Founded in 2017 and based in Seychelles, KuCoin is a leading crypto exchange that offers a wide range of digital assets that can be traded with low fees.

When initially launched, KuCoin supported Spot trading only. But as of this KuCoin review 2023, KuCoin has leveraged tokens, Futures trading, and Margin trading.

A unique feature of KuCoin is the availability of cryptocurrencies and different trading pairs and fiat trading pairs.

As of now, it lists more than 300 cryptocurrencies, along with nearly every crypto asset that has recently had its ICO.

When it comes to Futures trading, KuCoin has all the standard benefits, including up to 100x leverage, low trading fees, a robust trading platform, and more.

KuCoin Exchange: Supported Cryptocurrencies

KuCoin lists more than 300 cryptocurrencies (at the time of writing) and 400+ markets.

These include popular coins like Bitcoin (BTC) and Ethereum (ETH) and less popular coins like Lympho, KuCoin coin, and VeChain.

KuCoin is one popular exchange for new cryptocurrencies that have completed their initial coin offering (ICO).

If you are interested in investing and trading cryptocurrencies in the initial phase of their journey, you can find them on KuCoin.

KuCoin’s Margin Trading Pairs and Leverage Offerings

KuCoin supports Spot trading & Futures trading. Let’s talk about spot trading first.

- Spot Trading

KuCoin supports the spot trading of more than 70 cryptocurrencies.

You can trade cryptocurrencies settled in USDT, BTC, KCS, TRX, and ETH per your preferences.

KuCoin also offers margin trading, where you can trade cryptos with up to 10x leverage.

KuCoin has a daily volume (spot) of USD 559 million – the fourth highest in the market.

- Derivatives Trading

When it comes to derivatives trading, KuCoin has perpetual and quarterly Futures contracts.

Two types of Futures are available on KuCoin:

- USDT-Margined Contracts: Perpetual Futures settled in USDT stablecoin

- COIN-Margined Contracts: Perpetual Futures settled in USD

Please note that traditional Futures contracts with a quarterly expiry are available for BTC only.

For other cryptocurrency Futures, only perpetual contracts are available.

KuCoin has a 24h derivatives volume of USD 1.8 billion – the 4th highest in the market.

Coming to leverage, KuCoin supports up to 100x leverage on all traditional and perpetual Futures contracts.

- Leveraged Tokens

KuCoin offers leveraged tokens, tradable assets in the spot market that can be traded at up to 3x long/short without any liquidation risk.

Unlike margin and Futures trading, in which users need a maintenance margin, these tokens require no collateral and are entirely risk-free.

- KuCoin Earn

As someone who wants to stay in the crypto space long-term, you would love to stake your coins with the exchange and earn interest.

- KuCoin P2P

KuCoin also has an instant exchange service called KuCoin P2P.

The service allows buying and selling of cryptos using numerous fiat payment methods, such as PayPal.

- KuCoin Lending Platform

KuCoin’s crypto lending service allows users to use the exchange to lend cryptocurrencies to others and earn an interest rate.

The lender can fill in the loan amount and daily interest rate, ranging from 0 to 0.2%.

The default loan terms selection is 28 days; however, it can also be 14 days and seven days.

KuCoin Trading Fees

KuCoin follows a market maker-taker KuCoin fees structure for both spot and KuCoin Futures trading.

Let’s quickly review the market maker-taker fee structure and how it works.

All the orders placed on an exchange are categorized into two types:

- Orders that add liquidity

- Orders that reduce liquidity

Orders that enter the order book, such as limit orders, add liquidity to the market. Such orders are known as market maker orders.

Contrarily, orders that don’t enter the order book, such as market orders, reduce liquidity from the market.

Such orders are known as market-taker orders.

The market maker-taker fees vary by what you choose, and the two structures are further classified as below:

- Flat-fee model

- Tiered fee model

In the flat-fee model, the KuCoin instant exchange charges a fixed market maker and market taker fee.

In the tiered fee model, the market maker and taker fees depend on the last 30-day volume and other factors.

KuCoin also uses a tiered fee model for both spot and Futures trading. It has 13 tiers (Level 0 – Level 12).

- KuCoin Spot Trading Fees

For spot trading, users with the last 30d volume of less than 50 BTC and a KCS holding of less than 1,000 falls into Level 0.

For Level 0 accounts, the market maker/taker fee is 0.1%/0.1%, which reduces to 0.08%.0.08% when paid using KCS.

Similarly, accounts with a 30d volume of more than 80,000 BTC or KCS holding of more than 150,000 falls into Level 12.

