The crypto market is huge, and it brings investors a lot of opportunities. One can make money in the cryptocurrency market through investing, staking, lending pools, trading, and a lot more.

However, when it comes to crypto trading, beginners come across two crypto trading market types – spot trading and futures contracts. But as a newbie trader, what should you choose?

To help you out, below I have shared a detailed crypto spot vs futures trading guide:

What is Crypto Spot Trading?

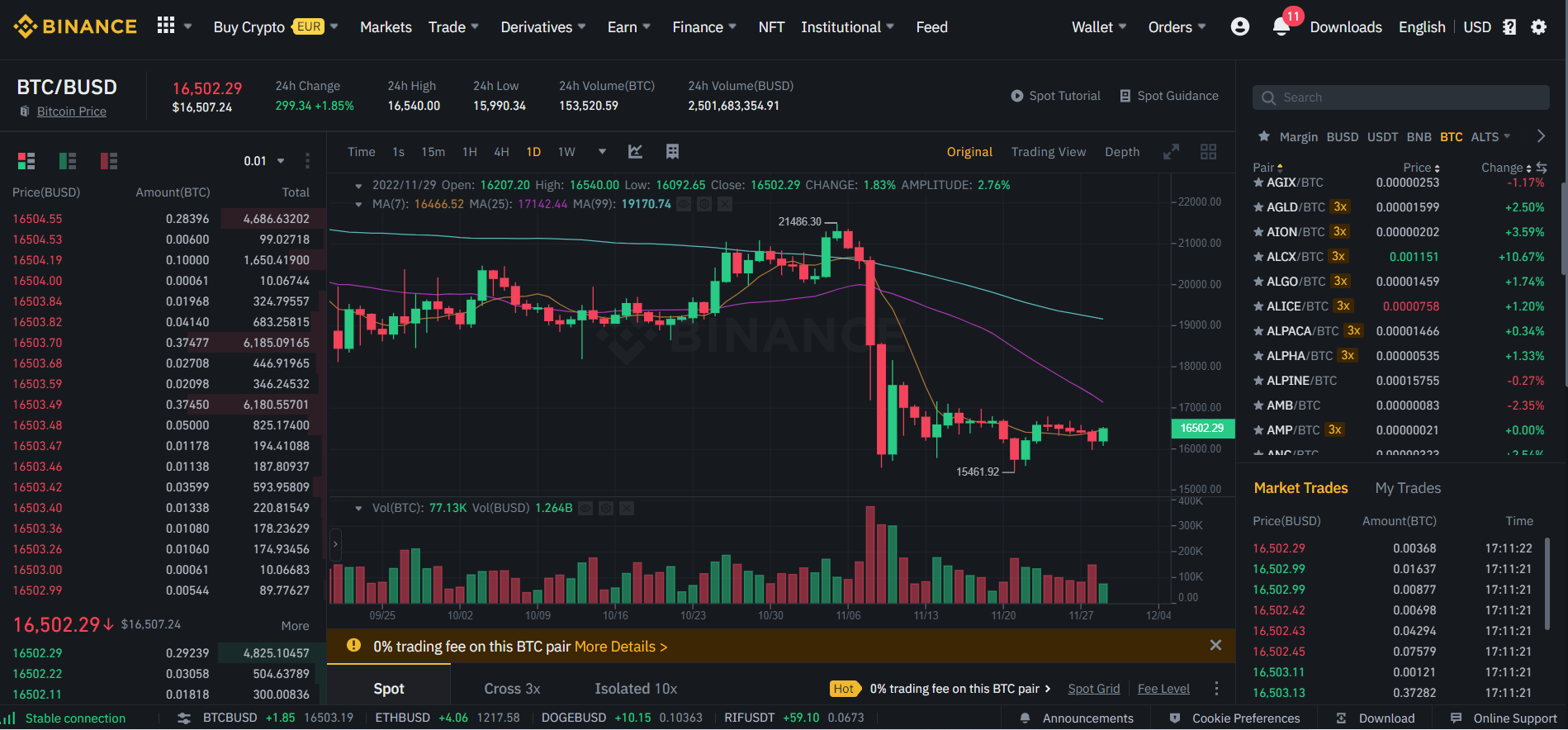

Crypto spot trading is the process of buying and selling cryptocurrencies at spot prices or real-time prices with the aim of earning a profit.

