One of the most prominent names I hear today in the crypto space is Margex. I am sure you guys are also wondering what makes Margex so popular in the market. To know that, let’s first discuss some background about it.

Margex was founded in 2020, with headquarters in Seychelles and with a motto to support the trading of cryptocurrencies. Margex is a Global platform that offers services in all the countries where crypto trading is legal.

It is a multi-product platform with various cryptocurrencies and trading pairs; let’s discuss them now.

Margex Supported Cryptocurrencies & Trading Pairs

Being a cryptocurrency day trading platform, Margex supports BTC, ETH, USDT, trc20, USDT, erc20, USDC, USDP, DAI, WBTC, Link, UST, and TRX. With 150+ fiat currencies, including the major currencies like AUD (Australia), New Zealand Dollar, Pound Sterling (UK), and SGD (Singapore).

Margex currently offers eight pairs- BTC/USD, ETH/USD, LTC/USD, XRP/ USD, EOS/USD, and YFI/USD cryptocurrency trading pairs.

Users can make a wallet-to-wallet transfer to the compatible Margex wallets. Margex is a multi-product platform, but what are the specific products? Let’s find out.

Product Offerings

Margex services include peer to peer trading platform that offers to trade:

- Cryptographic tokens and cryptocurrency trading: It offers eight different crypto pairs to trade with.

- Leveraged products: Margex offers a minimum of 5x and a maximum of 100x leverage.

With multiple products, Margex also offers numerous order types. Let’s see what they are.

Margex Order Types

- Limit order: This is a delayed order that is used to specify the highest/lowest price (the limit price) at which you want to trade an asset.

- Market order: It is an immediate order filled at the market (first available market price), used when entry or exit is the main priority for the trader.

- Stop Market order: It is also a delayed order used to buy or sell an asset once it reaches the price which was specified in this order. When the price of an asset reaches the stop price, this order will be executed as a market order and filled at the first available market price.

- Protective Stop Loss and Take Profit: These orders allow traders to minimize risk and gain profits by closing the position automatically when the price of an asset reaches your Stop Loss or Take Profit price.

Now that the products and order types have been discussed let’s jump into another essential aspect: fees.

Margex Trading Fees

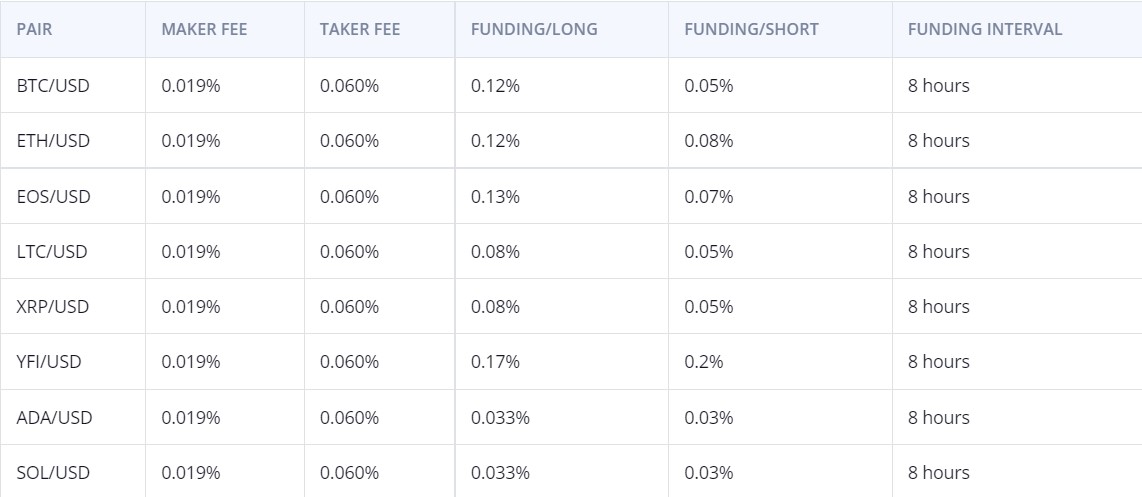

The trading fees on Margex are based on a maker/taker module being 0.019%/ 0.06%, and for further details, you can refer to the table below:

The financing costs are due every 8 hours, and if a position is closed before the funding cut-off time, there is no charge or any financing.

Margex provides one of the best trading conditions for market makers. Discounts of up to 80% are applied to execute market and stop market orders. Limit orders are always carried out with a positive commission.