For Level 12 accounts, the market maker/taker fee is –0.005%(rebate)/0.025%, which reduces to –0.005%/0.02% when paid using KCS.

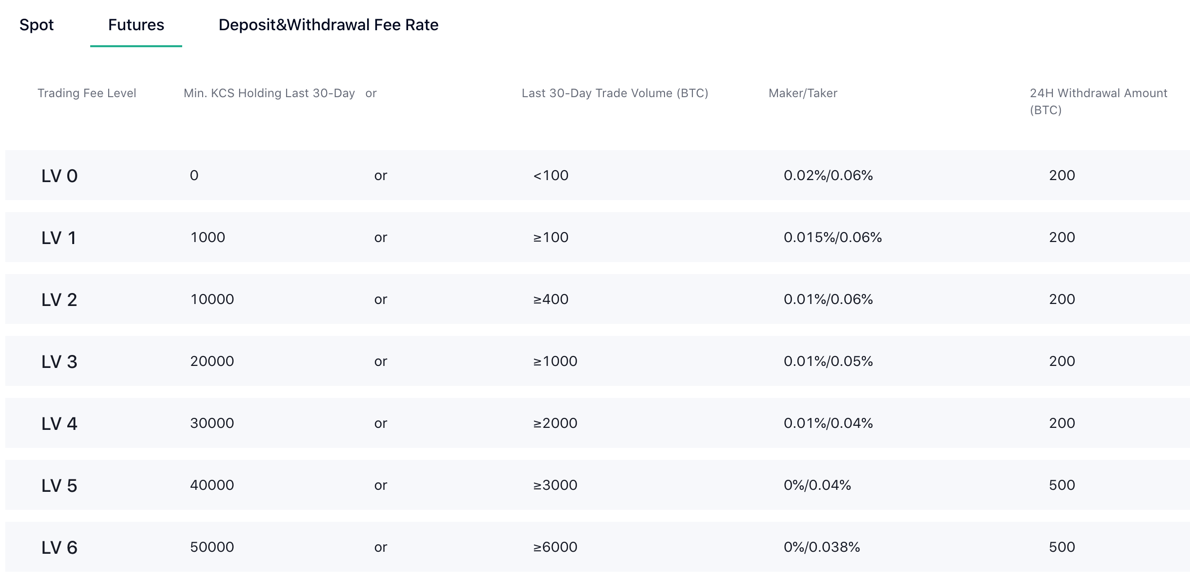

- Futures Collected Trading Fees

For Futures trading, users with the last 30d trade volume of less than 100 BTC or KCS holding of less than 1,000 falls into Level 0.

For Level 0 accounts, the market maker/taker trading costs are 0.02%/0.06%

Users with the last 30d trading volume of more than 160,000 BTC or KCS holding of more than 150,000 falls into Level 12.

For Level 12 accounts, the market maker/taker fee is –0.015%(rebate)/0.03%.

- KuCoin Deposit and Withdrawal Fees

Deposits are free on KuCoin regardless of the payment method.

However, when depositing fiat from third-party payment gateways, additional transaction charges may apply.

KuCoin charges a nominal withdrawal fee for all cryptocurrencies.

For instance, it charges 0.0005 BTC for Bitcoin withdrawals and 0.004 ETH for ETH withdrawals.

KuCoin Native Token (KCS) & Trading Fee Discount

KuCoin issued its native coin –KCS – in 2017.

The ICO price of the KuCoin token was 0.000055 BTC, which as of July 2023, has surged to around $6.4.

Users who hold KuCoin shares and pay with KCS can enjoy lower trading fees.

KuCoin Deposit Methods

KuCoin allows you to deposit funds using cryptocurrency and regular currency. As of 2021, the KuCoin exchange supports currencies like USD, CAD, VND, IDR, INR, EUR, AUD, NGN, and CNY.

If your country’s currency isn’t supported, you can use a Bitcoin exchange like Coinbase to convert your cash into BTC and transfer it into your KuCoin wallet.

KuCoin lets you use several convenient payment methods, such as credit/debit cards, ApplePay, SEPA, and P2P bank transfer, with more than 20 options.

Regarding cryptocurrency deposits, KuCoin allows BTC, USDT, ETH, and PAX if you already own crypto.

KuCoin Futures Funding Fees

In KuCoin Futures, the Last Price can deviate significantly from the spot price.

Since traditional Futures have a quarterly expiry date, the Last Price converges into the spot price at regular intervals.

However, perpetual contracts don’t have an expiry date, and hence, the Last Price can continue to trade away from the spot price.

