Fees significantly impact how profitable trades are when buying and selling crypto or trading derivatives contracts. Although different crypto exchanges will have varying trading fees, the maker and taker fees are the most common.

Most crypto exchanges keep them as low as possible and hardly ever go beyond 0.5%. However, although they might look almost insignificant, these fees can add up quite fast for frequent traders. Hence it is essential never to overlook them.

That said, traders should start by understanding what maker and taker fees are and how they relate to the transactions they make.

Maker vs Taker fee

The high-frequency trading in many crypto exchanges often reduces liquidity and leads to price distortion, benefiting short-term traders but harming long-term ones.

Crypto exchanges will often charge a fee for traders that want to trade quickly (taker fee) and incentivize those ready to wait by using limit orders with zero or lower fees (maker fees). Hence, the fees traders pay depend on whether they are market makers or takers.

New to futures trading? Learn about how to calculate Crypto Futures liquidation price

- Market Maker

Market makers add liquidity to the order books, so many crypto exchanges will charge them low fees. They do this by placing their order using the limit order that sets conditions for execution when the price gets to a certain point.

For example, if you place an order to buy 10 ETH at $3,000, it will be added to the order book. When another trader on the crypto exchange places an order to sell ETH with an order that matches yours, you become a market maker.

By adding your order to the books, you “make” the market and are called a market maker. Although institutional traders specializing in high-frequency trading are often the market makers, individual ones also become market makers when they place an order that does not require immediate execution.

- Market Taker

Market takers will draw liquidity from the order books. These traders will place an order that requires immediate execution. Market takers use a market order, and the order provides an instruction to buy or sell the asset at the current market price.

The immediate fulfillment of these order types means that some liquidity comes out of the books, and hence the trader is a market taker.

Therefore, as a liquidity taker, you have to pay a fee. The actual fee depends on the specific exchange you use and the trading pair.

Pros & Cons of Maker & Taker Fee Model

The maker and taker fee model is the standard way of charging trading fees in most crypto exchanges. However, while it seems to work well as most traders are already used to it, the model has its pros and cons.

Pros

The maker and taker fee model helps deal with price distortions resulting from rapid trading tendencies. An exchange can help prevent this undesirable behavior to ensure smooth trading by charging a higher fee for taking liquidity from the books.

Also, it helps protect long-term traders and tame short-term ones looking to make high profits quickly.

The maker and taker fee model encourages the traders to add more liquidity to the exchange’s book. High liquidity ensures there are lower spreads between the bid and ask prices. Hence traders on the exchange get to execute their trading positions with little slippage.

Although the undesirable behaviors of market takers are what this system aims to cure, the market orders also have advantages for some traders. These orders allow instant order execution as the trader will never have to wait for another trader to fulfill the order.

Cons

One major disadvantage of the maker and take fee model is that it can sometimes cause long waits before order execution. If you are a market maker, you may have to wait a long time for a buyer to fulfill the order.

Also, sometimes the order gets stuck in the books as you might never find a buyer/seller at your specific price.

Many exchanges charge high fees when using the taker orders, meaning you end up with little profit even if your order execution is immediate.

Another demerit for market takers is that in most instances, the order execution will be at a lower price if you are selling and a higher price when buying. Both will eat into your profits, making crypto trading less profitable for market takers.

Maker Taker Fees In Coinbase

Coinbase uses a tiered pricing system to implement their maker-taker fees. The fee you pay will depend on your tier when you place the order.

Since the tiers depending on your trading volume, they will change as your volume increases. Coinbase recalculates your fees every hour to ensure they always charge you highly accurate fees.

There are 14 different tiers on the platform. They start with traders with the lowest volume of under $10K to those trading over $2B a month, such as institutional traders.

Low volume traders in the under $10K tier will pay 0.5% in maker and taker fees. However, traders that trade over $300 million a month will not pay any maker fees, and their taker fees also reduce to between 0.08% and 0.04%.

When trading stable pairs such as USDT – USDC and DAI – USDC, you will never pay any maker fee, and Coinbase will only charge you 0.01% in taker fees.