In the spot markets, traders buy crypto assets and wait for the price to go up. You can also say that crypto spot trading is pretty much like crypto investing.

However, unlike crypto investments, you don’t hold to your investments for a short or long duration. Instead, traders buy and sell a wide range of cryptocurrencies to earn a profit.

Also, in spot trading, you buy crypto with your own money without using any sort of leverage. The leverage here indicates that you are borrowing funds from your exchange and using that additional funds to open your trading positions.

Since there is no involvement of borrowed funds in spot trading, your trading positions would be smaller and less risky.

Also, you have the freedom to hold onto your trades for as long as you wish to.

Moreover, when you trade in the spot market, you take direct ownership of the assets when you purchase them.

This means you are free to use the crypto assets for any sort of transaction. Also, when you sell your assets, you give up your ownership.

To help you with an example:

As a trader, you decide to buy one Bitcoin at the current market price of the asset from the Bitcoin spot market, which is $16550.

Now in spot trading, you would only make money when the price goes up, so if Bitcoin’s spot price reaches $16600, you will book a profit of $5o.

If the price moves below and you decide to sell your one Bitcoin at $16500, then you will take a loss of $50.

What is Crypto Futures Trading?

Crypto futures contracts are derivatives products. Or you can say it is a contract between two parties to buy and sell a specific underlying asset, such as Bitcoin futures, at a specific future date and at a predetermined price and specific amount in the future.

However, unlike in spot trading, futures contracts don’t offer you any ownership of the asset. But you own a contract with an agreement to buy and sell a cryptocurrency at specific futures prices.

When you are trading contracts, as a trader, you are taking advantage of market volatility. Or you can say that you are taking a bet on the futures price movements of an underlying asset. This allows you to take a trade in both market directions – Uptrend or downtrend.

Also, with futures contracts, you will enjoy higher leverage. So even with a little capital, you can trade crypto with high volume. As a result, if the market moves as per your predictions, you get to make a huge profit.

If it doesn’t, then the loss could be bigger than what you have initially invested. Hence, crypto futures trading is considered a risky area for newbie traders and risk management becomes crucial.

To help you with an example:

As a trader, you decide to buy a Bitcoin futures contract at a trading price of $10,000, and the validity of the contract is 90 days.

Now during this 90 days period, if the Bitcoin futures contract price goes to $13,000, then on the settlement date, you will earn $3,000 profit.

Now to trade the Bitcoin futures contract, you don’t have to have $10,000 in your account. Instead, you will need less capital due to the leverage provided by your exchange. Suppose you are using 100x leverage. Then you will only need $1000 to open your trade.

Next, during this 90 days period, if the Bitcoin futures contract price goes to $13,000, then on the settlement date, you will earn $3,000 profit.

However, things can be problematic when the price doesn’t move as you expected it to. If the price comes below, you will face the problem of liquidation.

Liquidation happens when your trading account fails to meet the margin requirements. You can also say that the margin requirement is the maximum amount you can lose in a trade.

When it happens, your exchange closes the trade on its own, leading your account to be emptied. Because there will be no funds left in your account to support the margin requirements.

However, if your account has enough funds and Bitcoin’s future market price falls to $9,000, then you will end up losing $1000.

However, it is not necessary to hold your contracts till the expiry. If you face a significant loss, you can exit the market before the expiration date.

Hence, when you are trading with leverage, make sure to use low funds for each of your trades while having a good amount of funds to support the margin requirements. Additionally, you can also lower your leverage if you are trading with more funds to minimize your risks.

