When it comes to a crypto exchange for trading futures, going with a platform that has low fees is important. It will help you reduce the cost of each trade you take, and it will significantly impact your profits and losses.

Hence, it is important to choose a crypto exchange that has the lowest fee. But which one should you really choose?

As there are a bunch of crypto exchanges available out there.

To help you find the right exchange, below, you will find a trading fee comparison for all the major crypto future exchanges:

Types of Fees In Crypto Futures Contracts?

When it comes to trading futures, there are two types of fees that a trader encounters. These are the maker and taker fees. And you can learn about them in brief below:

- Maker Fees

Maker fees are paid when you add liquidity to the order book by placing a limit order below or above the market price. In other words, maker fees are applicable when you want your trade to get executed at a specific price.

By placing an order to the order book, you are adding liquidity to the market and increasing the order book size for the exchange and market participants.

Hence, you are charged maker fees. Moreover, the maker fee is generally lower than the taker fee.

- Taker Fees

On the other hand, a taker fee is charged when you remove liquidity from the order book by placing market orders.

When you place a market order, your trade gets executed right away, and your order doesn’t get placed in the order book. Since you are removing liquidity than providing it, you are charged a higher fee compared to the maker fee.

Why Low Fees Matters In Futures With Example?

Unlike the spot market, the trading fee is not the only charge you have to pay for each of your trades. Along with your trading fee, futures trading also incurs a funding fee if you hold your trade for an extended period of time.

As a result, the cost of each trade is much higher than trading in the spot market, and it can impact your overall profits and losses.

As a trader, your goal is to earn maximized profits while keeping your costs low. And if a cryptocurrency exchange is charging too much of a trading fee, your profits will be low, and your losses will be higher.

To help understand better, here is an example:

A trader named John decided to take a long trade on the BTC/USDT pair on the Binance exchange by placing a limit order.

The current market price of Bitcoin is $16,000, and John is using 125x leverage for this trade. As a result, John would need $128 to open the long trade.

Since John has placed a limit order, he is subject to Binance’s maker fee, which is about 0.0200%, and the maker fee is 0.0400%.

Now the formula to calculate Binance’s future trading fee is (Position Size / 100) * maker fee. So the overall cost would be (16000 / 100) * 0.0200 = $3.2 USDT.

If John had placed a market order, then the overall trading cost would have been (16000 / 100) * 0.0400 = $6.4 USDT.

Hence, the lower the trading fee a crypto exchange charges, the higher profit you will book and the lesser losses you will face.

New to trading crypto? Learn the difference between Crypto Spot Trading vs Crypto Futures Trading

Trading Fees & Funding Fee Comparison

Below I have discussed the trading fees for USD-M Futures only across exchanges. For spot and Coin-M futures, the trading fee might be different.