Also, it is essential to note that if you place an order, but a part of it is fulfilled immediately, you will only need to pay taker fees for that portion of your order.

Maker Taker Fees In Kraken

Kraken will calculate their maker-taker fees as a percentage of the order value of the trade once it matches a buyer or seller.

Kraken has a tiered fees schedule based on your 30-day trading volume. Hence, the more assets you trade on the exchange, the smaller the fees you have to pay when trading.

There are 8 levels of traders when it comes to the maker-taker fees. Traders at the first tier have 30-day trading volumes of 0 to $100,000. These traders will pay 0.0500% taker fees and 0.0200% maker fees.

If your 30-day trade volume is more than $100, you will not need to pay any maker fees. Additionally, the taker fees are lower as the trades only pay 0.0100%.

Another essential thing a trader should know is that you cannot carry over trading volumes on your Kraken spot account to the futures account. Hence, only what you trade in the spot market will help determine your 30-day trading volume.

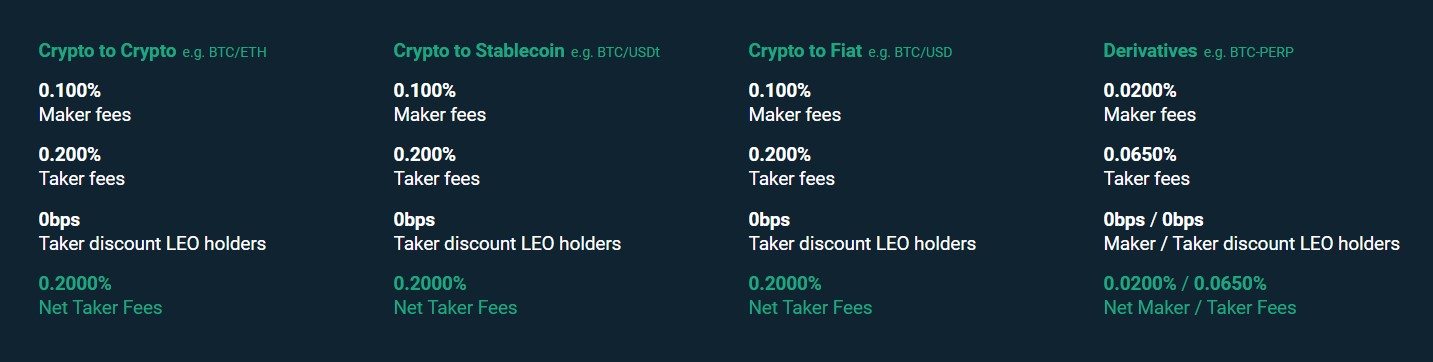

Maker Taker Fees In Bitfinex

Trading fees on the Bitfinex crypto exchange platform will also depend on your 30-day trading volume as the company uses the tiered system like most others out there.

Bitfinex has more trader tiers than most other crypto exchanges. There are16 different trader levels starting from those that trade $0.00 to the high volume traders transacting over $30 billion every 30 days.

For the low volume traders like beginners and inactive ones that only trader a little over $0.00, the maker fee will be 0.100%, and the traders will pay $0.200% for market taker orders.

Once your 30-day trading volume crosses the $7.5 million mark, you will not need to pay any maker fees, and the taker fees will also reduce considerably. For example, traders with a 30-day trading volume of over $30 billion will pay just 0.055% in taker fees.

Maker Taker Fees In Bybit

The maker and taker fees on Bybit will largely depend on the specific market you are trading. The fees are different for spot trading and the derivatives market.

The exchange will charge you 0.1% maker and taker fees for spot trading. The fees unit will be based on the purchased crypto. Also, Bybit will not charge you any fees for parts of the order not fulfilled or for canceled orders.

If you are trading derivatives, the contract type you enter determines your maker-taker fees. Traders that trade inverse contracts on Bybit will pay a takers fee of 0.075% when removing liquidity from the market or get a maker’s rebate of -0.025% when adding liquidity to the books.