The trade fee discount value varies according to the market maker’s trade turnover within the last 30 days. Margex also offers a referral program allowing a flat commission rate of 40% with transparent statistics and daily payments in BTC.

To become a Market Maker in the Margex trading system, you will need to have a confirmed track record of successful cooperation with other trading systems or work experience on classic assets exchanges.

With a minimum of 3+ years of work experience and with an average capital of at least 300 BTC (excluding the use of leverage during previous work experience)

It also offers participants in its marketing campaigns to earn bonuses reflected in their wallets.

Now that fees are discussed, it’s time to understand the overall trading platform and its tools.

Margex Trading Platform & Tools

Margex is a high leverage crypto trading platform that offers a broad range of powerful tools to harness your trading skills and boost profits like no other. Margex provides live deal flow and a $40,000,000+ deep order book combined from 12+ liquidity providers with all market data at your fingertips. Let’s look at these tools in more detail.

Margex’s Technical Analysis Tools

Margex, on its first page, consists of a chart like most of the other platforms except, Margex chart is pretty detailed, comprehensive, and compiled of most of the necessary tools of trading like:

- Indicators: It helps cryptocurrency traders to predict the movement in the price of their assets with greater accuracy. The indicators on Margex come in very handy to do so.

- Drawing tools: You can use various tools present on the Margex trading window by default. Just select the desired tool by clicking on the tools icons and start using them. It’s that simple.

- Time Intervals: You can zoom in and out to shorten or widen the time frames with precision on Margex and analyze the trends flawlessly.

Margex’s Mobile App

Margex comes with a Mobile Application for both iOS and Android. The Application doesn’t require much storage or ram usage. It has all the tools and features like the web portal.

With the Margex mobile app, you can access your account and trade anywhere.

New to Crypto Trading? Know What is spread in Crypto market?

Margex’s Desktop Trading Platform

Margex trading platform is quite competitive with Bank-Grade Multi-Layer Security, combined liquidity of 12+ exchanges all at one place, and no personal details or KYC requirements. The desktop platform provides more detailed and easy-to-use tools with a powerful engine yet subtle interface.

Margex’s Demo Trading Module

An inbuilt Demo mode on Margex lets you understand each of the terminals and the basic functionalities without any KYC procedures or deposits. Just click on the ‘live demo’ tab present on the top to use the demo mode. Once you are familiarised, you can drag the pointer towards the left, click on the ‘Get started’ option, and begin your trading journey with Margex.

User Interface & User Experience On Margex

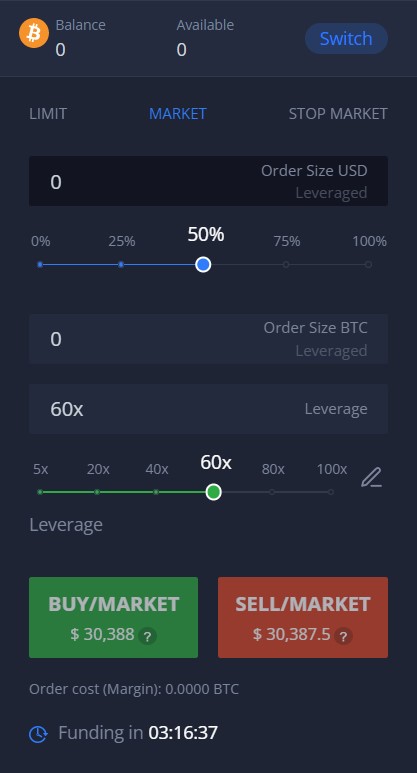

The overall interface is designed to aid all types of users. The trading terminal consists of:

- Chart and order placement module: It is located on the left-hand side of the trade interface and is used to place orders and reflects your balance information. It consists following attributes:

- Balance: Total amount of funds in your wallet.

- Available balance: Funds that can be used to open new trades, pay fees, and cover losses.

- Order types: Limit, Market, Stop Market

- Order size USD: Full size of your order in USD with selected leverage.

- Order size BTC: Full size of your order in BTC with selected leverage.

- Leverage: Used to choose your leverage for new orders.

- Buy/Sell: Place a long (buy) order or a short (sell) order.

- Margin cost– The amount of personal funds required and reserved to open a position.

- Funding: It is the funding countdown timer.