KuCoin uses the Funding mechanism to ensure that the Last Price of a Futures contract stays close to the global spot price.

When the Last Price is higher than the spot price, long accounts pay a funding fee to short accounts.

Similarly, short accounts pay a funding fee to long accounts when the Last Price is lower than the spot price.

The following formula calculates the funding fee:

- Funding Fee = Position Value x Funding Rate

KuCoin uses two components: The Interest Rate and Premium Index, to calculate the Funding Rate.

The formula for Perpetual Futures Funding Rate is:

- Funding Rate = Premium Index + clamp (Interest Rate – Premium Index, 0.05%, – 0.05%)

KuCoin Futures funding occurs every eight hours at 04:00 UTC, 12:00 UTC, and 20:00 UTC.

Tip: To understand how liquidation works and how to avoid liquidations, go through our guide on how to calculate liquidation price.

Insurance Fund

KuCoin uses an Insurance Fund backed by Lockton to hold liquidation orders until the auto-deleveraging mechanism takes over.

This insurance policy ensures that profitable accounts receive their profits even if the losing accounts’ positions get automatically liquidated.

KuCoin Account Opening Process

KuCoin has mandatory KYC (Know Your Customer) requirements.

The highest level of KYC allows accounts to enjoy a higher withdrawal limit of 1,000,000 USDT per day.

In addition, KYC is mandatory for users who want to deposit or withdraw money.

KuCoin recommends KYC verification to offer bank-level security to the user’s account and make the exchange a trustworthy place for all users.

KuCoin Trading Platform and User Interface

The KuCoin platform plays a vital role in the overall trading experience, regardless of whether you are a new or experienced trader.

Let’s delve deep into the KuCoin features.

Desktop Trading Platform

KuCoin is one exchange that supports two desktop trading versions for Futures trading.

The first one is Futures Lite, which is ideal for beginner traders.

It has a simple user interface with a price chart, a long/short ratio meter, and an Order Form.

It lets you select the pair you want to trade and place orders.

Futures Pro is also an option for those who prefer a comprehensive platform that uses the TradingView charting system that is accurate and up-to-date.

It features the Order Form at the extreme right.

On the left of the Order Form is the Order Book which provides real-time trade information and helps you analyze the market sentiment.

At the end of the panel, you’ll find the position manager that shows your open positions, closed positions, open orders, stop orders, take profit orders, fills, and order history.

The charting system is located on the left side of the trading panel.

KuCoin OTC Trading Desk

The KuCoin Over-the-Counter (OTC) Trading Desk enables institutional traders to execute large trades at specific prices without putting the market at risk of sudden fluctuations.

It also allows regular traders to use the platform still and not get liquidated.

The desk allows you to deposit funds using regular currencies for fiat to crypto trading. Please note that KYC is mandatory for OTC trading.

Mobile Trading

KuCoin right now has a mobile app for iOS and Android users.

It has various features, such as account opening, deposit and withdrawal, KYC verification, placing orders, and more.

The mobile app is intuitive and user-friendly and offers a pleasant trading experience.

User Experience

Overall, KuCoin deploys an industry-grade platform ideal for beginner and professional traders.

It comes with all the essential tools and features needed to help traders make informed trading decisions.

Furthermore, the platform is intuitive, robust, and user-friendly. It is easy to use and enables seamless navigation.

Therefore, if you are looking for an exchange with a simple yet powerful trading interface, KuCoin will be the right pick.

How to Start Trading on KuCoin?

The process of starting trading on KuCoin is similar to other exchanges. First, you need to open a trading account.

Depending on your requirements, you can verify your identity or begin with an unverified account.

Once you have opened your account, follow these steps to place your first trade on KuCoin.

1. Pick the Right Segment

As discussed, KuCoin enables trading in three market segments: Spot, Futures, and Leveraged Tokens.

Futures are naturally the first choice for traders as you can trade with high leverage and low margin. However, the risk is also high.

So, if you’re looking to trade for the short term (like intraday) and have a good risk appetite, you can opt for Futures trading.

Spot trading is the ideal pick if you want to hold crypto for a few months or years.

New to KuCoin? Know How to short Bitcoin on KuCoin?

2. Pick the Right Pair

Once you have chosen the segment you want to trade, the next step is to pick the trading pair.

It’s wise to choose a pair with good liquidity, like BTCUSDT and ETHUSDT.

3. Choose the Order Type

The next step is to choose the order type. If you want to enter a trade at the current market price, you can place a market order.

On the other hand, a limit order would be the ideal pick if you want to enter at a specific price.

