Launched in August 2018, Delta Exchange is one of the new crypto derivatives exchanges in the crypto space. However, in the past couple of years, the user base of Delta Exchange has surged.

There are many reasons for using Delta Exchange. It offers a wide range of trading products and allows you to trade various financial markets. It also has one of the most powerful and intuitive trading platforms, making it a preferred exchange for institutional and professional traders.

But is Delta Exchange a safe and legit exchange, and should you use it? This Delta Exchange Review will answer all your questions.

Delta Exchange Offer: Get 25% Bonus of up to 2500 USDT on deposit of $10,000 or more in BTC/ETH/USDT |

Delta Exchange Review: Supported Coins & Altcoins

Delta Exchange supports the trading of 20 cryptocurrencies and altcoins, including:

- AAVE (AAVE)

- Band Protocol Token (BAND)

- Basic Attention Token (BAT)

- Bitcoin Cash ABC (BCH)

- Bitcoin Cash SV (BSV)

- Bitcoin (BTC)

- ChainLink Coin (LINK)

- Enjin Coin (ENJ)

- EOS Token (EOS)

- Ethereum (ETH)

- Fantom Token (FTM)

- Kava Token (KAVA)

- Litecoin (LTC)

- Matic Network Token (MATIC)

- NEO Token (NEO)

- REN Token (REN)

- Ripple (XRP)

- Stellar (XLM)

- Synthetic Network Token (SNX)

- Tether (USDT)