- Order and Deals management module: It is used by the traders to manage all active orders and open positions. Margex has made this module highly customizable, allowing traders to add/ remove desired columns, filter orders and positions by date, and view orders and positions history.

- Order Book and Last Trades:

The order book reflects market participants’ current Buy (ask) and Sell (bid) limit orders. The Order Book is an additional instrument that helps traders monitor market activity and provides valuable information to make the right trading decisions.

Last trades reflect the last performed trades on the market in real-time and provide additional valuable information for traders when making trading decisions.

All these modules help traders to trade in complete control of their assets. My own experience with the Margex interface has been pretty good; it is fast, lag-free, and transparent with all the tools and options present at your fingertips.

Margex maximum trades capacity is 100,000 trades per second with an average order execution time of 8ms. Now, you know why I was referring to it fast.

Margex Deposit & Withdrawal Methods

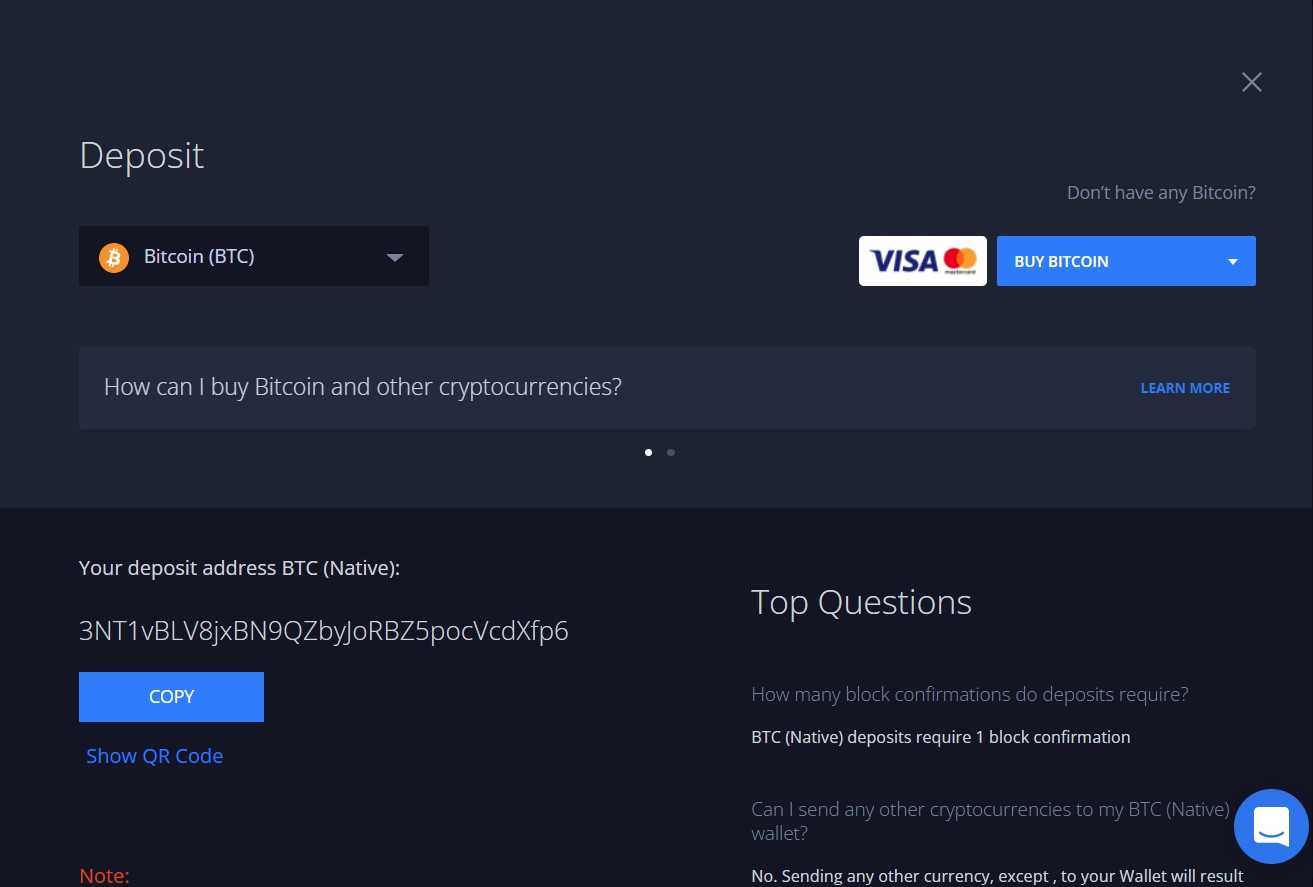

On Margex, there are two deposit options:

- Crypto or stablecoins deposits to your Margex account wallet from your wallets.