Pros & Cons Of Trading Cryptos On the Spot Market

Pros

- Easy To Understand

Spot trading is extremely beginner friendly. Unlike its counterparts, it doesn’t have any complicated terms like margin requirements, funding rate, liquidation, or anything.

This makes it pretty easy for a beginner to place their buy/sell orders and calculate their risk and reward.

- Ownership

When you buy crypto through the spot market, you actually own your digital assets. As after buying crypto, you will get immediate delivery of the assets to your crypto wallet.

As a result, you are free to transfer your assets from one wallet or exchange to another, stake your crypto, or use them for any sort of transaction. In other words, you become the sole owner, and you can sell your assets at any period of time.

- Less Risky

Spot trading is a less risky trading instrument compared to margin-based crypto trading. As you would buy virtual currencies of what you can afford without any leverage.

This keeps your trading size relatively low, and you will take less risk. Even if your account goes zero, you would only lose what you have invested.

But with futures contract trading, there is a risk that you would lose more than what you have invested.

New to crypto trading? Learn about Crypto Margin vs Crypto Futures Trading

Cons

- You Can’t Short

In trading, you can make money by both buying and selling an underlying cryptocurrency. However, the spot market does not let you sell or short the market.

This means you can only make money when the price movements are positive. As a result, you won’t be able to make significant profit trading in the spot market.

- No Leverage

Spot trading also does not offer you leverage. Leverage increases your buying power. So even with little capital, you can trade in large trading sizes and increase your profits.

But since the spot market doesn’t offer you any leverage, you need to invest significant capital to gain larger profits.

Pros & Cons Of Trading Cryptos On the Futures Market

Pros

- Higher Gains

With futures contracts, traders get to earn higher profits. As crypto futures contracts have low funds requirements and give you high leverage.

One can trade with large trading sizes and make more money than what they have invested. The gains are larger than the gains that can be earned in the spot market.

- Buying/Selling Allowed

In the spot market, you are only allowed to buy an asset and sell it at a higher price for profit. However, in crypto futures markets, you can trade in both directions of the market. You are allowed to take a long or short trade and make money in both bullish and bearish markets.

Cons

- No Ownership

When you trade crypto futures contracts, you don’t get an immediate delivery or any delivery of the assets at all.

Instead, you own a contract that prevents you from transferring the underlying assets, staking them, or earning interest on them. Instead, you have to close the trade at some point of time.

- Risky

As crypto futures contracts involve margin trading, which increases your trading size significantly.

And if the market doesn’t move as per your prediction, you will face a huge loss which can be bigger than what your initial margin is.

Also, if you fail to fulfil the required balance in your trading account, your crypto exchange will automatically close your trades leading your account balance to zero.

Types of Spot Markets

The crypto spot market has mainly two types; these are over counter or OTC and market exchange. Let me share a quick explanation about both these types below:

- The Counter (OTC)

OTC in crypto trading is when you trade in the decentralized market without an intermediary.

In other words, in OTC trading, instruments are traded between two parties outside the formal exchanges without any supervision of the exchange regulator. Instead, OTC is done in decentralized markets which are not controlled by anyone.

Moreover, the trade execution process of the OTC markets is also relatively straightforward.

Whenever two parties agree on a specific price, volume, and transfer method, the trade gets executed. It doesn’t require any involvement of an intermediary.

- Market Exchanges

Market Exchanges are regulated exchanges where you can place orders through a trading platform or broker. The crypto prices will be shown immediately through real-time quotes. Also, this type of spot market has exchange hours.

Also, in market exchanges, the crypto exchanges would act as an intermediary for the buyers and sellers to bid and ask for an asset. Whenever there is a match between the bid and the asking price, the exchange will execute the trade.

Types Of Futures Markets

- USD-M Futures

USD-M Futures or USD-Margined contracts are linear futures quoted and settled in USDT or BUSD. Both these coins are stablecoins and help you to calculate your returns in fiat. Hence, USD-M futures are preferred by most traders, as it is convenient to keep track of.