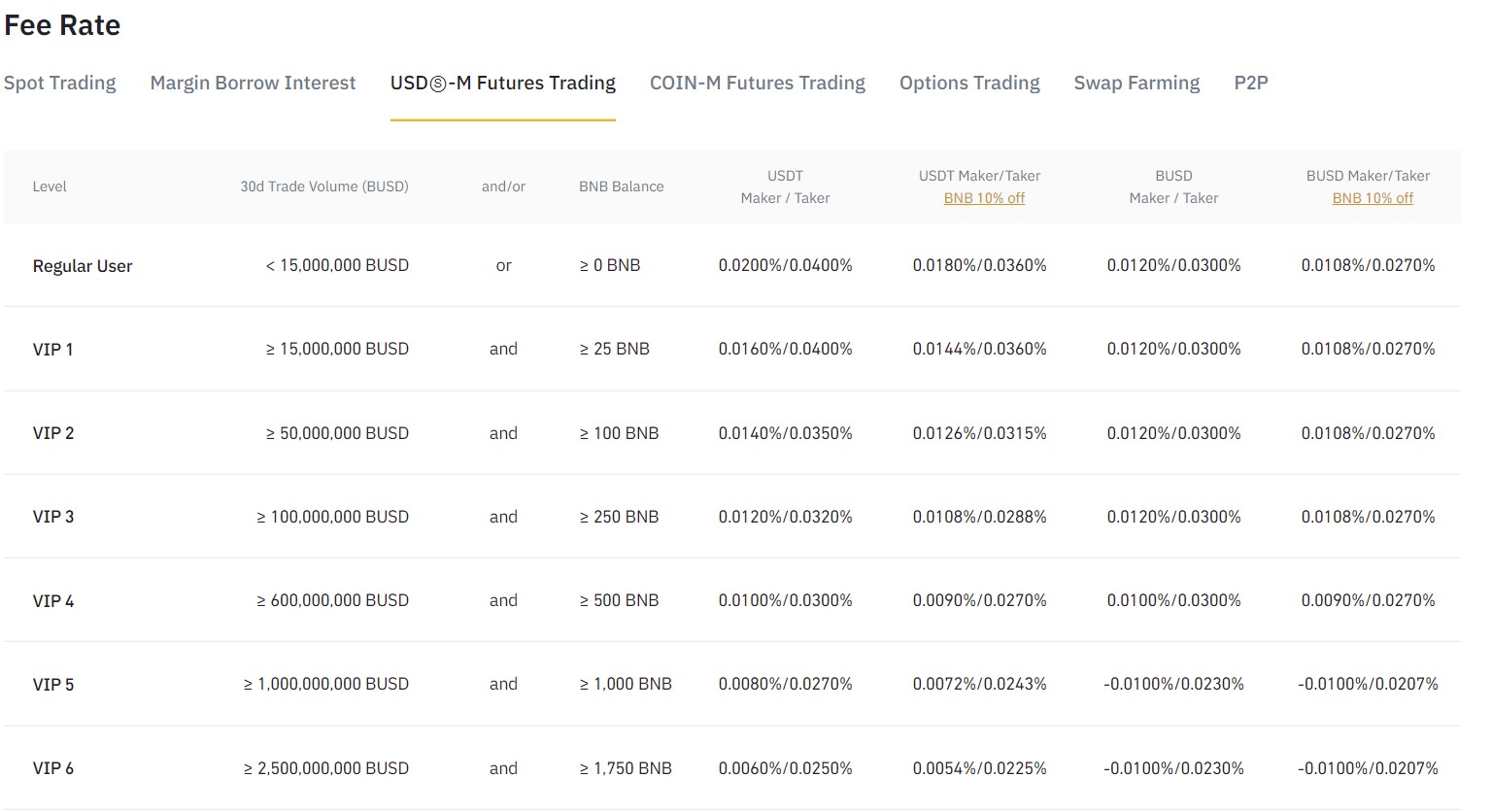

- Binance

Binance is one of the largest cryptocurrency exchanges with affordable trading fees. For regular users, the maker and taker fee is 0.0200% and 0.0400%, respectively.

However, if your 30-day trading volume exceeds 15,000,000 BUSD and has 25BNB in your account, you will enjoy VIP tired trading fees, which are about 0.0160% and 0.0400% for maker and taker fees.

- Bybit

Bybit is another famous cryptocurrency exchange with a lower trading fee. It charges about 0.01% as the maker fee and 0.06% as the taker fee.

Also, if you are a VIP-tiered trader, you will enjoy discounted trading fees. For example, VIP 1 traders will enjoy 0.006% as the maker and 0.05% as the taker fee.