- Purchase cryptos or stablecoins using a bank card.

Whereas users can withdraw funds via cryptos, stablecoins, or fiat currencies, which can be used to profit users without any compensation to be processed to purchase cryptos directly.

How to Buy Bitcoin using your credit card via Margex?

BTC can be purchased using a bank card through the Changelly widget integrated on our platform or numerous other 3rd services. The Changelly widget allows you to purchase BTC using your bank card and have it transferred directly to your personal Margex Wallet.

To purchase BTC with a bank card using Changelly, navigate to the “Wallet” page:

- Click “Deposit”. The Changelly deposit widget will now appear.

- Choose the Amount and Currency that you want to pay with and select your Country.

- Click “Exchange”, then check that your Margex deposit address matches the destination address in the Changelly widget.

- Click “Continue”.

- You will be redirected to the Changelly site, where you can enter your payment details and finalize your purchase.

How To Start Trading on Margex?

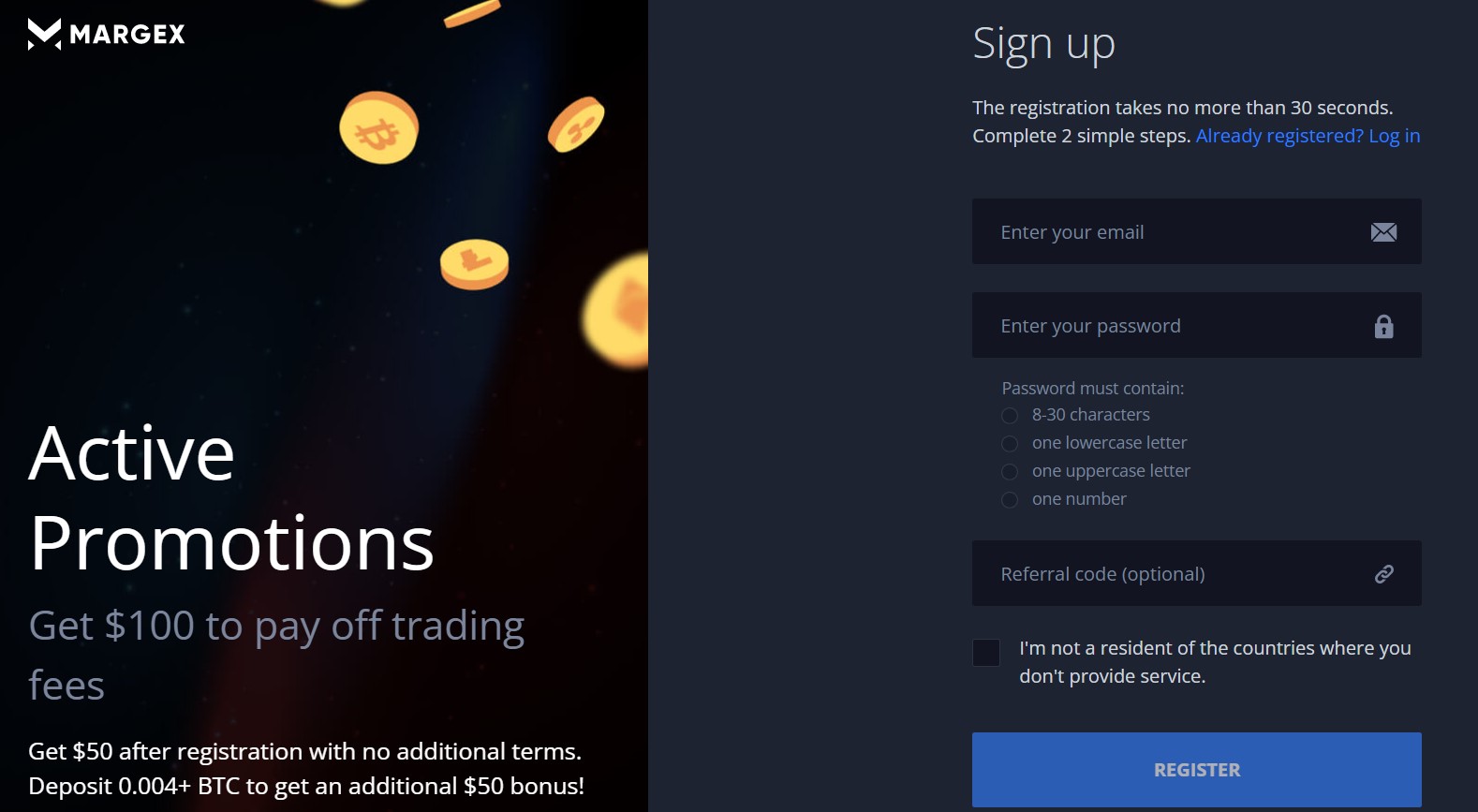

1. Register an account

Enter the registration page, fill in the required information and click ‘Register.’ Click the confirmation link received on your email ID.

2. Deposit

Click on the wallet tab on top, and you will enter the wallet page, then click ‘+Deposit.’ Select the desired deposit option.

3. Trade

Now you can start trading by navigating to the ‘Trade page.’ Select the desired order parameters like the instrument you want to trade-in and the order type. Specify the size and leverage. Then choose BUY LONG or SELL SHORT to place the corresponding order.

Margex Security Features

Margex has a built-in two-factor authorization feature that can be enabled on your account, such as logging in, placing a withdrawal, and changing your account password, which will require a 6- digit time code generated through your 2FA mobile app.

There is also an email notifications feature that would send notifications via your email on any activity on your account, like an unusual login, withdrawals, deposits, or something else that you should know about.

Margex also stores a significant amount of the client’s assets in cold storage wallets offline to protect assets from cybercrimes.

There is also a unique security feature on Margex called ‘Price Manipulation Protection’ let me tell you more about it.

Price Manipulation Protection Mechanism of Margex

Price feed and suspicious trading activities like spoofing and bluffing are monitored by the Margex machine learning equipped security system.

The liquidity pooling system combines multiple liquidity providers into a single, deep order book, ensuring the best entry and exit prices and the thinnest spreads available on the market.