4. Place Your Order

Once you have determined the type of order you want to place, fill out the Order Book and place an order book.

You’ll also need to select the position size (quantity) and leverage.

After filling these fields, you can Buy or Sell to go long or short, respectively.

5. Exit Your Order

The final step is to exit your order. You can exit orders in two ways: manually exiting your open position or placing a stop-limit order.

It is ideal to trade with stop-limit orders as it gives you better control over your trade.

KuCoin Security Features

Since its launch in 2017, KuCoin hasn’t experienced any hacking or security incidents.

It implements bank-level asset security, along with all the essential security measures prevalent in the cryptocurrency space.

KuCoin has worked with a company called Onchain Custodian to help secure the assets that are stored with the exchange. These include:

- Cold Wallet Storage: KuCoin uses cold storage micro withdrawal wallets to store users’ funds, protecting them from hacker attempts. KuCoin also uses industry-level multilayer encryption.

- Dynamic Multifactor Authentication: KuCoin allows its users to enable two-factor authentication to protect their accounts from unauthorized login attempts.

- Security Questions: KuCoin allows you to set security questions that will be asked when you take necessary actions, such as changing passwords, withdrawing funds, etc.

- Withdrawal Authentication: KuCoin works as a team to manually authenticate all withdrawal requests, ensuring no unauthorized activity occurs.

- Notifications: KuCoin sends email and push notifications for essential account actions, such as fund deposit/withdrawal, password change, etc.

KuCoin Customer Support

KuCoin has a reliable customer support team and offers support in the following ways:

- Help Center: KuCoin users can seek email support from KuCoin by raising a ticket from the KuCoin Help Center, accessible via the official website.

- Live Onsite Chat: It is one of the few cryptocurrency exchanges that offer live onsite chat support.

- FAQ: KuCoin has a comprehensive knowledge base that answers all the frequently asked questions about trading cryptos on KuCoin.

- Mobile App Support: KuCoin offers dedicated support to mobile app users.

Additionally, KuCoin users can interact with the KuCoin team on social media channels, including Facebook, Telegram, Twitter, and Reddit, in English, Russian, Vietnamese, Turkish, Italian, and Spanish.

Frequently Asked Questions

- Where is KuCoin located?

The KuCoin exchange is based in Seychelles.

- Is KuCoin Safe and Legit?

Yes. The KuCoin exchange is completely safe and legit, with more than five million global users.

KuCoin implements robust security features to provide a safe and secure trading experience to its users. It also enables you to perform identity verification.

- Is KuCoin Regulated?

No. KuCoin, like most cryptocurrency exchanges, is regulated in someplace and not regulated in some.

However, it implements all the essential security features needed to provide a seamless experience to its users.

- Can I Use a Credit Card to Deposit Funds on KuCoin?

Yes. KuCoin uses Banxa – a third-party payment gateway provider – to enable you to pay fees via payment methods, including MasterCard/Visa, Apple Pay, and more.

Depending on the payment method, there are different fees wherever they are licensed to operate.

- Is KYC Mandatory on KuCoin?

Yes, KYC is mandatory on KuCoin as the exchange recommends users complete KYC to create a trustworthy platform for trading.

It allows users to enjoy more trading features and discounts based on the available products or offers the exchange is running.

- Does KuCoin Have Any Withdrawal Limits?

Yes. The daily withdrawal limit on KuCoin is 25,000-1,000,000 USDT for verified users, depending on your level of KYC completion.

Conclusion

Coming to the pros, KuCoin supports many cryptocurrencies, trading pairs, and markets.

It also offers various trading products, such as spot trading, Futures trading, the KuCoin trading bot software, and leveraged tokens.

If you’re someone who prefers a lot of options in crypto trading, KuCoin will be an ideal platform for you.

Another significant upside to using KuCoin is the robust platform allowing you to stake your crypto to earn interest.

KuCoin has one of the most influential and intuitive platforms in the crypto space.

Other benefits include the lowest trading fees, KuCoin, leading-edge security, and good-quality customer support.

Some downside to using KuCoin is that it charges a withdrawal fee on all cryptocurrencies, and withdrawal fees vary depending on the withdrawn coin.

Another downside is that KuCoin is not licensed in the U.S. As of writing this article, they are still trying to get a license to operate in the U.S.

Outside the U.S., 200 countries enjoy the benefits of trading on a platform with one of the widest ranges of cryptocurrencies.

Overall, KuCoin is an excellent platform for crypto traders and has all the features you’ll see in other leading exchanges.

You might also like the following: