If you’ve ever dabbled in the world of cryptocurrencies, you’ve likely noticed something intriguing: the price of a single cryptocurrency can vary slightly across different crypto exchanges.

Ever wondered why?

Well, you’re not alone.

Many newcomers and even seasoned traders often scratch their heads trying to understand the nuances behind crypto pricing.

Determining the price of a cryptocurrency isn’t as straightforward as slapping a price tag on a product in a store.

It’s a complex interplay of various factors, from supply and demand dynamics to external market influences.

In this article, I’ll dive deep into the mechanisms that crypto exchanges use to determine their prices, shedding light on the intricacies of this fascinating digital economy.

So, buckle up, and let’s embark on this enlightening journey together!

Understanding How A Crypto Exchange Operates

Before we dive deep, let’s lay the groundwork.

Think of crypto exchanges as bustling digital marketplaces.

Like in a traditional stock exchange, buyers and sellers come together, but they’re trading cryptocurrencies here.

The price?

Well, it’s determined by what someone is willing to pay (the buyer) and what someone is willing to sell for (the seller).

This is the basic principle of supply and demand in action.

But there’s more to it.

Various factors influence these decisions, and exchanges are pivotal in facilitating this dance.

As we progress, we’ll unravel the layers that add complexity to this seemingly simple process.

Stay with me!

New to crypto trading? Learn What is the oldest cryptocurrency exchange?

Supply and Demand: The Fundamental Drivers

At its core, the price of any asset, including cryptocurrencies, hinges on the age-old economic principle of supply and demand.

So, how does this work?

Let’s break it down.

Imagine you’re at an auction.

If there’s a rare item up for grabs and many people want it, they’ll bid higher prices to ensure they get it.

This is demand driving up the price.

On the flip side, the price drops if an item is abundant and there are few takers.

That’s an excess supply situation.

Now, apply this to crypto exchanges.

When more people want to buy a cryptocurrency (like Bitcoin) than sell it, its price increases.

Conversely, the price decreases when more folks want to sell a cryptocurrency than buy it.

But here’s the kicker: crypto markets are incredibly volatile.

News, regulations, technological advancements, or tweets can sway public sentiment, affecting demand.

And since the total supply of many cryptocurrencies is limited (think Bitcoin’s 21 million cap), this can lead to dramatic price swings.

While supply and demand are the major drivers, external factors can amplify their effects in the crypto world.

And that’s what makes it so fascinating!

Order Book Dynamics and Price Formation

Diving deeper into the mechanics of crypto exchanges, you’ll encounter the order book—a crucial component in price determination.

But what exactly is it, and how does it influence prices?

Let’s unravel the mystery.

The order book is a real-time, continually updated collection of buy and sell orders in a particular cryptocurrency market.

These orders are categorized into two main types: Market Orders and Limit Orders.

- Market Orders are instructions to buy or sell immediately at the best available price. They say, “I want this now, no matter the cost!”. Because of their immediacy, market orders can cause sudden price movements, especially in less liquid markets.

- Limit Orders are a bit more patient. They specify a price a trader is willing to buy or sell. It’s like setting a budget for your shopping. If the market reaches that price, the order gets executed. If not, it waits.

The interplay between these orders and supply and demand dynamics results in the price you see on an exchange.

The order book shifts as traders place, modify, or cancel orders, leading to ever-changing crypto prices.

It’s a dance of numbers, strategy, and anticipation!

Recommended Read: How does a crypto exchange make money?

Role of Arbitrage in Price Stabilization

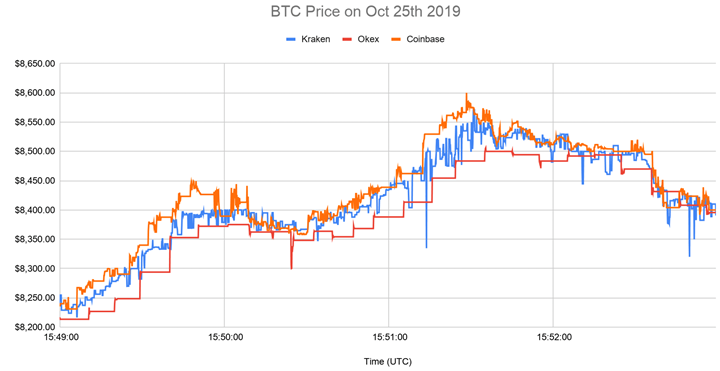

Have you ever wondered why prices across different exchanges are often close, with only minor variations?

Enter the world of arbitrage.

Arbitrage, in the crypto realm, is a fascinating strategy that plays a pivotal role in keeping prices in check.

