Deribit is one of the most popular cryptocurrency exchanges out there. The exchange mainly focuses on crypto futures and options trading and lets you trade in major cryptocurrencies.

So if you are too a user of Deribit or planning to use the exchange for futures trading, you might be wondering how to trade futures on Deribit.

If you do, then below, I have shared a detailed step-by-step guide that will help you navigate through the exchange and its features.

So here we go:

Deribit Futures Trading: How To Trade Futures on Deribit?

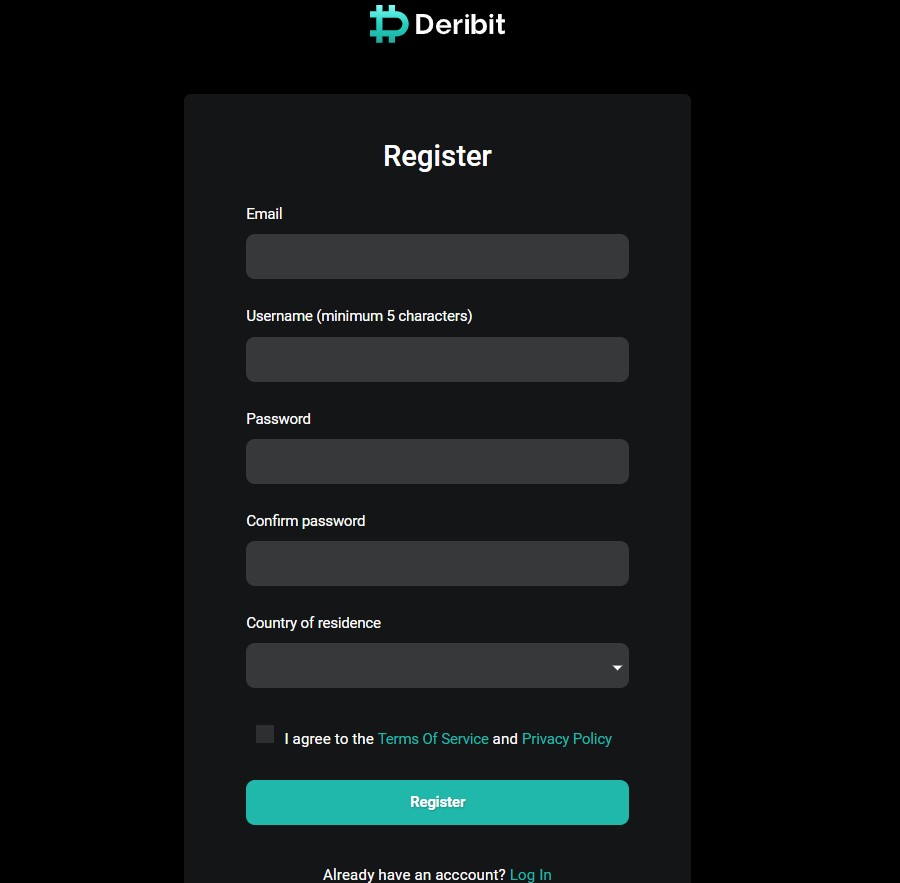

1. Create Deribit Account

The first step is to create a Deribit account. If you are a new user, then head over to Deribit.com’s website.

From the homepage, click on Don’t have an account.

Next, you will find a signup form, fill it up with your details and follow the onscreen instructions.

Also, Deribit requires you to complete your KYC, so make sure to do that before you start using the exchange. If your account is not verified, you are not authorized to deposit funds to your account.