Product Offerings

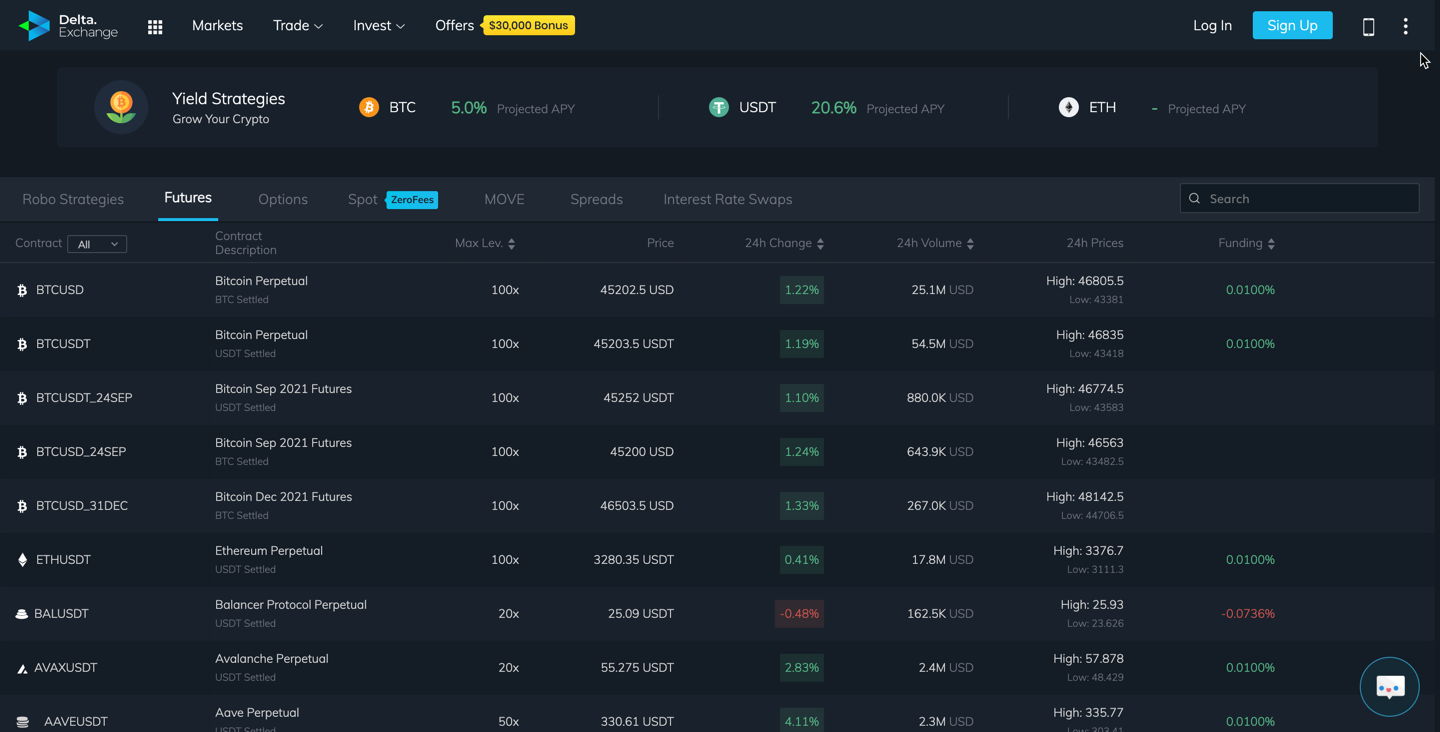

Delta Exchange has a comprehensive range of trading products. Whether you’re looking to trade futures, options, leveraged tokens, or spot trading, Delta Exchange has got you covered. Let’s look at the key product offerings of Delta Exchange.

- Futures: Traditional and perpetual futures contracts settled in BTC and USDT.

- Options: Conventional and MOVE options

- Spot: Spot trading of underlying assets BTC, ETH, and DETO settled in USDT

- Spreads: CSBTCUSD spreads

- Interest Rate Swaps: IRS-DE-BTCUSD interest rate swaps

- Robo Strategies: Nine Robo strategies catering to professional and experienced traders

Delta Exchange Offer: Get 25% Bonus of up to 2500 USDT on deposit of $10,000 or more in BTC/ETH/USDT |

Coming to leverage, Delta Exchange offers up to 100x leverage on all futures contracts. Hence, you can take positions worth 100 times more than your initial margin. This increases both your profit potential and risk exposure.

For example, for an initial margin of USD 5,000, you can use 100x leverage and buy a futures contract worth USD 500,000. This means if the price moves by 1%, your profit/loss will be USD 5,000. If the trade moves 1% against your direction, your position will be forcefully liquidated as all your margin will be exhausted.

Therefore, beginners should be extra careful when trading crypto derivatives with high leverage.

The daily cryptocurrency derivatives trading volume of Delta Exchange is USD 40 million – the 26th highest in the market.

Trading Fees

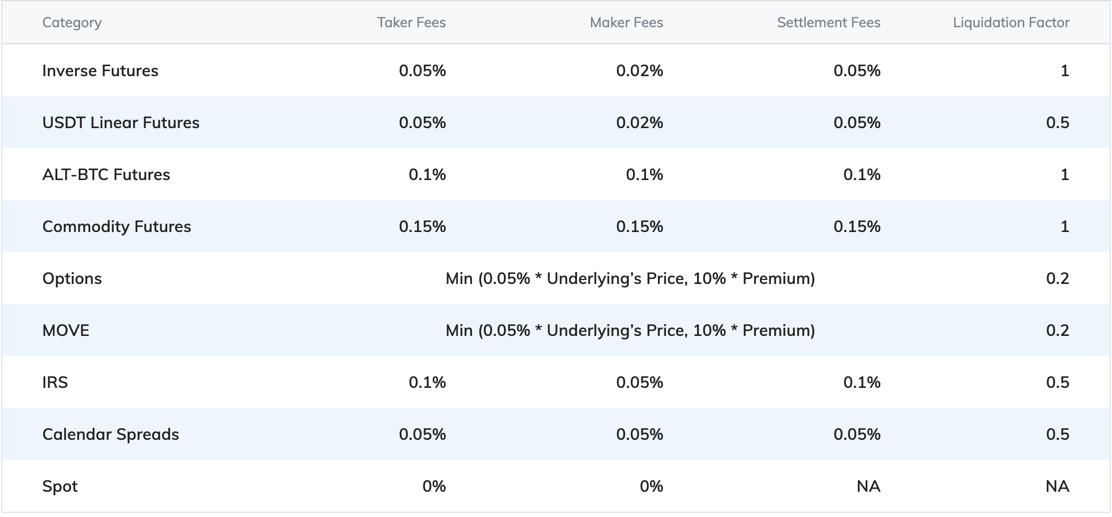

Like most cryptocurrency exchanges that offer derivatives trading, Delta Exchange follows a market maker-taker fee model. Here is how this fee model works.

Orders are of two types – first, that add liquidity to the market, and second, that reduce liquidity in the market. Orders that add liquidity are called market maker orders. These include orders that enter the order book, such as limit orders.

Contrarily, orders that reduce liquidity are known as market taker orders. These include orders that don’t enter the order book and get immediately executed, such as market orders.