Here’s the scoop: Arbitrageurs spot price discrepancies for the same asset across different exchanges.

They buy low on one platform and sell high on another, keeping the difference as profit.

This constant buying and selling, driven by the allure of risk-free profit, acts as a balancing force.

It ensures that significant price discrepancies are short-lived.

As arbitrageurs jump into action, they inadvertently help stabilize prices across exchanges.

In essence, while market dynamics like supply and demand set the stage, the silent work of arbitrageurs often keeps the play running smoothly, ensuring harmony in the volatile world of crypto prices.

External Factors Influencing Exchange Prices

Diving deeper into the crypto price puzzle, it’s crucial to recognize that exchanges don’t operate in isolation.

Several external factors can sway prices, sometimes dramatically.

- News and Events: Have you ever noticed a sudden spike or dip in crypto prices? Often, breaking news or significant events trigger these movements. A positive update about a cryptocurrency can send its price soaring, while negative news can lead to a sharp decline.

- Regulatory Changes: These play a massive role in deciding exchange prices. Announcements of government regulations, bans, or even endorsements can significantly impact prices. Traders closely watch these changes, adjusting their strategies accordingly.

- Market Sentiment: This is the collective attitude of traders towards a particular cryptocurrency. Influenced by news, events, and personal beliefs, it’s a powerful force that can drive prices up or down.

The Impact of Liquidity on Pricing

Dipping our toes into the deeper waters of crypto pricing, let’s tackle a term you might’ve heard before: Liquidity.

But what does it mean, and why should you care?

Liquidity refers to how fast and easily an asset can be traded without causing significant price changes.

Think of it as the “smoothness” of trading.

High liquidity means many buyers and sellers, leading to swift trades and stable prices.

On the flip side, low liquidity can cause prices to be more volatile.

Why? Because even a single large trade can cause drastic price swings.

Ever seen a sudden spike or drop in a coin’s value?

Low liquidity might be the culprit.

Liquidity thus acts as a buffer, absorbing large trades and ensuring price stability.

For traders, understanding liquidity is key to navigating the often-turbulent waters of crypto exchanges.

Recommended Read: Which crypto exchanges are registered with SEC?

How OTC (Over-the-Counter) Desks Influence Exchange Prices

Ever heard of OTC desks in the crypto world?

If not, you’re in for a revelation.

OTC desks cater to high-volume traders, facilitating large transactions without directly using the exchange order book.

Here’s the catch: because these trades don’t appear in the public order book, they can prevent drastic price swings that large trades might otherwise cause.

However, once these OTC deals are completed, they can indirectly influence market sentiment and exchange prices.

While OTC desks operate behind the scenes, their ripple effects can be felt throughout the crypto market.

Comparing Prices Across Different Exchanges

Ever noticed how Bitcoin’s price might differ slightly from one exchange to another?

It’s a common phenomenon, and here’s why.

Each crypto exchange operates in its unique ecosystem, influenced by its user base, liquidity, and geographical location.

Factors like trading volume, demand and supply dynamics, and specific exchange fees can lead to price discrepancies.

But wait, there’s more.

Arbitrage traders often spot these price differences and quickly buy on one exchange to sell on another, aiming to pocket the difference.

This action, in turn, helps in bringing the prices closer together.

However, always remember: while these price differences might seem like easy money, transaction fees, withdrawal limits, and potential transfer delays can impact the profitability of arbitrage.

So, when comparing prices across exchanges, it’s essential to consider the broader picture and not just the numbers.

The Future: Innovations and Evolutions in Crypto Pricing

As we gaze into the future of crypto, one thing’s for sure: change is on the horizon.

With the rapid pace of advancing technology, we will see more sophisticated pricing algorithms and tools.

Think about it: as decentralized finance (DeFi) platforms grow and interconnect, they’ll likely influence how prices are determined.

Additionally, as more institutional investors enter the scene, their trading strategies could reshape pricing dynamics.

And let’s not forget the potential of AI in analyzing large amounts of data to predict price movements.

As the crypto landscape evolves, so will the intricacies of price determination.

Stay tuned!

Conclusion: The Ever-Evolving World of Crypto Exchange Pricing

Navigating the world of crypto can feel like a roller-coaster ride, right?

With prices constantly fluctuating, it’s crucial to grasp how centralized crypto exchanges determine them.

From the tug-of-war of supply and demand to the subtle influences of news events, many factors come into play.

And as the crypto ecosystem continues to mature, we can expect even more complexities and innovations in pricing.

So, whether you’re a seasoned trader or a curious newbie, staying informed about these dynamics is key.

After all, in the fast-paced realm of crypto, knowledge truly is power.

Stay ahead of the curve!