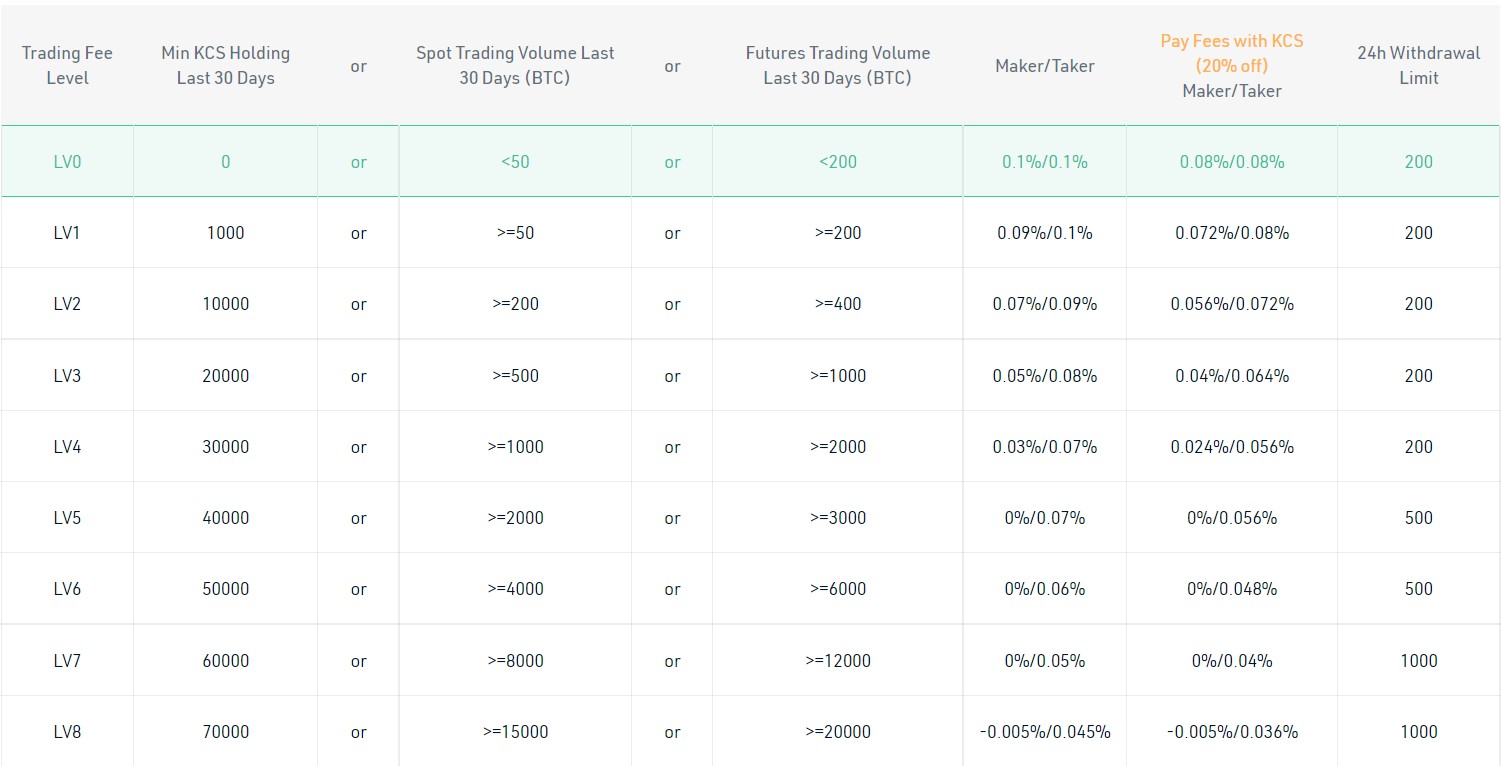

- KuCoin

KuCoin is one of the oldest cryptocurrency exchanges out there. For the level zero traders, it charges a maker and taker fee of about 0.1%.

Also, you will enjoy a 20% discounted maker and taker fee when you pay fees with KCS (Kraken’s native cryptocurrency), which is 0.08%.

The level 1 traders will be charged 0.09% as the maker fee and 0.1% as the taker fee. And for the KCS holders, the fee would be 0.072% (maker) and 0.08% (taker).