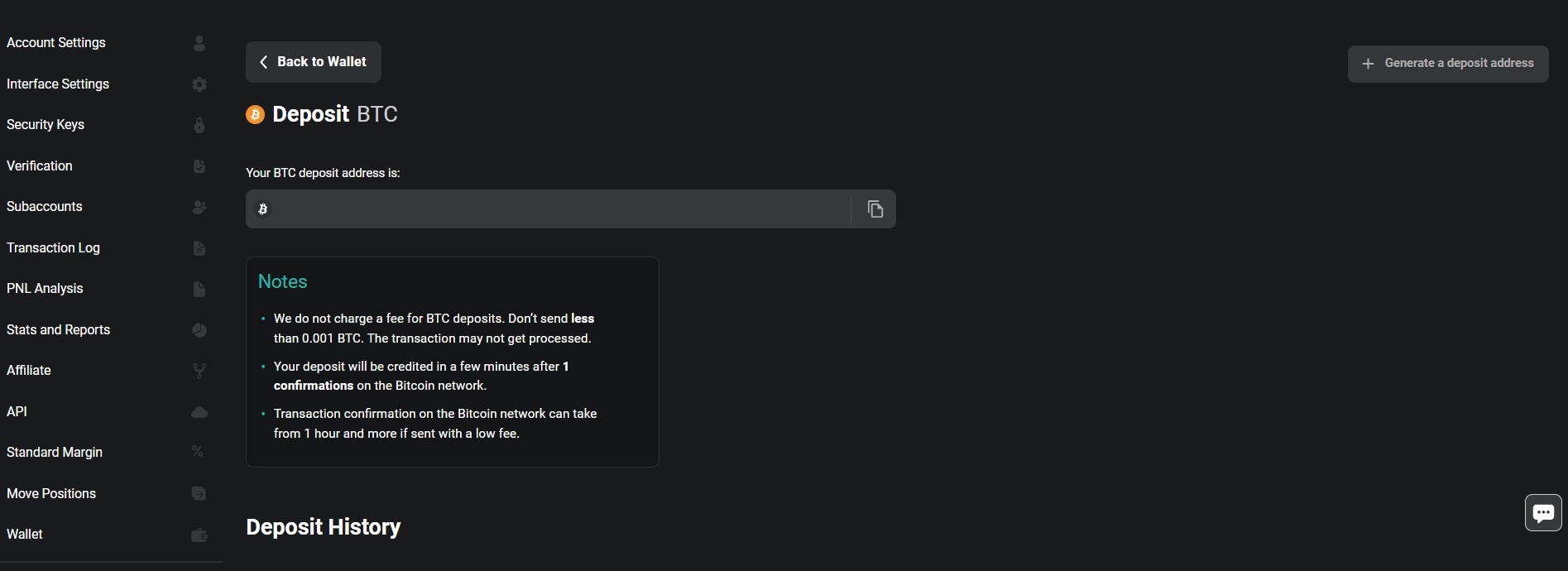

2. Deposit Funds

The next step is to deposit funds into your account. To deposit funds, you need to click on the Wallet icon from the top navigation bar.

Next, select your base currency, like BTC, ETH, or USDC, that you want to deposit and click on the deposit button next to it.

Then you will find a crypto deposit address, use it to send your crypto, and you are good to go.

However, unlike most exchanges, Deribit doesn’t let you buy crypto through peer-to-peer. Instead, you need to have existing crypto, which you are required to transfer to the exchange for trading.