Delta Exchange has a flat fee structure. It charges a 0.02% market maker fee and 0.05% market taker fee on all BTC perpetual and futures contracts and USDT-settled contracts. The fee is quite competitive as per industry standards.

However, for altcoin-BTC pair futures, Delta Exchange charges a 0.10% market maker-taker fee, which is quite high. You can visit the Delta Exchange fees page to learn about the fees for the categories.

Delta Exchange Offer: Get 25% Bonus of up to 2500 USDT on deposit of $10,000 or more in BTC/ETH/USDT |

Trading Platform & Tools

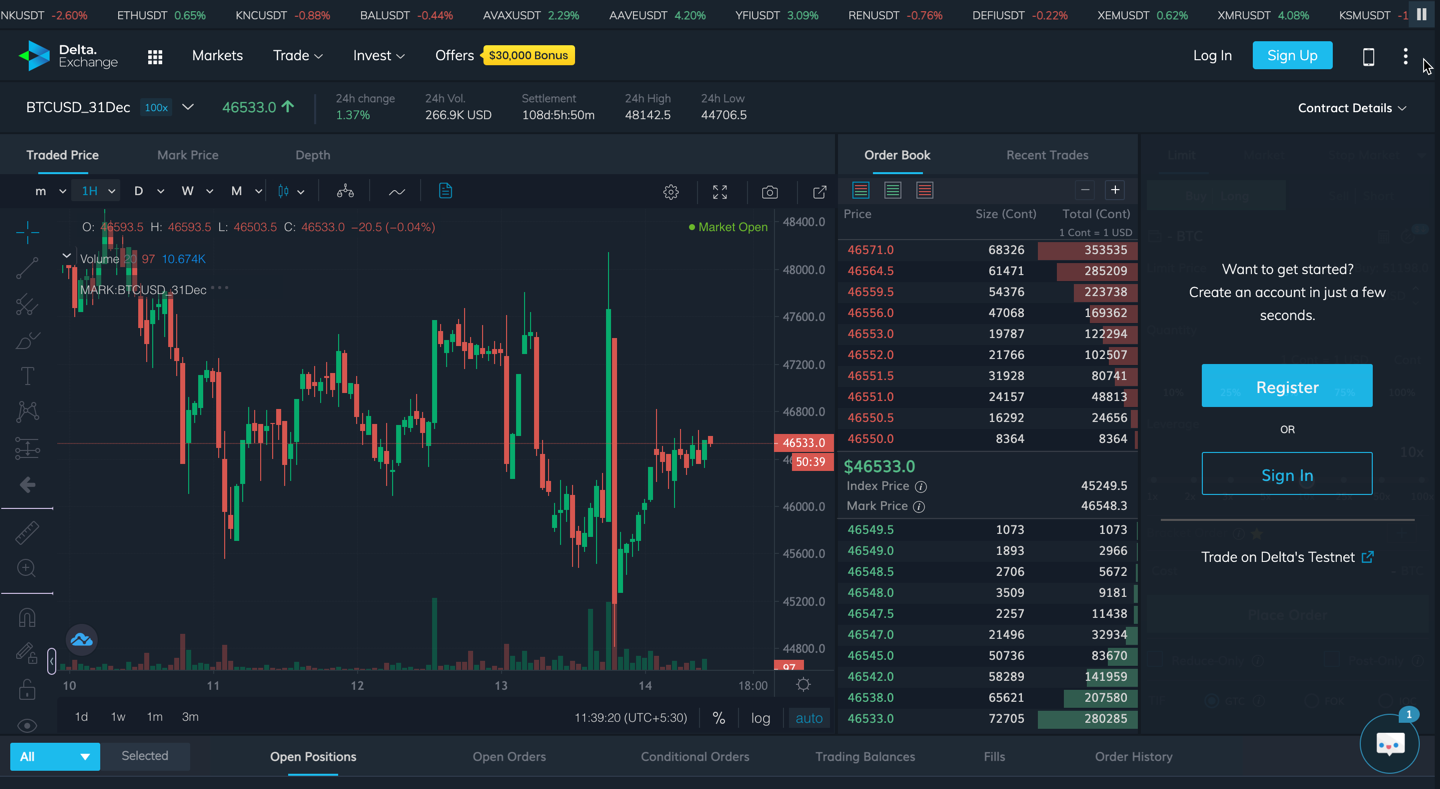

Hardly any crypto options trading exchange comes closer to Delta Exchange when it comes to the trading platform and tools. It has an institution-grade trading platform with all the features and functionalities you’ll find in other top-notch trading platforms.