It should be easy to figure out the fees you need to pay per trade for both derivatives and spot trading, as Bybit explains how to do the calculations.

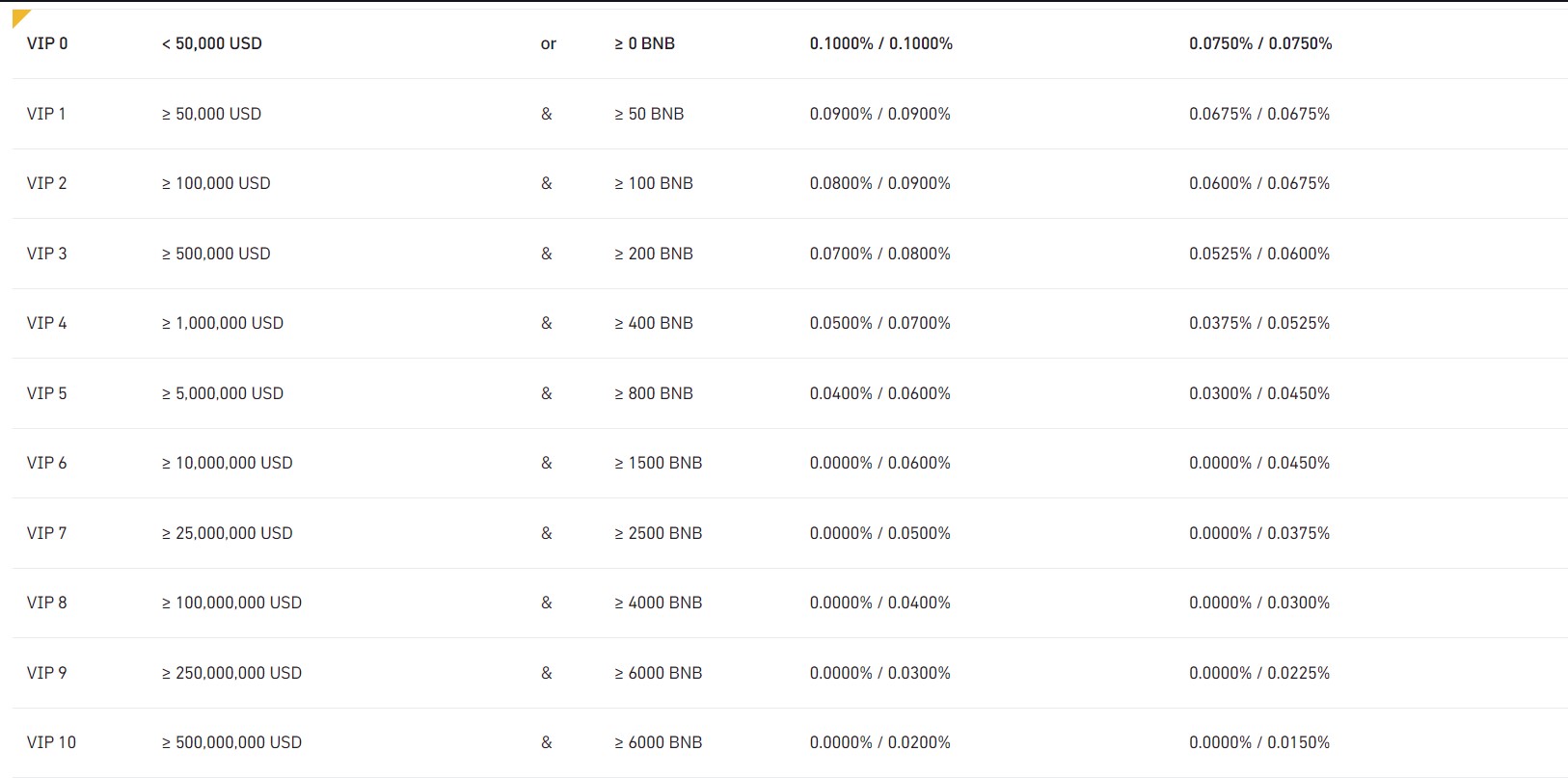

Maker Taker Fees In Binance US

Maker and taker fees on the Binance US platform depend on your 30-day trading volume and BNB balance.

