Spread is the price difference between the highest bid offer and the lowest ask offer on an order book.

It represents the difference between the price that traders are willing to buy the asset for and the price at which the traders are ready to sell the asset.

While the spread can help you make better trading decisions, there are traders who use spread as a trading strategy.

In this article, we are going to talk about spread trading in depth and how you can use it. So here we go:

What Is Spread Trading In Crypto?

We know that the spread represents the price difference between the asking price and the bid price. This gives you an idea about market volatility.

There is a specific strategy used by many traders called spread trading. In this trading, the trader opens two positions at the same time. A long position and a short position.

In most cases, the trader will use the same amount on both sides to open their positions. The aim of the trader is to make profit out of the two price differences.

The key to spread trading is not to trade an underlying asset, but you are trading the relationship between two price points.

The idea behind spread trading is to limit risk. Traders mainly use this strategy to fight against short-term volatility by spreading off the risk.

Example Of Bitcoin Spread Trading In Crypto

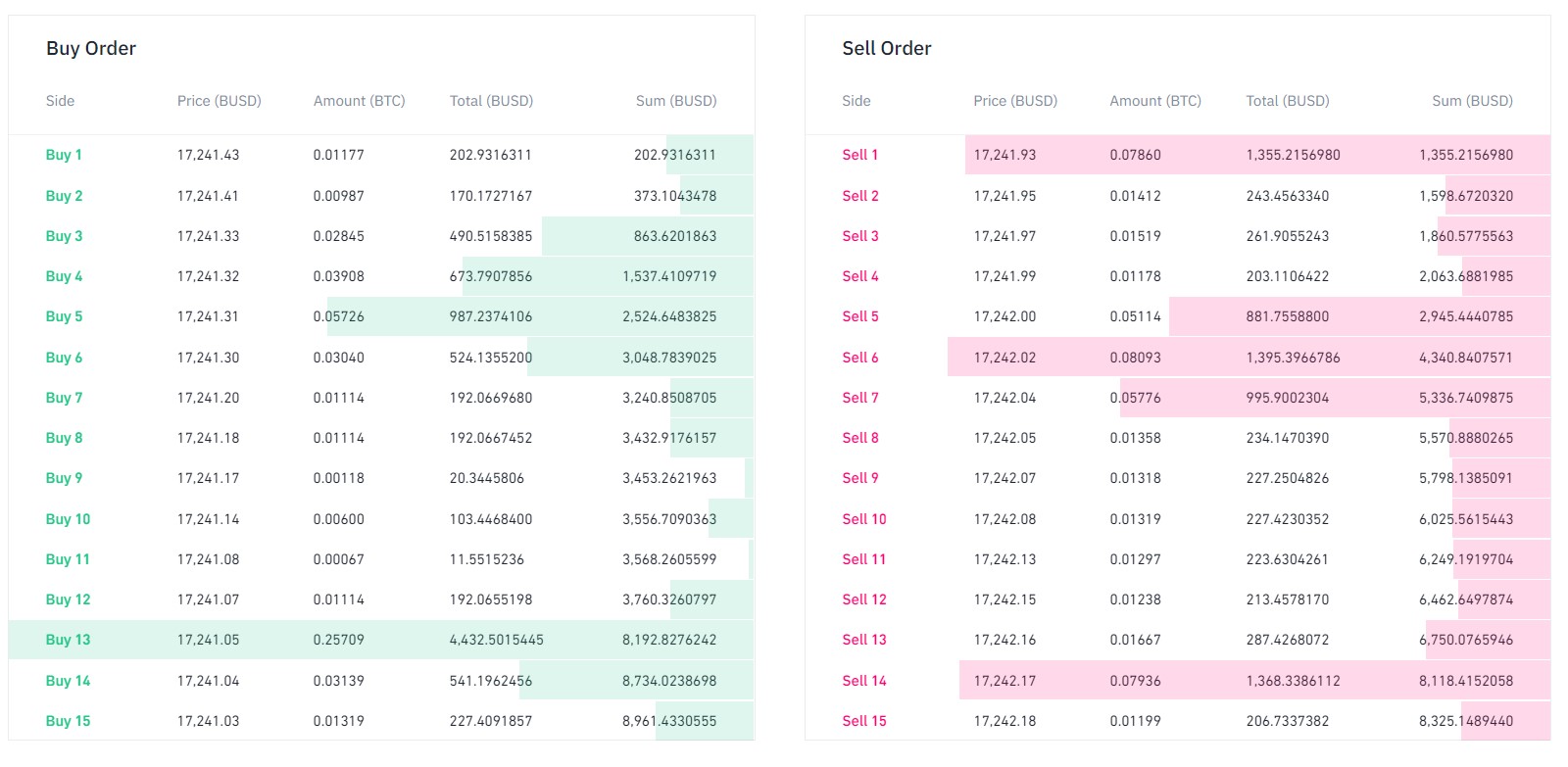

To help with an example, let’s say you are going to trade on the BTC/USDT pair on Binance.

To do so, you have to first go to Binance’s spot market. On any exchange be it Binance, Bybit or Phemex the order book works the same way. It shows you the list of all the open buy and sell orders.

There are a bunch of ways to trade spread in the cryptocurrency market. But one popular way of trading spread is through limit orders.

In this case, you are required to place two limit orders at the bid and ask price. You can place a buy or long limit order at the highest bid price and simultaneously place a short limit order at the lowest ask price.

Now, if the price of the cryptocurrency moves in your favour, one of your orders will be executed, and you will make a profit out of the spread.

However, this is not the only type of spread trading in crypto. You can also perform scalp trades and arbitrage trading based on the spread.

How Does Spread In Trading Work?

The spread is an essential factor in crypto futures trading as it has a significant impact on the profitability of a trade.

For instance, if the spread is large, it will be difficult to make a profit on trade even if the price of the asset moves in the desired direction.

On the other hand, if the spread is small, it may be easier to make a profit on the trade, even if the price of the asset only moves slightly in your desired direction.

Usually, the spread tends to be wider in less liquid markets and narrower in more liquid markets.

