Bitcoin Futures are a part of the new and shiny cryptocurrency derivatives market along with Options. These derivatives are traded as a legal contract to buy or sell Bitcoin at a particular price when the expiry date lapses.

Bitcoin Futures contracts have been instrumental in bridging the gap between mainstream financial markets and the recent and more speculative cryptocurrency market.

As it has the highest market share in capitalization and traded volume, Bitcoin was the first choice to create cryptocurrency Futures contracts.

Since then, major cryptocurrency exchanges, like ByBit, Binance, and even CME and CBOE (in 2017) have formalized the trading of Bitcoin future contracts.

This unlocks Bitcoin exposure to institutional investors that might otherwise be wary of an asset as volatile as Bitcoin.

How Do Bitcoin (BTC) Futures Contracts Work?

Bitcoin Futures allow traders and institutional investors to speculate on which way Bitcoin’s price movement will take it.

Other than this, investors will also use Bitcoin Futures contracts as a strategic hedge against Bitcoin’s famed volatility and fast price action.

The expiry date on your Futures contract will protect against extreme price losses in the spot BTC market.

If you think the price of Bitcoin is going to go higher, you can take a long position on the asset. On the other hand, you can take a short position on the contract if you think the price is going to go down and make a profit off of falling prices.

When investing for a longer time frame, it is imperative to keep in mind that Bitcoin can go through occasional bear markets. In these uncertain times, your Bitcoin will not give you too much movement to the upside.

Both long-term retail and institutional traders opt to keep themselves exposed to Perpetual Futures contracts that do not have an expiry date.

If you are good at your job, Bitcoin Futures contracts can be used to protect any spot Bitcoin investments against risks to the downside.

As an example, if you want to short Bitcoin, you will have to put up some percentage of the value as a margin for the position.

So if the value of Bitcoin is currently $16,600, long or short, 1 Bitcoin at 20x leverage will cost a total of $830. You now stand to benefit from the price movement of 1 Bitcoin for just $830 and no exposure to the asset itself.

In a long position, a ~800 price movement in your favour will lead to a 100% return, and your position stands to be liquidated at $15,837. In a short position, you will get liquidated at $17,356 and make a 100% return when the price reaches $15,770.

Types of Bitcoin Futures contracts

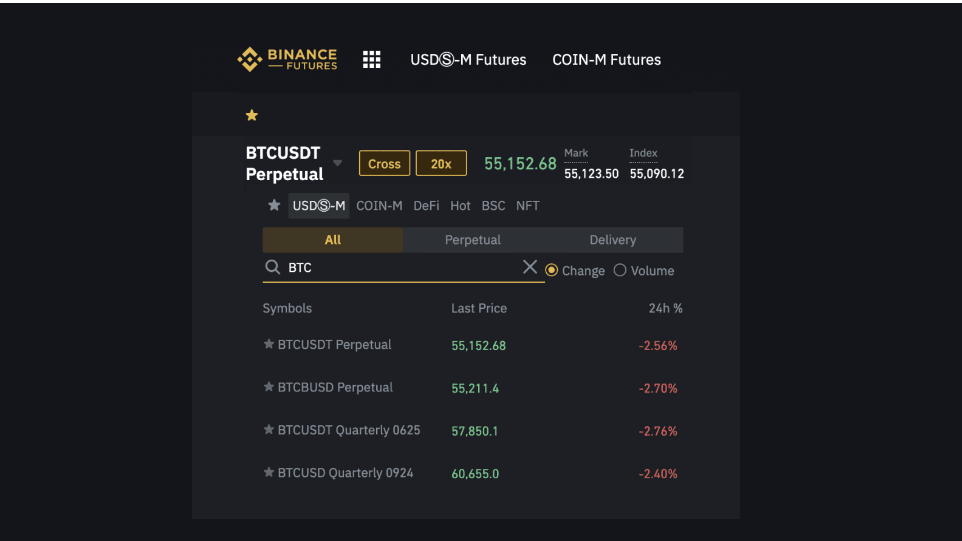

Bitcoin Futures contracts can be settled in USDT and other stablecoins (USD-margined) or other major coins like Bitcoin and Ethereum (COIN-Margined).

Within COIN-Margined Futures, there are contracts that either expire every financial quarter (Quarterly Futures) or others that do not have an expiry date but involve the use of Funding fees (Perpetual Futures). To learn more about these futures contracts, check this Crypto Perpetuals vs Quarterly Futures guide.

In USDT-Margined Futures, Binance Futures only offers Perpetual Futures that do not have an expiry date and resets Funding Fees to pay traders of one side to pay the other side. The exchange itself does not take any cut of these fees as this is settled between traders only.

USDT-Margined coins are similar to conventional standard Futures contracts in the way that they are margined and settled in fiat currency to either take delivery of the commodity or settle it monetarily.

COIN-Margined Futures are margined with another crypto asset and are designed after the concept of ‘inverse’ contracts that are counterintuitive to traditional Futures contracts.