If you have BNB in your account, Binance automatically deducts the trading fee from this balance. When using BNB to cover the trading fees, you will get a 25% discount.

The Binance trading fees structure follows the tiered system that most other top exchanges use. They have VIP levels based on 30-day trading volume from VIP 0 to VIP 10.

Traders at the VIP 0 level have a 30-day trading volume of less than $50,000. These traders will pay 0.100% for both the maker and taker fees.

Traders with the highest trading volume on the platform of over $500 million per month will be VIP 10. There are no maker fees for these traders, and the taker fee is 0.0200%. Also, note that Binance will not charge any maker fee, provided your 30-day trading volume is over $10 million.

Maker Taker Fees In BitMEX

The BitMEX fee schedule is as simple as possible to ensure traders do not have difficulties figuring out how much trades will cost. They do this by maintaining a standard trading fee system for all the trading pairs.

Also, like many other crypto exchanges, they have a tiered system that uses your 30-day average trading volume to calculate how much you have to pay per transaction.

There are 5 tiers of traders: 0, B, M, E, and X. Traders on tier 0 are those with a volume of less than $5 million and will pay the highest fees on the platform as market takers have to pay 0.050% in taker fees. For the high-volume traders in tier X with a trading volume of more than $50 million, the taker fees are 0.025%.

The fees also depend on the market you are trading in and the trading pairs. However, the company makes all the fees clear in their fees schedule.

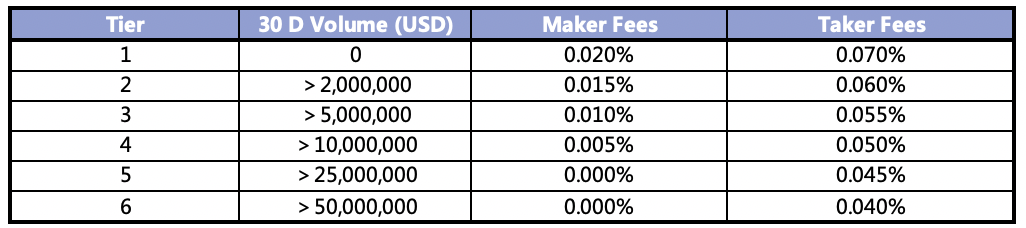

Maker Taker Fees In FTX

FTX uses a tiered fees structure for its spot and futures trading markets. The crypto exchange has 6 trader levels based on 30-day trading levels from tier 1 to tier 6.

Tier 1 includes traders with low trading volumes as low as 0. The maker fees are 0.020% at this tier, while the taker fees are 0.070%.

Traders will not pay any maker fees at tier 5 (over $25 million trading volume) and tier 6 (over $50 million trading volume). These traders also have the lowest taker fees on FTX. At tier 5, the taker fee is 0.045%, and at tier 6, it is 0.040%.

FTX offers trading fees discounts for traders holding the FTT. For example, traders with a trading volume of over $5 million will pay up to 60% less in trading fees with the FTT.

Example with Bitcoin’s Price

Supposing the current price of BTC futures is $40,100 but want to wait and buy at $40,000. In such a case, if there is no one to buy it at the said price, the order will sit on the order book until a trader aggress to sell the BTC at the stated price.

You will pay a maker fee when your order matches a buyer or seller, which is often just a tiny percentage. In most platforms, traders with high trading volumes will not pay any maker fee.

That said, if you make your order to buy the BTC at the currency $40,100 to ensure immediate execution of the trade, you will have to pay taker fees. The fee is often higher than the maker fee since you will be removing liquidity from the exchange.

Conclusion

If you understand what maker and taker fees are and how they work in crypto trading, you will have an easy time figuring out trading fees.

The good news is that both are pretty simple to grasp as they are all about whether you are adding or taking liquidity from the exchange.

Liquidity takers have to pay a taker fee, while those that add liquidity to the books pay a maker fee which is often much lower.