Here’s a detailed overview of Delta exchange’s trading platform.

#1. Desktop Platform

Delta Exchange has one of the most intuitive desktop trading systems in the market. A moving tab on the top of the page displays the percent price change of all cryptocurrencies and altcoins listed on the exchange.

The tab on the top of the trading panel shows the details about the opened contract, including:

- 24h change

- 24h volume

- Funding rate

- Est. next funding

- Next funding in

- 24h high

- 24h low

The extreme right of the trading panel has the Order Form that allows you to place orders. The order form lets you select the order type, amount, leverage, and advanced order type (if any).

Left from the Order Form is the Order Book, where you can track real-time trades, recent trades, and market depth.

At the bottom of the trading panel, you’ll find the positions section where you can track your open positions, open orders, stop orders, trading balances, fills, and order history.

The web trading platform is highly intuitive and has a responsive interface. If you use a tablet or mobile phone, the trading panel gets separated into the following subsections:

- Home

- Book

- Trade

- Charts

- Positions

You can easily navigate to each section without the need to zoom in or zoom out based on your screen size and resolution.

#2. Charting System

Delta Exchange has a proprietary charting system powered by Trading View. You can see the chart of four variables:

- Traded Price

- Mark Price

- Funding

- Market Depth

Since Delta exchange deploys the TradingView charting system, it comes with all the TradingView features, including:

- Multiple Time Frames: Delta exchange allows you to view charts across time frames ranging from 1 minute to four months. This allows you to get a short-term and long-term view of the market.

- Chart Types: Delta exchange supports six chart types: bars, candles, hollow candles, Heikin Ashi, line, and area.

- Indicators: Delta exchange has hundreds of built-in indicators that help you conduct proper technical analysis and make informed trading decisions.

- Drawing Tools: Delta exchange offers a wide range of drawing tools to help you mark important levels, trends, and areas.

- Strategy Tester: Delta exchange’s trading platform allows you to deploy and test strategies before using them in the live market.

#3. Mobile App

Delta exchange has a high-quality mobile app that comes with all the features and functionalities of the desktop trading platform. The app allows you to open an account, deposit funds, take positions, withdraw funds, and more.

#4. Testnet

Delta Exchange is one of the few crypto derivatives exchanges that offer a testnet. A testnet is a demo trading panel where users can participate in simulated trading and understand how the platform works. Once you gain enough confidence, you can start trading with real money.

Delta Exchange Order Types

The following order types are currently available on Delta Exchange.

- Limit Orders

When placing a limit order, you specify a price at which you want the order to execute. The order will only execute if the market price reaches your entered price.

- Market Orders

Market orders execute at the current price and don’t enter the order book, unlike limit orders.

- Stop Orders

Stop orders are a type of conditional orders placed either in the direction of your open position or against it to trigger profits or losses. Stop orders are mainly of two types: take-profit orders and stop-loss orders.

- Bracket Orders

Bracket orders allow you to place a market or limit order, along with two opposite-side orders. This means you can place a stop-loss and take-profit order, along with a market or limit order, all at once.

- Advanced Attributes for Orders

Delta Exchange also supports advanced attributes for orders. These include:

- Order validity attributes, including immediate or cancel (IOC), fill or kill (FOC), and Good till canceled (GTC).

- Order execution attributes, including post only and reduce only orders

Delta Exchange Offer: Get 25% Bonus of up to 2500 USDT on deposit of $10,000 or more in BTC/ETH/USDT |

Delta Exchange Token DETO Use Case

DETO is the native token of Delta Exchange. Here’s all you need to know about the token:

- Token Ticker: DETO

- Token Type: ERC-20

- Token Category: Exchange Token

- Price: USD 0.1149

- Token Supply: 500 million

- Circulating Supply: 46.5 million

- Market Cap: USD 5.46 million

- Supply Hard Cap: 750 million

Users with a Delta Exchange account can use DETO to pay 25% of their trading fees. To use this feature, you’ll need to turn on the “use DETO to pay trading fees” feature in the account preferences.

Please note that only verified users can buy DETO. If you want to buy DETO, you’ll need to complete the KYC process.