An asset’s price on Margex depends on the combined liquidity of 12+ different providers. Margex does not offer illiquid assets with artificially inflated prices via false and misleading settlements.

The price squeezing protection system helps execute your orders at the expected price level. Margex does not include list assets with low liquidity or high affected by manipulations and significantly decreases price manipulation.To provide fair and equal trading opportunities, Margex continuously monitors all suspicious trading activities. The AI-based algorithmic technology by Margex continuously monitors the consistency of received price feeds from each liquidity provider.

Now that you got to know about the impenetrable security features of Margex, let’s see how their customer support system is.

Margex Customer Support

Margex has pretty robust customer support with a promised response time of under 10 minutes; you can raise your query using the live chat option. They are also available on other platforms like Facebook, Twitter, and YouTube.

You can also navigate into their help center, which is also enlisted with almost all the necessary information one would enquire for. There are also video tutorials to learn all the skills and knowledge about trading in Margex in depth.

Margex Referral Program

It is an excellent way to earn for those who want to make a passive income other than trading. You have to just share your affiliate link and build a referral network of traders and receive 40% of all trade fees paid by your referrals.

On the ‘Referral’ page of your account, you will find details and core statistics of your referral network, the status of your referral payouts, and materials such as a Marketing Kit to help you grow your network and increase your earnings.

Referral Payouts are processed once a day between 12:00 and 15:00 UTC. Pending referral payouts are updated hourly on the ‘Referral’ page and credited to the account wallet balance and can be further withdrawn or used for trading.

Margex Review Conclusion

Margex is one of the most uniquely designed crypto trading platforms with a variety of tools and services to aid crypto traders like me and you to crypto gains. Its carefully mapped-out interface and powerful engine simplify trading flawlessly like no other.

The platform is regulated by well-known authorities, making it secure and trustworthy, together with effective payment methods that assist deposits and withdrawals. Margex is a worldwide accepted platform that takes care of your anonymity with no compromise on the security standards.

And if you feel difficulty in understanding any of the tools or procedures on the platform feel free to go through their comprehensive video tutorials. Try Margex and take advantage of its excellent trading options and referral programs to magnify your profits even further.

You might also like:

- StormGain Review

- Phemex Review

- Kraken Review

- Delta Exchange Review

- ChangeHero.io Review

- Paxful Review