Because there are fewer buyers and sellers in less liquid markets, this means there will be less competition and a larger difference between the bid and ask prices.

In more liquid markets, there are more buyers and sellers, which means more competition and a smaller difference between the bid and ask prices.

Also, the spread would be pretty tiny in highly traded or liquidated cryptocurrencies. On the other hand, for obscure coins, the market spread would be huge.

Benefits of Spread Trading

- Reduced Risk

As we know that the crypto market is extremely volatile. Hence it becomes extremely important to manage the risk properly.

So by trading spreads, you are hedging your positions. Meaning one of your trades would perform better than the other one.

This way, your risks will be reduced. As you will only gain or lose the unrealized profit value on both trades.

- Diversification

Spread trading allows you to diversify your trading strategies. As spread trading is a risk management trading strategy, it allows you to use high leverage and more capital per trade.

- Potential for profit in a range-bound market

Spread trading can also be very profitable in a range-bound market where the price of an underlying asset is not expected to move significantly.

Risks of Spread Trading

- Market risk

There is a good chance that the price of an underlying asset in a spread trade may move against you. As a result, you will end up facing a loss.

- Execution risk

There is a risk that the spread trade may not be executed at the desired price, which could result in a loss.

- Complexity

Spread trading in the cryptocurrency market can be complex as you are required to identify correlated crypto pairs and should understand their market value and price movements.

Plus, timing is also an essential factor.

Starting with crypto trading? Know the difference between Crypto Margin Trading & Futures Trading

How Does Spread Impact Crypto Trading Strategies?

When it comes to cryptocurrency trading, it is important that you understand the importance of spread. First of all, if the spread is larger, it will be difficult to trade profitably.

Or if the spread is slow, it will be easy to make profits on your trades.

The spread can also impact the choice of your trading strategy.

Like if you are going to the scalp, then you would prefer a market with a narrow spread.

Moreover, spread also plays a key role in the trading fee. If there is a large spread, it will maximize your trading cost and vice versa.

Conclusion

Spread trading can be considered a risk management strategy, as it can lower your losses.

But it can be a complex concept to understand. So before you test this strategy on a live market, we would recommend you perform backtesting to get the best results.

Also, make sure to choose a cryptocurrency day trading platform that has a narrow spread. As it will be easier for you to trade, and the overall trading fees will be minimized.