Traditional Futures contracts are not settled instantly, unlike Bitcoin Futures which is one of its biggest advantages. In this way, Bitcoin can be used both as currency for settlement and as the asset that a contract is settled in for the purpose of hedging your portfolio.

How to buy Bitcoin Futures contracts?

If you want to take a long or short position on the price of Bitcoin, you will first need to create a Futures trading account on Binance and enable two-factor authentication.

Next, you can deposit funds into your Futures wallet, which is separate from your spot trading wallet. Any stablecoins like USDT, BUSD, or other cryptocurrencies like Bitcoin and Ethereum that can be used as collateral for COIN-Margined contracts can be deposited.

Binance Futures offers two types of Futures contracts, as mentioned above, i.e. USDT-Margined and COIN-Margined.

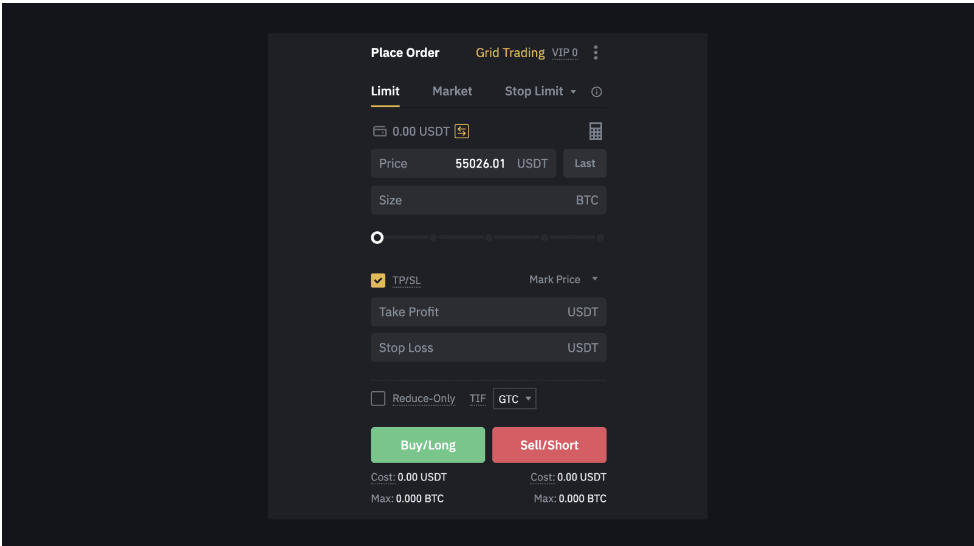

Next, you will need to decide and pick the amount of leverage you would like to use. The default value is at 20x but can be set to as high as 50x, depending on how confident you are.

The last step is to select the type of order you would like to place. Depending on how you want the order to be filled, you can choose between a Limit Buy order or a Market Buy order.

The former will fill your order at a certain pre-decided price, whereas the Market Buy order fills your order at the current market value. During a fast price move, a Market Buy order can fill at a lower or higher than the current market price.

In this step, you also have to make the decision whether you are taking a Long or Short position on Bitcoin and click the appropriate button.

Advanced users can also set their Take Profit and Stoploss levels while placing the order itself.

Hence you should be careful with the amount of leverage you use as the rewards are high but so are the risks with small price movements against you.

New to Bitcoin Futures trading? Know How long can you hold Crypto Futures Contracts?

Can I buy Bitcoin as part of an ETF?

The SEC has, in 2021, after long deliberations, made the decision to approve a Bitcoin Futures ETF. So instead of having exposure to Bitcoin itself, this fund buys a varied basket of Bitcoin Futures contracts.

Benefits of Bitcoin Futures

- Flexibility

Bitcoin Futures contracts help investors have flexibility in profiting from Bitcoin price movement without having any exposure to Bitcoin itself.

- Leverage

If you can use leverage for futures trading, it is your best friend, allowing you to gain access to a larger market position at a fraction of the actual cost.

- Hedging

Owning some sort of Bitcoin Futures contract while betting on the value of your other assets to go up will help you offset some losses if you are wrong.

When you crypto hedging strategy, Bitcoin Futures can protect you from bearing the full brunt of the volatility of the asset without having to own it.

- Liquidity

The Bitcoin market is one the more liquid cryptocurrency markets with trillions in monthly traded value. This means that you will have a taker for most trades that you are looking to make, which carries less risk of a higher or lower fill price.

- Portfolio Diversification

Exposure to Bitcoin Futures diversifies your portfolio and lets you wet your beak in the cryptocurrency market. Having some Bitcoin Futures in your portfolio acts as a hedge against investment in traditional markets.

Conclusion

Just like any investment in the cryptocurrency derivatives markets, you can be sure that your profits will be quick and large if you have a trading system and place your bets wisely. As a beginner trader, you would do well to use this as a hedge for your traditional investments.

Leverage is a powerful tool that enables seasoned traders to increase their position size and consequently profits. It can work against you if used recklessly, and high leverage is best left to professional Futures traders.

Futures also carry with them the risk of your position getting liquidated if the market moves against your positions at a quick pace.