In traditional futures contracts, you treat futures trading as an agreement to buy and sell an underlying asset at a specific date, size, and price.

However, these contracts do come with an expiration date.

But when you trade crypto futures on a crypto derivative exchange, the expiration date is not a thing. Instead, it is labelled as the funding rate.

Now the question is, what is the funding rate? Well, this is what we will be learning about in this article.

So here we go:

Traditional Futures vs Perpetual Futures Contract

Before we learn about funding rates, you need to learn the key difference between a traditional futures contract and a perpetual contract.

In the traditional futures market, you see an expiry date for the contract. When the contract expires, the next process, which is settlement begins.

Usually, the traditional futures contracts are settled on a monthly and quarterly basis, and they are managed by regulated exchanges such as CME.

Joining CME? Know What is Bitcoin CME Gap?

On the other side, there are perpetual futures, also known as perpetual swaps. These contracts are more popular and easy to access by the majority of crypto traders.

You can trade perpetual contracts on different crypto futures trading exchanges such as Binance, ByBit, Kraken, and more.

Perpetual contracts are pretty similar to traditional futures contracts but without an expiry date.

This allows you to hold your trading positions for as long as you wish. Also, you do not need to worry about the expiry of the contract.

But since perpetual contracts don’t have an expiry, the contracts don’t settle in the traditional way. This could make the contract price significantly different from the underlying assets from which they derive their value.

To prevent this, crypto exchanges have a funding rate mechanism in place to ensure that the futures prices converge on a regular basis.

What Is Funding Rate In Crypto?

A funding rate can be considered as periodic payments or tax or interest payments, depending if the traders have long positions or short positions open.

Longs pay shorts when the funding rate is positive, and the short positions pay the longs traders when the funding rate is negative.

This gets calculated based on the price differences between perpetual contract markets and spot prices.

Moreover, crypto funding rates prevent lasting divergence in the price of both markets. The funding rates are calculated several times a day. However, a majority of the exchanges calculate the funding rate every eight hours.

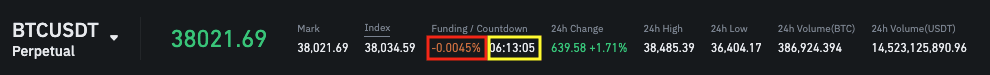

You can view the funding rate at the top of your exchange’s trading chart. In Binance, it is labelled as Funding / Countdown, the funding rates are highlighted in red, and the countdown to the next funding is highlighted in white.

How Is Funding Rate Determined?

The funding rate consists of two things: The interest rate and the Premium or Discount. Different crypto exchanges have their own way of calculating funding rates.

For instance, on Binance Futures, the interest rate is fixed at 0.03% daily (0.01% funding interval). Also, for certain contracts such as BNBUSDT and BNBBUSD, Binance charges no interest rates.

On the other side, the premium varies according to the price difference between the perpetual contract and the marked price.

If the difference between the perpetual contract and mark price is huge, then it will lead to a higher premium. In case there is a narrow spread between the two prices, there will be a low premium.

Moreover, when the funding rate is positive, and the price of the perpetual contract is higher than the marked price.

In such a case, traders having long open positions would pay for short positions. Similarly, negative funding rates suggest that the short position holders will pay to the longs, and they will receive funding.

Also, funding rates are paid peer-to-peer. This means Binance Futures don’t take any fees from funding rates.

How Does Funding Rate Impacts Traders?

Funding calculations are based on the amount of leverage used. Hence, funding rates may have a big impact on profits and losses.

Thanks to the high leverage offered by the perpetual futures contracts, a trader that pays the funding may suffer losses and get liquidated even in low-volatility markets.

On the other hand, collecting funding can be quite profitable in range-bound markets. Hence, many traders developed trading strategies to take advantage of funding rates and profit even in low-volatility markets.

Essentially, funding rates are designed to encourage traders to take positions that keep perpetual contract prices in line with spot markets.

Even certain traders use funding rates to understand the market sentiment and volatility while trading perpetual contracts.

For instance, if the market has a negative funding rate, but prices are going up, it can be an indication that the market is bullish.

How Can You Trade Using Funding Rate?

In the crypto markets, funding rate can be one of the indicators to identify the market sentiments. Many traders treat the funding rate as a sentiment indicator.

As the funding rate is designed to show the overall sentiment of the traders and how they look at the current market conditions. It indicates that the traders are planning to go short, and the market will go down as well.

If the funding rates are positive, then it implies how traders are long or expect the market to go up in the long run.

To help you understand better, let me share a quick example:

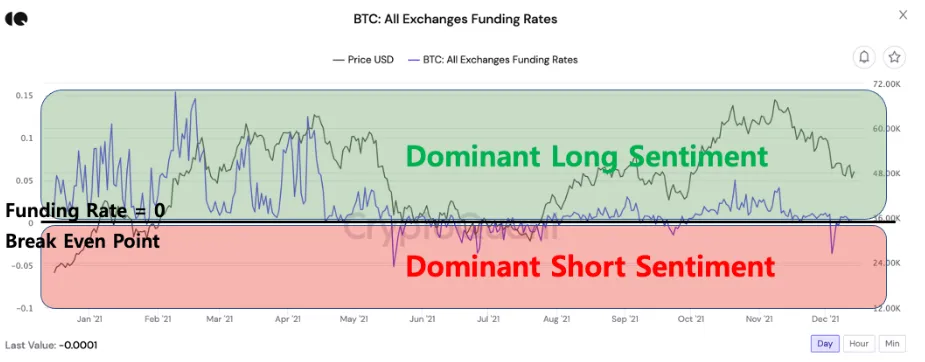

The above chart shows how funding rates under zero indicate that most traders are expecting lower Bitcoin levels to come.

When the funding rates are above zero, it will show that the traders are expecting higher future prices. The low funding rate indicates that a majority of the traders are bearish.

FAQs

- What does a positive funding rate mean in crypto?

Positive funding rates indicate that the long-term traders have the upper hand in the market and they are willing to pay funding to the short-term traders.

In this case, the traders are optimistic as the funding rates tend to be positive.

On the other side, low funding rates tend to indicate that short-term traders have the upper hand and are ready to pay compensation to long-term traders.

- How often is the funding rate paid?

The funding rate is updated every hour. However, a majority of the exchanges do prefer to use a 8 hour cycle to represent the funding rate. This means after each 8 hour period, funding accounts may expect to pay/receive funds.

- What is the funding fee on Binance?

Funding fees are periodic payments to traders. Binance pays funding fees through a paid peer-to-peer protocol.

Hence, Binance does not take any fees from funding rates transfer. Depending on their positions, traders will either pay or receive funding.

Conclusion

So that was all for crypto funding rates. Funding rates are an important element of trading the perpetual futures market, and they can help you shape your trading strategy.

Also, you should know that the funding rate differs from one exchange to another.

Plus, different exchanges can use their own way of calculating and updating the funding rate. So make sure to do your own research while choosing a crypto derivatives exchange.