying Price, Strike Price, Delta, and Mark Price.

Joining ByBit? How to connect Bybit to TradingView?

Next, you can select the Expiration Date of the contract you would like to place an order on or scroll through the options available on the page.

In our example, we have a medium-term bearish outlook on Bitcoin, I will place an order for a Put option on Bitcoin with an expiry date of 30 June 2023. You can see the Call options on the left, and the Put options on the right side of the page.

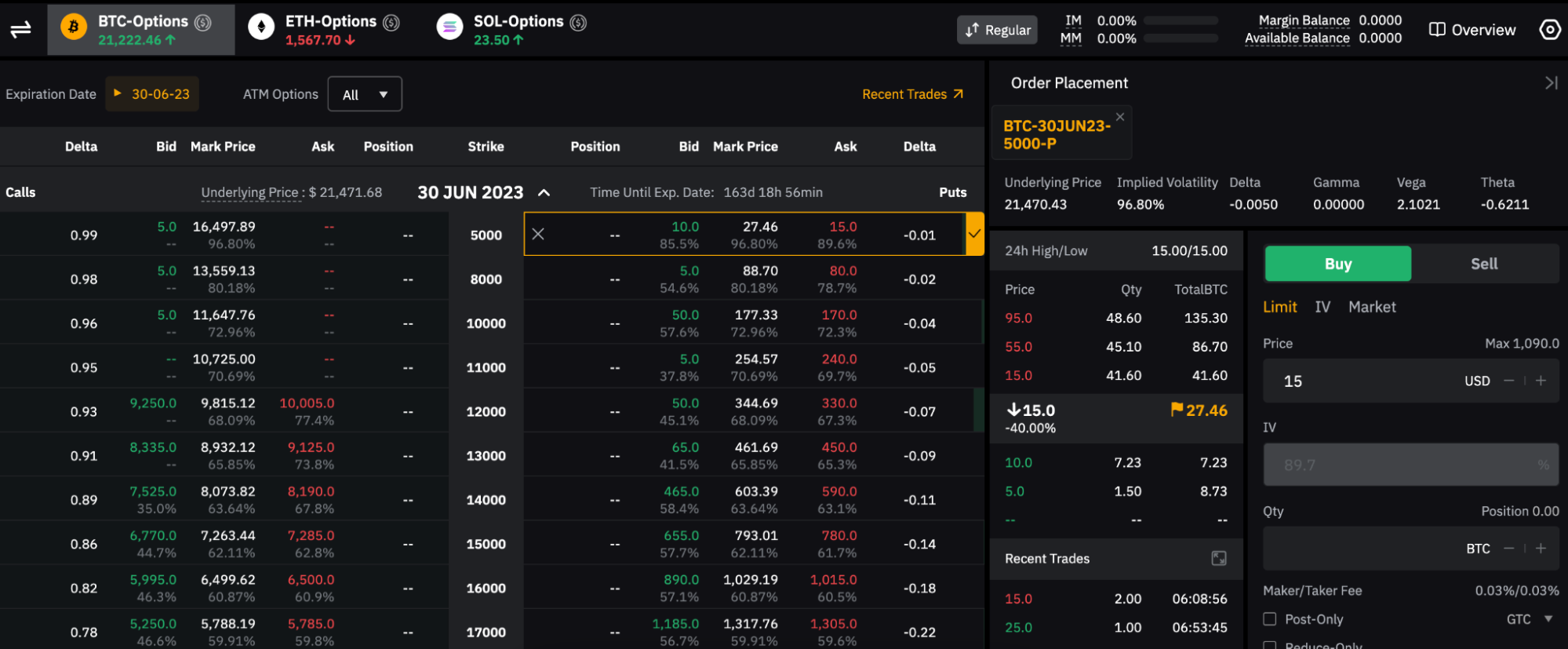

When you click on the desired Strike Price, you see the UI where you can enter the particulars of the trade and place your order.

To place your order, select the Buy option, and then if you want to place the order via a Limit order, Implied Volatility order, or Market order.

After this, you enter the order price you would like to buy the contract for and what quantity you want to buy.

We will place a Limit order to buy the Bitcoin Options contract for the expiry date of 30 June 2023 at a Mark price of $14,350 and a quantity of 1 BTC.

As Bybit does not provide any leverage for Options trades, you will need to have enough margin to cover the cost of the contract plus that of any fee charged by Bybit for facilitating this.

In this case, the fee charged is close to $6.4, which might change when you place your order.

If the price of Bitcoin futures reaches $14,350 (Bitcoin is currently trading at $21,300) before this contract expires on 30 June 2023, then your position will be in-the-money.

This position, in that case, will make you ( 21,300-14,350)*1 = 6,950 USDC without considering the fees that will need to be paid.

To close your position, you will have to place a Limit order at your Take Profit price where you select the Sell option.

Conclusion

Trading on Bybit is very smooth once you get used to the interface, and that is one of the reasons that it is one of the most used Centralized Cryptocurrency Exchanges (CEX) out there, boasting more than 10 million users.

As someone just learning how to trade on Bybit, you might not need all the advanced options right now, but you will thank them as you keep getting better at the trading game.

Their help articles are very rich with knowledge and supported by screenshots to make it easier for people to understand advanced concepts.

Just remember to invest what you can afford to lose and try to start small so that you can learn by making mistakes that don’t hamper your life savings. Trade safe!

Starting with Crypto Trading? Know How much money do you need to trade Crypto Futures?