Delta Exchange Offer: Get 25% Bonus of up to 2500 USDT on deposit of $10,000 or more in BTC/ETH/USDT |

How to Start Trading on Delta Exchange?

Delta exchange offers a seamless account registration process. You can visit the registration page and create an account. Delta exchange doesn’t have mandatory KYC requirements, and you can create an account, deposit funds, and start trading without proving your identity.

The deposits are free, and there is no minimum deposit requirement on Delta Exchange. However, users need to pay a nominal withdrawal fee. The withdrawal fees are unique for each cryptocurrency.

However, unverified accounts have a withdrawal limit of USD 1,000. By verifying your account, you can enjoy unlimited BTC and USDT withdrawals. Delta Exchange requires your full legal name, address, proof of identity, and proof of address selfie to verify your account.

Once you have created your account, you can start trading on the platform. Here’s how you can get started.

- Deposit Funds

The first step is to deposit funds. Delta Exchange accepts deposits in BTC and USDT only. If you don’t own them, you can head to an exchange like Coinbase to convert your fiat currency into cryptocurrency.

- Pick a Ticker

Once you have deposited funds, you now need to pick a ticker (or contract) to trade. For example, you can choose BTCUSD (BTC Perpetual Swaps).

- Place Your First Trade

Now that you have decided which contract to trade, head to the Order Form and fill it. First, determine what order you want to place – limit or market. If you want to place a market order, enter the limit price.

Next, fill in the quantity and leverage. Select reduce-only or post-only if needed. Once your order book is filled, select Buy or Sell and place the order.

That’s it. You have placed your first trade on Delta Exchange.

- Exit Your Trade

After entering a trade, only two outcomes are possible. Either it will end in a win or a loss. If your trade goes your way, you must ensure that you take the profits correctly. If your trade goes south, you must cut your losses in time.

There are two ways to exit your trade. The first way is to cancel your open position manually. By doing so, you will place a market order against your open position.

The second way is to place a take-profit or stop-loss order. These are limit orders placed in the same direction or opposite direction of your trade. Placing these orders is the best practice, especially if you can’t monitor price movement after placing a trade.

- Keep Practicing

Trading is a journey, and no new trader can become profitable all of a sudden. Be sure to trade with a proper strategy and learn from your losses. A winning trading strategy, along with effective risk management and position sizing, is the key to being a successful trader.

Delta Exchange Security Features

Reliability, security, and liquidity are the key features of Delta exchange. Some security measures implemented by Delta Exchange are:

- Multi-Signature Cold Wallet: Like most crypto exchanges, Delta Exchanges uses a multi-sign cold wallet system to store users’ funds.

- Two-Factor Authentication: Delta Exchange encourages users to activate two-factor authentication (2FA) to enhance the security of their accounts.

- Withdrawal Authorizations: The team at Delta Exchange manually authorizes all withdrawal requests.

- Secure Infrastructure: Delta Exchange uses cutting-edge technologies like IP whitelisting, SSL encryption, traffic monitoring, etc., to further enhance the exchange’s security.

Delta Exchange Offer: Get 25% Bonus of up to 2500 USDT on deposit of $10,000 or more in BTC/ETH/USDT |

Customer Support

Delta Exchange offers support via Telegram only, which is a major drawback of the exchange. However, the exchange compensates it with its support center that includes a comprehensive knowledge base. It has dedicated sections for:

- Account management

- Deposits and withdrawals

- Fees

- Futures trading

- Margin trading

- Perpetual contracts trading

- Security

- Order types

- Promotions

- MOVE options

- Latest announcements

Delta Exchange Review Summary

Delta Exchange is one of the best crypto derivatives and spot trading exchanges for beginners and professional traders. It supports 20+ currencies and offers a variety of trading products to choose from.

If you’re looking for an exchange with a robust trading platform, look no further. Delta Exchange has a top-notch trading platform. It also implements leading-edge security to provide a safe trading experience to traders.

On the downside, it offers support only via Telegram, which could be a turn-off for many traders, especially new traders. The trading fee charged by the exchange is also slightly higher than the industry standard.

Overall, Delta Exchange is one of the top exchanges for both derivatives and spot trading.

You might also like:

- Is Bitcoin Real Money?: Understanding Different Types Of Money - June 28, 2024

- Bitcoin Transaction Accelerator: 5 Services to Unstuck Your BTC - September 23, 2023

- What Is Bitcoin Private Key? Everything You Need To Know !! - June 2, 2023