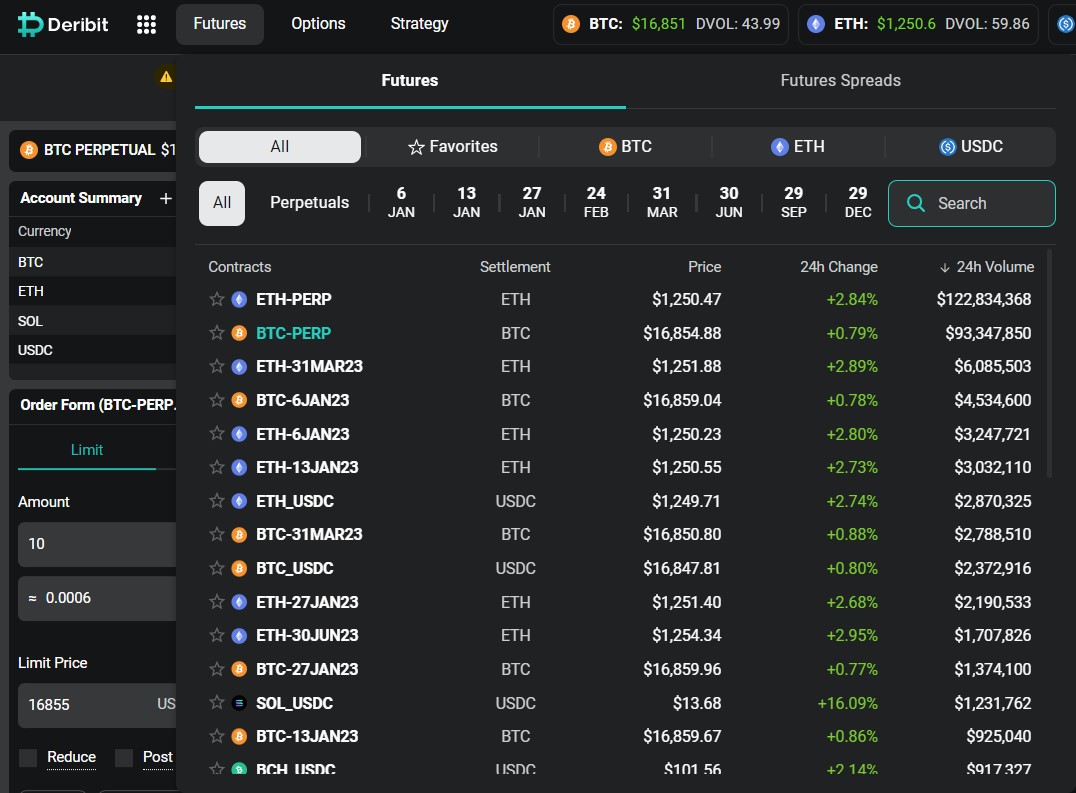

3. Go To Crypto Futures

After adding funds to your account, you need to go to Deribit Futures from the top navigation bar.

This will open up a list of available trading pairs. Over here, you will find both perpetual future contracts and regular future contracts with an expiry date.

Select a trading pair as per your requirements, and it will open up its technical chart and other options.

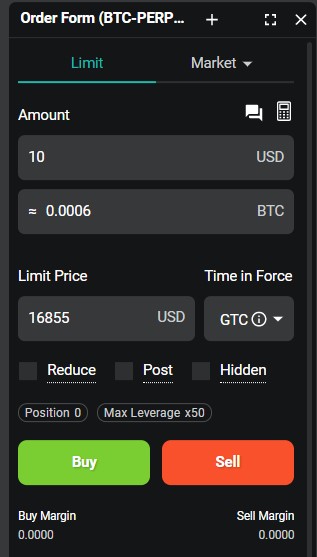

4. Fill Out The Order Form

When you open a trading pair’s chart, you will find the order form on the left side of your screen, while the chart sits in the middle, and on the right side, you get the order book.

Talking about the order form, you first have the Limit and Market option. Using these two, you can select your preferred market type.

Below that, you have an amount field that represents the order value and the price you want your trade to get executed.

Finally, there are the Buy and sell buttons which will let you go long or short the market as per your trade.

However, Deribit does not offer you an option to adjust the leverage. The leverage is calculated automatically. But you have the option to control the position size and margin.

5. Place Your Order

Once you have filled in all the trading details, such as the amount and price, it’s time to place your order. If you want to go long, click on the Buy button. Alternatively, click on the Sell button to short the market.

After placing your order, you will find it right below the technical chart under the Positions option. Also, you have tabs for open order, triggered order, your order and trade history.

From here, you will have all the options, such as edit, cancel or close your order.

FAQs:

– What Are Deribit Futures Fees?

Unlike other cryptocurrency exchanges, Deribit has a fixed fee structure rather than a tiered fee structure.

The exchange charges maker and taker fees, and it is different for different types of trading products.

For instance, for BTC Futures & Perpetual and ETH Futures & Perpetual contracts, the maker and taker fees are 0.00% and 0.05%, respectively. Whereas for the SOL Futures & Perpetual, the maker and taker fee stands at -0.02% and 0.05%.

Moreover, for BTC and ETH Weekly futures, the maker fee is -0.01%, and the taker fee is 0.05%.

– Deribit Provides Futures on Which Assets?

Deribit does not have a massive list of trading pairs, unlike the other cryptocurrency exchanges. Instead, you will find a handful of trading pairs only.

But it offers you both weekly and perpetual contracts on the exchange. And some of the top trading pairs are:

- ETH-PERP

- BTC-PERP

- ETH_USDC

- BTC_USDC

- SOL_USDC

The exchange mainly offers BTC, ETH, and SOL weekly futures and perpetual contracts. Also, instead of using USDT as the base currency, which most other exchanges use, Deribit uses USDC as the base currency.

Conclusion

Deribit futures can be an ideal choice for trading crypto futures, as it has a fixed crypto trading fee.

However, there are certain drawbacks that this exchange has.

But overall, the exchange offers a smooth experience for trading crypto futures with ease.