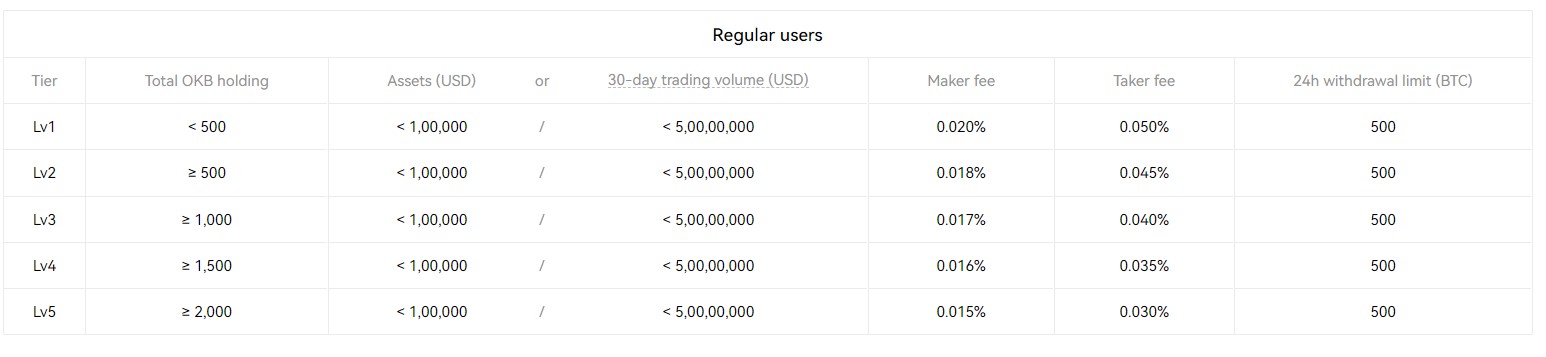

- OKX

OKX also follows a tiered fee structure. For the level 1 users, the exchanges charge 0.020% as the maker fee and 0.050% as the taker fee.

But if you are a VIP 1 user, you will enjoy 0.010% and 0.030% as the maker and taker fees, respectively.

The trading fee tier is based on 30 days of trading volume in USD. So the higher the volume of USD you trade, the lesser you have to pay as the maker and taker fee.

- Huobi

Huobi charges about 0.02% and 0.04% as the maker and taker fees, respectively. Along with the maker and taker fees, the exchange also charges about 0.015% as the delivery fee.

Also, unlike the other exchanges, it doesn’t have a tiered fee structure. Instead, it charges the same fee to all its customers.

- Deribit

Deribit has one of the lowest trading fees in the market. It charges different makers and trading fees for different types of futures contracts. For instance,

BTC Futures and perpetual contract’s maker and taker fee is 0.00% and 0.05%, respectively. In contrast, the BTC weekly Futures trading fee is -0.01% (maker) and 0.05% (taker).

- Poloniex

Unlike other exchanges, Poloniex doesn’t have a tiered fee structure. Instead, it charges the same for all its customers. Poloniex charges a maker and taker fee of about 0.01% and 0.075%, respectively.

| Exchange | Maker | Taker | Discounts (Maker/Taker) |

| Binance | 0.0200% | 0.0400% | 0.0180%/0.0360% |

| Bybit | 0.01% | 0.06% | |

| KuCoin | 0.1% | 0.01% | 0.08%/0.08% |

| OKX | 0.080% | 0.100% | |

| Huobi | 0.02% | 0.04% | |

| Deribit | 0.00% | 0.05% | |

| Poloniex | 0.01% | 0.075% |

Conclusion

So those were a few cryptocurrency day trading exchanges with the lowest fees for futures. For a detailed fee structure, I would recommend you check the exchange’s respective websites.

Since some exchanges offer trading fees based on your 30-day trading volume. So go ahead and do your own research and then settle down with an affordable crypto exchange.

Trading Futures? Know How do Bitcoin futures contracts affect Bitcoin prices?