Moreover, during high volatility, USD-Margined contracts can also help you reduce the risk of large price swings.

- Coin-M Futures

Coin-M Future contracts are similar to USD-M futures. However, instead of using a stablecoin, it uses digital currencies as collateral.

Coin-Margined contracts are a type of derivative that obtain their value from the underlying cryptocurrency they represent.

You can use your crypto holdings like Bitcoin to open future trading positions rather than using a stablecoin such as USDT. In this case, your trading pair would be ETH/BTC or BNB/BTC rather than BTC/USDT or ETH/USDT.

- Perpetual Contracts

Perpetual contracts are what you will see across different cryptocurrency exchanges. A Perpetual future contract is also known as a perpetual swap.

It is the most popular crypto derivative out there. Crypto future contracts is perpetual swaps that don’t have an expiry date.

You can keep your positions open for as long as you wish to. However, you will be required to pay holding fees or the funding rate.

Also, your crypto account must contain a minimum amount known as a margin. Plus, apart from the funding rate, you also have to trade fees.

- Quarterly Futures Contract

A quarterly futures contract represents a contract between two parties to buy or sell an underlying asset at a fixed price at a specific time period or delivery date in the future.

Unlike perpetual contracts, quarterly futures contracts have an expiry date, and as its name suggests, these contracts expire on a quarterly cycle.

When trading quarterly futures contracts, both the buyer and seller have to execute their contract regardless of where the price of the underlying asset.

New to perpetual trading? Learn about Crypto Perpetuals vs Quarterly Futures

Crypto Spot Trading Vs Crypto Futures Trading: Key Differences

- Leverage

Experienced traders love to trade in the crypto futures market because of the leverage. As leverage increases your trading capital, you can book higher profits without needing to invest a huge amount of money.

Binance (A well-known derivatives exchange) offers you pretty high leverage for a bunch of cryptocurrencies. For instance, the leverage for the Bitcoin market is 125x while it is 100x for Ethereum.

This means if you have 100 USDT deposited in your exchange account, you can open a BTC trade worth up to 12,500 USDT.

But on the other side, you don’t see any leverage with spot trading. If you have 100 USDT in your account, then you can open positions worth 100 USDT only. As a result, both your profits and losses will be low.

- Flexibility To Long Or Short

When you trade in the spot markets, you would only make money when the market price goes up. However, in the bear market, you won’t be able to make money.

But crypto futures markets allow you to make a profit from short-term market movements or price volatility regardless of the market direction. You can open a short position when the market falls and go long when the market goes up.

Also, as a trader, you get complete freedom to try out different trading strategies to trade the market.

Also, as it offers you higher leverage, even with a small market move, you would gain great profits or lose your capital. So make sure to follow proper risk management strategies.

- Liquidity

Liquidity or trading volume is an important element of trading. If the market doesn’t have enough liquidity, you won’t be able to buy or sell a crypto asset at your desired price. Or it will take too long to complete.

However, the crypto futures markets have deep liquidity with trillions in monthly volume.

As a result, you will always find market participants willing to buy and sell crypto at your desired price. Plus, you can get out of the market whenever you wish to without waiting for too long.

- Trading Style

Another way to draw a difference between the spot markets and the futures market is your trading style. If you want to trade price movements, then the futures market is a much better option. You can trade in any market direction with high leverage.

On the other side, trading in the crypto exchange spot market is limited. Also, it is time-consuming and costly. Plus, you won’t make huge profits.

Conclusion

So that was a quick difference between spot markets and futures contracts. Both spot and futures markets have different purposes.

The key difference that you need to understand as a trader is that if you want to participate in day trading, then trading futures contracts is the way to go. But futures trading is riskier, and you should be an experienced trader with proven trading strategies in place to make profits.

On the other side, if you are just starting out or your goal is to hold onto your investments, then spot trading would be a better choice for you.